Rail Wheel Market Size 2025-2029

The rail wheel market size is forecast to increase by USD 1.46 billion, at a CAGR of 5.8% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing rail passenger traffic worldwide. This trend is further bolstered by increased government funding and the adoption of public-private partnerships (PPPs) to expand and modernize rail infrastructure. However, the market faces challenges due to the volatility in prices of raw materials, particularly steel, which is a primary component in rail wheel manufacturing. This price instability can impact the profitability of rail wheel manufacturers and may necessitate strategic sourcing and supply chain management to mitigate risks.

- Companies in the rail wheel industry must navigate these market dynamics to capitalize on opportunities and maintain a competitive edge. Effective cost management, innovation in manufacturing processes, and strategic partnerships will be crucial for success in this evolving market landscape.

What will be the Size of the Rail Wheel Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market is a dynamic and evolving industry, characterized by continuous advancements in technology and applications across various sectors. From heavy haul rail to passenger transportation, the demand for robust and efficient wheel sets is paramount. Manufacturers employ various techniques in rail wheel manufacturing, including casting and forging, to produce wheels that can withstand the rigors of freight and transit rail applications. Material science plays a crucial role in wheel production, with an emphasis on understanding wheel material properties and their impact on wheel life prediction. Rolling contact fatigue, wheel wear, and wheel defects are key concerns, necessitating rigorous testing and maintenance procedures.

Non-destructive testing methods, such as ultrasonic inspection and magnetic particle inspection, are employed to ensure wheel integrity. Heat treatment and precision engineering techniques are utilized to optimize wheel performance and extend wheel life. Bearing technology, suspension systems, and brake systems are essential components of wheel assemblies, requiring ongoing research and development. Raw material sourcing, inventory management, and supply chain optimization are also critical aspects of the industry. Safety standards, including railway regulations, are stringently enforced to ensure the safety and reliability of wheel sets. Surface treatments, such as coatings and lubricants, are used to mitigate rolling resistance and enhance wheel performance.

Wheel profiles, wheel diameter, axle load, track gauge, and flange geometry are all factors that influence wheel-rail interaction, which is a key consideration in the design and manufacturing of rail wheels. Steel alloys, tire mounting, and wheel rim and wheel tread analysis are other essential elements of the market. In the realm of passenger transportation, metro cars, passenger cars, and tram cars all require wheels that can provide a smooth and quiet ride, while maintaining safety and reliability. The ongoing unfolding of market activities in the rail wheel industry underscores the importance of ongoing research, innovation, and adaptation to meet the evolving needs of the transportation sector.

How is this Rail Wheel Industry segmented?

The rail wheel industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Freight trains

- Long-distance trains

- Suburban trains

- Metro and monorails

- Application

- OEM

- Aftermarket

- Component

- Solid wheels

- Hollow wheels

- Composite wheels

- Geography

- North America

- US

- Canada

- Europe

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The freight trains segment is estimated to witness significant growth during the forecast period.

The market has witnessed significant growth in recent years due to the increasing demand for freight transportation and the expansion of railway networks in various countries. Rail wheels are a crucial component of freight and passenger trains, ensuring efficient and safe transportation. In the context of freight transportation, the heavy haul rail sector has experienced notable growth, necessitating the manufacturing of robust and durable wheels to support the increased axle loads. Advancements in material science and technology have led to the development of high-performance wheel materials, such as steel alloys, which enhance wheel life prediction and fatigue life.

These innovations have also facilitated the production of cast and forged wheels, which offer superior strength and precision engineering. Non-destructive testing techniques, including ultrasonic inspection, magnetic particle inspection, and vibration analysis, are employed to ensure the quality of rail wheels and detect any defects before they cause potential safety issues. Additionally, heat treatment and surface treatments are utilized to improve wheel properties and reduce wheel wear. In the passenger transportation sector, metro cars and passenger cars rely on wheels that provide smooth and quiet operation. Bearing technology, flange geometry, and caliper brakes are essential considerations for passenger rail wheels.

