Fresh Meat Packaging Market Size 2025-2029

The fresh meat packaging market size is forecast to increase by USD 545.8 million, at a CAGR of 3.5% between 2024 and 2029.

- The market is witnessing significant growth due to the increasing adoption of case-ready packaging solutions. This trend is driven by the convenience and extended shelf life benefits offered by such packaging, catering to the evolving consumer preferences for ready-to-cook and convenient food options. However, the market faces challenges as well. The global packaging industry is experiencing consolidation, leading to increased competition and pricing pressure. Moreover, the high costs associated with manufacturing flexible packaging materials pose a significant challenge for market participants. To capitalize on the growth opportunities and navigate these challenges effectively, companies need to focus on innovation, cost optimization, and strategic partnerships.

- By addressing these factors, they can differentiate their offerings and maintain a competitive edge in the market.

What will be the Size of the Fresh Meat Packaging Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by the dynamic interplay of various factors. Retailers and butchers employ diverse packaging solutions to showcase their offerings, with retail display and shrink wrapping being popular choices. Polypropylene (PP) and skin packaging offer excellent barrier properties, ensuring product protection and shelf life extension. Storage conditions, temperature control, and oxygen permeability are crucial factors influencing meat quality and freshness retention. Quality control and product handling are paramount to maintain food safety and consumer appeal. Meat wholesalers and food service industries rely on packaging solutions like flow wrapping, vacuum packaging, and high-speed packaging lines for efficiency and seal integrity.

Labeling requirements and brand identity play significant roles in consumer decision-making. Meat processing and distribution networks demand packaging solutions that cater to specific meat grades and cuts, ensuring hygiene standards and cold chain logistics. Biodegradable materials and gas flushing are emerging trends in the market, addressing environmental concerns and extending shelf life. Consumer behavior and foodborne pathogens continue to shape the market landscape, with packaging solutions adapting to meet evolving needs. In the realm of meat packaging, the ongoing pursuit of innovation and efficiency characterizes the industry. From retail merchandising to meat processing, packaging solutions continue to adapt and respond to the ever-changing market dynamics.

The integration of technology, such as packaging automation and temperature control systems, further enhances the industry's ability to meet the demands of various sectors. In the market, the focus on product presentation and food safety remains a top priority. The continuous unfolding of market activities and evolving patterns underscores the importance of staying informed and adaptable. As consumer preferences and regulatory requirements continue to evolve, packaging solutions must adapt to meet these changing needs. From polyethylene (PE) and polyvinyl chloride (PVC) to blister packaging and tray sealing, the market offers a diverse range of solutions. Each solution addresses specific needs, from product protection and presentation to cost-effectiveness and sustainability.

As the market continues to evolve, the integration of these solutions into the broader food industry landscape shapes the future of meat packaging.

How is this Fresh Meat Packaging Industry segmented?

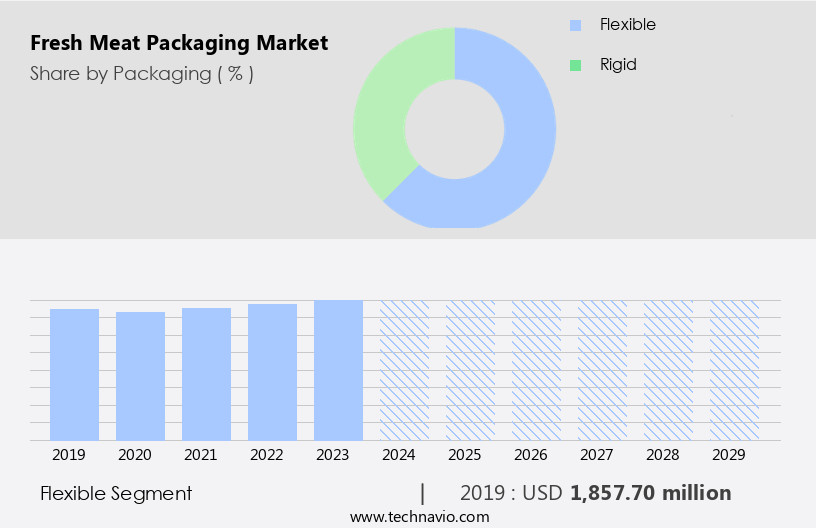

The fresh meat packaging industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Packaging

- Flexible

- Rigid

- Type

- Beef

- Pork

- Goat meat/mutton

- Poultry

- Seafood

- Geography

- North America

- US

- Mexico

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Packaging Insights

The flexible segment is estimated to witness significant growth during the forecast period.

Fresh meat packaging is a critical aspect of the meat industry, focusing on maintaining product quality, safety, and consumer appeal. Flexible packaging, including skin packaging, shrink wrapping, flow wrapping, and vacuum packaging, has gained significant traction due to its numerous benefits. Retail butchers and meat wholesalers favor flexible packaging for its cost-effectiveness, as it reduces transportation and storage costs by occupying less space and weight. Polypropylene (PP) and polyethylene (PE) are popular materials for fresh meat packaging due to their barrier properties, which help extend shelf life and maintain temperature control. Skin packaging, for instance, allows meat to breathe while preventing contamination, enhancing consumer appeal.

Oxygen permeability is a crucial factor in meat packaging, as it affects meat freshness and quality. Therefore, packaging materials with low oxygen permeability, such as PP and PE, are preferred. Quality control and product handling are essential considerations in fresh meat packaging. High-speed packaging lines and automation ensure efficient production and minimize human error. Temperature control during processing, storage, and transportation is vital to prevent foodborne pathogens and maintain meat freshness. Labeling requirements and brand identity are essential for retail merchandising. Proper labeling ensures compliance with food safety regulations and provides consumers with essential product information. Gas flushing and tray sealing are additional techniques used to enhance product presentation and extend shelf life.

Meat processing and distribution networks rely on packaging efficiency and cold chain logistics to maintain product quality and freshness. Biodegradable materials are increasingly being adopted to address environmental concerns and meet consumer preferences for sustainable packaging. In conclusion, the market is driven by the need for cost-effective, efficient, and sustainable packaging solutions that ensure product safety, quality, and consumer appeal. Flexible packaging, temperature control, and oxygen barrier properties are key factors influencing market trends. The market continues to evolve, with a focus on improving product presentation, enhancing food safety, and reducing environmental impact.

The Flexible segment was valued at USD 1857.70 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 37% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the North American market, the US leads the fresh meat packaging industry due to its economic growth since the 2008 recession. This expansion is anticipated to significantly impact the regional market. Furthermore, the food industry in North America is experiencing a shift towards biodegradable plastics, driven by environmental regulations against plastic waste from food packaging. The US Environmental Protection Agency (EPA) reports that approximately 80 million tons of packaging and plastic container waste are generated annually in the US. The Food and Drug Administration (FDA) has granted certifications for various food packaging products, further promoting their adoption.

Product handling, temperature control, and shelf life extension are essential factors influencing the market's dynamics. Meat processors and retailers prioritize packaging solutions with superior barrier properties, such as polypropylene (PP) and polyethylene (PE), to maintain meat freshness and prevent foodborne pathogens. Meat wholesalers and retail butchers seek cost-effective options like shrink wrapping and flow wrapping, while food service establishments prefer tray sealing and vacuum packaging for product presentation and efficiency. High-speed packaging lines and automation are essential for meeting the growing demand for fresh meat. Consumer behavior and brand identity also play a crucial role in market trends.

Meat processing and distribution networks prioritize food safety, cold chain logistics, and hygiene standards to ensure product quality. The market is also exploring sustainable, biodegradable materials to minimize environmental impact.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Fresh Meat Packaging Industry?

- The significant increase in the utilization of case-ready fresh meat packaging is the primary factor fueling market growth. This trend reflects consumers' shifting preferences towards convenient and hygienic meat packaging solutions. Additionally, the adoption of advanced technologies, such as modified atmosphere packaging and vacuum sealing, further enhances the shelf life and preserves the freshness of the meat, thereby boosting market expansion.

- Case-ready fresh meat packaging has witnessed significant growth in the global market over the past decade. This type of packaging involves processing and packaging fresh meat at a centralized location before distribution to retail stores. By implementing case-ready fresh meat packaging, retailers can reduce operational costs associated with labor, meat-cutting equipment, and space utilization for fresh meat preparation in their stores. The process of meat cutting and preparation requires substantial space, which can be optimally utilized for other merchandising activities through case-ready packaging. Moreover, this packaging ensures better quality control and prevents leakage during transportation. Additionally, the use of biodegradable materials in meat packaging aligns with consumer preferences for eco-friendly products and adherence to food safety regulations.

- Cold chain logistics and hygiene standards are crucial factors in the meat processing industry, and case-ready fresh meat packaging caters to these requirements effectively. Consumer behavior towards meat cuts and freshness retention is a significant driver for the growth of this market. Case-ready fresh meat packaging offers an immersive and harmonious shopping experience for consumers, emphasizing the importance of convenience and quality. In conclusion, recent research indicates a continued emphasis on case-ready fresh meat packaging due to its numerous benefits for retailers and consumers alike.

What are the market trends shaping the Fresh Meat Packaging Industry?

- The global packaging industry is experiencing increasing market consolidation, which represents a significant trend in the sector. This trend is driven by various factors, including economies of scale, technological advancements, and the quest for competitive advantage.

- The market is experiencing consolidation as small players merge with larger ones to enhance their market presence and adopt advanced technologies. This trend is driven by the fragmented nature of the market and competitive pressure from major companies. Mergers and acquisitions enable smaller players to access new technologies and expand their offerings, making it essential for them to remain competitive. The global packaging industry's consolidation will further propel the growth of the market, as it is a significant segment of the overall packaging industry. Notable mergers and acquisitions in the global packaging sector include Sonoco's acquisition of Eviosys, a leading European metal packaging and food can manufacturer, in December 2024.

- Effective retail display, storage conditions, and product handling are crucial factors in fresh meat packaging. Packaging solutions such as shrink wrapping using polypropylene (PP), skin packaging, and flow wrapping are popular due to their ability to extend shelf life and maintain product quality. Oxygen permeability is a critical consideration in fresh meat packaging to prevent spoilage and maintain product freshness. Quality control measures and adherence to strict storage conditions are necessary to ensure the safety and integrity of the meat products. While packaging costs are a concern, the benefits of improved product handling, shelf life extension, and enhanced consumer appeal make investing in advanced packaging solutions a worthwhile investment for meat processors and retailers.

What challenges does the Fresh Meat Packaging Industry face during its growth?

- The high costs associated with manufacturing flexible packaging represent a significant challenge to the industry's growth trajectory.

- The market faces rising production costs due to the increasing prices of raw materials, primarily plastic, which is the primary component used in its manufacturing. The prices of PE, PP, and other plastics have experienced significant hikes, with PP experiencing a 6.2% increase in the first quarter of 2022 in Asia alone. These price increases negatively impact companies' profit margins, compelling them to pass on these added costs to retail butchers, meat wholesalers, and ultimately, consumers. Temperature control, barrier properties, and labeling requirements are essential factors driving the demand for high-quality meat packaging.

- Consumers prioritize packaging that ensures seal integrity, preserves meat grades, and maintains consumer appeal through vacuum packaging and blister packaging. Despite these challenges, companies invest in high-speed packaging lines to meet the market's demands, focusing on maintaining product quality and meeting labeling requirements.

Exclusive Customer Landscape

The fresh meat packaging market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the fresh meat packaging market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, fresh meat packaging market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amcor Plc - The company specializes in innovative meat packaging solutions, including ICE Coextruded Films, OvenRite packaging, and FreshCase active vacuum packaging. ICE Coextruded Films offer superior temperature resistance and clarity, ensuring optimal meat presentation. OvenRite packaging is designed for enhanced ovenability, preserving meat's texture and flavor during cooking. FreshCase active vacuum packaging utilizes advanced technology to maintain the freshness and shelf life of meat products. These solutions prioritize food safety, sustainability, and consumer convenience, setting new standards in the meat packaging industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amcor Plc

- Amerplast Ltd.

- Berry Global Inc.

- Cabinplant AS

- Cascades Inc.

- Constantia Flexibles Group GmbH

- Coveris Management GmbH

- Faerch AS

- GRUPO ULMA S. COOP

- Kureha Corp.

- Mondi Plc

- Pactiv Evergreen Inc.

- Printpack Inc.

- Sealed Air Corp.

- Smurfit Kappa Group

- Sonoco Products Co.

- The Dow Chemical Co.

- Transcontinental Inc.

- UFlex Ltd.

- Winpak Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Fresh Meat Packaging Market

- In February 2024, Tetra Pak, a leading food processing and packaging solutions company, introduced its new Fresh 'N' Save meat packaging solution, which combines vacuum technology with modified atmosphere packaging to extend the shelf life of fresh meat products (Tetra Pak Press Release, 2024). This innovation aims to reduce food waste and improve the convenience for consumers.

- In March 2025, Sealed Air Corporation, a global leader in food protection, announced a strategic partnership with Danish Crown, a major European pork producer, to develop advanced packaging solutions for the fresh meat industry (Sealed Air Corporation Press Release, 2025). The collaboration is expected to result in improved product preservation, reduced food waste, and enhanced sustainability.

- In May 2024, Amcor, a global packaging company, completed the acquisition of Bemis Company, Inc., a significant player in the flexible packaging industry, creating a leading global packaging powerhouse with a combined revenue of over USD17 billion (Amcor Press Release, 2024). This merger is expected to strengthen Amcor's position in the market through increased scale and expanded product offerings.

- In June 2025, the European Union approved the use of natural antimicrobial agents in fresh meat packaging, paving the way for the commercialization of these innovative products (European Commission Press Release, 2025). This regulatory approval is expected to boost the growth of the market by enabling the development of more effective and sustainable packaging solutions.

Research Analyst Overview

- The market is experiencing dynamic shifts, driven by various factors. Meat traceability, a critical concern for consumers, is being addressed through advanced technologies like RFID tagging and barcode labeling. Smoked meat and processed meat segments are capitalizing on value-addition with innovative packaging designs. Food allergies and dietary restrictions necessitate stringent food labeling regulations. Sustainability certifications and e-commerce packaging are gaining traction, as consumers prioritize health and environmental concerns. Intelligent packaging and active packaging technologies offer meat authenticity assurance and extended shelf life. Alternative proteins, including plant-based meat and meat substitutes, are disrupting traditional meat markets, necessitating new packaging regulations. Consumer perception, brand loyalty, and meal preparation convenience are key drivers shaping the market.

- Nutritional labeling and health claims are essential for consumer transparency. Home delivery and meal kit services are transforming the meat industry, requiring packaging solutions that cater to their unique needs. Overall, the market is witnessing significant changes, driven by consumer preferences, regulatory requirements, and technological advancements.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Fresh Meat Packaging Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

208 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.5% |

|

Market growth 2025-2029 |

USD 545.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.3 |

|

Key countries |

US, Mexico, China, Germany, India, UK, France, Japan, Australia, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Fresh Meat Packaging Market Research and Growth Report?

- CAGR of the Fresh Meat Packaging industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the fresh meat packaging market growth of industry companies

We can help! Our analysts can customize this fresh meat packaging market research report to meet your requirements.