Residential Microwave Oven Market Size 2024-2028

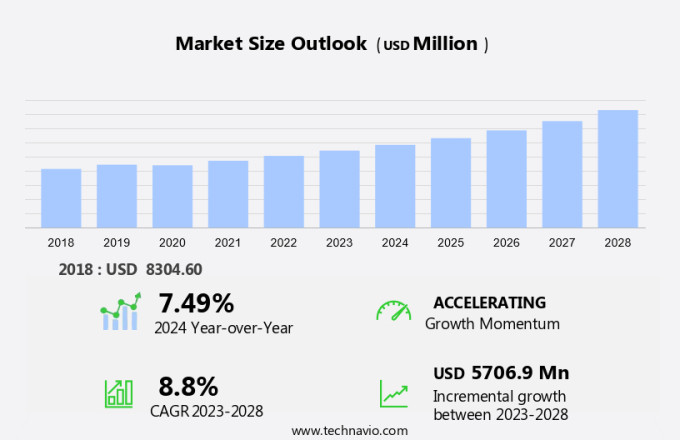

The residential microwave oven market size is forecast to increase by USD 5.71 million at a CAGR of 8.8% between 2023 and 2028.

- The market is experiencing significant growth, driven by several key factors. Firstly, the increasing disposable income of consumers allows them to invest in modern kitchen appliances, including microwaves. Secondly, companies are focusing on new product innovations, such as smart and energy-efficient models, to cater to evolving consumer preferences. However, the market also faces challenges from alternative cooking methods and appliances, such as air fryers and convection ovens, which offer unique features and functionality. Despite these challenges, the market is expected to continue its growth trajectory due to the convenience and versatility of microwave ovens in modern households.

What will be the Size of the Market During the Forecast Period?

- The market is witnessing significant growth due to urbanization and the increasing demand for convenient cooking solutions. Smart microwaves with enhanced cooking features, energy efficiency, and eco-friendly appliances are becoming popular among time-pressed consumers with busy lifestyles and time constraints. Technological advancements in microwave ovens, such as Inverter technology, sensors, connectivity modulus, software, IoT technology, and digital control features, are driving the market growth. Alternative appliances like toaster ovens and air fryers are facing stiff competition from microwave ovens due to their convenience and versatility. The microwave oven industry is also witnessing the integration of smart kitchen appliance technology and energy-saving features, making them an essential appliance in modern kitchens.

- Further, frozen foods are another significant factor fueling the market growth, as microwave ovens offer quick and easy cooking solutions for these convenience foods. Online retail channels are also contributing to the market growth, making microwave ovens easily accessible to consumers. Commercial ovens are a separate market segment, catering to the needs of the foodservice industry. Overall, the market is expected to continue its growth trajectory in the coming years.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Countertop microwave oven

- Built-in microwave oven

- Product

- Microwave oven without smart connectivity

- Microwave oven with smart connectivity

- Geography

- APAC

- China

- Japan

- North America

- US

- Europe

- Germany

- UK

- Middle East and Africa

- South America

- APAC

By Type Insights

- The countertop microwave oven segment is estimated to witness significant growth during the forecast period.

The microwave oven market is witnessing significant growth due to urbanization and the increasing number of time-pressed consumers with busy lifestyles. Countertop microwave ovens, as cooking solutions, have gained popularity for their space-saving design and ease of use. Smart microwaves with enhanced cooking features, energy efficiency, and eco-friendly appliances are preferred by eco-conscious consumers. Online retail channels have expanded the distribution network, making these appliances more accessible. Frozen foods and convenience are major factors driving the demand for microwave ovens. Technological advancements, such as magnetrons, smart technology, sensors, connectivity modulus, software, and inverter technology, have further enhanced the functionality of microwave ovens.

