Renal Dialysis Market Size 2025-2029

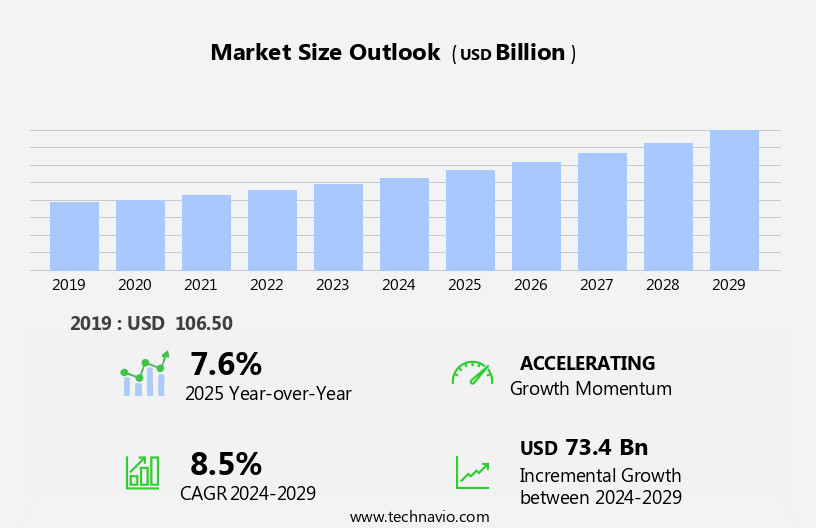

The renal dialysis market size is forecast to increase by USD 73.4 billion at a CAGR of 8.5% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing prevalence of kidney diseases and the rising demand for home peritoneal dialysis treatment. According to data, the number of patients requiring renal replacement therapy is projected to increase, fueling market expansion. Home peritoneal dialysis, in particular, is gaining popularity due to its convenience and cost-effectiveness compared to in-center hemodialysis. However, market growth is not without challenges. High treatment costs, a significant barrier to entry for many patients, remain a major concern. Additionally, direct medical costs encompass staffing, physician fees, dialyzer and tubing expenses, solution costs, hospitalization fees, and capital costs for hemodialysis and peritoneal dialysis machines.

- Supply chain inconsistencies also temper growth potential, as inconsistent availability of essential supplies can disrupt treatment schedules and impact patient outcomes. Companies seeking to capitalize on market opportunities must navigate these challenges effectively, focusing on cost reduction strategies, regulatory compliance, and supply chain optimization. By addressing these challenges and leveraging the growing demand for renal dialysis treatments, market participants can seize opportunities for growth and innovation in this dynamic market.

What will be the Size of the Renal Dialysis Market during the forecast period?

- The market is characterized by a constant focus on enhancing patient care and safety. Renal physicians and dialysis clinical trials are pivotal in advancing dialysis therapies, while dialysis patient education plays a crucial role in improving patient experience and self-management. Dialysis patient safety is a top priority, with dialysis session length, dialysate flow rate, and blood flow rate being critical factors. Dialysis technicians and nurses ensure equipment maintenance and sterilization, while dialysis medications and dialysis drugs are essential components of the dialysis regimen. Dialysis care extends to managing vascular access, catheters, and needles, while data analytics and innovation drive improvements in dialysis efficiency and outcomes.

- Dialysis clearance and dialysis therapeutics are continually evolving to address the diverse needs of patients. Dialysis side effects and dialysis frequency are ongoing concerns, necessitating ongoing research and innovation in patient care. Dialysis social workers provide vital support to patients and their families, contributing to overall patient well-being.

How is this Renal Dialysis Industry segmented?

The renal dialysis industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- In center dialysis

- Home dialysis

- Type

- Hemodialysis

- Peritoneal

- Others

- Modality

- Conventional hemodialysis

- Short daily hemodialysis

- Nocturnal hemodialysis

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By End-user Insights

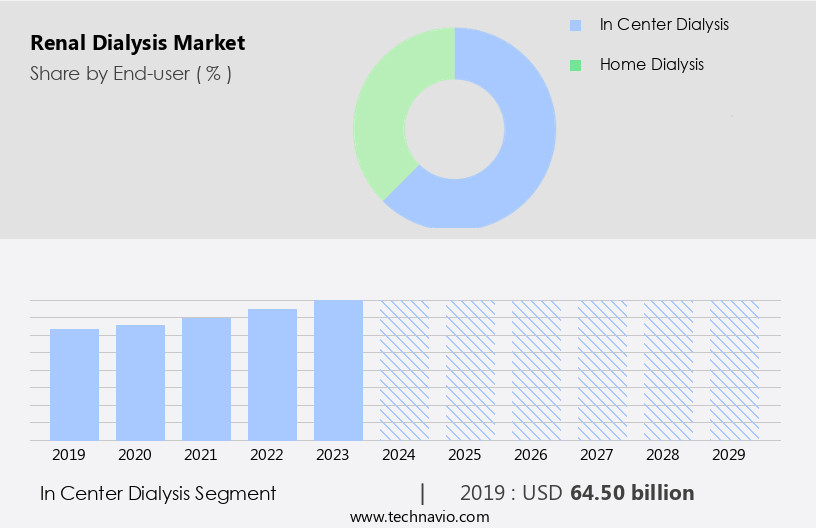

The in center dialysis segment is estimated to witness significant growth during the forecast period. The market encompasses various modalities and technologies aimed at treating kidney failure, primarily chronic kidney disease and acute kidney injury. In-center dialysis, a common treatment option, involves patients visiting dialysis clinics or hospitals three times a week for a 3-4 hour session. Here, a medical professional attaches a blood-cleaning device to the patient's arm, filtering and cleansing the blood using specialized equipment. Dialysis centers house these facilities, offering essential services like training, monitoring, and management. Dialysis technology advances include artificial intelligence, machine learning, and remote patient monitoring, enhancing patient care and adherence. Dialysis machines, filters, and solutions are integral components of these treatments, ensuring efficient dialysis and addressing complications such as dialysis infections, cardiomyopathy, and bone disease.

Renal replacement therapy, including home dialysis and peritoneal dialysis, offers alternatives to in-center treatments. Dialysis education and training are crucial for maintaining dialysis quality and patient compliance. Dialysis cost and anemia management are ongoing concerns for patients and healthcare systems, necessitating ongoing research and development.

The in center dialysis segment was valued at USD 64.50 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

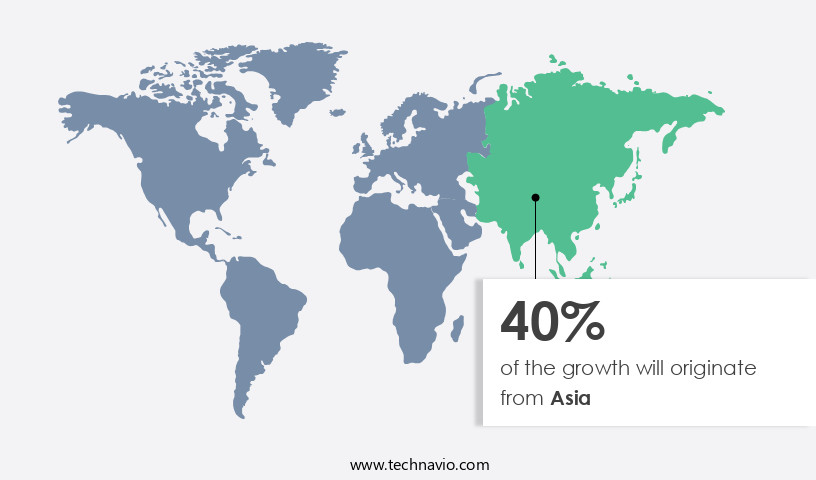

Asia is estimated to contribute 40% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In 2024, the North American market held a significant share due to the region's aging population and increased prevalence of end-stage renal disease (ESRD). The US, specifically, was the major contributor to the market's dominance, driven by high healthcare awareness, developed infrastructure, and government initiatives. Advanced healthcare infrastructure in the US ensures a consistent supply of dialysis devices and systems, catering to the growing number of kidney failure cases and the high cost of transplantation procedures. The adoption of technology, such as artificial intelligence, machine learning, and remote patient monitoring, is also on the rise, improving dialysis efficiency, patient compliance, and outcomes.

Dialysis centers offer various treatments, including in-center and acute dialysis, peritoneal dialysis, and home dialysis, addressing diverse patient needs. Dialysis training for healthcare professionals and data analytics for dialysis management are essential components of the market, ensuring quality care and reducing complications. Dialysis technology advancements include improvements in dialysis filters, membranes, solutions, and needles, enhancing patient safety and treatment effectiveness. Despite these advancements, challenges persist, such as dialysis access complications, infections, dialysis cardiomyopathy, and dialysis bone disease. The market continues to innovate, with renal replacement therapy and dialysis education playing crucial roles in addressing these challenges and improving patient care.

The cost of dialysis remains a significant concern, with anemia management and vascular access being major cost drivers. Overall, the market is dynamic, with a focus on improving patient care, reducing complications, and enhancing efficiency.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Renal Dialysis market drivers leading to the rise in the adoption of Industry?

- The rising incidence of kidney diseases serves as the primary catalyst for market growth in this sector. Kidney diseases, including chronic kidney disease (CKD), are on the rise, with estimates suggesting over 37 million people in the US are affected. CKD is characterized by a gradual loss of kidney function, resulting in the buildup of waste products and fluids in the body. This condition can lead to severe complications, such as heart disease, stroke, and kidney failure. Aging is a significant contributing factor, as older individuals are more susceptible to kidney-related complications. Dialysis is a common treatment for CKD, with two primary types: in-center dialysis and home dialysis. In-center dialysis is administered at dialysis centers, while home dialysis can be performed at home with proper training.

- Dialysis technology includes advanced machines, filters, and access methods to ensure effective treatment and minimize complications. Despite the benefits, dialysis comes with risks, such as infections and access-related complications. Dialysis centers and clinics invest in rigorous training programs for their staff to minimize these risks and ensure optimal patient care. Regular maintenance and updates to dialysis machines and filters are crucial to maintaining the highest standards of cleanliness and efficiency. The increasing prevalence of kidney diseases necessitates continued advancements in dialysis technology and training to ensure effective and safe treatment for patients. The focus on minimizing complications, such as infections and access-related issues, remains a top priority for dialysis centers and clinics.

What are the Renal Dialysis market trends shaping the Industry?

- The increasing demand for home peritoneal dialysis treatment represents a significant market trend in the healthcare industry. This non-invasive dialysis method enables patients to receive treatment in the comfort of their own homes, offering greater convenience and flexibility. Peritoneal dialysis is an increasingly popular treatment option for managing kidney failure and chronic kidney disease. This non-invasive therapy involves the insertion of a catheter through the abdominal muscles, allowing the peritoneal cavity to be used as a filter for waste removal from the blood. The catheter is filled with a dialysate solution, which remains in the cavity for several hours before being drained and replaced. This process can be performed at home, work, or while traveling, offering greater flexibility for patients. Training is essential for patients to ensure proper catheter care, exchange techniques, and infection prevention. Advancements in technology have significantly improved peritoneal dialysis, with artificial intelligence, remote patient monitoring, and machine learning playing crucial roles.

- These technologies enable real-time monitoring of dialysis adherence, vascular access, and dialysis monitoring, ensuring optimal treatment outcomes. Dialysis catheters are a vital component of peritoneal dialysis, with various types available to minimize complications and enhance patient safety. Despite its benefits, peritoneal dialysis requires careful management and ongoing education to ensure successful treatment.

How does Renal Dialysis market faces challenges face during its growth?

- The escalating treatment costs pose a significant challenge to the growth of the industry. The market faces challenges due to the high cost of treatments for chronic kidney diseases like End-Stage Renal Disease (ESRD). This financial burden is felt even in well-established economies, limiting market expansion. In low- and middle-income countries, a lack of awareness about dialysis treatments further hinders market growth. Government policies regarding insurance coverage and reimbursement for ESRD vary significantly from country to country. The dialysis process involves substantial resource consumption, with expensive dialysis equipment and materials contributing to the high costs.

