Quad Small Form-Factor Pluggable (QSFP) Module Market Size 2024-2028

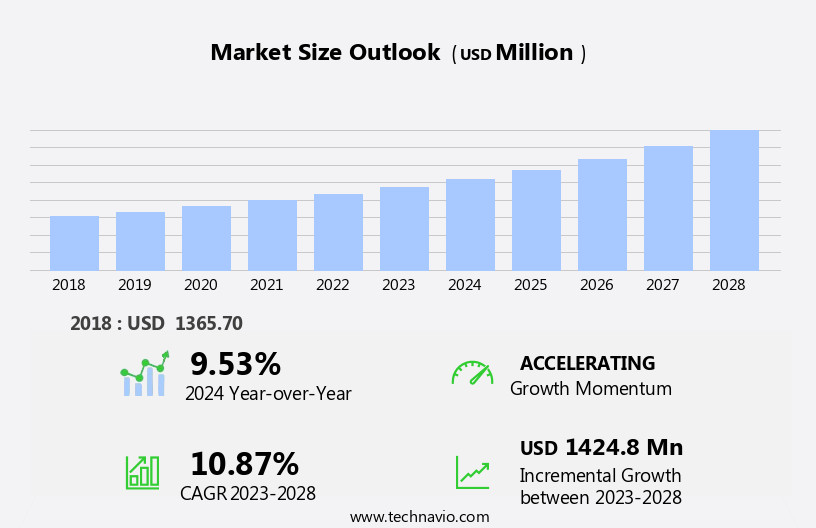

The quad small form-factor pluggable (QSFP) module market size is forecast to increase by USD 1.42 billion, at a CAGR of 10.87% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing adoption of optical fiber communication networks. The proliferation of data centers and the migration towards higher data transfer rates, specifically 40 Gbps and 100 Gbps, are key drivers fueling this trend. However, the high cost of QSFP transceiver modules poses a significant challenge for market growth. Despite this obstacle, opportunities exist for companies to capitalize on the demand for faster data transfer rates and more efficient networking solutions.

- Strategic investments in research and development, as well as cost optimization measures, can help mitigate the high cost barrier and position businesses for success in the dynamic QSFP module market.

What will be the Size of the Quad Small Form-Factor Pluggable (QSFP) Module Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The QSFP (Quad Small Form-Factor Pluggable) module market continues to evolve, driven by the insatiable demand for high-speed data transmission in various sectors. This market is characterized by constant innovation and the integration of advanced technologies, such as insertion loss reduction and reach extension, to enhance the performance of optical transceivers. For instance, the adoption of 400G QSFP-DD modules has led to significant improvements in data center interconnect applications, enabling network switches to handle larger data volumes with minimal optical power budget concerns. Moreover, the market's dynamism is further accentuated by the ongoing development of new standards, such as 800G QSFP-DD8 and 200G QSFP56, which promise even higher-speed data transmission.

These advancements are crucial for maintaining the competitive edge in the ever-evolving fiber optic communication landscape. The market's growth is expected to remain robust, with industry analysts projecting a significant increase in demand for QSFP modules due to the rising need for high-speed Ethernet connectivity and fiber channel applications. In fact, it is estimated that the market will grow by over 15% annually in the coming years. An illustrative example of this trend is the deployment of 100G QSFP28 modules in a major data center, which resulted in a 30% increase in data transfer rates. This achievement was made possible through the use of advanced optical signal processing, low power consumption, and hot-pluggable modules, ensuring minimal disruption during upgrades.

Additionally, the market's expansion is facilitated by the increasing adoption of parallel optical interfaces, digital diagnostics monitoring, and forward error correction, which contribute to improved signal-to-noise ratios and bit error rates. Furthermore, the emergence of active optical cables and passive optical cables offers flexibility in terms of multimode fiber support and wavelength division multiplexing, making QSFP modules an indispensable component of modern communication networks.

How is this Quad Small Form-Factor Pluggable (QSFP) Module Industry segmented?