Safety standards and regulations, such as those related to wheel profiles, wheel diameter, and track gauge, are strictly adhered to ensure passenger safety. The distribution networks for rail wheels involve complex supply chain management, including raw material sourcing, inventory management, and wheel replacement procedures. The integration of advanced technologies, such as acoustic emission and maintenance procedures, enables early detection of wheel defects and efficient wheel repair. High-speed rail and transit rail systems require wheels that can withstand the increased wheel load and rolling resistance. The use of disc brakes and suspension systems further adds to the complexity of wheel design and manufacturing.

In conclusion, the market is driven by the growing demand for freight and passenger transportation, technological advancements, and regulatory requirements. The market is characterized by continuous innovation, stringent quality control, and a focus on safety and efficiency.

The Freight trains segment was valued at USD 1.74 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

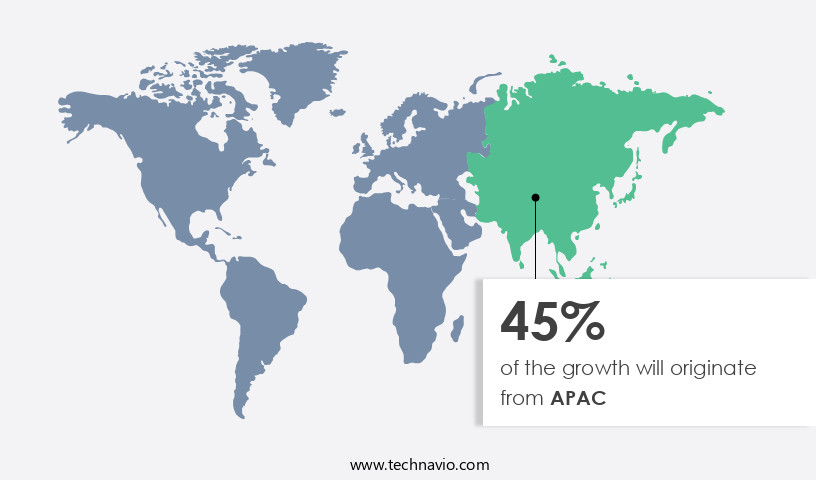

APAC is estimated to contribute 45% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is witnessing significant growth due to the expanding transportation infrastructure, particularly in Asia Pacific. By 2025, substantial investments, estimated in trillions of dollars, are projected for railway development in countries like China and India. This trend is driven by the region's economic growth and urbanization, positioning rail as the second most invested infrastructure sector after roads. Rail wheel manufacturing encompasses various processes, including cast wheels, forged wheels, and wheel machining. Material science plays a crucial role in wheel manufacturing, with steel alloys and surface treatments essential for enhancing wheel life prediction and resistance to rolling contact fatigue.

Non-destructive testing techniques, such as ultrasonic inspection and magnetic particle inspection, are employed for failure analysis and quality control. Heavy haul rail and passenger transportation sectors rely on robust wheel sets, axle assemblies, and suspension systems to ensure safety and efficiency. Railways adhere to stringent safety standards and regulations, mandating regular maintenance procedures, including vibration analysis and wheel wear monitoring. In the passenger transportation sector, metro cars and tram cars utilize disc brakes and caliper brakes, while freight transportation relies on air brakes and rail track interaction. Bearing technology and wheel profiles are essential components for optimizing wheel load and reducing rolling resistance.

Distribution networks and supply chain management are critical for timely wheel replacement and repair. Raw material sourcing and precision engineering are essential for maintaining inventory levels and ensuring a consistent supply of high-quality wheels. High-speed rail and transit rail sectors are experiencing a surge in demand, necessitating advanced wheel technologies and safety standards. Electric and diesel locomotives, wheel sets, and wheel profiles are being developed to cater to the evolving needs of these sectors. In conclusion, the market is experiencing substantial growth due to the expanding transportation infrastructure, particularly in Asia Pacific. Factors such as material science advancements, non-destructive testing, and safety regulations are driving innovation and efficiency in rail wheel manufacturing and transportation.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a vital segment of the global rail transportation industry, encompassing the design, manufacturing, and supply of wheels for various types of rail vehicles. This market caters to the demands of high-speed trains, freight trains, and metro systems, requiring robust and efficient wheels for optimal performance. Rail wheel manufacturers prioritize materials like steel, alloy, and composite to ensure durability and resistance to wear and tear. Other essential considerations include wheel profile design, tread patterns, and wheel-rail interaction. The market also focuses on reducing noise pollution and improving energy efficiency through innovations in wheel technology. Additionally, the market is driven by factors such as increasing rail transportation infrastructure development and growing demand for sustainable transportation solutions. Regulatory compliance and safety standards are stringent, ensuring the production of top-quality wheels for rail applications.

What are the key market drivers leading to the rise in the adoption of Rail Wheel Industry?

- The significant growth in rail passenger traffic serves as the primary catalyst for market expansion.

- The market is experiencing steady growth, driven by the increasing demand for rail transportation due to rising passenger traffic, particularly in urban areas. This trend is being fueled by railway infrastructure development and the expansion of high-speed rail networks, making rail a sophisticated and preferred mode of transportation. Developing countries, such as India, are witnessing significant growth in passenger rail traffic, with the Indian Railways reporting a passenger traffic increase from 3.54 billion in 2022 to 3.82 billion in 2024. Rolling contact fatigue, a critical factor in wheel performance, is a major focus in the market.

- To address this issue, advanced bearing technology, heat treatment, precision engineering, and quality control measures are being employed in the production of metro cars and passenger cars. Additionally, wheel repair and replacement, as well as raw material sourcing, are essential aspects of the market. Axle assemblies and disc brakes are integral components of the wheel system, ensuring smooth and efficient operation. Distribution networks play a crucial role in ensuring the timely delivery of wheels to meet the demands of the rail industry. With the growing importance of high-speed rail, the market for rail wheels is expected to continue its growth trajectory at an average annual rate of around 4% through 2025.

What are the market trends shaping the Rail Wheel Industry?

- One emerging market trend involves an increase in government funding and the implementation of public-private partnerships (PPPs) in various sectors. These initiatives aim to foster economic growth and efficiency through collaborative efforts between the public and private sectors.

- The market is experiencing significant growth due to increased investment in freight transportation infrastructure, particularly in the public-private partnership (PPP) model. This trend is driven by governments and industries seeking to expand and maintain rail networks, including the development of new freight corridors and the enhancement of existing ones. In North America alone, over USD550 billion has been invested since 2000, leading to more frequent and efficient freight transportation. This growth in freight capabilities and operations necessitates the demand for new rail wheels and maintenance services. Suspension systems, magnetic particle inspection, flange geometry, axle load, track gauge, caliper brakes, wheel defects, tram cars, air brakes, and brake systems are all crucial components of the market.

- Railway regulations also play a vital role in ensuring the safety and reliability of rail transportation systems. Acoustic emission technology is increasingly being used for early detection of wheel defects, enhancing the overall efficiency and safety of the rail network.

What challenges does the Rail Wheel Industry face during its growth?

- The volatility in raw material prices poses a significant challenge to the industry's growth trajectory. In order to maintain competitiveness and profitability, businesses must effectively manage price fluctuations and mitigate their impact on operations and financial planning.

- The market faces challenges due to the volatility in the prices of raw materials used in production, which can hinder market expansion. Key components in rail wheel manufacturing include steel, aluminum, and cast iron, whose prices are influenced by market demand and supply, currency fluctuations, and geopolitical tensions. These price fluctuations increase the production cost, which may be transferred to consumers, leading to higher rail wheel prices. The global economic climate and price elasticity significantly impact commodity and metal prices. In the rail industry, maintenance procedures for wheel sets, such as surface treatments, vibration analysis, and inventory management, are crucial for ensuring safety standards.