- Additionally, indirect costs, such as transportation and patient compliance, add to the overall expense. Dialysis efficiency is a critical concern for improving patient outcomes and reducing costs. Advancements in dialysis membranes, solutions, and data analytics have led to more effective treatments and better patient compliance. Home dialysis is another area of focus, as it offers cost savings and increased patient convenience. Dialysis management companies are investing in these areas to enhance their offerings and cater to the evolving needs of the market.

Exclusive Customer Landscape

The renal dialysis market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the renal dialysis market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, renal dialysis market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AngioDynamics Inc. - The company offers hemodialysis catheter which is used for exchanging blood to and from the hemodialysis machine.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AngioDynamics Inc.

- Asahi Kasei Corp.

- B.Braun SE

- Baxter International Inc.

- Becton Dickinson and Co.

- DaVita Inc.

- Dialysis Clinic Inc.

- Diaverum AB

- Fresenius Medical Care AG and Co. KGaA

- JMS Co. Ltd.

- Medtronic Plc

- Merck and Co. Inc.

- Nikkiso Co. Ltd.

- Nipro Corp.

- Nxstage Medical Inc.

- Physidia

- Satellite Healthcare Inc.

- STERIS plc

- Toray Industries Inc.

- US Renal Care

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Renal Dialysis Market

- In February 2024, Fresenius Medical Care, a global leader in the market, announced the launch of its new generation of dialysis machines, the 5008S and 5008S Artis, featuring advanced technologies to enhance patient care and treatment efficiency (Fresenius Medical Care press release). In May 2025, Diaverum, a European dialysis provider, entered into a strategic partnership with the Indian government to establish 50 new dialysis centers across the country, aiming to expand access to renal care for underserved populations (Diaverum press release).

- In September 2024, NxStage Medical, a leading provider of home dialysis systems, secured a significant investment of USD200 million from private equity firm Warburg Pincus to support its growth initiatives and expand its product offerings (Warburg Pincus press release). In January 2025, the US Food and Drug Administration (FDA) approved DaVita Inc.'s new home hemodialysis system, the Aquadex FlexFlow, marking the first major regulatory approval for this innovative technology in the market (DaVita press release). These developments demonstrate significant advancements in product innovation, strategic partnerships, and regulatory approvals, shaping the future of the market.

Research Analyst Overview

The market continues to evolve, driven by advancements in technology and the increasing prevalence of chronic kidney disease (CKD) and kidney failure. Dialysis cardiomyopathy and peritoneal dialysis are two significant areas of focus, with ongoing research and innovation aimed at improving patient outcomes. Artificial intelligence (AI) and machine learning are increasingly being integrated into dialysis care, enabling more efficient and effective treatment through data analytics and remote patient monitoring. Dialysis adherence remains a critical challenge, with efforts underway to enhance patient compliance through innovative approaches. Vascular access and dialysis monitoring are also key areas of development, with a focus on reducing complications and improving dialysis efficiency.

The integration of dialysis technology, such as dialysis membranes and solutions, into renal replacement therapy is transforming the landscape of dialysis care. Dialysis innovation continues to unfold, with a focus on improving patient quality of life and reducing the cost of care. Dialysis education and training are essential components of this evolving landscape, ensuring that healthcare professionals are equipped with the latest knowledge and skills to provide optimal care for patients.

Dive into Technavio's strong research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Renal Dialysis Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

221 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.5% |

|

Market growth 2025-2029 |

USD 73.4 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.6 |

|

Key countries |

US, China, Japan, Germany, Canada, UK, India, South Korea, France, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Renal Dialysis Market Research and Growth Report?

- CAGR of the Renal Dialysis industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Asia, Europe, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the renal dialysis market growth and forecasting

We can help! Our analysts can customize this renal dialysis market research report to meet your requirements.