GCC Refractory Materials For Steel Industry Market Size 2025-2029

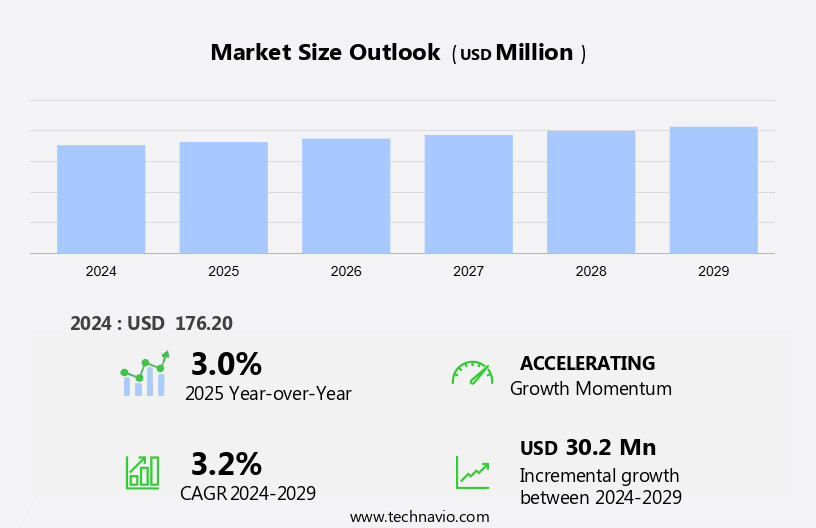

The gcc refractory materials for steel industry market size is forecast to increase by USD 30.2 million million at a CAGR of 3.2% between 2024 and 2029.

- The Refractory Materials Market for the Steel Industry In the GCC region is experiencing significant growth, driven primarily by the increasing demand from the construction and infrastructure sector. This sector's expansion is fueled by the region's ongoing economic development and infrastructure modernization efforts. Another key trend influencing market growth is the rising popularity of monolithic refractories over shaped refractories. Monolithic refractories offer several advantages, including better insulation properties, improved durability, and easier installation. However, the market is not without its challenges.

- Fluctuating costs of refractory materials and high energy consumption remain significant hurdles for market participants. Producers must navigate these challenges to remain competitive and capitalize on the market's opportunities. Companies seeking to succeed in this market should focus on innovation, cost reduction, and operational efficiency. By staying abreast of market trends and adapting to the evolving landscape, they can effectively navigate challenges and capitalize on growth opportunities.

What will be the size of the GCC Refractory Materials For Steel Industry Market during the forecast period?

- The refractory materials market In the Gulf Cooperation Council (GCC) region for the steel industry exhibits growth, driven by increasing steel demand and the need for industrial processes to operate at high temperatures. Refractory materials are essential for various applications, including thermal abrasion resistance, corrosion protection, and fire safety in steel manufacturing. The market is characterized by continuous innovation, with a focus on life cycle analysis, maintenance optimization, industrial automation, and waste management to enhance performance and reduce environmental impact. Additionally, there is a growing emphasis on sustainability and resource recovery, aligning with the circular economy and Industry 4.0 trends.

- Material science plays a crucial role in material selection, ensuring optimal insulation materials, refractory lining design, and fireproofing for industrial furnaces. Safety regulations remain a priority, with a focus on energy efficiency and heat resistance. The market encompasses various industries, including steel, ceramics, glass, and construction, and is influenced by factors such as industrial processes, renewable energy, and digital transformation.

How is this market segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Bricks

- Monolithic

- Type

- Acidic and neutral

- Basic

- Geography

- GCC

By Product Insights

The bricks segment is estimated to witness significant growth during the forecast period.

Refractory bricks are essential components in various industries, particularly In the steel sector, due to their high thermal stability and mechanical strength. These bricks are primarily used in steel factories to line furnaces and kilns, providing insulation and resistance to both mechanical abrasion and chemical corrosion. The manufacturing process involves carefully balancing the brick's solid particles and air spaces to ensure effective insulation. Refractory bricks come in standard sizes, with some applications requiring special shapes and dimensions. These bricks are produced using either machine-pressing or hand-molding techniques. Insulation is achieved through the presence of numerous air spaces withIn the brick, which prevent heat conduction.

Key raw materials include non-metallic minerals, chrome-based refractory, and raw materials from the pulp & paper, petrochemicals, and transportation infrastructure industries. Sustainable alternatives, such as recycled waste and landfill sites, are gaining popularity due to their environmental benefits. The refractory industry continues to evolve, with a focus on innovation, testing standards, and consumer demands for non-toxic, renewable energy, and self-reliance.

Get a glance at the market share of various segments Request Free Sample

The Bricks segment was valued at USD million in 2019 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of GCC Refractory Materials For Steel Industry Market?

- Mounting demand for refractory materials from construction and infrastructure sector is the key driver of the market.

- The GCC region is experiencing a notable up in steel demand, driven primarily by the expansion of the construction and infrastructure sectors. This trend is attributed to the substantial investment inflows from international players, fueled by the region's abundant petrodollars and oil companies' diversification efforts. The construction sector's growth has positioned GCC as an attractive business destination, leading to a significant increase in steel consumption.

- Key factors contributing to this trend include the proliferation of construction projects, increasing investments in railway, infrastructure, and road development, and the availability of inexpensive and reliable energy sources. Among the GCC countries, Saudi Arabia is projected to be the largest consumer of steel.

What are the market trends shaping the GCC Refractory Materials For Steel Industry Market?

- Rising popularity of monolithic refractories over shaped refractories is the upcoming trend In the market.

- Monolithic refractories, characterized by their distinct blend of dry granular or cohesive plastic materials with an indefinite form, are poised for significant growth in various applications, including the steel industry. Unlike shaped refractories, monolithic refractories offer several advantages, such as the ability to create virtually joint-free linings and the capacity to assume shape upon application. These refractories are typically applied as a suspension that solidifies to form a solid mass. The primary components of monolithic preparations consist of large refractory particulates, fine filler constituents, and a binder phase.

- Monolithic refractories are available in various forms, including castables, plastics, gunning mixes, mortars, and ramming mixes. The demand for monolithic refractories is anticipated to increase at a considerable rate due to their versatility and effectiveness in various applications.

What challenges does GCC Refractory Materials For Steel Industry Market face during the growth?

- Fluctuating cost of refractory materials and high energy consumption is a key challenge affecting the market growth.

- Refractory materials, essential for the steel industry, have experienced significant price volatility in recent years. The cost of these materials significantly influences their end-use. The price of a refractory product is primarily determined by the cost of raw materials, production costs, and design and product testing expenses. The primary refractory raw materials include magnesite, alumina, bauxite, graphite, and zirconium. Their prices exhibit instability due to economic conditions, political unrest, and the Eurozone economic slowdown.

- Additionally, China's export policies contribute to the price fluctuations. As a major raw material supplier, China imposes heavy taxes on the export of magnesite, high-grade aluminum, and bauxite.

Exclusive GCC Refractory Materials For Steel Industry Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adani Group

- Allied Mineral Products LLC

- CALDERYS France SAS

- Chosun Refractories ENG Co. Ltd.

- Compagnie de Saint-Gobain SA

- HarbisonWalker International Inc.

- IFGL Refractories Ltd.

- Imerys S.A.

- Kanthal AB

- Krosaki Harima Corp.

- Magnezit Group

- Minerals Technologies Inc.

- Morgan Advanced Materials Plc

- Refractarios Alfran S.A

- Refratechnik Holding GmbH

- RHI Magnesita GmbH

- Saudi Refractory Industries

- Shinagawa Refractories Co. Ltd.

- Trent Refractories Ltd

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The refractory industry plays a vital role In the steel industry withIn the Gulf Cooperation Council (GCC) region, supplying essential materials for various manufacturing processes. Refractory materials, including mechanical abrasion and chemical corrosion resistance solutions, are integral to the production of iron and steel. These materials are utilized in heat-intensive processes, ensuring thermal stability and mechanical strength. The refractory industry caters to numerous sectors, with significant applications In the pulp & paper, petrochemicals, and transportation infrastructure industries. In the steel industry, refractory products are employed extensively In the manufacturing processes, enabling self-reliance In the production of high-quality steel.

Raw materials for refractory production primarily consist of non-metallic minerals. Chrome-based refractories are a popular choice due to their excellent resistance to chemical corrosion and high-temperature applications. The industry's focus on sustainability has led to the exploration of waste recycling as a viable alternative, reducing the environmental impact and minimizing the reliance on landfill sites. Refractory materials are essential for thermal insulation, ensuring energy efficiency and reducing heat loss in various industrial processes. In the power generation sector, refractory products play a crucial role in maintaining the efficiency of boilers and ensuring the safety of power plants. The infrastructure development sector also benefits from refractory materials, particularly In the construction output of infrastructure projects.

In the transport sector, refractory materials are used In the production of glass-based materials, ensuring the thermal stability and mechanical strength required for glass manufacturing. Testing standards are crucial In the refractory industry, ensuring the quality and performance of refractory products. These standards cover various aspects, including thermal stability, mechanical strength, and resistance to chemical corrosion. The use of refractory materials extends beyond the steel industry, with applications In the glass manufacturing and ceramics sectors. Renewable energy sources, such as solar and wind power, are increasingly utilizing refractory materials In their production processes. Despite the numerous benefits, the use of refractory materials comes with potential health hazards, necessitating strict safety protocols and regulations.

The industry is continually researching sustainable alternatives to minimize these hazards and promote a safer working environment. In , the refractory industry plays a pivotal role In the steel industry withIn the GCC region, providing essential materials for various manufacturing processes. With a focus on sustainability and safety, the industry continues to evolve, catering to the demands of various sectors while minimizing its environmental impact.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

172 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.2% |

|

Market growth 2025-2029 |

USD 30.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.0 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across GCC

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch