Rapid Diagnostics Market Size 2024-2028

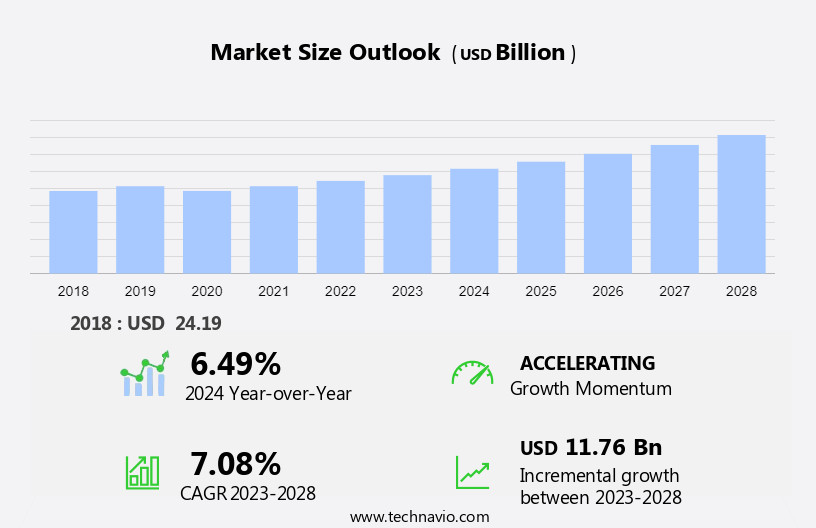

The rapid diagnostics market size is forecast to increase by USD 11.76 billion at a CAGR of 7.08% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing incidence of chronic and infectious diseases, such as cancer, cardiac conditions, and infectious diseases, which necessitate routine testing. This trend is driven by the need for early and accurate diagnosis to improve patient outcomes and reduce healthcare costs. The market is driven by the growing presence of Original Equipment Manufacturers offering advanced diagnostic solutions for proteins, health conditions, and disease detection.

- Additionally, the growing presence of Original Equipment Manufacturers (OEMs) In the market is contributing to the market's expansion. Key application areas include blood glucose testing, cardiac markers, lipid profile, and cholesterol testing. However, the high cost of rapid diagnostic products remains a challenge for market growth. To address this challenge, manufacturers are focusing on developing cost-effective solutions while maintaining the accuracy and reliability of their products. Overall, the market is expected to continue its growth trajectory In the coming years, driven by these key trends and challenges.

What will be the Size of the Rapid Diagnostics Market During the Forecast Period?

- The market encompasses medical tests conducted at health facilities and screening sites, primarily utilizing RDT kits for the detection of various diseases. These tests are essential for health care providers in identifying conditions such as hepatitis, influenza, dengue, and coronavirus, among others, with rapid results. RDTs employ the use of antigens and antibodies or genetic material for diagnosis, providing accuracy and reducing the risk of misdiagnosis and inappropriate treatment.

- Additionally, hospitals and clinical laboratories are significant consumers of these diagnostics, with primary care facilities also adopting them for improved patient management. The market is driven by the increasing demand for point-of-care testing, the need for early disease detection, and the growing awareness of infectious diseases. Diagnostic equipment, including Medical gloves, plays a crucial role in ensuring accurate results and maintaining hygiene during the testing process.

How is this Rapid Diagnostics Industry segmented and which is the largest segment?

