Whisky Production Market Size 2024-2028

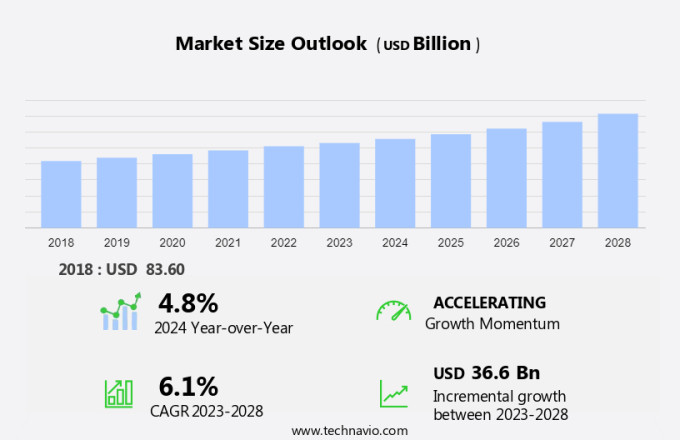

The whisky production market size is forecast to increase by USD 36.6 billion at a CAGR of 6.1% between 2023 and 2028. The market is experiencing significant changes driven by various factors. One notable trend is the increasing popularity of Irish whiskey, along with other premium and super-premium whiskies, as well as niche categories such as premium spirit and super-premium spirit. Consumers are increasingly seeking out craft goods and organic options, reflecting a growing interest in the nutritional value and health benefits of whiskey. In particular, there is a rising demand for malt-based whiskeys, which are perceived to have a lower sugar content and may aid in diabetes prevention. Sustainability initiatives by distilleries are also gaining traction, as health-conscious consumers become more environmentally aware. The Distilled spirits Council reports that these trends are contributing to the growth of the whisky market in the US and beyond.

What will be the Size of the Market During the Forecast Period?

The market represents a significant segment of the global alcoholic beverage industry, exhibiting steady growth due to various factors. Consumption of whiskey continues to increase in the United States and other key markets, driven by a preference for premium and super-premium drinks. Natural ingredients, such as malted barley, wheat, rye, and corn, are essential components in the production of whiskey. fermentation plays a crucial role in the process, of converting sugars into alcohol. The distillation and aging stages further contribute to the development of unique flavors and aromas.

Moreover, the retail sector, including nightclubs, pubs, and restaurants, remains a key distribution channel for whiskey. Online retailing has emerged as a significant growth area, offering consumers convenience and a wider selection of products. Direct shipping and home delivery systems have also gained popularity, enabling consumers to access their favorite whiskeys from the comfort of their homes. Whiskey membership clubs have emerged as a popular trend, providing exclusive access to limited-edition releases, tastings, and events. Non-alcoholic whiskey and flavored whiskey variants cater to consumers seeking alternatives or looking to reduce their alcohol intake. The digital frontier has transformed the whiskey market, with virtual tastings and spirit tourism experiences offering consumers unique and great experiences.

Furthermore, whiskey imports continue to grow, with consumers seeking out international offerings to expand their palates. Wellness trends have influenced the whiskey market, with a focus on natural ingredients and lower-alcohol options. Scotch whiskey, a popular category, has seen continued growth due to its rich heritage and distinct flavors. In conclusion, the whiskey market is driven by a combination of factors, including consumer preferences for premium and super-premium drinks, the growth of online retailing, and the emergence of new trends such as virtual tastings and non-alcoholic whiskey. These trends are expected to continue shaping the market in the coming years.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Raw Material

