India Ready Mix Concrete Market Size 2025-2029

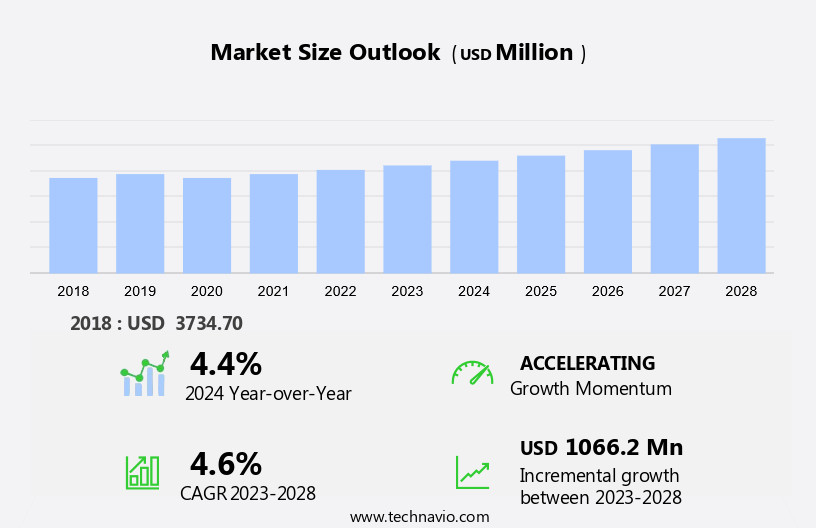

The India ready mix concrete market size is forecast to increase by USD 1.14 billion, at a CAGR of 4.7% between 2024 and 2029.

- The ready-mix concrete market in India is experiencing significant growth due to the increasing preference for this construction material over traditional cement. One such advantage is the use of geopolymer cement concrete, which offers improved durability, reduced carbon emissions, and enhanced workability. This trend is expected to continue, as the construction industry shifts towards more sustainable and efficient solutions. However, the market also faces challenges, most notably the high operating costs associated with ready mix concrete production. These costs include the expense of raw materials, transportation, and labor. To mitigate these challenges, companies in the ready mix concrete industry must focus on optimizing their operations through process improvements, cost reduction strategies, and the adoption of advanced technologies.

- Additionally, collaboration with suppliers and logistics partners can help reduce transportation costs and improve overall efficiency. Furthermore, the adoption of geopolymers and plasticizers is expected to further enhance the strength and durability of ready-mix concrete. By addressing these challenges and capitalizing on the growing demand for ready mix concrete, industry players can effectively navigate the market landscape and gain a competitive edge.

What will be the size of the India Ready Mix Concrete Market during the forecast period?

- The ready mix concrete market encompasses various aspects of concrete production and application, including concrete development, design, and maintenance. Key concerns in this industry include concrete durability, fire resistance, and sustainability. Concrete fatigue and environmental impact are significant challenges, driving the demand for innovative solutions such as concrete coatings and rehabilitation techniques. Concrete research continues to advance, addressing issues like shrinkage, permeability, and corrosion through modeling, simulation, and analysis. Concrete technology innovations, including 3D printing and sealing, are revolutionizing construction processes.

- Meanwhile, concrete trends focus on sustainability, with an emphasis on repairs, applications, and surface treatments that minimize waste and enhance durability. Concrete creep and concrete modeling are crucial in ensuring optimal concrete design and performance. Overall, the ready mix concrete market is dynamic, with a constant focus on improving concrete's properties and reducing its environmental footprint.

How is this market segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Transit mixed concrete

- Shrink mixed concrete

- Application

- Non-residential

- Residential

- Type

- In-transit mixer

- Volumetric mixer

- Geography

- APAC

- India

- APAC

By Product Insights

The transit mixed concrete segment is estimated to witness significant growth during the forecast period. The market is marked by the significant role of the transit mixed concrete segment. In this process, concrete is produced in central batching plants and transported to construction sites in specialized transit mixers, complete with rotating drums. The benefits of transit mixed concrete include consistent quality and strength, ensured through meticulous control of material proportions during batching. Furthermore, transit mixers mitigate the risk of segregation, preserving the desired workability of the concrete. Commercial construction projects, including concrete foundations and structural and architectural applications, heavily rely on transit mixed concrete due to its efficiency and reliability. Sustainability is a growing trend in the market, with the adoption of green concrete, recycled aggregates, and concrete additives such as water-reducing agents and air entrainment.

High-performance concrete, precast concrete, and prestressed concrete are also popular choices for infrastructure development and industrial construction. Civil engineering projects require precise supply chain management and project scheduling, which is facilitated by ready-mix delivery services. Concrete technology advancements, such as self-consolidating concrete and fiber reinforcement, contribute to efficiency improvements and enhanced compressive strength. Curing concrete and concrete paving are essential aspects of construction, with concrete recycling and waste management playing a crucial role in cost optimization. The concrete industry continues to evolve, with innovations in concrete testing, concrete flooring, and concrete restoration.

Get a glance at the market share of various segments Request Free Sample

The Transit mixed concrete segment was valued at USD 2908.80 million in 2019 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Ready Mix Concrete in India Industry?

- The significant preference for ready-mix concrete is the primary market driver, as this construction material's convenience, consistency, and efficiency continue to make it a preferred choice for various infrastructure and construction projects. Ready mix concrete (RMC) is gaining significant traction in the Indian construction industry due to its numerous advantages over traditional concrete production methods. The demand for RMC is fueled by large-scale residential projects, infrastructure expansion, and technological advancements. RMC offers superior quality control, eliminating the need for on-site storage and machinery, optimized raw material selection, minimal waste generation, enhanced safety standards, reduced labor requirements, and faster construction timelines. Furthermore, RMC's lower environmental impact and streamlined supply chain align with India's infrastructure development goals, including smart cities, highways, and metro projects. Concrete testing plays a crucial role in ensuring the quality and consistency of RMC, with water-reducing agents and fiber reinforcement used to enhance its properties.

- Curing concrete properly is essential to achieve the desired compressive strength and durability. Decorative concrete and concrete paving are also popular applications of RMC, adding aesthetic value to various projects. Overall, the adoption of RMC is expected to continue rising in India due to its efficiency, quality, and environmental benefits.

What are the market trends shaping the Ready Mix Concrete in India Industry?

- The increasing preference for geopolymer cement concrete is a notable trend in the construction industry. This eco-friendly and durable alternative to traditional Portland cement concrete is gaining significant market traction. Geopolymers, derived from industrial by-products like fly ash and slag, are increasingly utilized in the concrete industry due to their eco-friendliness and superior performance. These materials offer advantages such as high resistance to acids, ability to withstand extreme temperatures, and enhanced structural strength, making them a preferred choice for sustainable construction. The global push towards green building initiatives is driving the adoption of geopolymers in infrastructure projects. Governments and organizations worldwide prioritize reducing the carbon footprint of the construction sector, and geopolymers provide a viable solution.

- Concrete production using geopolymers reduces carbon dioxide emissions significantly compared to traditional cement. Concrete pumping, project scheduling, and ready-mix delivery are key areas where geopolymers contribute to increased labor productivity. Concrete technology continues to evolve, with a focus on waste management and lightweight concrete. The concrete industry's shift towards sustainability and low-carbon alternatives is expected to continue, with geopolymers playing a pivotal role.

What challenges does the Ready Mix Concrete in India Industry face during its growth?

- The high operating costs of ready-mix concrete production represent a significant challenge to the industry's growth trajectory. Ready mix concrete plays a significant role in India's construction industry, necessitating substantial amounts of cement, aggregates, and additives for its production. The cost of ready mix concrete is higher than onsite mix concrete due to factors such as extensive cement usage, manufacturing site management, and transportation expenses. The transportation of concrete often requires the addition of admixtures to prevent premature setting, and traffic congestion further increases operational costs and delays. However, these external factors are beyond the control of concrete manufacturers. Despite these challenges, ready mix concrete remains a preferred choice for construction projects due to its efficiency and consistent quality.

- Ready mix concrete's production process involves the transportation of raw materials to a centralized plant, where they are mixed and poured into trucks for delivery to construction sites. This process offers several advantages over onsite mix concrete, including time savings, improved consistency, and reduced labor requirements. However, the costs associated with cement usage, plant management, and transportation can be significant. Moreover, the transportation of ready mix concrete requires the use of admixtures to prevent premature setting, which adds to the overall cost. Traffic congestion further increases operational expenses and delays. Despite these challenges, the construction industry continues to prefer ready mix concrete due to its efficiency and consistent quality.

Exclusive Customer Landscape

The ready mix concrete market in India forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the ready mix concrete market in India report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, ready mix concrete market in India forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Adani Group - ACC Ltd., a subsidiary of the organization, provides top-tier ready-mix concrete solutions under the brand name ACC RMX.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adani Group

- Alcon

- Aparna Enterprises Ltd.

- Concrete India RMC

- Godrej and Boyce Manufacturing Co. Ltd.

- Hindustan Infrastructure Solution

- JK Lakshmi Cement Ltd.

- JSW Cement Ltd.

- Nuvoco Vistas Corp. Ltd.

- Prism Johnson Ltd.

- RDC Concrete India Pvt. Ltd.

