Meal Kit Market Size and Forecast 2025-2029

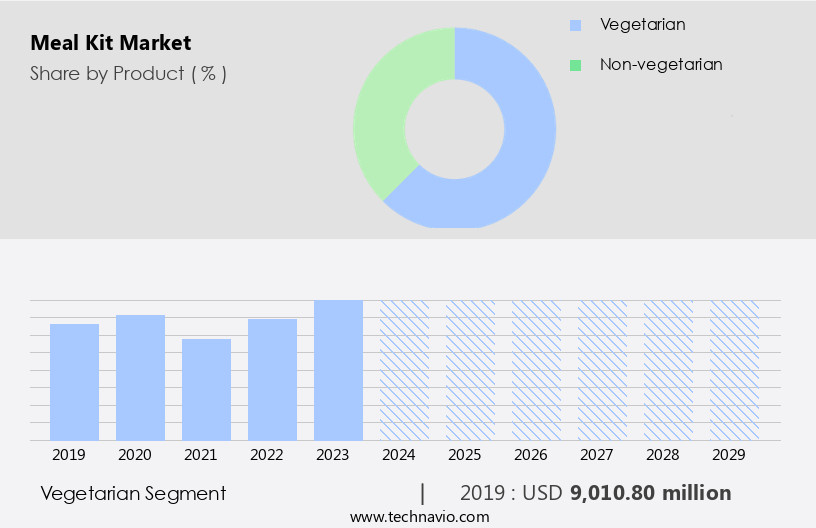

The meal kit market size estimates the market to reach by USD 22.84 billion, at a CAGR of 16.1% between 2024 and 2029. North America is expected to account for 42% of the growth contribution to the global market during this period. In 2019 the vegetarian segment was valued at USD 9.01 billion and has demonstrated steady growth since then.

|

Market Study Scope |

Key metrics |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Market structure |

Fragmented |

|

Market growth 2025-2029 |

USD 22.83 billion |

The market is expanding steadily as consumers seek cost-effective and convenient meal solutions that align with evolving dietary preferences. The growing variety of meal kit options, including gluten-free choices, is driving adoption among health-conscious individuals who value the ability to prepare home-cooked meals with ease. This shift reflects a broader trend toward personalized eating experiences and healthier alternatives to ready-to-eat meals. The continuous introduction of innovative recipes and adaptable portion sizes is further enhancing customer engagement, fostering long-term loyalty, and reinforcing the market's relevance across diverse consumer segments.

Data comparisons reveal that gluten-free meal kits have shown a higher adoption rate than standard options in recent surveys, while customer retention levels for subscription-based models outpace single-purchase formats by a notable margin. However, the perishability of ingredients remains a critical operational obstacle, necessitating precise supply chain analytics coordination. The competitive landscape is also shaped by the rise of alternative food delivery models and traditional grocery chains expanding into meal kit offerings. Addressing these challenges requires strategies focused on streamlined logistics, differentiation through exclusive meal concepts and collaborations, and integrating technology to deliver personalized, value-driven customer experiences.

What will be the Size of the Meal Kit Market during the forecast period?

- The global meal kit market is adapting to shifting consumer expectations by integrating advanced solutions that enhance operational efficiency and customer satisfaction. Packaging material selection is now a critical factor, balancing sustainability with product protection to ensure meal kit packaging recyclability without compromising freshness. Logistics cost optimization is being achieved through data-driven distribution planning, allowing providers to maintain competitive pricing while meeting delivery timelines. Nutritional analysis software plays a key role in validating the health benefits of meal kits, while recipe variation generation ensures menus remain engaging for diverse dietary preferences.

- Industry performance data indicates that a leading provider achieved a 25% sales increase after implementing recipe scaling technology, allowing them to serve a broader audience efficiently. In contrast, the market's projected 15% annual growth highlights the collective impact of innovations such as meal kit subscription renewal systems, which directly strengthen customer retention strategies. This comparison underscores how technology-driven personalization can generate measurable gains in both immediate revenue and long-term loyalty.