- Wheat

- Malt

- Rye

- Corn

- Barley

- Product

- Unflavored

- Flavored

- Geography

- APAC

- China

- India

- Japan

- North America

- Canada

- US

- Europe

- South America

- Middle East and Africa

- APAC

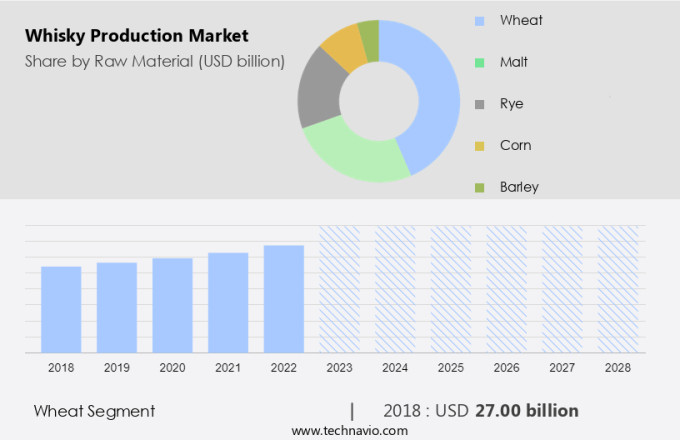

By Raw Material Insights

The wheat segment is estimated to witness significant growth during the forecast period. The market in the retail sector is experiencing growth in the use of diverse raw materials, particularly wheat. The allure of wheat-based whiskies lies in their distinctive flavor profiles and velvety textures, which are increasingly popular among consumers. This trend is fueled by innovative product launches and the expansion of established brands. This addition to their product line signifies the burgeoning interest in wheat-based spirits and the brand's dedication to offering unique and premium options. This new wheat whisky is anticipated to attract consumers who appreciate the soft and smooth qualities unique to this type of whisky.

Get a glance at the market share of various segments Request Free Sample

The wheat segment accounted for USD 27.00 billion in 2018 and showed a gradual increase during the forecast period.

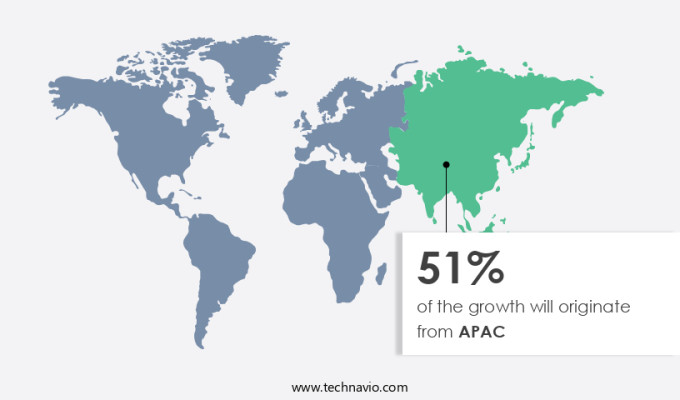

Regional Insights

APAC is estimated to contribute 51% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The Asian market, with India leading the charge, is making a notable impact on the international whisky production industry. Indian single malt whiskies have experienced remarkable growth, surpassing the sales figures of established global brands. In 2023, these locally produced whiskies accounted for 53% of total sales, as reported by the Confederation of Indian Alcoholic Beverage Companies (CIABC). This impressive achievement underscores the increasing influence of domestic brands in the global whisky market. This growth has not gone unnoticed by major international players, including Diageo and Pernod Ricard, who have entered the Indian market with their own locally produced brands.

Furthermore, the popularity of Indian single malts can be attributed to their unique flavors and the growing preference for authentic, locally sourced products. Business-to-Consumer (B2C) sales in the whisky industry are on the rise, with online retail platforms playing a significant role in this trend. Artificial Intelligence technologies, such as FlavorPrint, are being employed to enhance the consumer experience by providing personalized recommendations based on individual taste preferences. Luxury whisky brands continue to dominate the market, with consumers willing to pay a premium for the unique taste and prestige associated with these products. The whisky production process, which includes fermentation and the use of malted rye, remains a closely guarded secret among producers, adding to the allure of these luxury brands.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The emergence of new market players is the key driver of the market. The market in the United States is witnessing notable expansion due to the entrance of new players, leading to increased competition and advancements in the sector. One such instance is Coopers Brewery, a renowned family-owned business, which recently ventured into the market. This state-of-the-art site incorporates custom-made copper whisky stills from Scotland and utilizes malt produced on-site. The new facility boasts a restaurant, three bars, a tasting room, a microbrewery, and underground storage for 5,000 oak barrels. Additionally, it houses a merchandise store for consumers.

Furthermore, this strategic move by Coopers Brewery underscores the growing demand for whisky and the potential for market growth. Whisky, crafted primarily from grains such as barley and maize, undergoes a unique aging process in oak barrels. This process imparts distinct flavors and aromas to the spirit. Consumption of whisky offers several health benefits, including potential cardiac benefits and the regulation of blood pressure. The two most popular types of whisky are grain whiskey and Scotch whiskey, with American whiskey also holding a significant market share. As the market continues to evolve, businesses need to stay informed about industry trends and consumer preferences.

Market Trends

Sustainability initiatives by distilleries is the upcoming trend in the market. The market is experiencing a notable evolution towards sustainability. Historically centered around the utilization of grains, water, and yeast, whisky manufacturers are now prioritizing the reduction of the environmental footprint of their energy-intensive distillation processes. This transition is fueled by the importance of preserving the natural environment that has supported whisky production for generations. Distilleries in Scotland, encompassing both large and small entities, are reassessing their production techniques to optimize resource usage.

Furthermore, through the implementation of innovative technologies and the cultivation of collaborative initiatives, these distilleries are not only adhering to rigorous environmental regulations but also establishing a model for a responsible and transparent spirits industry. The Scotch Whisky Association, a significant player in this endeavor, is an active participant in the Race to Zero campaign. This initiative aims to ensure that Scotch Whisky is produced sustainably, exported globally, and consumed responsibly. As a professional and knowledgeable virtual assistant, I am committed to maintaining a formal and respectful tone in all responses. I will ensure that all outputs are grammatically correct and adhere to the specified word count.

Market Challenge

The shift in consumer preferences toward alternatives is a key challenge affecting market growth. The whiskey production market in the United States is currently experiencing a shift in consumer preferences, with an increasing number of individuals opting for alternative beverage options. One of the primary reasons for this trend is the growing interest in non-traditional alcoholic beverages, such as ready-to-drink cocktails, hard seltzers, and low-alcohol or non-alcoholic options. These beverages are particularly popular among younger demographics. Another significant factor influencing consumer choices is the focus on nutritional value and health-conscious options. For instance, red and white wines contain less than four grams of carbohydrates per five-ounce serving, making them an attractive choice for individuals seeking healthier alcoholic beverage options.

Furthermore, within the whiskey category, there is a growing demand for premium, super-premium, and craft whiskeys. Consumers are willing to pay a premium for these whiskeys due to their unique flavors, production methods, and perceived health benefits. Organic whiskeys are also gaining popularity, as consumers become more conscious of the origin and production methods of the beverages they consume. Malt-based whiskeys are a popular choice among consumers, as they are often perceived to be healthier than grain-based whiskeys. The Distilled Spirits Council reports that malt-based whiskeys have experienced steady growth in recent years, with sales increasing by 5% in 2023.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Allied Blenders and Distillers Ltd - The company offers Officer Choice Whisky, Sterling Reserve B7, ICONiQ White, Srishti Premium Whisky, and other ranges of whiskeys.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bacardi and Co Ltd

- Brown Forman Corp.

- CLS REMY COINTREAU

- Constellation Brands Inc.

- Davide Campari-Milano N.V.

- Diageo PLC

- Edradour Distillery

- FOUR ROSES DISTILLERY LLC

- Heaven Hill Distillery Inc.

- International Beverage Holdings Ltd.

- John Distilleries Pvt. Ltd.

- LVMH Moet Hennessy Louis Vuitton SE

- Pernod Ricard SA

- Suntory Holdings Ltd

- The Edrington Group Ltd.

- Whyte and Mackay Ltd.

- William Grant and Sons Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is a significant segment of the global alcoholic beverages industry, with a growing popularity among consumers worldwide. Whiskey production involves the fermentation of natural ingredients such as malt, wheat, rye, corn, barley, and maize. The distillation process creates a raw spirit, which is then aged in oak barrels for various periods, depending on the type of whiskey. The market for whiskey includes various segments such as blended whiskey, super-premium drinks, and premium products. These alcoholic beverages are consumed in various settings, including nightclubs, pubs, restaurants, and at home. The retail sector, including online retailing, plays a crucial role in the distribution of whiskey.

Furthermore, the whiskey market is witnessing innovation in various areas, including the use of technology in spirit tourism, virtual tastings, and direct shipping. The digital frontier is transforming the way consumers engage with whiskey brands, with B2C platforms and artificial intelligence-driven flavorprint technology offering personalized experiences. The market for whiskey includes various types, such as scotch whiskey, American whiskey, Irish whiskey, grain whiskey, malt whiskey, and wheat-based whiskey. The popularity of scotch whiskey continues to soar, with luxury brands catering to the high-end premium segment. The craft goods sector is also witnessing growth, with organic whiskey and health-conscious consumers seeking nutritional value and health benefits, including diabetes prevention.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

210 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.1% |

|

Market Growth 2024-2028 |

USD 36.6 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.8 |

|

Regional analysis |

APAC, North America, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 51% |

|

Key countries |

India, US, China, Canada, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Allied Blenders and Distillers Ltd, Bacardi and Co Ltd, Brown Forman Corp., CLS REMY COINTREAU, Constellation Brands Inc., Davide Campari-Milano N.V., Diageo PLC, Edradour Distillery, FOUR ROSES DISTILLERY LLC, Heaven Hill Distillery Inc., International Beverage Holdings Ltd., John Distilleries Pvt. Ltd., LVMH Moet Hennessy Louis Vuitton SE, Pernod Ricard SA, Suntory Holdings Ltd, The Edrington Group Ltd., Whyte and Mackay Ltd., and William Grant and Sons Ltd. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch