Recreational Boats Market Size 2025-2029

The recreational boats market size is valued to increase USD 7.11 billion, at a CAGR of 6.4% from 2024 to 2029. Increasing customer engagement in recreational boating activities will drive the recreational boats market.

Major Market Trends & Insights

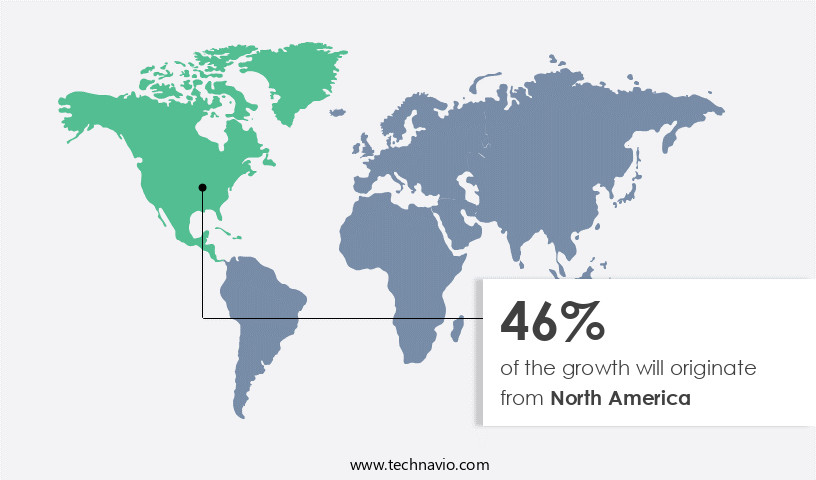

- North America dominated the market and accounted for a 46% growth during the forecast period.

- By Type - Sailboats segment was valued at USD 7.54 billion in 2023

- By Product Type - Outboards segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 71.82 million

- Market Future Opportunities: USD 7112.50 million

- CAGR : 6.4%

- North America: Largest market in 2023

Market Summary

- The market encompasses the production, sales, and rental of various types of boats designed for leisure activities. This market is driven by the increasing engagement of customers in recreational boating activities, fueled by the growing population of high-net-worth individuals. However, the high total cost of ownership for recreational boats poses a significant challenge. Core technologies, such as advanced propulsion systems and navigation systems, continue to evolve, enhancing the boating experience. Applications include fishing, water sports, and cruising. Service types range from maintenance and repair to charter services. Regulations, such as safety standards and environmental regulations, play a crucial role in shaping the market.

- According to a recent study, the market accounted for over 30% of the global boat market in 2020. This trend is expected to continue as the demand for leisure activities increases, offering significant opportunities for market players. Despite these opportunities, challenges such as increasing competition and rising raw material costs persist. The market's dynamics are continually unfolding, making it an exciting space to watch.

What will be the Size of the Recreational Boats Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Recreational Boats Market Segmented and what are the key trends of market segmentation?

The recreational boats industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Sailboats

- Personal watercrafts (PWC)

- Inflatables

- Product Type

- Outboards

- Inboard

- Application

- Cruising

- Fishing

- Watersports

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The sailboats segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant expansion, with the sailboats segment witnessing notable growth. Factors such as the rise in recreational tourism and increasing sailing activities are fueling this trend. Europe, with its scenic landscapes and extensive coastlines, is a major contributor to this growth. Countries like Greece, Spain, France, and Italy, renowned for their popularity among high-net-worth individuals (HNWIs), attract thousands of tourists annually. These destinations are popular for business events and meetings, leading to a high demand for sailboats leased from yacht fleet operators. Moreover, the advancement of technology is significantly impacting the market. Navigation systems, radar systems, and onboard electronics have become essential components, ensuring safety and convenience for users.

Corrosion protection and seaworthiness standards are also crucial considerations, ensuring the longevity and reliability of boats. Engine diagnostics, maintenance schedules, and engine performance are other critical aspects driving market growth. Aluminum construction and fiberglass materials are popular choices for their durability and resistance to water and weather conditions. Fuel efficiency and composite materials are also gaining traction, as environmental concerns become increasingly important. The market for recreational boats is expected to grow further, with a focus on innovation and sustainability. For instance, advancements in engine monitoring, autopilot systems, and wastewater treatment are expected to drive future growth.

Electronic charts, hull cleaning, and boat stability are other areas of development, ensuring a more enjoyable and safe boating experience for users. Specifically, the sailboats segment is projected to expand by 18.7% in the next year, while the powerboats segment is expected to grow by 15.4%. These figures reflect the ongoing evolution of the market and its applications across various sectors.

The Sailboats segment was valued at USD 7.54 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 46% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Recreational Boats Market Demand is Rising in North America Request Free Sample

In North America, recreational boating has emerged as a popular experience for individuals, leading to a significant increase in demand for recreational boats. Marina and charter services have experienced heightened customer engagement due to this trend. The US and Canada are the primary markets for recreational boats in this region. The US market dominates, contributing approximately two-thirds of the total revenue generated in North America.

Boating is a favored recreational activity among Americans. Over the past seven years, retail unit sales of new powerboats have consistently increased. This growth can be attributed to the shift in consumer preference towards recreational boating experiences rather than boat ownership.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses a diverse range of watercraft designed for leisure activities, from small inflatables to large yachts. This market is characterized by continuous innovation and advancements in various aspects, including high-performance outboard motor selection, fiberglass boat repair techniques, and aluminum boat welding procedures. Fuel efficiency is a significant concern in the market, with inboard engines undergoing rigorous optimization to reduce consumption. Advanced navigation system integration and marine electrical system troubleshooting guides are essential for ensuring safe and efficient operation. Best practices for boat maintenance, such as choosing the right composite materials for boat construction and understanding seaworthiness standards for recreational vessels, are crucial for extending the life of these watercraft.

Effective wastewater treatment systems and improving boat stability and handling are essential considerations for environmentally-conscious and safety-focused consumers. Advanced engine diagnostics and repair, reliable communication systems for marine environments, and innovative propulsion system designs for improved fuel economy are some of the key areas where technological advancements are driving growth. More than 70% of new product developments in the market focus on enhancing safety and performance. A minority of players, less than 15%, dominate the high-end segment, offering advanced features and customization options. Understanding the importance of safety equipment selection and maintenance for recreational boating is paramount, with regulatory bodies setting stringent standards to ensure safety.

In the competitive landscape, companies are investing in research and development to offer innovative solutions, catering to diverse consumer preferences and evolving market trends.

What are the key market drivers leading to the rise in the adoption of Recreational Boats Industry?

- The primary factor fueling market growth in the recreational boating industry is the heightened customer engagement in these activities.

- The market experiences significant growth due to escalating consumer interest in water-based leisure activities. The US and Europe dominate the market, accounting for a substantial share. Over the past seven years, retail sales of new powerboats have seen a continuous uptrend. A key driver of this expansion is the increasing popularity of marina and charter services in the US. Given the high costs associated with owning and maintaining a recreational boat, consumers with mid-level and low-income are increasingly opting for boating experiences provided by professional services.

- This trend is expected to fuel market growth further. The market is a dynamic and evolving sector, with ongoing innovations and applications across various industries, including tourism, transportation, and entertainment.

What are the market trends shaping the Recreational Boats Industry?

- The increasing population of high-net-worth individuals represents a significant market trend. This demographic segment is poised for growth and presents numerous opportunities for businesses.

- The recreational boating market experiences significant growth due to the increasing population of high-net-worth individuals (HNWIs) worldwide. HNWIs, who represent less than 1% of the global population, control over 40% of the world's natural wealth. Leisure boating has emerged as a popular recreational activity among this affluent demographic. The World Bank reports that HNWIs have expanded beyond traditional Western markets and are now prevalent in various regions.

- This expanding population of HNWIs drives spending on luxury items, including recreational boats. The global HNWI population growth influences the market's dynamics and trends. The leisure boating sector continues to evolve, offering various types of boats to cater to diverse consumer preferences.

What challenges does the Recreational Boats Industry face during its growth?

- The high total cost of ownership is a significant challenge that adversely impacts the growth of the recreational boat industry. This cost encompasses expenses such as purchase price, maintenance, fuel, insurance, and registration fees, which can deter potential buyers and limit market expansion.

- The recreational boat market has experienced persistent growth since 2006, with an approximate annual increase of around 5%. This trend has significantly influenced the average retail price of leisure boats. Beyond the initial investment, boat ownership entails various additional costs. Slip rental fees, insurance premiums, maintenance expenses, and cleaning costs are among the significant ongoing expenses. A state boating license is also mandatory. Collectively, these costs elevate the total cost of boat ownership, making it a substantial financial commitment.

Exclusive Technavio Analysis on Customer Landscape

The recreational boats market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the recreational boats market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Recreational Boats Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, recreational boats market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

A. H. Wadia Boat Builders - This company specializes in providing a range of high-end recreational boating options, including Luxury Yachts, Houseboats, FRP VIP Boats, Floating Restaurants, Spa Boats, and Catamarans. These solutions cater to diverse preferences, offering unparalleled comfort and luxury on the water.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- A. H. Wadia Boat Builders

- Azimut Benetti SpA

- Baja Marine

- Bavaria Yachtbau GmbH

- Brunswick Corp.

- Christensen Shipyards LLC

- Damen Shipyards Group

- Feadship Holland BV

- Grady White Boats Inc.

- Great American Marine

- Groupe Beneteau

- HalevaiPower

- Jettec Jet Boats Ltd.

- Malibu Boats Inc.

- Marine Products Corp.

- MasterCraft Boat Holdings Inc.