The rapid diagnostics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Blood glucose

- Infectious disease

- Cardiometabolic

- Pregnancy and fertility

- Others

- Geography

- North America

- Canada

- US

- Europe

- Germany

- France

- Asia

- China

- Japan

- Rest of World (ROW)

- North America

By Application Insights

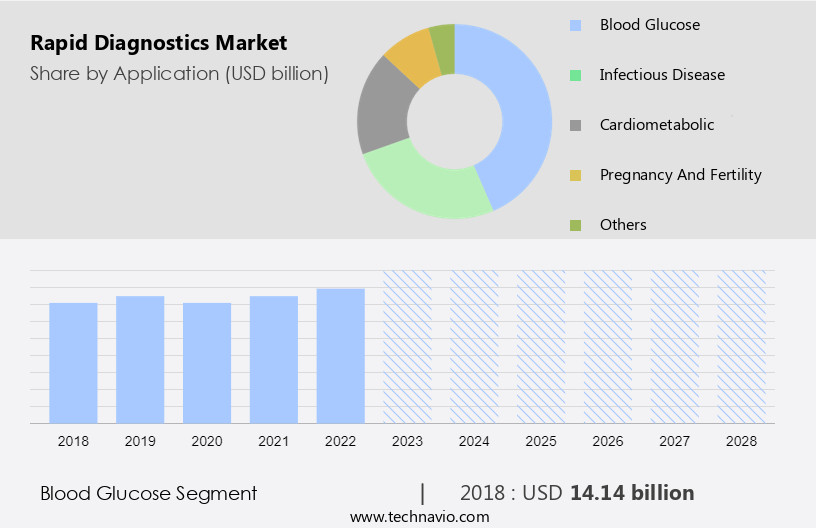

- The blood glucose segment is estimated to witness significant growth during the forecast period.

The market is primarily driven by the increasing prevalence of various health conditions, including diabetes, infectious diseases, and chronic conditions. Blood glucose testing holds the largest market share due to the rising number of diabetes cases, particularly In the geriatric population. In the US, for instance, the CDC reported that approximately 1.4 million new diabetes cases were diagnosed in adults aged 18 years and above in 2019. The market also caters to various healthcare settings, such as hospitals, clinical laboratories, screening sites, and homecare settings, to facilitate precise diagnosis and patient management. Rapid diagnostic tests, including antigen and antibody tests, are utilized for various health conditions, such as cancer, cardiac markers, lipid profile, cholesterol, and infectious diseases like hepatitis, influenza, dengue, and coronavirus.

Additionally, these tests are available at various channels, including medical facilities, pharmacies, supermarkets, e-commerce websites, and web meetings. Misdiagnosis and inappropriate treatment can lead to severe health complications, emphasizing the importance of accurate and timely diagnosis. Rapid diagnostics play a crucial role in decentralized settings, offering inexpensive and bedside diagnostic testing for symptomatic and asymptomatic individuals. Additionally, they are essential in immunoassays and coagulation and toxicology rapid diagnostics.

Get a glance at the Rapid Diagnostics Industry report of share of various segments Request Free Sample

The blood glucose segment was valued at USD 14.14 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- Asia is estimated to contribute 33% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

In 2023, North America held a significant market share in rapid diagnostics due to the high prevalence of chronic diseases, including heart diseases and diabetes, as well as infectious diseases like HIV/AIDS. According to the Centers for Disease Control and Prevention (CDC), approximately 28.4 million adults In the US were diagnosed with heart diseases, accounting for around 11.7% of the population. The American Heart Association reports that heart diseases resulted in 696,962 deaths in 2020. Lifestyle factors such as sedentary habits, alcohol consumption, and smoking, along with high cholesterol levels, contribute to the high incidence of these conditions in North America.

As a result, there is a growing demand for rapid diagnostic tests, particularly for antigens, antibodies, genetic material, proteins, and health conditions like cancer, blood glucose, cardiac markers, lipid profile, cholesterol, and infectious diseases such as hepatitis, influenza, dengue, coronavirus, and HIV. Rapid diagnostics are essential for patient management, screening in decentralized settings, and inexpensive and bedside testing in homecare and primary care. Key players include medical facilities, hospitals, clinical laboratories, and screening sites. Rapid antigen tests, immunoassays, and rapid HIV tests are commonly used. Supermarkets, drug stores, pharmacies, and e-commerce websites also offer these tests for symptomatic and asymptomatic individuals. Misdiagnosis and inappropriate treatment can lead to precision issues, emphasizing the importance of accurate and timely diagnosis. Medical gloves and diagnostic equipment are also crucial components of the market. The epidemiology of chronic diseases and infectious diseases continues to evolve, necessitating ongoing innovation in rapid diagnostics.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Rapid Diagnostics Industry?

The increasing incidence of chronic and infectious diseases is the key driver of the market.

- The market encompasses the production and distribution of Medical diagnostic tests utilized in various health facilities and screening sites for the detection of various health conditions, including infectious diseases, cardiac markers, lipid profile, cholesterol, and cancer. These diagnostic tests, often administered by health care providers, employ RDT kits that identify antigens, antibodies, genetic material, or proteins to determine the presence or absence of a disease. Hospitals and clinical laboratories are significant consumers of these tests, with an increasing focus on inexpensive diagnostic testing and bedside diagnostic testing in homecare settings. Infectious diseases such as hepatitis, influenza, dengue, coronavirus, and HIV are a significant portion of the market. Symptomatic and asymptomatic individuals can be diagnosed using rapid antigen tests, which provide quick results at the point of care. Supermarket chains, drug stores, pharmacies, and e-commerce websites have expanded their offerings to include these tests, making them more accessible to the general population.

- Additionally, rapid antibody tests, such as the Rapid HIV test and Rapid Plasma Regain, are essential for patient management and diagnosis in various medical facilities. Precision and accuracy are crucial to prevent misdiagnosis and inappropriate treatment. The geriatric population and those with chronic diseases, such as cardiometabolic conditions, hepatitis, and infectious diseases, are significant beneficiaries of these tests. The epidemiology of various diseases necessitates decentralized settings for screening and diagnosis. Rapid diagnostics offer a cost-effective and convenient solution for early detection and intervention, reducing the burden on hospitals and clinical laboratories. The market is expected to grow due to the increasing prevalence of chronic diseases and the need for quick and accurate diagnostic testing. Medical gloves and diagnostic equipment are essential accessories for these tests to maintain sterility and precision.

What are the market trends shaping the Rapid Diagnostics Industry?

The growing presence of OEMs is the upcoming market trend.

- The market encompasses the production and distribution of Medical diagnostic tests utilized in various health facilities and screening sites. These tests, often In the form of RDT kits, are employed by healthcare providers in hospitals and clinical laboratories to identify antigens, antibodies, genetic material, proteins, and health conditions related to diseases such as cancer, infectious diseases, and chronic conditions like hepatitis, influenza, dengue, coronavirus, and HIV. Rapid antigen tests, such as those for blood glucose, cardiac markers, lipid profile, cholesterol, and coagulation, are increasingly popular due to their ease of use and quick results. Supermarket chains, drug stores, pharmacies, and e-commerce websites offer these tests for both symptomatic and asymptomatic individuals.

- Immunoassays, including rapid antibody tests, are crucial in patient management, particularly in epidemiology and decentralized settings. The geriatric population and those with chronic diseases benefit significantly from inexpensive diagnostic testing and bedside diagnostic testing in homecare settings. Misdiagnosis and inappropriate treatment can lead to precision concerns, making the need for accurate and reliable rapid diagnostics essential. Medical gloves and diagnostic equipment are also crucial components of this market. The market is expanding, with a growing focus on cardiometabolic rapid diagnostics, toxicology rapid diagnostics, and infectious disease segments. OEMs, such as Sekisui Diagnostics, play a vital role In the development and distribution of these diagnostic components.

What challenges does the Rapid Diagnostics Industry face during its growth?

The high cost of rapid diagnostic products is a key challenge affecting the industry's growth.

