Residential Cooking Grills Market Size 2024-2028

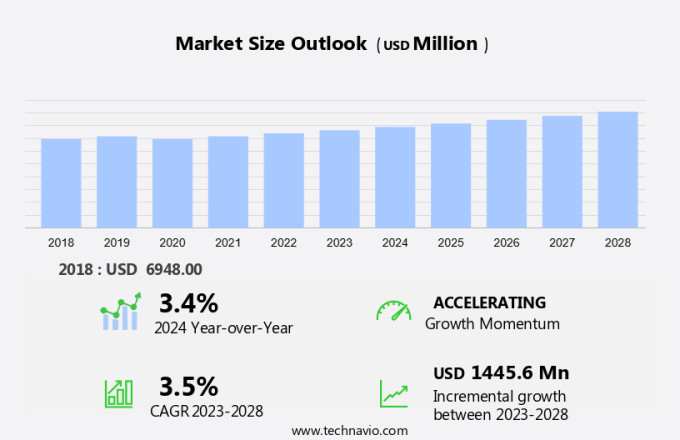

The residential cooking grills market size is forecast to increase by USD 1.45 billion, at a CAGR of 3.5% between 2023 and 2028.

- The market is driven by the ongoing trend towards premiumization, as consumers increasingly seek innovative and advanced Cooking Grills to enhance their home culinary experiences. Product portfolio extensions and technological innovations have enabled manufacturers to cater to this demand, offering features such as smart functionality, multi-cooking options, and improved energy efficiency. Simultaneously, the market faces significant challenges from increasing competition in the form of alternative cooking appliances, such as induction cooktops and air fryers. These competitors offer convenience and versatility, posing a threat to the market share of traditional cooking grills. Additionally, the growing popularity of online sales channels has intensified competition, as consumers have greater access to a wider range of options and can easily compare prices and features.

- To capitalize on market opportunities and navigate these challenges effectively, companies must focus on offering unique value propositions, investing in research and development, and leveraging digital marketing strategies to reach and engage consumers.

What will be the Size of the Residential Cooking Grills Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology and consumer preferences. Propane and pellet grills dominate the landscape, each offering unique benefits. Propane grills provide quick heating and easy ignition, making them a popular choice for many home cooks. Pellet grills, on the other hand, offer the ability to smoke, grill, and roast with precise temperature control. Grill temperature control is a key consideration for consumers, leading to the development of advanced features such as digital controllers and Wi-Fi connectivity. Grill accessories, parts, and thermometers cater to these needs, ensuring optimal cooking performance. Restaurant use and commercial applications are expanding the market's reach, as establishments seek to offer outdoor dining experiences.

Grilling recipes and techniques are also a focus, with cast iron construction and grill cleaning tools essential for maintaining quality. Grilling techniques continue to evolve, with sear burners, stainless steel construction, and side burners adding versatility to grilling. Grill maintenance and assembly are also important considerations, with grill brushes and grill covers essential for upkeep. The market is diverse, with a range of grill types including charcoal, natural gas, and infrared grills, as well as griddle grills, smoker grills, and rotisserie grills. Outdoor kitchens and built-in grills offer convenience and style, while grill safety features and warranties provide peace of mind.

Grill brands compete on features, performance, and price, with ongoing innovation and product comparisons shaping consumer decisions. Backyard entertaining and outdoor living are driving demand, as consumers seek to enhance their home cooking experiences.

How is this Residential Cooking Grills Industry segmented?

The residential cooking grills industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Gas

- Charcoal

- Electric

- Application

- Outdoor

- Indoor

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- Australia

- China

- Rest of World (ROW)

- North America

.

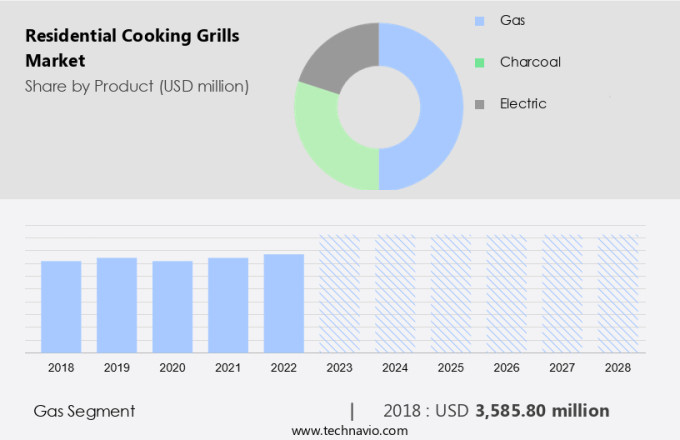

By Product Insights

The gas segment is estimated to witness significant growth during the forecast period.

