High Heels Footwear Market Size 2025-2029

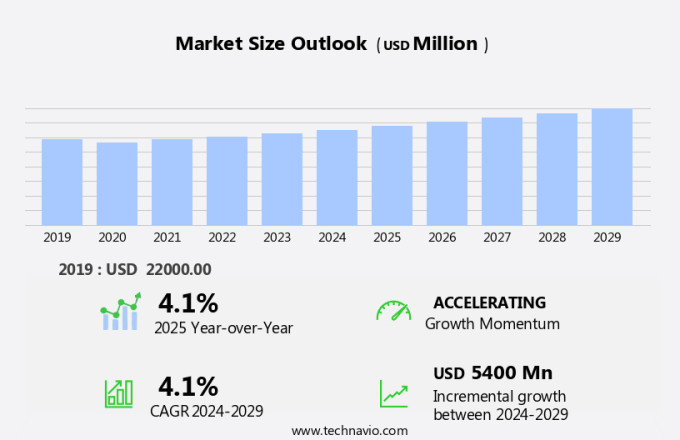

The high heels footwear market size is forecast to increase by USD 5.4 billion at a CAGR of 4.1% between 2024 and 2029.

- The market is experiencing significant growth, driven by several key trends. One of the most notable trends is the increasing preference for premium high heels, as consumers are willing to pay more for superior quality and unique designs. Colours and finishes span the spectrum, reflecting the footwear industry's commitment to catering to diverse tastes. Influencer marketing and comfort issues are also influencing the market's direction, with some brands exploring 3D printing and virtual reality technologies to create customized and comfortable high heels. Another trend is the rise of online sales, which has led to increased competition and convenience for consumers. However, the market is also facing challenges, such as the increasing cost of production due to raw material prices and labor costs. Despite these challenges, the market is expected to continue growing, driven by the enduring popularity of high heels and the continued innovation in design and materials.

What will be the Size of the High Heels Footwear Market During the Forecast Period?

- The market encompasses a diverse range of elevated heel designs, including pumps and various toe angles, catering to various consumer preferences and use cases. Equestrian activities and fashion statements are among the primary drivers of this market, with visual elongation and the enhancement of legs and calf muscles being key benefits. Kitten heels and mid-height heels offer a balance between elegance and comfort, while stilettos and pointy toes epitomize self-expression and special occasions.

- Additionally, performance-oriented high heels, such as those designed for dancing or sports, prioritize comfort, durability, and versatility. Celebrity endorsements further fuel demand, making high heels a timeless fashion statement in professional settings and beyond. Equestrian-inspired footwear, like cowboy boots and cuban heels, add unique twists to this dynamic market.

How is this High Heels Footwear Industry segmented and which is the largest segment?

The high heels footwear industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Type

- 1-1.75

- 2-2.75

- 3-3.75

- 4-4.75

- Geography

- APAC

- China

- India

- Japan

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- Middle East and Africa

- South America

- Brazil

- APAC

By Distribution Channel Insights

- The offline segment is estimated to witness significant growth during the forecast period.

The offline retail sector, including specialty stores, department stores, hypermarkets, and warehouse clubs, dominates the organized market. Offline stores offer buyers the convenience of trying on shoes, assessing quality, and comparing products. Specialty stores, accounting for over half of the offline footwear market, follow standardized business practices and centralized management systems. High heels footwear is available in various styles such as pumps, mid-height heels, stilettos, and cowboy boots, among others. Colors, materials like wood, suede, and plastic, and heel angles also vary. Health concerns, including foot pain, sprains, fractures, and deformities, influence consumer preferences. Innovative outsoles with deep treads, non-slip rubber, and improved grip offer stability and safety.

Comfort, durability, and versatility are essential factors. Fashion trends, celebrity endorsements, and social media influence consumer choices. Adaptability to various surfaces and weather conditions is crucial. Comfortable footwear made from novel materials addresses aesthetic demands while ensuring foot health. The footwear industry offers high-quality shoes through various manufacturing processes, catering to luxury, daily wear, work wear, and performance-oriented high heels.

Get a glance at the High Heels Footwear Industry report of share of various segments Request Free Sample

The offline segment was valued at USD 13.92 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 38% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The high-heel footwear market in Asia Pacific (APAC) is experiencing growth due to increasing disposable income, urbanization, and low manufacturing costs. Key countries, including China, India, and Japan, are significant contributors to the market's expansion. In China, the rising affluence is fueling the demand for luxury footwear, making it an attractive market for international brands like Guccio Gucci S.P.A and PRADA S.P.A. Companies are capitalizing on this potential by expanding their presence In the region. High heels come in various styles, such as pumps, Elevated heels, and toe shapes like pointy toes, stiletto heels, and cowboy boots. Colors, mid-height heels, and innovative outsoles with non-slip rubber outsoles, stability, and safety features cater to diverse consumer needs.

Additionally, health concerns, such as foot pain, sprains, fractures, and deformities, are driving the demand for comfortable and supportive footwear. The market offers a wide range of options, from affordable to luxury and performance-oriented high heels for daily wear, work wear, and special occasions. Manufacturing processes employ novel materials and aesthetic demands to create high-quality shoes. The footwear industry continues to evolve with fashion trends, social media influence, and adaptability to Gen Z preferences.

Market Dynamics

Our high heels footwear market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of High Heels Footwear Industry?

Premiumization of high heels footwear is the key driver of the market.

- The market is experiencing significant growth due to the increasing popularity of fashion statements and visual elongation that these shoes provide. Elevated heels, available in various styles such as pumps, stilettos, and kitten heels, have become synonymous with femininity and self-expression. Colours, materials like wood, suede, and plastic, and heel heights, including mid-height and thick high heels, add to the versatility of this footwear category. However, health concerns related to foot pain, sprains, fractures, and deformities, such as bunions, hammer toes, neuromas, metatarsalgia, and Achilles tendonitis, have led to a growing demand for comfortable and practical high heels. Innovative outsoles with deep treads, non-slip rubber, and traction have been introduced to enhance stability and safety in high heels, making them suitable for various settings, including daily wear, work wear, and special occasions.

- Additionally, despite these advancements, high heels continue to face criticism due to their impact on foot health. The fashion industry is addressing these concerns by introducing novel materials and designs that cater to both aesthetic demands and foot health. The footwear industry's focus on performance-oriented high heels for dancing, sports, and outdoor events, as well as workwear high heels, has led to a fusion of fashion with functionality.

- Thus, the market's growth is driven by factors such as increasing disposable income, celebrity endorsements, and the adaptability of high heels to various fashion trends. The market is catering to diverse consumer needs through physical stores, boutiques, department stores, and online distribution channels.

What are the market trends shaping the High Heels Footwear Industry?

Increased online sales are the upcoming market trend.

- The market encompasses various styles, including pumps with an elevated heel, pumps with pointy toes, mid-height heels, stiletto heels, and cuban heels. Equestrian activities may call for cowboy boots with heels. Colours, materials such as wood, suede, and plastic, and heel angles vary, catering to fashion statements, visual elongation, and leg accentuation. However, health concerns like foot pain, sprains, fractures, deformities, and unsteady walking pose challenges. Innovative outsoles with non-slip rubber, stability, safety, deep treads, and wet condition traction enhance practicality and well-being.

- Additionally, fashion trends, social media, and celebrity endorsements influence consumer preferences, while comfort, durability, and versatility are essential factors. The footwear industry offers high-quality shoes through various manufacturing processes and luxurious options, addressing aesthetic demands and footwear industry trends. Despite comfort issues, consumers continue to seek fashion statements and self-expression through high heels for special occasions, professional settings, and performance-oriented activities like dancing, sports, and outdoor events.

- Overall, online distribution channels, including e-commerce sites and influencer marketing, have significantly impacted sales, contributing to the market's growth. Increasing internet penetration in developing countries further boosts demand.

What challenges does the High Heels Footwear Industry face during its growth?

Increased cost of production is a key challenge affecting the industry growth.

- The market is characterized by the use of various styles, including pumps with an elevated heel, pumps with a pointy toe and angle, and mid-height and stiletto heels. Equestrian activities have influenced the design of cowboy boots with cuban heels. Colours, materials such as wood, suede, and plastic, and narrow high heels continue to be popular choices. However, health concerns, including foot pain, sprains, fractures, deformities, and difficulty navigating surfaces, have led to the development of innovative outsoles with non-slip rubber and deep treads for improved stability and safety. Fashion statements, visual elongation, and femininity remain key drivers for the market.

- Additionally, thick high heels and luxury offerings cater to the aesthetic demands of consumers. The footwear industry is adapting to changing trends, with influencer marketing and social media platforms playing a significant role. Comfort and durability are essential considerations, with performance-oriented high heels designed for dancing, sports, and outdoor events. Despite these advancements, the market faces challenges, including increasing production costs due to the rising price of raw materials, such as ethylene-vinyl acetate (EVA), and labor costs. Manufacturers are responding by exploring novel materials and manufacturing processes to maintain the balance between fashion trends, comfort, and affordability. The market offers a range of options, from daily wear to work wear, luxury to practicality, and comfort to high-quality shoes.

- Thus, foot health concerns, including bunions, hammer toes, neuromas, metatarsalgia, Achilles tendonitis, ingrown toenails, corns, and calluses, continue to be a priority, driving the demand for comfortable footwear.

Exclusive Customer Landscape

The high heels footwear market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the high heels footwear market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, high heels footwear market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Hermes International SA - The company offers high heel footwear under the name Fever sandal, Candy sandal, Oasis sandal, Figari 55 sandal, Flirt 60 sandal, and Oran sandal.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ACI Footwear

- Brian Atwood

- Christian Dior SE

- Christian Louboutin

- COACH

- Deeasjer Ltd.

- ECCO Sko AS

- Gianni Versace Srl

- Guccio Gucci Spa

- Hermes International SA

- Manolo Blahnik International Ltd

- Marks and Spencer Group plc

- Prada Spa

- Steven Madden Ltd.

- Theory LLC

- ValterShoes

- Vestiaire Collective

- Yull Ltd

- Zara Footwear Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a diverse range of elevated shoes that cater to various consumer preferences and needs. These shoes, characterized by their elevated heels, have long been a staple in fashion and continue to evolve with changing trends and consumer demands. The market is driven by several factors. One significant factor is the desire for visual elongation and the perception of elegance and femininity that comes with wearing high heels. This has led to the production of various styles, including pumps, stilettos, and kitten heels, among others. Another factor fueling the growth of the market is the innovation in outsoles. Manufacturers are focusing on creating outsoles that offer stability, safety, and practicality, with features such as non-slip rubber outsoles, deep treads, and wet condition traction. These innovations have made high heels more adaptable to different environments and activities, expanding their usage beyond traditional fashion statements. The market also caters to consumers who prioritize comfort and well-being. This has led to the production of high-quality shoes that incorporate comfortable footwear manufacturing processes and novel materials.

Additionally, there is a growing emphasis on addressing foot-related ailments, such as bunions, hammer toes, neuromas, and metatarsalgia, by designing shoes that offer support and mobility. In recent years, the market has seen a shift towards performance-oriented high heels, with offerings designed for dancing, sports, and outdoor events. These shoes prioritize support, mobility, and durability, making them suitable for individuals seeking functionality in addition to fashion. The market is also influenced by fashion trends and social media. Social media platforms have become a significant source of inspiration for consumers, with influencer marketing playing a crucial role in shaping consumer preferences. Gen Z consumers, in particular, are known for their adaptability and openness to new trends, making them a key demographic for the market. Despite the growing popularity of high heels, there are concerns regarding their potential health risks, such as foot pain, sprains, fractures, and deformities.

However, manufacturers are addressing these concerns by focusing on creating shoes that offer comfort, stability, and safety. The market is diverse, with offerings ranging from luxury options to daily wear and work wear. Materials used in manufacturing include wood, suede, and plastic, among others. The market is served by both physical stores and online distribution channels, with boutiques, department stores, and offline distribution channels catering to consumers seeking a more personalized shopping experience. In summary, the market is a dynamic and evolving industry that caters to various consumer preferences and needs. From fashion statements to performance-oriented shoes, high heels continue to be a popular choice for individuals seeking to express themselves and enhance their appearance. With a focus on innovation, comfort, and safety, the future of the market looks promising.

|

High Heels Footwear Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

197 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.1% |

|

Market growth 2025-2029 |

USD 5.4 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.1 |

|

Key countries |

US, China, India, Germany, Japan, Canada, UK, France, Italy, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this High Heels Footwear Market Research and Growth Report?

- CAGR of the High Heels Footwear industry during the forecast period

- Detailed information on factors that will drive the High Heels Footwear growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the high heels footwear market growth of industry companies

We can help! Our analysts can customize this high heels footwear market research report to meet your requirements.