Further, alternative appliances like toaster ovens, air fryers, and multi-cookers, along with price sensitivity and energy consumption, are factors influencing consumer choices. Proper e-waste management is essential for the sustainable growth of the microwave oven industry. Grill microwave ovens, solo microwave ovens, and convection microwave ovens cater to various consumer needs. The market is served through distribution channels, including multibrand stores, exclusive stores, online platforms, supermarkets, and electronics stores. Single person households and dual income families are the primary target consumers for microwave ovens.

Get a glance at the market report of share of various segments Request Free Sample

The countertop microwave oven segment was valued at USD 5.07 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

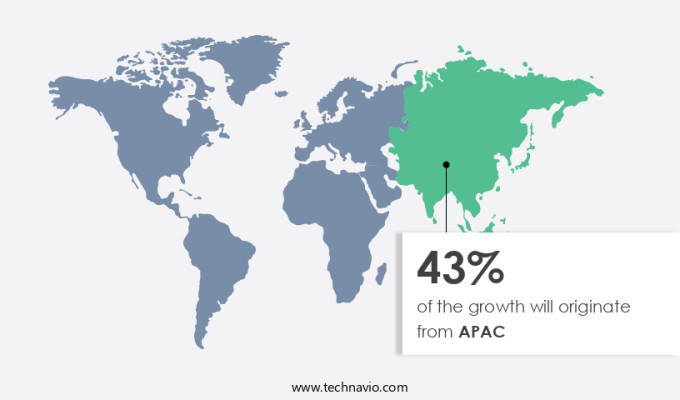

- APAC is estimated to contribute 43% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market encompasses a wide range of kitchen appliances designed for domestic use. These ovens offer advanced features such as digital control, IoT technology integration, and the HydroClean function for effortless cleaning. Commercial ovens may share some similarities, but residential models prioritize energy efficiency and convenience for the sustainable life of homeowners. E-commerce platforms have significantly impacted the market, enabling consumers to easily purchase microwave ovens online. Kitchen appliances, including microwaves, are essential living solutions for modern households. Additionally, laundry appliances are often bundled with microwave ovens to create comprehensive home appliance packages. The integration of digital control features and IoT technology enhances the user experience, allowing for remote operation and real-time temperature monitoring. These advancements contribute to the ongoing evolution of residential microwave ovens.

These advancements contribute to the ongoing evolution of residential microwave ovens.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the Residential Microwave Oven Market?

Increasing disposable income of consumers is the key driver of the market.

- The market is experiencing significant growth due to urbanization and the rising disposable income of consumers in developing countries like India and China. The shift in demographics, the increasing number of working women, and the enhancement of living standards are leading consumers to invest in advanced and efficient cooking solutions. In today's fast-paced world, time-pressed consumers with busy lifestyles are turning to smart microwaves with enhanced cooking features, energy efficiency, and eco-friendly appliances. Technological advancements, such as magnetrons, smart technology, sensors, connectivity modulus, software, and inverter technology, are driving innovation in the microwave oven industry. Alternative appliances like toaster ovens, air fryers, and multi-cookers are also gaining popularity, but microwave ovens continue to dominate due to their convenience and affordability.

- Price sensitivity and energy consumption are crucial factors for eco-conscious consumers, leading to a growing focus on e-waste management. The distribution channels for microwave ovens include multi-brand stores, exclusive stores, online platforms, supermarkets, and electronics stores. The lifestyle of single-person households and dual-income families is fueling the demand for microwave ovens, with grill microwave ovens, solo microwave ovens, and convection microwave ovens being popular choices.

What are the market trends shaping the Residential Microwave Oven Market?

The increasing focus of companies on new product innovations is the upcoming trend in the market.

- The market is witnessing significant growth due to urbanization and the increasing demand for efficient cooking solutions. With busy lifestyles and time constraints, microwaves have become essential appliances for time-pressed consumers. companies in the microwave oven industry are focusing on technological advancements to cater to evolving consumer preferences. These advancements include smart microwaves with enhanced cooking features, energy efficiency, and eco-friendly designs. Smart microwaves integrate sensors, connectivity modulus, and software to offer customized cooking solutions. Inverter technology and magnetrons ensure even heating and faster cooking times. Smart grid Energy efficiency and eco-consciousness are key considerations for consumers, leading to the popularity of eco-friendly appliances.