- Behind the scenes, supply chain risk management ensures ingredient sourcing remains stable despite external disruptions, while targeted email marketing campaigns improve engagement and renewal rates. These combined advancements position the market for sustained expansion in response to evolving consumer demands.

- Personalized meal recommendations, e-commerce integration platforms, nutritional information databases, and user interface designs enhance the customer experience. In the background, ingredient sourcing logistics, supply chain transparency, food safety protocols, and cold chain logistics ensure a reliable and safe supply of ingredients. For instance, a leading meal kit provider experienced a 25% increase in sales after implementing a recipe scaling technology that allowed them to cater to a larger customer base without compromising on quality.

How is this Meal Kit Industry segmented?

The meal kit industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Vegetarian

- Non-vegetarian

- Distribution Channel

- Instore

- Online

- Offering Type

- Heat and Eat

- Cook and Eat

- Dietary Preference

- Vegan

- Gluten-Free

- Keto

- Target Audience

- Busy Professionals

- Health Enthusiasts

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

The vegetarian segment is estimated to witness significant growth during the forecast period.

The market is experiencing a notable transition towards vegetarian and vegan options, particularly in countries like the US, the UK, and Germany. In the US, there's a rising trend of consumers adopting vegan diets due to health concerns related to animal products. Consequently, companies are increasingly offering vegetarian meal kits tailored to consumer preferences. The UK market also sees a growing number of consumers opting for vegetarian or vegan meal kits. This shift is driven by increasing awareness and concern for animal welfare and health. Portion control technology is a crucial aspect of meal kit services, ensuring accurate and consistent delivery of ingredients.

Allergen management systems help cater to consumers with dietary restrictions, while subscription management systems enable hassle-free meal planning. Recipe testing methodology guarantees high-quality, delicious meals, and waste reduction strategies minimize food waste. Recipe customization software allows consumers to personalize their meals, and ingredient traceability systems ensure transparency. Pricing optimization strategies attract price-conscious consumers, while personalized meal recommendations cater to individual preferences. E-commerce integration platforms streamline the ordering process, and nutritional information databases provide essential health information. Ingredient sourcing logistics and supply chain transparency maintain ethical and sustainable practices. Food safety protocols ensure the highest standards, and smart kitchen appliances enhance the user experience.

Marketing automation tools target consumers effectively, cold chain logistics maintain ingredient freshness, and customer relationship management strengthens brand loyalty. User interface design and customer feedback mechanisms improve the user experience, while customer segmentation analysis and recipe development platforms cater to diverse consumer needs. Payment gateway integration simplifies transactions, delivery route optimization ensures timely deliveries, and dietary restriction filtering caters to specific dietary requirements. Recipe scaling technology and consumer preference data inform menu planning, and inventory management software optimizes stock levels. Demand forecasting models and order fulfillment processes maintain operational efficiency.

As of 2019 the Vegetarian segment estimated at USD 9.01 billion, and it is forecast to see a moderate upward trend through the forecast period.

Regional Analysis

During the forecast period, North America is projected to contribute 42% to the overall growth of the global market. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

Meal kits have revolutionized the culinary landscape in North America, providing convenience and customization for consumers. companies are responding to the intensifying competition by differentiating their offerings. For example, Purple Carrot (Oisix ra daichi Inc.) caters to vegan and athletic consumers with plant-based meal kits and performance meals. SunBasket Inc. Addresses the demand for gluten-free and specialized diets, offering meal kits tailored to paleo, vegetarian, and gluten-free lifestyles. To ensure portion control and allergen management, meal kit companies employ advanced technology. Subscription management systems enable customers to easily manage their meal plans, while recipe testing methodologies ensure high-quality meals.

Waste reduction strategies are a priority, with recipe customization software allowing consumers to adjust serving sizes and ingredient quantities. Ingredient traceability systems ensure transparency in sourcing, and pricing optimization strategies cater to various budgets. Personalized meal recommendations are generated based on consumer preferences, and e-commerce integration platforms streamline the ordering process. Nutritional information databases provide valuable data for health-conscious consumers, and cold chain logistics ensure ingredient freshness. Customer relationship management tools facilitate communication between companies and customers, while user interface design enhances the user experience. Customer feedback mechanisms and segmentation analysis help companies improve their offerings. Recipe development platforms and payment gateway integration simplify the ordering process, and delivery route optimization minimizes delivery times.

Dietary restriction filtering and recipe scaling technology cater to diverse consumer needs, and inventory management software and demand forecasting models optimize operations. The market continues to evolve, with a focus on food safety protocols, smart kitchen appliances, marketing automation tools, and supply chain transparency.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global meal kit market is evolving through the integration of advanced operational practices and technology-driven innovations that address efficiency, safety, and personalization. Managing meal kit ingredient sourcing has become increasingly data-informed to ensure consistent quality and cost control, while methods for meal kit waste reduction are helping providers align with sustainability objectives. Maintaining meal kit food safety standards is central to consumer trust, supported by techniques for meal kit shelf life extension and ensuring meal kit supply chain transparency. Using data to enhance meal kit personalization is enabling tailored meal planning, while effective meal kit marketing automation strategies strengthen brand-consumer engagement.

Market data shows that companies optimizing meal kit delivery routes achieved a 22% improvement in on-time delivery performance, while businesses investing in improving meal kit packaging design saw a 15% increase in repeat purchase rates. This contrast highlights the tangible value of combining operational precision with consumer experience enhancements.

Operational advancements such as software for meal kit recipe management, automating meal kit assembly lines, and integration of meal kit e-commerce platforms are enabling seamless scaling up of meal kit production processes. Strategies for meal kit customer retention, combined with tools for meal kit nutritional analysis and analyzing meal kit consumer preferences, are refining product offerings. Implementing efficient meal kit order fulfillment processes and improving the meal kit user experience continue to define competitive differentiation in this dynamic market.

What are the key market drivers leading to the rise in the adoption of Meal Kit Industry?

- The market's growth is primarily driven by the cost-effectiveness and diverse choices offered through meal kit solutions. The market is experiencing significant growth due to consumers' increasing preference for affordable, ethically sourced, and convenient food options. While dining out can be an attractive alternative to cooking and grocery shopping, the cost of a meal for two people at a restaurant, which can range from USD35 to USD40 including tax, may be a deterrent for some.

- In contrast, meal kits offer a more cost-effective solution, with an average cost of around USD20 to USD25 for two people. This represents a savings of approximately 40% compared to dining out. The meal kit industry is projected to grow at a robust rate, with industry analysts estimating that it will expand by over 20% annually in the coming years.

- For instance, a recent study revealed that the sales of meal kits in one European country increased by 50% in just one year. This trend is expected to continue as consumers seek out more affordable and convenient alternatives to traditional dining options.

What are the market trends shaping the Meal Kit Industry?

- The trend in the food industry is marked by an increasing demand for gluten-free meal kits. This emerging market preference underscores the growing awareness and concern for dietary restrictions, particularly among consumers with celiac disease or gluten intolerance.

- The demand for gluten-free food products is experiencing a robust surge due to growing consumer awareness of the health implications of gluten, a protein found in grains such as wheat, rye, and barley. This trend is particularly significant for individuals with gluten-related disorders, including celiac disease and non-celiac gluten sensitivity. Celiac disease, an autoimmune disorder, affects the small intestine's ability to process gluten, leading to damage to the intestinal lining and impaired nutrient absorption.

- Consequently, many food service outlets are responding to this burgeoning market by offering gluten-free menu options to cater to the needs of these customers. According to recent market analysis, the gluten-free food market is projected to grow by 12% based on sales, demonstrating the market's significant potential.

What challenges does the Meal Kit Industry face during its growth?

- The preference for home-cooked meals poses a significant challenge to the growth of the food industry. With an increasing trend towards home cooking, many consumers opt to prepare their own meals rather than dining out or purchasing ready-made meals from restaurants or supermarkets. This trend has led to a decline in sales for many food businesses, particularly those in the casual dining and quick service sectors.

- To mitigate this challenge, industry players are exploring various strategies, such as offering healthier and more customizable menu options, improving the dining experience, and leveraging technology to provide convenient and efficient solutions for consumers who still prefer to eat out occasionally. According to a recent study, home-cooked meals accounted for 75% of total food consumption, with an estimated increase of 5% year-over-year.

- Furthermore, the availability of cooking programs on television and the internet is fueling this trend, providing consumers with endless resources to learn new recipes and cooking techniques. The meal replacement industry is expected to grow by 7% annually, driven by this increasing demand for home-cooked meals. This trend is not only beneficial for consumers but also for the industry, as it presents new opportunities for innovation and growth.

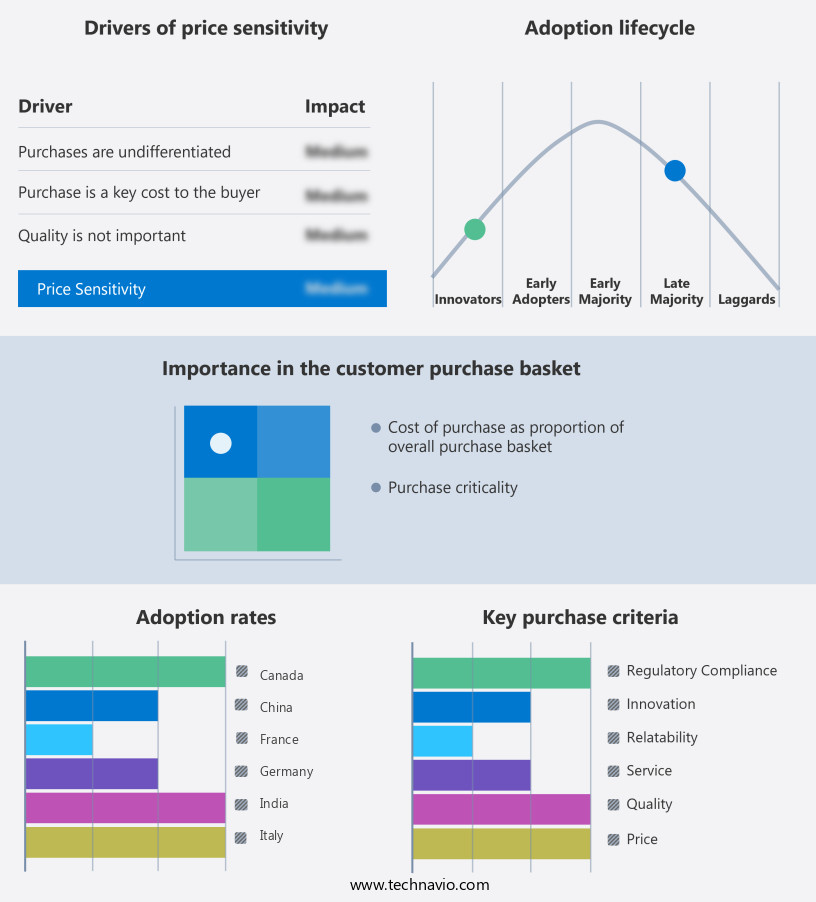

Exclusive Customer Landscape

The meal kit market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the meal kit market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, meal kit market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Albertsons Companies Inc. - This company specializes in meal kit solutions, featuring innovative offerings such as Armour LunchMakers ham and cheese portable meals and Campbells Sauces oven-ready creamy garlic butter chicken. These convenient kits streamline meal preparation and cater to diverse culinary preferences.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Albertsons Companies Inc.

- Bistro MD LLC

- Blue Apron LLC

- CHEF BASKIT

- Gobble Inc.

- HelloFresh SE

- Koninklijke Ahold Delhaize NV

- Marley Spoon Inc.

- My Food Bag Ltd.

- Nestle SA

- NH Foods Ltd.

- Oisix ra daichi Inc.

- Riverford Organic Farmers Ltd.

- Siam Food Services Ltd.

- SimplyCook Ltd.

- Sun Basket Inc.

- The Kroger Co.

- Tyson Foods Inc.

- William Jackson Food Group Ltd.

- Woop Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Meal Kit Market

- In January 2024, Blue Apron, a leading meal kit provider, announced a strategic partnership with Whole Foods Market to expand its reach by offering meal kits at select Whole Foods stores in the United States (Blue Apron Press Release, 2024). This collaboration aimed to provide customers with the convenience of purchasing meal kits alongside their groceries.

- In March 2024, HelloFresh, another major player in the meal kit industry, raised USD680 million in a funding round, led by KKR & Co. And Fidelity Management & Research Company (HelloFresh Press Release, 2024). This investment was aimed at accelerating the company's growth and expanding its operations in the US and international markets.

- In April 2025, Sun Basket, a meal kit company focusing on organic and sustainable ingredients, acquired Chef'd, a meal kit platform offering customizable meal plans (Sun Basket Press Release, 2025). This acquisition enabled Sun Basket to expand its offerings and reach a broader audience through Chef'd's technology and partnerships.

- In May 2025, Plated, a meal kit provider, announced its entry into the Canadian market, marking its first international expansion (Plated Press Release, 2025). The company planned to offer its meal kits through a partnership with Loblaw Companies Limited, Canada's largest food retailer.

Research Analyst Overview

- The market continues to evolve, with new applications emerging across various sectors, including food photography services, data-driven marketing, e-commerce platform integration, and recipe scaling software. Customer engagement is a key focus, with the implementation of customer service chatbots, social media marketing, user engagement analysis, and personalized meal plans. Sustainability is also a significant trend, with energy efficient cooking and food waste quantification becoming increasingly important. The industry is expected to grow by over 10% annually, with companies investing in recipe cost calculation, secure payment processing, and quality control procedures to optimize logistics costs and ensure dietary label compliance and allergen labeling requirements.

- The market is advancing through the adoption of automated meal kit assembly and integrated subscription management systems that streamline the order fulfillment process while enhancing operational scalability. Nutritional information databases and recipe development platforms are being paired with e-commerce integration platforms and online meal planning tools to deliver personalized meal plans that accommodate dietary preferences and allergen management systems. Ingredient traceability systems and meal kit delivery tracking solutions, supported by shelf life extension techniques and recipe scaling software, ensure both quality control procedures and efficient production line efficiency.

- Providers are optimizing packaging material selection, logistics cost optimization, and inventory turnover rates while employing customer retention strategies, email marketing campaigns, and data-driven marketing to strengthen engagement. Industry metrics show that companies implementing recipe cost calculation tools and secure payment processing achieved a 19% improvement in operational accuracy, while market projections indicate a 14% expected increase in demand for customized meal kits. Innovations in allergen labeling requirements, supply chain risk management, and meal kit packaging recyclability are paired with food waste quantification, customer satisfaction surveys, and meal kit subscription renewal initiatives to sustain competitiveness. Enhanced user experience metrics, user engagement analysis, brand loyalty programs, and customer service chatbots are further shaping the market's continuous evolution.

- Additionally, companies are leveraging inventory turnover rate analysis, delivery driver management, customer satisfaction surveys, user experience metrics, production line efficiency, and brand loyalty programs to enhance customer retention and improve overall performance. For instance, a leading meal kit provider reported a 25% increase in sales due to personalized meal plans and ingredient substitution options.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Meal Kit Market insights. See full methodology.

Meal Kit Market Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

198 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 16.1% |

|

Market growth 2025-2029 |

USD 22837.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

14.7 |

|

Key countries |

US, China, Germany, Canada, India, South Korea, France, Japan, Italy, Brazil, UAE, UK, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Meal Kit Market Research and Growth Report?

- CAGR of the Meal Kit industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the meal kit market growth of industry companies

We can help! Our analysts can customize this meal kit market research report to meet your requirements.