In the dynamic the market, gas grills, including propane and natural gas models, dominate the landscape due to their convenience and efficiency. These grills offer temperature control through simple knob adjustments, making them a popular choice for residential use. Grill accessories, parts, and thermometers cater to the needs of these consumers, ensuring optimal cooking results. Gas grills are not only preferred for backyard barbecues but also find application in restaurant settings. Grilling recipes and techniques continue to evolve, with cast iron and stainless steel construction becoming increasingly popular for their durability and heat retention. Grill maintenance and assembly are simplified with the availability of various tools and resources.

Sear burners and side burners expand the versatility of gas grills, enabling users to cook a variety of dishes. Outdoor kitchens and built-in grills offer a more integrated solution for homeowners. Grill safety features, such as igniters and grill covers, are essential considerations. The market for residential cooking grills is characterized by continuous innovation, with companies introducing advanced technologies like infrared and griddle grills. Cast aluminum construction and smoker grills cater to the growing demand for versatile cooking options. Portable grills offer flexibility for those with limited outdoor space. Grill reviews and comparisons help consumers make informed decisions.

Grill brands, such as those specializing in gas grills, continue to shape the market with their offerings. Grilling tips and techniques are widely shared, fostering a vibrant grilling community. In conclusion, the market is driven by the desire for convenient, efficient, and versatile cooking solutions. Gas grills, with their ease of use and maintenance, remain a top choice for consumers. companies focus on product innovations and quality improvements to cater to evolving consumer needs.

The Gas segment was valued at USD 3.59 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 33% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American market for residential cooking grills is a significant contributor to the global industry, holding one of the top three positions. This region's market is projected to expand at a noteworthy rate throughout the forecast period. The United States and Canada are the leading countries in this market, with the US holding the largest market share in North America as of 2023. The growing health consciousness in North America, with a focus on preventing conditions like high blood pressure, obesity, and cardiac diseases, has driven the demand for residential cooking grills. These grills offer versatility in cooking methods and allow users to prepare healthier meals at home.

The market caters to various preferences, including propane grills, pellet grills, charcoal grills, natural gas grills, smoker grills, portable grills, and built-in grills. Accessories such as grill thermometers, grill temperature control, grill cleaning tools, grill brushes, grill covers, and grill parts are essential for maintaining and enhancing the functionality of these grills. Additionally, grilling techniques, grilling recipes, grill lighting, grill safety features, and grill warranties are essential considerations for consumers. Outdoor living spaces, including outdoor kitchens and backyard entertaining areas, have become increasingly popular, further fueling the demand for residential cooking grills. Grilling tips, cooking area comparisons, and grill brand preferences are essential factors influencing consumer decisions.

Infrared grills, griddle grills, side burners, sear burners, rotisserie grills, and cast iron or stainless steel construction are among the trends shaping the market. Grill igniters, grill assemblies, and grill maintenance tools are also essential components of the market.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Residential Cooking Grills Industry?

- Product premiumization, driven by innovations and portfolio extensions, serves as the primary growth catalyst in the market.

- The market has seen significant advancements with the integration of technology, leading to innovative appliances that enhance the cooking experience for consumers. Smart grills, enabled with Wi-Fi and Bluetooth technology, allow for remote monitoring and control of cooking activities, making them increasingly popular. Char-Broil, a leading brand, offers the SmartChef TRU-Infrared 3-Burner Gas Grill, featuring the company's patented SmartChef technology. Grill safety features, such as automatic shut-off and temperature control, are essential considerations for consumers. Grill lighting and grill covers are additional features that add convenience and protection. Built-in grills offer a sleek design and seamless integration into outdoor living spaces, making them a desirable option for backyard entertaining.

- Grill brands prioritize grill warranty and durability, ensuring customer satisfaction and longevity of their products. Rotisserie burners are a popular feature for those who enjoy cooking rotisserie dishes. Grill grates, made from materials like stainless steel or cast iron, impact the cooking performance and ease of use. Grill safety is a critical factor, with features like flame tamers, automatic shut-off, and temperature control ensuring safe and efficient cooking. Grill lighting, available in various forms such as infrared or LED, enhances the cooking experience and convenience. Grill covers protect the appliance from the elements, extending its life and maintaining its appearance.

- Grill brands offer various warranty options, ensuring customer satisfaction and peace of mind. In conclusion, the market is driven by technological advancements, consumer demand for convenience, and a focus on safety and durability. Smart grills, grill covers, and other innovative features continue to shape the market, providing consumers with a wide range of options for their outdoor cooking needs.

What are the market trends shaping the Residential Cooking Grills Industry?

- The trend in business is shifting towards increased online sales. As a professional Virtual Assistant, I can help you capitalize on this market trend by implementing effective strategies to boost your online sales.

- The market has experienced notable growth due to the increasing popularity of grilling and the convenience offered by online distribution channels. As of 2022, the global e-commerce industry was valued at around USD3.5 trillion and is projected to expand significantly in the coming years. This growth can be attributed to the widespread use of smart devices and the ease of purchasing grills online. Prominent companies in the market, such as Weber, Newell Brands, W. C. Bradley, and Napoleon (Wolf Steel), sell their products through various channels, including third-party e-retailers like Amazon.Com and Alibaba Group, as well as their own company-owned web portals.

- Grill options include propane grills and pellet grills, which offer temperature control features, grill accessories, grill parts, grill thermometers, and grilling recipes for consumers. Grilling techniques and cleaning tools are also essential components of the market. Cast iron construction adds durability and harmonious aesthetics to these grills, making them suitable for both residential and restaurant use.

What challenges does the Residential Cooking Grills Industry face during its growth?

- The intense competition posed by various alternative cooking appliances represents a significant challenge to the growth of the industry.

- The market faces significant challenges due to the increasing popularity of alternative cooking appliances. Grill pans and grill microwave ovens are becoming increasingly preferred options for consumers, particularly those living in apartments with limited outdoor space. Price sensitivity is another factor influencing the demand for these alternatives. The number of apartment dwellers is on the rise, leading to a decrease in demand for residential cooking grills and an increase in demand for space-saving alternatives. Griddle grills and side burners are other alternatives gaining traction in the market. Grill maintenance and assembly can be time-consuming and labor-intensive, making grill pans and grill microwave ovens more convenient options.

- When selecting a cooking appliance, consumers often consider factors such as grill BTU output, stainless steel construction, and the number of burners. Grill reviews play a crucial role in influencing purchasing decisions. As the trend towards outdoor kitchens continues, the demand for high-performance, easy-to-use, and easy-to-store cooking appliances is expected to grow.

Exclusive Customer Landscape

The residential cooking grills market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the residential cooking grills market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, residential cooking grills market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Bull Outdoor Products Inc. - The company showcases an array of residential cooking grills, including the Avance Collection and Viva Collection models.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bull Outdoor Products Inc.

- De Longhi S.p.A

- Koninklijke Philips N.V.

- Modern Home Products Corp.

- Newell Brands Inc.

- Onward Manufacturing Company Ltd.

- RH Peterson Co.

- Robert Bosch GmbH

- SEB Developpement SA

- Spectrum Brands Holdings Inc.

- Sub Zero Group Inc.

- The Middleby Corp.

- Traeger Inc.

- Transform Holdco LLC

- W.C. Bradley Co.

- Weber Stephen Products HK Ltd.

- Whirlpool Corp.

- Wolf Steel Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Residential Cooking Grills Market

- In February 2023, Traeger Grills, a leading outdoor living brand, introduced the Pro Series 34 Pellet Grill, featuring WiFi connectivity and Traeger's new D2 Direct Drive Technology for improved temperature control and cooking consistency (Traeger Grills Press Release).

- In March 2024, Weber LLC, a major player in the market, announced a strategic partnership with Amazon Fresh to offer Meal Kit delivery services, allowing customers to receive pre-portioned ingredients and recipes directly to their doors for easy meal preparation on Weber grills (Amazon Business Wire).

- In May 2024, Char-Broil, a subsidiary of privately-held W.C. Bradley Co., completed the acquisition of Twin-Eagles, a high-end outdoor living products manufacturer, expanding its product portfolio and market presence in the premium residential cooking grills segment (Char-Broil Press Release).

- In October 2025, the U.S. Environmental Protection Agency (EPA) finalized new regulations for residential wood heaters and cooking appliances, requiring stricter emission standards to reduce air pollution. This development is expected to drive demand for cleaner-burning alternatives, such as pellet and gas grills, in the market (EPA Press Release).

Research Analyst Overview

- The market is experiencing significant advancements, driven by the integration of smart grill technology and innovative manufacturing processes. Grill marketing strategies are evolving to emphasize safety standards and sensor technology, ensuring consumer satisfaction and trust. Grill market segmentation reveals a diverse retail landscape, with distribution channels ranging from brick-and-mortar stores to online sales. Grill trends analysis indicates a growing demand for connectivity, fuel efficiency, and automation, while consumer demographics continue to shift towards tech-savvy individuals. The competitive landscape remains dynamic, with companies focusing on innovation, value proposition, and aesthetics to differentiate their offerings.

- Grill price points are becoming more competitive, with remote control and monitoring features becoming increasingly common. The industry's growth is also influenced by the increasing focus on grill durability and environmental impact, as sustainability becomes a key concern for consumers. Overall, the market is poised for continued growth and innovation.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Residential Cooking Grills Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

161 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.5% |

|

Market growth 2024-2028 |

USD 1445.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.4 |

|

Key countries |

US, UK, Germany, Australia, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Residential Cooking Grills Market Research and Growth Report?

- CAGR of the Residential Cooking Grills industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the residential cooking grills market growth of industry companies

We can help! Our analysts can customize this residential cooking grills market research report to meet your requirements.