- Additionally, online retail channels have expanded the distribution network for microwave ovens, making them easily accessible to consumers. Alternative appliances such as toaster ovens, air fryers, and multi-cookers pose competition, but microwaves continue to dominate due to their convenience and versatility. Price sensitivity and energy consumption are crucial factors influencing consumer decisions. companies are focusing on e-waste management and manufacturing sustainable products to cater to the growing demand for eco-friendly appliances. Grill microwave ovens, solo microwave ovens, and convection microwave ovens cater to diverse consumer needs. Lifestyle trends such as single-person households and dual-income families further expand the market potential.

What challenges does the Residential Microwave Oven Market face during the growth?

The availability of alternative products is a key challenge affecting market growth.

- The market faces competition from various alternative cooking solutions, such as toaster ovens, air fryers, multi-cookers, and solo stovetops. Urbanization and the increasing number of time-pressed consumers, particularly in developing countries like India and China, continue to prefer traditional cooking methods due to their affordability and cultural significance. However, technological advancements in microwave ovens, including smart microwaves with enhanced cooking features, energy efficiency, and eco-friendly designs, are gaining popularity among eco-conscious consumers. Online retail channels and multibrand stores offer convenient access to these modern microwave ovens, catering to the needs of single person households and dual income families.

- Magnetrons, smart technology, sensors, connectivity modulus, software, and inverter technology are some of the key features driving innovation in the microwave oven industry. Energy consumption and e-waste management are crucial considerations for price-sensitive consumers, leading to a growing demand for energy-efficient appliances and proper disposal methods. Convection microwave ovens and grill microwave ovens offer additional cooking capabilities, further expanding the market. Distribution channels, including exclusive stores, online platforms, supermarkets, and electronics stores, play a significant role in the lifestyle of consumers and the overall growth of the market.

Exclusive Customer Landscape

The market forecasting report includes the market's adoption lifecycle, covering the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alto Shaam Inc.

- Brandt Group

- Breville Group Ltd.

- Daewoo Electricals

- Electrolux group

- Felix Storch Inc.

- Haier Smart Home Co. Ltd.

- LG Electronics Inc.

- Panasonic Holdings Corp.

- Robert Bosch GmbH

- Samsung Electronics Co. Ltd.

- Shandong Qingneng Power Co. Ltd.

- Sharp Corp.

- Smeg S.p.a.

- Techtronic Industries Co. Ltd.

- The Middleby Corp.

- Whirlpool Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to urbanization and the increasing number of time-pressed consumers with busy lifestyles. Microwave ovens have become essential cooking solutions for single person households and dual income families. Technological advancements in the microwave oven industry have led to the development of smart microwaves with enhanced cooking features, sensors, connectivity modulus, and software. Eco-friendly appliances and energy efficiency are key factors influencing consumer preferences. The market for microwave ovens is also driven by the availability of online retail channels for purchasing these appliances.

Furthermore, frozen foods are a popular choice for consumers due to their convenience, leading to increased demand for microwave ovens. Alternative appliances such as toaster ovens, air fryers, and multi-cookers are also gaining popularity, but microwave ovens continue to dominate due to their versatility and affordability. Price sensitivity and energy consumption are important considerations for eco-conscious consumers, leading to the adoption of e-waste management practices and the development of more energy-efficient models. The market for microwave ovens is segmented based on product type, including solo microwave ovens, grill microwave ovens, and convection microwave ovens. Distribution channels include multibrand stores, exclusive stores, online platforms, supermarkets, and electronics stores. Magnetrons, smart technology, inverter technology, and sensors are key components driving technological advancements in the microwave oven industry.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

161 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.8% |

|

Market Growth 2024-2028 |

USD 5.71 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.49 |

|

Key countries |

US, China, Japan, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch