Vacuum Packaging Market Size 2024-2028

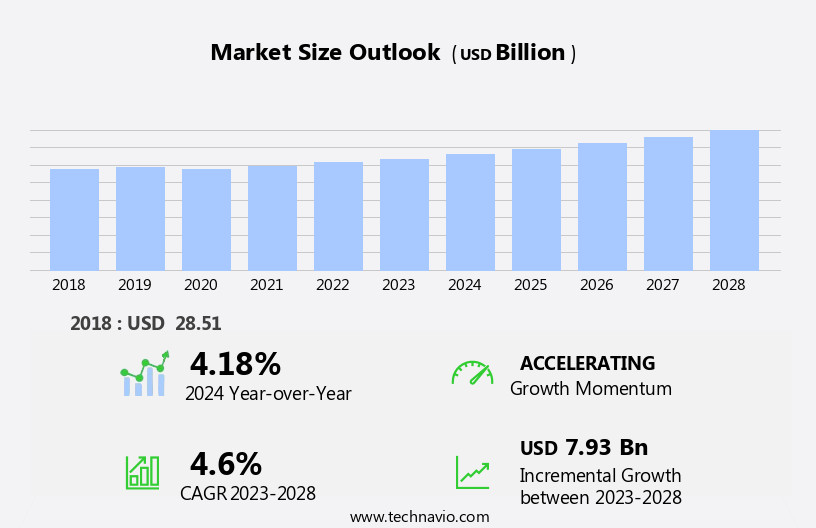

The vacuum packaging market size is forecast to increase by USD 7.93 billion at a CAGR of 4.6% between 2023 and 2028.

What will be the Size of the Vacuum Packaging Market During the Forecast Period?

How is this Vacuum Packaging Industry segmented and which is the largest segment?

The vacuum packaging industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Material

- Polyethylene

- Polyamide

- EVOH

- Others

- End-user

- Food

- Healthcare and pharmaceutical

- Industrial

- Others

- Geography

- APAC

- China

- India

- Japan

- Europe

- Germany

- North America

- US

- Middle East and Africa

- South America

- APAC

By Material Insights

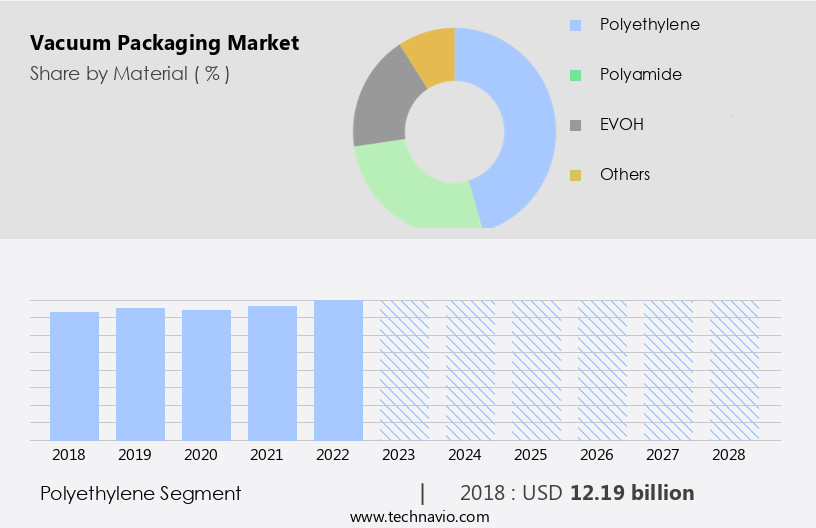

- The polyethylene segment is estimated to witness significant growth during the forecast period.

Vacuum packaging, utilizing Polyethylene (PE) as a primary material, significantly contributes to the global market. PE's advantageous properties make it a preferred choice for various applications. Its high barrier capabilities effectively inhibit the transmission of oxygen and moisture, thereby enhancing the shelf life of perishable goods, including food. Vacuum-sealed PE bags maintaIn the freshness of fruits and vegetables, thereby reducing food waste and improving product quality and safety. PE's durability is another key attribute, as it offers flexibility and resistance to external impacts, making it suitable for safeguarding delicate items during transportation. Vacuum packaging technology, comprising vacuum sealers, machines, and equipment, employs PE materials to create airtight seals, preserving the product's freshness and integrity.

The vacuum packaging industry's growth is driven by increasing consumer demand for extended product shelf life, improved food safety, and reduced waste. Innovations in vacuum packaging systems and designs continue to expand the application scope, including pharmaceuticals, electronics, and industrial sectors.

Get a glance at the Vacuum Packaging Industry report of share of various segments Request Free Sample

The Polyethylene segment was valued at USD 12.19 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

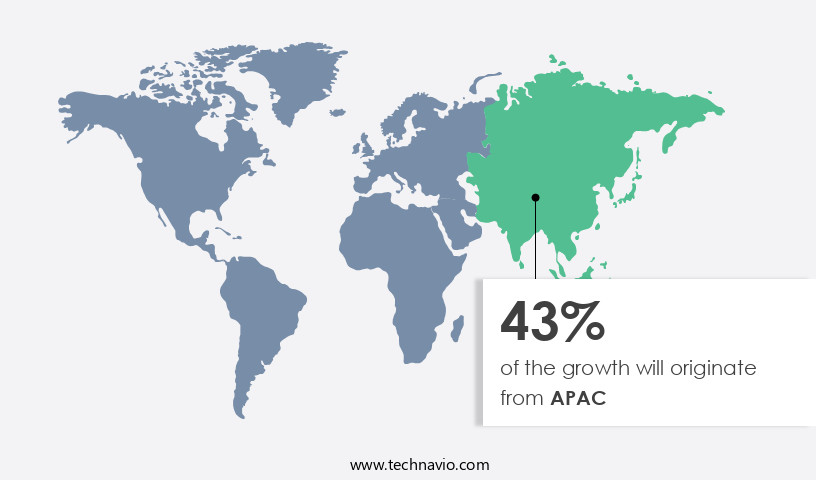

- APAC is estimated to contribute 43% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The Asia Pacific (APAC) region is a major contributor to The market, driven by factors such as increasing urbanization, economic growth, and changing consumer preferences. Consumers in APAC are increasingly seeking convenience and ready-to-eat food solutions, leading to a surge in demand for vacuum packaging. This trend is fueled by advancements in packaging technology, which enable longer shelf life, improved food safety, and enhanced product preservation. Vacuum packaging equipment, including vacuum sealers, packaging machines, and materials, are essential components of this process. Benefits such as reduced food waste, improved product appearance, and extended shelf life further boost market growth.

Vacuum packaging applications span various industries, including food and beverage, healthcare, and industrial manufacturing. As the market continues to evolve, innovations in vacuum packaging systems and designs are expected to drive growth and meet the demands of diverse applications.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Vacuum Packaging Industry?

Increasing awareness about food safety and hygiene is the key driver of the market.

What are the market trends shaping the Vacuum Packaging Industry?

Growing demand for sustainable packaging solutions is the upcoming market trend.

What challenges does the Vacuum Packaging Industry face during its growth?

Stringent regulation on plastics is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The vacuum packaging market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the vacuum packaging market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, vacuum packaging market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Amcor Plc - Vacuum packaging is a growing market for eco-friendly solutions, with Ecoguard being a notable provider of bags and pouches in this sector. This technology, which removes air from packaging to extend product shelf life and preserve freshness, is gaining traction across various industries. Ecoguard's offerings under the Ecoguard brand are designed to meet the demands of businesses seeking sustainable and efficient packaging solutions. These vacuum-sealed bags and pouches maintain product integrity, reduce waste, and ensure food safety. By utilizing advanced technology and eco-friendly materials, Ecoguard caters to the increasing consumer preference for sustainable packaging options.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amcor Plc

- Dow Chemical Co.

- Filtration Group Corp.

- GRUPO ULMA S. COOP

- Henkelman BV

- ILAPAK International S.A.

- Ishida Co. Ltd.

- KP Holding GmbH and Co. KG

- Minipack International Pty Ltd.

- Mondi Plc

- MULTIVAC Sepp Haggenmuller SE and Co. KG

- PAC Machinery

- Plastopil Hazorea Co. Ltd.

- Promarks Vac Co. Ltd.

- Sealed Air Corp.

- SencorpWhite

- Smurfit Kappa Group

- The Vacuum Pouch Co. Ltd.

- WEBOMATIC Maschinenfabrik GmbH

- Winpak Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Vacuum packaging is a modern preservation method that utilizes modified atmospheric conditions to extend the shelf life and maintaIn the quality of various perishable and semi-perishable food products. This innovative packaging technology has gained significant traction In the global market due to its numerous advantages. The vacuum packaging process involves removing air from the packaging chamber and sealing the bag or container, creating an airtight seal. This process inhibits the growth of microorganisms and prevents oxidation, thereby preserving the freshness and texture of the food. Vacuum packaging is not limited to food products alone; it is also used extensively in various industries such as pharmaceuticals, cosmetics, and electronics, among others.

Vacuum packaging technology has undergone significant advancements in recent years, leading to the development of sophisticated vacuum packaging machines and equipment. These machines offer increased efficiency, improved sealing technology, and enhanced design features, making vacuum packaging a more viable and cost-effective solution for businesses. The vacuum packaging industry has witnessed substantial growth in recent times, driven by the increasing demand for extended shelf life, improved food safety, and the need for sustainable packaging solutions. The market is expected to grow at a steady pace In the coming years, with key factors such as increasing consumer awareness, technological advancements, and changing consumer preferences fueling this growth.

Vacuum packaging offers several advantages over traditional packaging methods. It helps reduce food waste by extending the shelf life of perishable items, thereby reducing the need for frequent replenishment. It also helps maintaIn the quality and freshness of food products, ensuring that they retaIn their original taste and texture. Furthermore, vacuum packaging offers improved food safety by inhibiting the growth of microorganisms and preventing contamination. The vacuum packaging process is versatile and can be applied to various food products, including meats, poultry, fish, fruits, vegetables, and baked goods, among others. It is also used extensively In the pharmaceutical industry for packaging drugs and medical devices, and In the cosmetics industry for packaging various beauty products.

The vacuum packaging industry is continuously innovating to meet the evolving needs of businesses and consumers. New developments in vacuum packaging technology include the use of advanced materials, such as biodegradable and recyclable vacuum packaging bags, and the integration of smart packaging solutions, such as temperature indicators and oxygen scavengers, to enhance the functionality and effectiveness of vacuum packaging. In conclusion, vacuum packaging is a dynamic and innovative packaging technology that offers numerous advantages for businesses and consumers alike. Its ability to extend the shelf life, maintain quality, and ensure food safety makes it a popular choice for various industries, including food, pharmaceuticals, and cosmetics.

The vacuum packaging industry is expected to continue growing In the coming years, driven by technological advancements, changing consumer preferences, and the need for sustainable packaging solutions.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

181 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.6% |

|

Market growth 2024-2028 |

USD 7.93 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.18 |

|

Key countries |

China, US, Germany, Japan, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Vacuum Packaging Market Research and Growth Report?

- CAGR of the Vacuum Packaging industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the vacuum packaging market growth of industry companies

We can help! Our analysts can customize this vacuum packaging market research report to meet your requirements.