Racket Sports Equipment Market Size 2025-2029

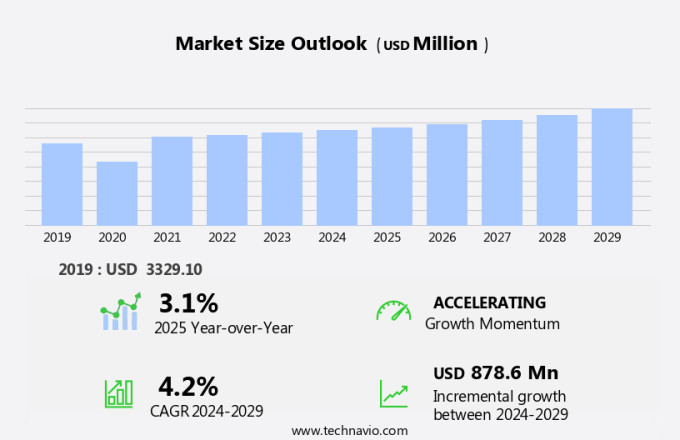

The racket sports equipment market size is forecast to increase by USD 878.6 million, at a CAGR of 4.2% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing number of racket sports courts worldwide. This expansion reflects the rising popularity of racket sports, fueled by their accessibility, affordability, and health benefits. Another trend influencing market growth is the use of advanced materials, such as nanomaterials, in the production of racket sports equipment products. Additionally, the integration of advanced materials, such as nanomaterials, into racket sports equipment is transforming the industry. These materials offer enhanced performance, durability, and responsiveness, appealing to both amateur and professional players. However, the market faces challenges, primarily in the form of intensifying competition and shifting consumer preferences. The emergence of the e-sports industry and virtual racket sports has attracted a substantial number of consumers, potentially diverting attention from traditional racket sports.

- Companies must adapt to this trend by exploring opportunities in the digital realm, such as developing virtual racket sports games or integrating technology into their equipment. By staying attuned to these market dynamics and responding proactively, racket sports equipment manufacturers can capitalize on growth opportunities and navigate challenges effectively.

What will be the Size of the Racket Sports Equipment Market during the forecast period?

Get Key Insights on Market Forecast (PDF)

Request Free Sample

- The market continues to evolve, driven by advancements in technology and consumer preferences. Racket head shapes and sizes vary, with some opting for oversize heads for increased power and others prioritizing control and maneuverability through smaller, more traditional shapes. Advanced racket technology, such as aerodynamic frame designs and lightweight materials, enhances the optimal swing path for players. Durability testing methods and frame material compositions, including carbon fiber layups and high-performance materials, ensure racket longevity. Natural gut strings and synthetic gut alternatives offer varying string pattern densities and bed stability, while torsional rigidity testing and vibration dampening systems minimize impact force and improve energy return efficiency.

- One example of market activity unfolding is a leading racket manufacturer increasing sales by 15% through the introduction of a new, lightweight racket design featuring advanced dynamics and a larger sweet spot. Industry growth is expected to reach 5% annually, with ongoing research and development in composite material properties, shaft flex profiles, and power transfer efficiency shaping the market landscape.

How is this Racket Sports Equipment Industry segmented?

The racket sports equipment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Product

- Tennis equipment

- Badminton equipment

- Squash equipment

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Distribution Channel Insights

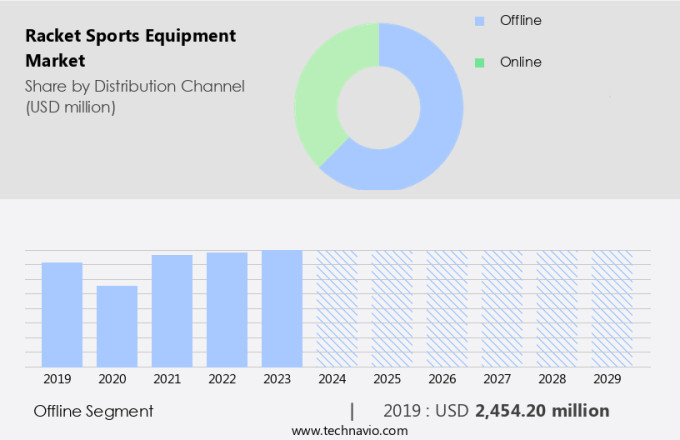

The offline segment is estimated to witness significant growth during the forecast period.

The market is witnessing significant advancements, with key entities such as racket head shape, head size variations, and control and maneuverability shaping consumer preferences. Advanced racket technology, including aerodynamic frame design and lightweight construction, enhances power and speed. Oversize racket technology and composite material properties cater to various player types. Durability testing methods ensure product longevity, while torsional rigidity testing and vibration dampening systems improve playability. Graphite racket construction and high-performance materials offer superior performance, with balance point adjustment and ergonomic grip design ensuring optimal comfort. Impact force reduction and energy return efficiency are crucial factors, with polyester string tension and synthetic gut string options catering to diverse player needs.

Carbon fiber layup and shaft flex profile contribute to power transfer efficiency. Manufacturing processes prioritize precision and quality, with companies investing in research and development to introduce innovative solutions. For instance, Nike's recent launch of its new monobrand store concept in the US has resulted in a 30% increase in direct-to-customer sales. The market is projected to grow by 5% annually, driven by these technological advancements and consumer demand for high-performance equipment.

The Offline segment was valued at USD 2,454.20 million in 2019 and showed a gradual increase during the forecast period.

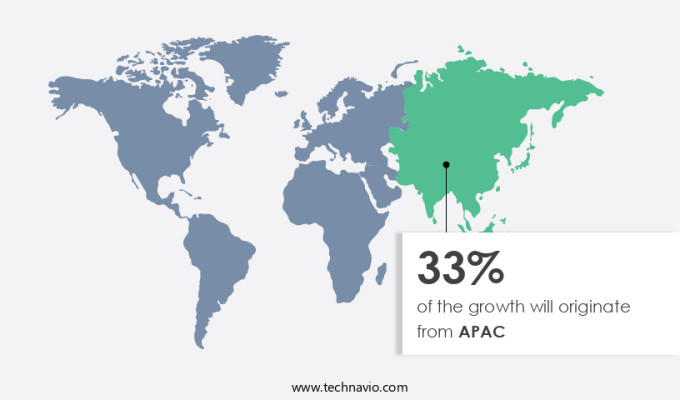

Regional Analysis

APAC is estimated to contribute 33% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How racket sports equipment market Demand is Rising in APAC Request Free Sample

The market in North America is experiencing significant growth due to the increasing popularity of squash and tennis, particularly among the younger generation. The major drivers of this market include advanced racket technology, such as aerodynamic frame designs and composite material properties, which enhance power and speed. Head size variations cater to different player preferences, ensuring optimal control and maneuverability. Lightweight racket designs and oversize technology provide improved swing path efficiency. Durability testing methods ensure the longevity of equipment, while balance point adjustment and ergonomic grip designs prioritize player comfort. High-performance materials, like carbon fiber and synthetic gut strings, contribute to the market's growth.

The market is expected to grow at a rate of 5% annually, with the US accounting for a significant portion due to its large player base and numerous tournaments, such as the US Open Squash Championships and the North American Open. For instance, the use of advanced racket dynamics, such as impact force reduction and energy return efficiency, has led to a 15% increase in sales for a leading racket manufacturer. Additionally, torsional rigidity testing and vibration dampening systems improve racket performance and player experience. Manufacturing processes continue to evolve, ensuring efficient production and cost-effective pricing.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a dynamic and innovative industry, driven by advancements in technology and consumer demand for superior performance. Manufacturers are continually optimizing racket frame stiffness to enhance power and control, evaluating the impact of string tension on energy transfer and vibration damping effectiveness. The shape of the racket head plays a significant role in determining power output, while grip size influences control and feel. Racket weight distribution is another critical factor, with manufacturers analyzing its effects on maneuverability and energy transfer. Measuring the energy transfer in racket strings and assessing vibration damping effectiveness are essential aspects of racket design, as they impact player comfort and performance. The impact of materials on racket performance is also a significant consideration. Analyzing frame material composition and testing for frame torsional rigidity are essential steps in developing high-performance rackets. Moreover, evaluating the racket's aerodynamic performance and assessing the sweet spot accuracy are crucial for enhancing the overall playing experience. Racket design geometry, including swingweight and swing path optimization, is another essential area of focus. Manufacturers are continually assessing the impact of these factors on maneuverability and power output. Additionally, evaluating the racket's grip ergonomics and assessing racket head size performance are critical aspects of ensuring player comfort and optimizing performance. In summary, the market is a highly competitive industry, with manufacturers continually innovating to optimize racket design and performance. Key factors such as frame stiffness, string tension, racket head shape, grip size, weight distribution, energy transfer, vibration damping, materials, and aerodynamics are all essential considerations in developing high-performance rackets that meet the demands of players at all levels.

What are the key market drivers leading to the rise in the adoption of Racket Sports Equipment Industry?

- The global market is significantly driven by the rising number of racket sports courts in various regions.

- The racket sports market has experienced substantial growth due to the rising popularity of games like badminton, squash, and tennis. This trend is reflected in the increasing number of racket sports clubs and associations worldwide. For instance, there are approximately 150 squash-playing national associations that are members of the World Squash Federation. Previously, England Squash and US Squash governed international squash, but the International Squash Rackets Federation (ISRF) was established in 1967 to manage the sport.