- Sai RMC India

- SCC Group

- Skyway RMC Plants Pvt. Ltd.

- Sriram RMC Pvt. Ltd.

- The India Cements Ltd

- The Ramco Cements Ltd.

- UltraTech Cement Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Ready Mix Concrete Market In India

- In March 2023, LafargeHolcim, a leading global construction materials company, announced the launch of its new ready-mix concrete product, "Eco-Friendly Concrete," which reduces carbon emissions by up to 30% without compromising performance (LafargeHolcim press release). This innovative solution is expected to significantly contribute to the market's shift towards more sustainable construction practices.

- In July 2024, Cemex and Holcim, two major players in the ready mix concrete market, announced a strategic partnership to strengthen their positions in the European market. The collaboration includes the exchange of certain assets and the creation of a joint venture, aiming to increase operational efficiency and enhance their combined market presence (Bloomberg).

- In October 2024, the European Union passed a new regulation mandating the use of low-carbon concrete in all public construction projects starting from 2026. This initiative is expected to drive the demand for ready-mix concrete with reduced carbon emissions, creating new opportunities for market players (European Parliament press release).

- In January 2025, Sika AG, a leading specialty chemical company, successfully deployed its new digital platform, "Concremote," which allows real-time monitoring and control of ready-mix concrete's quality and consistency during transportation and placement. This technological advancement is expected to improve efficiency and reduce waste in the construction industry (Sika AG press release).

Research Analyst Overview

The ready mix concrete market continues to evolve, driven by the diverse applications across various sectors. Commercial construction projects rely on high-performance concrete for structural integrity, while civil engineering initiatives prioritize cost optimization through the use of recycled aggregates and concrete additives. Insulating concrete provides energy efficiency in residential and industrial construction, and precast concrete offers efficiency improvements in construction projects through off-site manufacturing. Continuous innovation in concrete technology brings forth new offerings such as self-consolidating concrete, fiber reinforcement, and carbon footprint-reducing green concrete. Concrete restoration plays a crucial role in maintaining the durability of existing structures, from concrete foundations to concrete walls and concrete flooring.

The Ready Mix Concrete Market in India is expanding due to urbanization and infrastructure growth. Builders prioritize quality, enhancing concrete permeability for durability while minimizing concrete shrinkage to prevent structural issues. Advanced formulations improve concrete fire resistance, ensuring safety in construction, while protective coatings mitigate concrete corrosion. Techniques like concrete sealing and concrete waterproofing enhance longevity, reducing maintenance costs. Innovative concrete surface treatments, including concrete staining and concrete polishing, elevate aesthetics. Regular concrete cleaning, concrete maintenance, and timely concrete repairs preserve integrity, supporting concrete rehabilitation efforts. Efficient concrete demolition methods optimize site redevelopment. Advanced concrete design software and concrete simulation enhance planning precision, driving sector advancements.

The Ready Mix Concrete Market in India is evolving rapidly, driven by technological advancements and demand for efficient construction solutions. Advanced concrete analysis helps optimize mix designs, ensuring superior durability and strength. Emerging trends like concrete 3D printing revolutionize construction methods, allowing faster and more precise building processes. Continuous concrete innovation introduces new formulations that enhance sustainability and structural performance. Expanding concrete applications across residential, commercial, and infrastructure projects further boost market growth. Quality control measures like the slump test ensure consistency and workability of concrete for diverse applications. Efficient production through the batching plant streamlines the process, enhancing productivity and reducing waste. Timely delivery via the concrete mixer truck ensures freshly mixed concrete reaches construction sites without compromising quality. Proper placing concrete techniques further contribute to structural integrity, optimizing performance and durability.

The concrete industry's focus on quality control and concrete standards ensures that these applications meet the demands of the ever-changing market. Supply chain management and project scheduling are optimized through the use of concrete mix designs, concrete testing, and ready-mix delivery. Concrete paving and concrete pumping are essential for infrastructure development, while concrete waste management and concrete recycling contribute to sustainability efforts. Curing concrete, compressive strength, and efficiency improvements remain key concerns for the industry, with ongoing research and development in these areas. The concrete industry's commitment to innovation and adaptation ensures its continued relevance and growth in the construction landscape.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Ready Mix Concrete Market in India insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

152 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.7% |

|

Market growth 2025-2029 |

USD 1.14 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.5 |

|

Key countries |

India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, Industry Risks, |

What are the Key Data Covered in this Ready Mix Concrete Market in India Research and Growth Report?

- CAGR of the Ready Mix Concrete in India industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across India

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the ready mix concrete market in India growth of industry companies

We can help! Our analysts can customize this ready mix concrete market in India research report to meet your requirements.