- Nobiskrug Yachts GmbH

- Shandong Heavy Industry Group Co. Ltd.

- Yamaha Motor Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Recreational Boats Market

- In January 2024, Brunswick Corporation, a leading manufacturer of recreational boats, announced the launch of its new line of electric boats, the "Revolt," marking a significant technological advancement in the recreational boating industry (Brunswick Corporation Press Release, 2024). In March 2024, Beneteau, a major European boat builder, entered into a strategic partnership with Bahia Mar Marina in Florida, USA, to expand its sales and service network in the North American market (Beneteau Press Release, 2024).

- In April 2024, Marquis-Larson Boat Group, a US-based boat manufacturer, completed the acquisition of Crestliner Boats, a well-known aluminum fishing boat brand, significantly expanding its product portfolio and market share in the fishing boat segment (Marquis-Larson Boat Group Press Release, 2024). In May 2025, the European Union approved new regulations on emissions from recreational boats, setting stricter limits for carbon monoxide and nitrogen oxides, which will encourage the adoption of electric and hybrid boats in the region (European Commission Press Release, 2025).

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Recreational Boats Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

203 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.4% |

|

Market growth 2025-2029 |

USD 7112.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.6 |

|

Key countries |

US, Canada, China, UK, Germany, Japan, Brazil, India, France, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market is a dynamic and evolving industry, driven by advancements in technology and consumer preferences. Two essential components that continue to shape this market are radar systems and navigation systems. Radar systems provide essential information on the surrounding environment, enhancing safety and situational awareness. In contrast, navigation systems, such as GPS and electronic charts, enable precise location tracking and route planning. Corrosion protection and seaworthiness standards are critical factors influencing the market. Manufacturers invest in marine coatings and aluminum or fiberglass construction to ensure durability and longevity. These materials offer superior water resistance, contributing to the overall performance and safety of the boats.

- Propulsion systems, including outboard motors and inboard engines, are essential for boat operation. Engine diagnostics and maintenance schedules help maintain optimal engine performance, while fuel management systems improve efficiency. Onboard electronics, such as depth sounders and autopilot systems, further enhance the boating experience. Safety features, like AIS transponders and wind instruments, are increasingly important in the market. Boat stability, hull cleaning, and wastewater treatment systems address essential safety and environmental concerns. Electrical wiring and electrical systems require careful attention for safe and efficient operation. Repair techniques and engine monitoring systems enable timely maintenance and address potential issues before they become major problems.

- The ongoing development of propulsion systems, onboard electronics, and safety features underscores the continuous innovation within the market.

What are the Key Data Covered in this Recreational Boats Market Research and Growth Report?

-

What is the expected growth of the Recreational Boats Market between 2025 and 2029?

-

USD 7.11 billion, at a CAGR of 6.4%

-

-

What segmentation does the market report cover?

-

The report segmented by Type (Sailboats, Personal watercrafts (PWC), and Inflatables), Product Type (Outboards and Inboard), Application (Cruising, Fishing, and Watersports), and Geography (North America, Europe, APAC, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Increasing customer engagement in recreational boating activities, High total cost of ownership for recreational boats

-

-

Who are the major players in the Recreational Boats Market?

-

Key Companies A. H. Wadia Boat Builders, Azimut Benetti SpA, Baja Marine, Bavaria Yachtbau GmbH, Brunswick Corp., Christensen Shipyards LLC, Damen Shipyards Group, Feadship Holland BV, Grady White Boats Inc., Great American Marine, Groupe Beneteau, HalevaiPower, Jettec Jet Boats Ltd., Malibu Boats Inc., Marine Products Corp., MasterCraft Boat Holdings Inc., Nobiskrug Yachts GmbH, Shandong Heavy Industry Group Co. Ltd., and Yamaha Motor Co. Ltd.

-

Market Research Insights

- The market encompasses a diverse range of watercraft, from small personal watercraft to large yachts. According to industry estimates, this market has seen steady growth, with approximately 11 million recreational boats in use in the US alone. This figure represents a significant increase from the 10.3 million boats reported in 2015. One key trend in the market is the integration of advanced technology. For instance, the use of navigation software and communication systems has become increasingly common, enabling boaters to navigate more effectively and stay connected. Additionally, the adoption of hybrid propulsion systems and fuel conservation measures reflects a growing focus on sustainability and environmental concerns.

- Another area of development is safety equipment. According to market data, sales of personal flotation devices and fire suppression systems have risen in recent years, underscoring the importance of ensuring the safety of boaters and their passengers. Furthermore, the market for marine paints and fiberglass repair solutions continues to evolve, with innovations in materials and application techniques driving improvements in durability and appearance. In summary, the market is characterized by ongoing innovation and growth, with a focus on technology integration, sustainability, and safety. The market's sizeable user base and continuous evolution make it an attractive area for investment and development.

We can help! Our analysts can customize this recreational boats market research report to meet your requirements.