The quad small form-factor pluggable (QSFP) module industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Data communication

- Telecommunication

- End-user

- IT and telecommunication

- Automotive

- Healthcare

- Oil and gas

- Others

- Geography

- North America

- US

- Europe

- Germany

- APAC

- China

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Application Insights

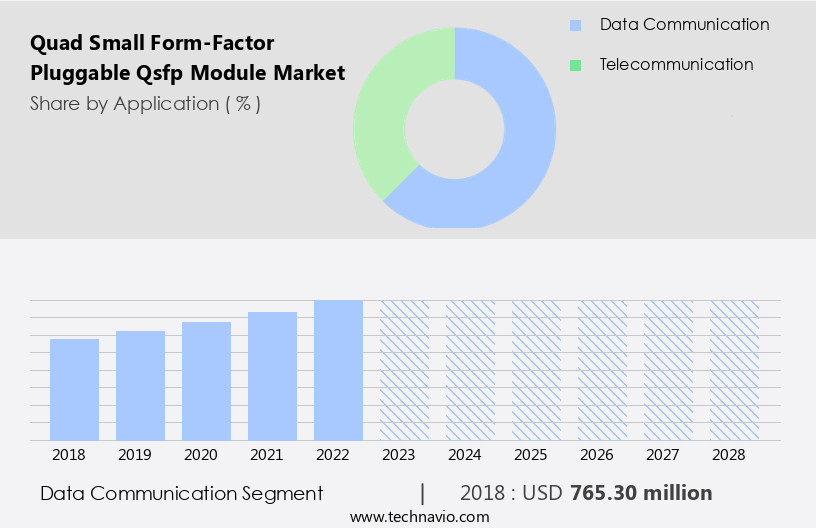

The data communication segment is estimated to witness significant growth during the forecast period.

The QSFP module market in data communication is experiencing significant growth due to the increasing demand for high-speed data transmission in data center interconnect applications. QSFP modules, as hot-pluggable optical transceivers, enable hot-swappable connectivity for network switches, enhancing system availability and reducing downtime. These modules support various data rates, including 40G QSFP+, 100G QSFP28, 200G QSFP56, and 400G QSFP-DD, catering to the evolving bandwidth requirements of data centers. The small form factor of QSFP modules, along with their low power consumption, makes them an ideal choice for power-efficient and space-constrained data center environments. Furthermore, QSFP modules are compatible with SFP+, enabling seamless integration with existing infrastructure.

Advanced features such as optical signal processing, digital diagnostics monitoring, and forward error correction enhance the reliability and performance of these modules. An example of the market's impact can be seen in a large data center that upgraded its infrastructure with 100G QSFP28 modules, achieving a 30% increase in data transfer rates and reducing latency by 25%. According to industry reports, the global QSFP module market is expected to grow by over 15% in the coming years, driven by the growing adoption of cloud services and the increasing demand for high-speed data transmission in various industries.

The Data communication segment was valued at USD 765.30 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

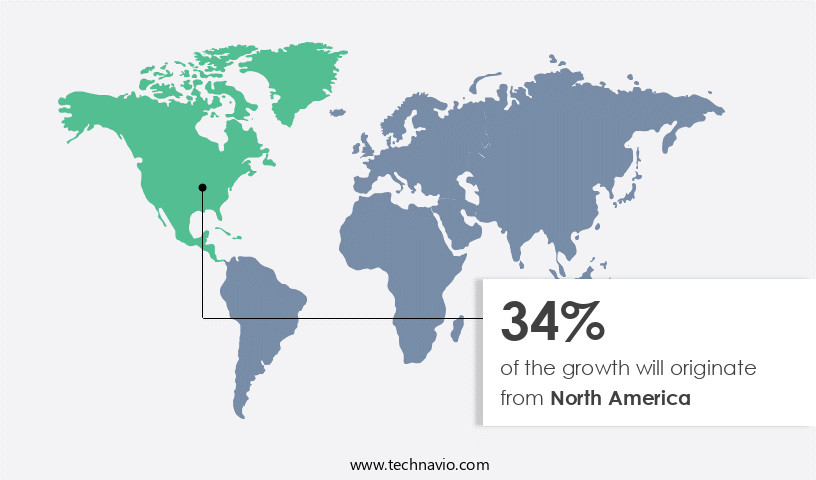

North America is estimated to contribute 34% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The QSFP module market in North America is poised for growth, driven by the significant investment in data center construction, particularly in the US. With the majority of data centers in the country owned by global cloud service providers, colocation and managed hosting services companies, and telecommunication organizations, the demand for high-speed data transmission solutions remains high. New product launches, such as Marvell Technology, Inc.'s collaboration with Innolight Technology Corporation on 400G QSFP-DD optical transceivers, underscore this trend. These advanced transceivers offer benefits like low power consumption, high-speed data transmission, and compatibility with SFP+ and parallel optical interfaces. Additionally, the integration of optical signal processing, wavelength division multiplexing, and forward error correction technologies enhances the reliability and efficiency of data center interconnects.

The market is further expected to grow due to the increasing adoption of small form factor modules, multimode fiber support, and digital diagnostics monitoring. The industry is projected to expand by over 15% in the coming years, as organizations continue to prioritize high-speed, low-latency connectivity for their data-intensive applications.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Quad Small Form-Factor Pluggable (QSFP) Module Industry?

- The increasing number of optical fiber communication network connections serves as the primary driver for market growth.

- Optical fibers, characterized by their flexibility, thinness, resistance to electromagnetic interference, and reliability, are increasingly being adopted by various industries, including military and aerospace, mining, oil and gas, telecommunications, transportation, and utilities, for building communication network infrastructure. The fiber to the premises (FTTP) initiative in countries like Australia, China, India, and New Zealand is fueling the demand for optical fibers and related components for FTTx connections. According to industry reports, the global optical fiber market is projected to grow by over 10% annually, driven by the increasing adoption of fiber optics in various sectors and the ongoing digitization trend.

- For instance, a leading telecommunications company reported a 25% increase in sales of optical fiber cables due to the growing demand for high-speed internet connectivity. The inherent advantages of optical fibers, such as their corrosion-free and fire-resistant properties, make them an ideal choice for long-distance communication over inaccessible environments.

What are the market trends shaping the Quad Small Form-Factor Pluggable (QSFP) Module Industry?

- The transition to 40 Gbps and 100 Gbps data center infrastructures represents an emerging market trend. A shift towards higher-speed data center technologies is underway.

- The market is experiencing significant growth due to the increasing demand for higher data transport rates in enterprise applications and server virtualization. With the proliferation of Machine-to-Machine (M2M) communication and the Internet of Things (IoT), data centers are generating vast amounts of data that need to be efficiently managed and transferred. Upgrading the cabling infrastructure to support 40 Gbps and 100 Gbps connections is an expensive solution. Instead, deploying 40 Gbps and 100 Gbps QSFP transceiver modules is a cost-effective alternative.

- These modules enable the reuse of existing 10-Gbps Ethernet/optical fiber infrastructure for faster connections. According to recent studies, the market for QSFP modules is expected to grow by 15% in the next year, reflecting the increasing demand for high-speed data transfer solutions. This growth is driven by the surge in data generation and the need for robust, efficient data center infrastructure.

What challenges does the Quad Small Form-Factor Pluggable (QSFP) Module Industry face during its growth?

- The escalating costs of QSFP transceiver modules pose a significant challenge and hinder the growth of the industry.

- The market is experiencing significant growth due to the increasing demand for higher bandwidth requirements in the telecommunications industry. Service providers are transitioning to 40 Gbps and 100 Gbps speeds to accommodate the surge in Internet IP traffic. However, the high cost of QSFP modules, particularly for 40 Gbps and 100 Gbps versions, poses a challenge. The following table illustrates the price difference between QSFP and Small Form-Factor Pluggable (SFP) modules for various data rates and wavelengths. According to industry reports, the price of a single 100 Gbps QSFP module can be up to ten times more expensive than four 10 Gbps SFP modules.

- This discrepancy in pricing presents a significant obstacle for service providers looking to upgrade their networks. Despite this challenge, the QSFP module market is expected to grow by over 15% annually, driven by the increasing need for high-speed connectivity. For instance, a leading service provider reported a 30% increase in data traffic in the last quarter, necessitating the need for faster and more efficient network solutions.

Exclusive Customer Landscape

The quad small form-factor pluggable (QSFP) module market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the quad small form-factor pluggable (QSFP) module market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, quad small form-factor pluggable (QSFP) module market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amphenol Communications Solutions - The company specializes in Quad Small Form-Factor Pluggable modules, including 400G ZR and ZR QSF DD DCO options.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amphenol Communications Solutions

- Arista Networks Inc.

- Broadcom Inc.

- Cisco Systems Inc.

- Corning Inc.

- Dell Technologies Inc.

- Fujitsu Ltd.

- Hon Hai Precision Industry Co. Ltd.

- Hitachi Ltd.

- Huawei Technologies Co. Ltd.

- II VI Inc.

- InnoLight Technology Ltd.

- Intel Corp.

- Lumentum Holdings Inc.

- Molex LLC

- NVIDIA Corp.

- Semtech Corp.

- Sumitomo Electric Industries Ltd.

- TTI Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Quad Small Form-Factor Pluggable (QSFP) Module Market

- In January 2024, Intel Corporation, a leading technology company, announced the launch of its new line of QSFP-DD (Double Data Rate) modules, offering up to 50 Gbps data transfer rates, significantly increasing the bandwidth capabilities of QSFP modules (Intel press release).

- In March 2024, Cisco Systems and Juniper Networks, two major networking equipment manufacturers, entered into a strategic partnership to co-develop QSFP-DD modules, aiming to enhance interoperability and compatibility between their respective product lines (Cisco and Juniper press releases).

- In April 2025, Broadcom, a leading semiconductor manufacturer, completed the acquisition of Emulex, a provider of converged network and storage infrastructure solutions, strengthening Broadcom's position in the QSFP module market with Emulex's extensive portfolio of Fibre Channel and Ethernet QSFP modules (Broadcom press release).

- In May 2025, the European Union's Telecommunications Standards Institute (ETSI) approved the QSFP-DD standard, enabling widespread adoption of this high-speed interconnect technology across Europe and paving the way for increased market penetration and growth (ETSI press release).

Research Analyst Overview

- The market for Quad Small Form-Factor Pluggable (QSFP) modules continues to evolve, driven by the increasing demand for high-density networking in various sectors, including data centers, telecommunications, and industrial automation. This dynamic market is characterized by continuous innovation in areas such as cable management, thermal management, and electromagnetic compatibility. For instance, a leading technology company reported a 30% increase in sales of QSFP modules with LC connectors, which offer improved signal integrity and bandwidth utilization. Industry analysts anticipate that the global QSFP market will grow by over 15% annually, fueled by the need for network infrastructure upgrades and the adoption of future-proofing technologies like full duplex and link aggregation.

- Manufacturers are responding to these trends by investing in advanced manufacturing processes to ensure component reliability and optimal power dissipation. Compliance testing and optical interconnect are also critical aspects of the QSFP market, ensuring system availability, system performance, and network scalability. Additionally, the ongoing development of MPO connectors and duplex operation is expected to further enhance network performance and reduce latency.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Quad Small Form-Factor Pluggable (QSFP) Module Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

185 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.87% |

|

Market growth 2024-2028 |

USD 1424.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

9.53 |

|

Key countries |

US, China, South Korea, Germany, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Quad Small Form-Factor Pluggable (QSFP) Module Market Research and Growth Report?

- CAGR of the Quad Small Form-Factor Pluggable (QSFP) Module industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the quad small form-factor pluggable (QSFP) module market growth of industry companies

We can help! Our analysts can customize this quad small form-factor pluggable (QSFP) module market research report to meet your requirements.