- Electric and diesel locomotives utilize different wheel profiles and steel alloys for optimal rail track interaction and rolling resistance. Forged wheels offer enhanced durability and strength, while wheel rim and wheel tread designs vary depending on the specific application. Safety standards and regulations mandate regular inspections and maintenance to ensure the longevity and reliability of rail wheel systems.

Exclusive Customer Landscape

The rail wheel market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the rail wheel market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, rail wheel market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ALSTOM SA - The company specializes in manufacturing and supplying rail components, including wheels, axles, and wheelsets.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ALSTOM SA

- Amsted Rail Company Inc.

- ArcelorMittal

- Bharat Forge Ltd.

- Bochumer Verein Verkehrstechnik GmbH

- BONATRANS GROUP a. s

- CONSTRUCCIONES Y AUXILIAR DE FERROCARRILES S.A.

- CRRC Corp. Ltd.

- EVRAZ Plc

- Georgsmarienhutte Holding GmbH

- JIANGSU RAILTECO EQUIPMENT CO. LTD.

- Kolowag

- Lucchini RS Group

- Molycop

- Nippon Steel Corp.

- Qingdao TSKY Railway Equipment Co. Ltd.

- Ramkrishna Forgings Ltd.

- Steel Authority of India Ltd.

- Taiyuan Heavy Industry Co. Ltd.

- United Metallurgical Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Rail Wheel Market

- In January 2024, Knorr-Bremse, a leading rail technology company, announced the launch of its new generation of rail wheels, the "EcoWheel," designed to reduce rolling resistance and improve energy efficiency by up to 10% (Knorr-Bremse press release).

- In March 2024, Bombardier Transportation and Alstom signed a strategic partnership agreement to collaborate on the development and production of innovative rail wheels and axles, combining their expertise and resources (Bombardier Transportation press release).

- In April 2024, Wabtec Corporation completed the acquisition of Fischer Pander Group, a leading European manufacturer of rail wheels and axles, significantly expanding its global footprint and market share in the European rail industry (Wabtec Corporation SEC filing).

- In May 2025, the European Union approved the Horizon Europe research and innovation program, which includes a substantial focus on developing advanced rail technologies, including next-generation rail wheels, to reduce carbon emissions and improve overall rail efficiency (European Commission press release).

Research Analyst Overview

- In the market, energy efficiency and cost optimization are key priorities for railway infrastructure operators. Sensor technology plays a crucial role in monitoring wheel condition and reducing noise pollution, while environmental impact is a growing concern. Dynamic testing and wheel slip analysis are essential for maintaining optimal wheel performance and ensuring signal systems function effectively. Advanced manufacturing techniques, such as additive manufacturing and 3D printing, are transforming the production of rail wheels. Lightweight materials, including composite materials, are being adopted to minimize the carbon footprint of railway operations. Control systems and machine learning algorithms are used to optimize maintenance schedules and predict potential issues before they become major problems.

- IoT integration and data analytics enable real-time condition monitoring and predictive analytics, improving overall efficiency and safety. Static testing, finite element analysis, and simulation modeling are essential tools for ensuring wheel durability and performance. Rail profile and track geometry are critical factors in wheel design and optimization. Circular economy principles, such as life cycle assessment and recycled materials, are increasingly important in the market. Vibration damping and noise reduction are essential for enhancing passenger comfort and reducing environmental impact. Return on investment is a key consideration for railway operators, with advanced technologies and maintenance optimization strategies providing significant cost savings over time.

- Artificial intelligence and digital twins are being used to optimize railway infrastructure and improve overall operational efficiency.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Rail Wheel Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

222 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.8% |

|

Market growth 2025-2029 |

USD 1463.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.1 |

|

Key countries |

US, China, Canada, Japan, India, Germany, UK, South Korea, Brazil, and Argentina |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Rail Wheel Market Research and Growth Report?

- CAGR of the Rail Wheel industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the rail wheel market growth of industry companies

We can help! Our analysts can customize this rail wheel market research report to meet your requirements.