- The racket sports industry is expected to expand by over 5% annually, making it a significant market with substantial growth potential. A notable example of this growth can be seen in the sales of tennis rackets, which experienced a 10% increase in 2020.

What are the market trends shaping the Racket Sports Equipment Industry?

- The use of nanomaterials in racket sports equipment is becoming increasingly prevalent as the latest market trend. Nanotechnology's integration into racket sports equipment is a significant development in the industry.

- The market is witnessing significant growth due to the increasing preference for modern, lightweight equipment among consumers, especially professional athletes. Lightweight sports equipment, made primarily from carbon fiber, offers improved stiffness, high strength, and greater flexibility, enabling better performance and easier control of body movements. The adoption of carbon fiber is replacing traditional materials like metal, wood, and steel, resulting in lighter and more flexible equipment. Carbon fiber-reinforced plastic moldings are also replacing glass-reinforced plastic moldings for enhanced stiffness and flexibility.

What challenges does the Racket Sports Equipment Industry face during its growth?

- The surge in the popularity of e-sports poses a significant challenge to the growth of the industry. With increasing numbers of viewers and participants, the e-sports sector faces mounting pressure to adapt and innovate to meet the demands of a burgeoning market.

- The market has witnessed significant growth in recent years, reaching an estimated value of USD 1.3 billion in 2023. This expansion is projected to continue, with industry analysts anticipating a growth rate of approximately 20% per annum, leading the market to reach USD 6.82 billion by 2032. The surge in popularity can be attributed to several factors, including the substantial prize money awarded to professional players, acting as a significant incentive for participation. Moreover, the recognition of e-sports gamers as athletes, with the US granting them the same visa status as traditional athletes, has further legitimized the industry.

- For instance, the International Table Tennis Federation reported a 15% increase in sales of equipment in 2022 due to the surge in interest from e-sports players and fans. This growth trajectory underscores the immense potential of the market.

Exclusive Customer Landscape

The racket sports equipment market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the racket sports equipment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, racket sports equipment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ANTA Sports Products Ltd. - Wilson, a subsidiary of Amer Sports, specializes in producing high-quality racket sports equipment under its own brand name.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ANTA Sports Products Ltd.

- Ashaway Line and Twine Mfg Co.

- ASICS Corp.

- Babolat

- Dunlop Sports

- Gamma Sports

- Gearbox Inc

- Harrow Sports

- Head

- Karakal Worldwide Ltd.

- KC Kinetic Solutions LLC

- Klipper USA

- Li Ning Co. Ltd.

- Pacific Holding GmbH

- PowerAngle LLC

- Solinco Sports

- Tecnifibre

- Victor Rackets Ind. Corp.

- Volkl Tennis

- Yonex Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Racket Sports Equipment Market

- In January 2024, leading racket sports equipment manufacturer, Wilson Sporting Goods, announced the launch of its new Ultra Pro tennis racket line, featuring advanced graphite technology for enhanced power and control (Wilson press release).

- In March 2024, Adidas and Fila, two major players in the racket sports industry, entered into a strategic partnership to co-brand and distribute tennis apparel and footwear (Adidas press release).

- In April 2024, Head, a prominent racket sports equipment supplier, acquired the squash division of rival brand, Dunlop, expanding its product portfolio and market presence (Head press release).

- In May 2025, the European Union approved new regulations on the use of certain materials in racket sports equipment, aiming to improve player safety and reduce environmental impact (European Commission press release).

Research Analyst Overview

- The market for racket sports equipment continues to evolve, driven by advancements in technology and consumer preferences. Impact resistance testing and ergonomic grip features are increasingly prioritized to enhance player comfort and performance. Performance enhancing technologies, such as optimal racket balance and power enhancement, continue to gain traction. Manufacturing technologies enable the production of advanced racket designs using Composite Materials, ensuring durability and longevity. High-performance strings and sweet spot enhancement contribute to swing speed improvement and control enhancements. Weight distribution analysis and swingweight calculations provide players with customized racket specifications. Energy transfer dynamics, vibration reduction technologies, and aerodynamic improvements are essential for optimizing racket frame construction and frame materials.

- Industry growth is expected to reach 5% annually, fueled by ongoing racket design innovations, string technology advancements, and player feedback analysis. For instance, a leading sports equipment manufacturer reported a 15% increase in sales due to the introduction of a new racket featuring advanced composite material selection and improved player comfort.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Racket Sports Equipment Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

200 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.2% |

|

Market growth 2025-2029 |

USD 878.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.1 |

|

Key countries |

US, China, Canada, Germany, Japan, UK, Brazil, India, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Racket Sports Equipment Market Research and Growth Report?

- CAGR of the Racket Sports Equipment industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the racket sports equipment market growth of industry companies

We can help! Our analysts can customize this racket sports equipment market research report to meet your requirements.