- The market encompasses various medical diagnostic tests utilized in health facilities and screening sites for the detection of diverse health conditions, including infectious diseases, cardiac markers, lipid profile, cholesterol, cancer, and genetic material. These tests employ antigens, antibodies, and proteins for diagnosis, with RDT kits gaining popularity due to their ease of use and quick results. Hospitals and clinical laboratories are significant end-users of these tests, while homecare settings and decentralized settings are increasingly adopting them for inexpensive diagnostic testing and bedside diagnostic testing. Rapid antigen tests, such as those for influenza disease, hepatitis, dengue, coronavirus, and HIV, are commonly used for symptomatic and asymptomatic individuals. Supermarket chains, drug stores, pharmacies, and e-commerce websites are increasingly stocking RDT kits for easy access. Misdiagnosis and inappropriate treatment can lead to precision concerns, emphasizing the importance of accurate and reliable diagnostic tests. The immunoassays segment, including rapid antibody tests and rapid HIV tests, plays a crucial role in patient management. Coagulation rapid diagnostics and toxicology rapid diagnostics are essential for disease monitoring and treatment.

- Additionally, the geriatric population and chronic diseases segment are significant contributors to the market growth, with a focus on inexpensive diagnostic testing and point-of-care (POC) diagnostics. Epidemiology and screening programs are driving the demand for rapid diagnostics in various applications. Precision and patient management are key considerations In the market, with a growing emphasis on decentralized settings and POC diagnostics. The infectious disease segment, including hepatitis, influenza disease, dengue, coronavirus, and HIV, is a significant market driver. Medical gloves and diagnostic equipment are essential accessories for these tests. In summary, the market is a dynamic and evolving industry that plays a crucial role in disease detection and patient management. With a focus on precision, inexpensive testing, and ease of use, rapid diagnostics are becoming increasingly important in various healthcare settings. The market is driven by the growing demand for POC diagnostics, infectious disease testing, and chronic disease management.

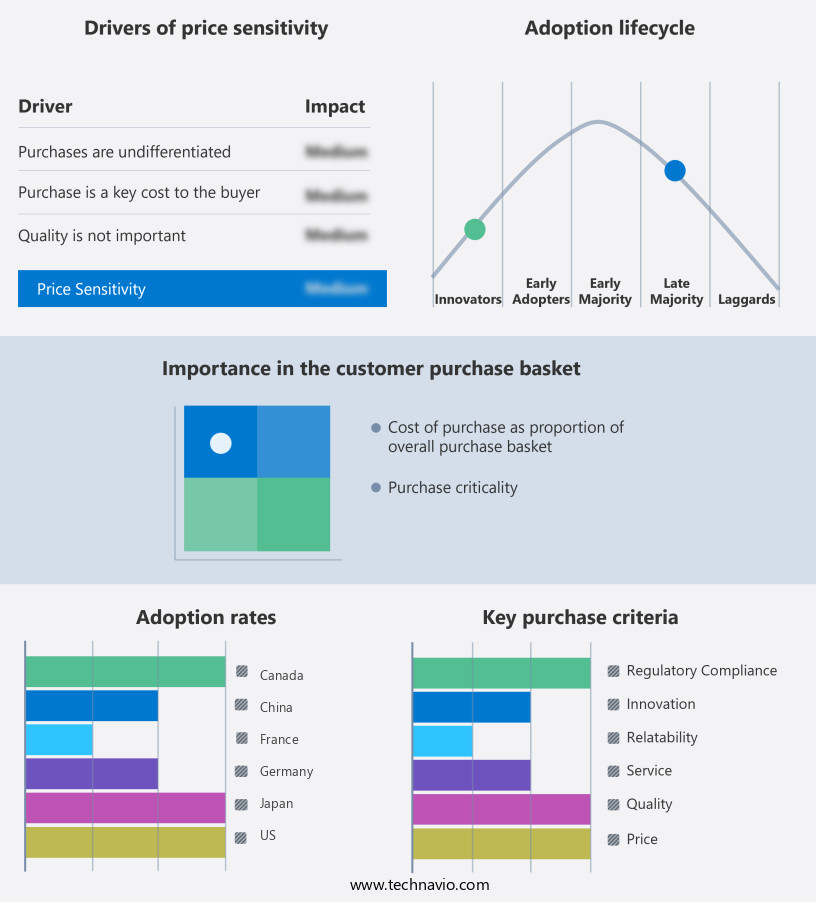

Exclusive Customer Landscape

The rapid diagnostics market forecasting report includes the adoption lifecycle of the market, market growth and forecasting, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the rapid diagnostics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, rapid diagnostics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry. The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- Atomo Diagnostics Ltd.

- Becton Dickinson and Co.

- bioMerieux SA

- Cardinal Health Inc.

- Chembio Diagnostics Inc.

- DAAN Gene Co. Ltd.

- Danaher Corp.

- DiaSorin SpA

- F. Hoffmann La Roche Ltd.

- GlySens Inc.

- Johnson and Johnson Services Inc.

- Meridian Bioscience Inc.

- NanoRepro AG

- OraSure Technologies Inc.

- Quidelortho Corp.

- Siemens Healthineers AG

- Thermo Fisher Scientific Inc.

- Trinity Biotech Plc

- Wuhan EasyDiagnosis Biomedicine Co. Ltd

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a broad range of medical tests designed to deliver accurate and timely results for various health conditions. These tests are essential in healthcare settings, enabling health facilities and care providers to make informed decisions regarding patient management. The market comprises a diverse array of products, including those that detect antigens, antibodies, genetic material, and proteins. Rapid diagnostics play a crucial role in identifying health conditions, from routine testing for cardiac markers, lipid profiles, and cholesterol levels to the detection of infectious diseases such as hepatitis, influenza, dengue, and coronavirus. The market caters to both symptomatic and asymptomatic individuals, ensuring early detection and intervention. The infectious disease segment holds a significant share In the market. The importance of rapid testing in this area is underscored by the need for early detection and isolation to prevent the spread of diseases. For instance, rapid antigen tests have gained popularity In the fight against influenza, enabling health care providers to diagnose and treat patients promptly. The geriatric population and individuals with chronic diseases are prime beneficiaries of rapid diagnostics.

Furthermore, these groups often require frequent monitoring, making inexpensive, decentralized testing a practical solution. Homecare settings and primary care providers have increasingly adopted rapid diagnostics to improve patient management and reduce the burden on hospitals and clinical laboratories. The use of rapid diagnostics extends beyond traditional healthcare settings. Supermarkets, drug stores, pharmacies, and e-commerce websites have started offering rapid tests, making diagnostic services more accessible to the general public. This trend is particularly noticeable In the case of self-testing for conditions like blood glucose levels and pregnancy. Rapid diagnostics are not limited to the detection of diseases. They also play a role in vaccination programs, enabling health care providers to determine immunity status and administer appropriate doses. In addition, rapid antibody tests have gained prominence In the context of epidemiology and screening, providing valuable insights into disease prevalence and transmission.

Thus, the precision and reliability of rapid diagnostics have become increasingly important In the face of misdiagnosis and inappropriate treatment. Decentralized settings, such as bedside diagnostic testing, have emerged as a viable solution to address these challenges. Furthermore, advances in technology have led to the development of cardiometabolic rapid diagnostics, coagulation rapid diagnostics, and toxicology rapid diagnostics, expanding the market's scope and addressing diverse healthcare needs. In summary, the market is a dynamic and evolving landscape, driven by the need for accurate, timely, and accessible diagnostic solutions. The market caters to various healthcare settings and populations, ensuring that individuals receive the right diagnosis and treatment at the right time. The continued innovation and adoption of rapid diagnostics will undoubtedly contribute to improved patient outcomes and more effective disease management.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

166 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.08% |

|

Market growth 2024-2028 |

USD 11.76 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.49 |

|

Key countries |

US, Canada, Japan, Germany, France, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Rapid Diagnostics Market Research and Growth Report?

- CAGR of the Rapid Diagnostics industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the rapid diagnostics market growth of industry companies

We can help! Our analysts can customize this rapid diagnostics market research report to meet your requirements.