Cooking Grills Market Size 2025-2029

The cooking grills market size is forecast to increase by USD 2 billion, at a CAGR of 5.5% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing preference for outdoor cooking experiences among consumers. This trend is driven by the desire for social gatherings and the enjoyment of preparing meals in a natural environment. However, market participants face challenges in managing the fluctuation of raw material prices, which can impact their profitability. Product innovation is a key strategy for companies to differentiate themselves and cater to evolving consumer preferences. Manufacturers introduce new features and technologies, such as smart gas functionality, to enhance the grilling experience, particularly in residential cooking grills.

- The ability to adapt to price fluctuations and invest in research and development will be crucial for market success. Companies that effectively navigate these challenges and innovate to meet consumer demands will be well-positioned to capitalize on the expanding market for cooking grills.

What will be the Size of the Cooking Grills Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology and shifting consumer preferences. Grill temperature control systems enable precise cooking, ensuring optimal results for various dishes. Grill safety features, such as automatic shut-off and cool-touch handles, enhance user experience and minimize risks. Grill thermometers provide real-time temperature readings, while electronic ignition systems simplify the grilling process. Grill lights offer convenience for nighttime cooking, and grill maintenance products ensure longevity. Portable grills cater to the on-the-go lifestyle, while grill performance and design innovations captivate the market. Grill warranty and efficiency are crucial factors for consumers, leading to increased demand for high-performing and durable grills.

BBQ culture remains a significant influence, with charcoal grills maintaining their popularity due to their unique flavor profile. Griddle grills expand cooking possibilities, and grilling events bring communities together. Grill Btu ratings, grill covers, and grill cleaning products cater to the diverse needs of grill enthusiasts. Innovations in grill ignition systems, grill rotisseries, and built-in grills continue to unfold, integrating grills into outdoor kitchens and enhancing the overall outdoor cooking experience. The market's continuous dynamism is reflected in the evolving grill functionality, grill user experience, and grilling lifestyle trends. Gas cartridges and propane tanks ensure a steady fuel supply, while grill aesthetics and grilling techniques add to the overall appeal.

Cooking surface area, grill storage, and grill cleaning techniques cater to the practical aspects of grilling. Ceramic grates and piezo ignition systems offer improved heat distribution and ease of use. Grill brushes, grilling recipes, and grill assembly instructions simplify the grilling process, while grill accessories expand the possibilities for creative and delicious meals. Backyard entertainment and summer activities revolve around the grill, making it an essential fixture for many households.

How is this Cooking Grills Industry segmented?

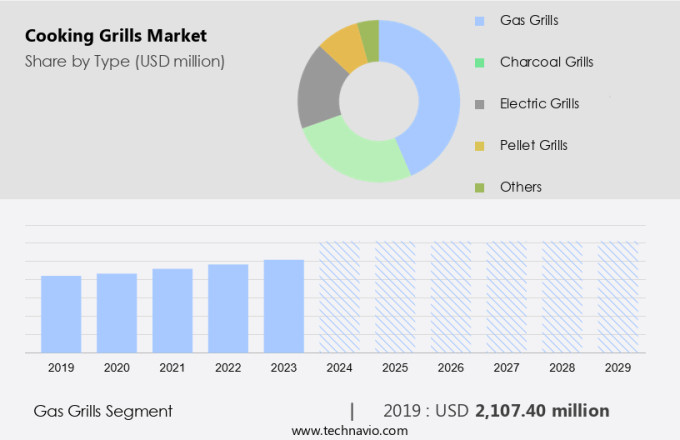

The cooking grills industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Gas grills

- Charcoal grills

- Electric grills

- Pellet grills

- Others

- End-user

- Residential

- Commercial

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- UK

- APAC

- China

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

.

By Type Insights

The gas grills segment is estimated to witness significant growth during the forecast period.

The market encompasses various segments, including gas, charcoal, electric, pellet, and infrared grills, each catering to distinct preferences and cooking styles. Gas grills, renowned for their efficiency and convenience, continue to dominate the market. Weber LLC's recent introduction, the SUMMIT smart gas barbecue, epitomizes this segment's evolution. This premium offering boasts advanced technology and innovative design, tailored to outdoor cooking enthusiasts' demands. Safety features, such as automatic shut-off and flame failure devices, are increasingly prioritized in gas grills. Grill thermometers ensure precise temperature control, while electronic ignition systems simplify the grilling process. Grill lights enable cooking after dark, and grill covers protect against weather damage.

Portable grills offer flexibility, while built-in grills integrate seamlessly into outdoor kitchens. Grill performance is enhanced through heat distribution technologies, such as infrared and ceramic grates. Grill efficiency is a significant consideration, with some models utilizing piezo ignition or propane tanks for fuel. Grill design trends include sleek, modern aesthetics, as well as grills with additional features like rotisseries, griddle grills, and grilling accessories. Grilling events and BBQ culture continue to fuel market growth, with grilling techniques and recipes driving consumer interest. Grill maintenance is crucial for longevity, with cleaning products and techniques essential for optimal grill functionality and user experience.

Grill durability is a key factor, with stainless steel grates and cast iron grates offering durability and excellent heat retention. In summary, the market is characterized by continuous innovation and technological advancements, catering to the diverse needs and preferences of outdoor cooking enthusiasts.

The Gas grills segment was valued at USD 2.11 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 45% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American market is a thriving and innovative sector, fueled by a strong consumer preference for outdoor cooking and advanced grilling technologies. Char-Broil, a prominent player in this region, recently introduced the EDGE electric grill, setting new standards in the electric grill segment. This high-performance, eco-friendly alternative to gas and charcoal grills offers temperature control, electronic ignition, and grill lights, enhancing the grilling experience. The grill's durability and efficiency are further emphasized by its cast iron grates, ceramic grates, and piezo ignition system. Grill maintenance is simplified with the availability of grill cleaning products and grill cleaning techniques.

Portable grills, infrared grills, and built-in grills cater to various consumer needs, while grilling events and grilling competitions foster a vibrant grilling lifestyle. Grill design, grill functionality, and grill user experience continue to be key focus areas for manufacturers, ensuring a harmonious blend of aesthetics and performance. Grill warranties and grill accessories further add value to the consumer's grilling journey.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Cooking Grills Industry?

- The surge in consumer preference for outdoor cooking experiences is the primary market motivator.

- The market is experiencing significant growth due to the increasing demand for enhanced outdoor cooking experiences. Consumers are seeking more versatile and enjoyable ways to prepare meals, particularly in social settings. This trend is evident in the launch of innovative grills, such as Traeger Inc.'s Flatrock Grill, which features a large cooking surface area and advanced ignition systems like piezo ignition. These grills also come with grill storage solutions and grill cleaning techniques, making outdoor cooking more convenient. Grill accessories, such as ceramic grates and grill brushes, have gained popularity due to their ability to enhance the flavor of grilled food and maintain the grill's cleanliness.

- Stainless steel grates are also preferred for their durability and easy maintenance. Grilling recipes have become more diverse, with consumers experimenting with various cuisines and cooking techniques. Grill assembly has become more user-friendly, making it easier for consumers to set up and use their grills. Backyard entertainment has become a priority for many households, and cooking grills have become an essential part of these gatherings. The market for grill accessories continues to grow, with offerings ranging from grill covers to grill lights and even smart grills with Bluetooth connectivity. Overall, the market is expected to continue its growth trajectory, driven by consumer preferences for outdoor cooking and the availability of innovative grill designs and features.

What are the market trends shaping the Cooking Grills Industry?

- Product innovation is an essential trend in today's market. Companies that prioritize new product development and technological advancements are more likely to stay competitive and attract customers.

- The market is experiencing a notable evolution, fueled by technological advancements and consumer preferences for convenience and precision. At the consumer electronics Show (CES) in January 2024, Weber, a leading grill manufacturer, introduced an innovative smart BBQ solution. This groundbreaking BBQ boasts an advanced electronic ignition and gas control system, developed in partnership with Copreci. This system empowers users to digitally manage the grill's flame through a smartphone app or the grill's display. This innovation introduces numerous benefits, such as real-time food temperature control, notifications sent to the user's smartphone, and access to a vast array of recipes.

- Grill safety features, including thermometers, and grill design continue to be essential considerations for consumers. Portable grills remain popular due to their versatility and convenience. Manufacturers prioritize grill performance, efficiency, and warranty to cater to evolving consumer demands. BBQ culture persists as a significant aspect of social gatherings and outdoor living, with charcoal grills maintaining a strong presence in the market.

What challenges does the Cooking Grills Industry face during its growth?

- The volatility in raw material prices poses a significant challenge and impedes growth within the industry.

- The market encounters challenges due to volatility in steel prices and disruptions in supply. The Raw Steels Monthly Metals Index (MMI) revealed a 1.44% increase from October to November 2024, but the third quarter of 2024 posed difficulties for steel suppliers. Major US steel mills, including Nucor, Cleveland-Cliffs, Steel Dynamics (SDI), and US Steel, reported a combined 5.4% decline in year-over-year shipments during this period. These fluctuations and supply disruptions create challenges for the market, affecting grill manufacturers that use steel for grill covers, cast iron grates, and griddle grills. The market dynamics are influenced by various factors, including grill BTU ratings, grill ignition systems, grilling events, grilling competitions, food preservation, and the grilling lifestyle.

- Electric grills, pellet grills, and gas grills are popular choices for consumers, and the market continues to evolve with advancements in technology. Despite these challenges, the market remains significant and continues to grow, driven by consumer demand for high-quality grilling experiences.

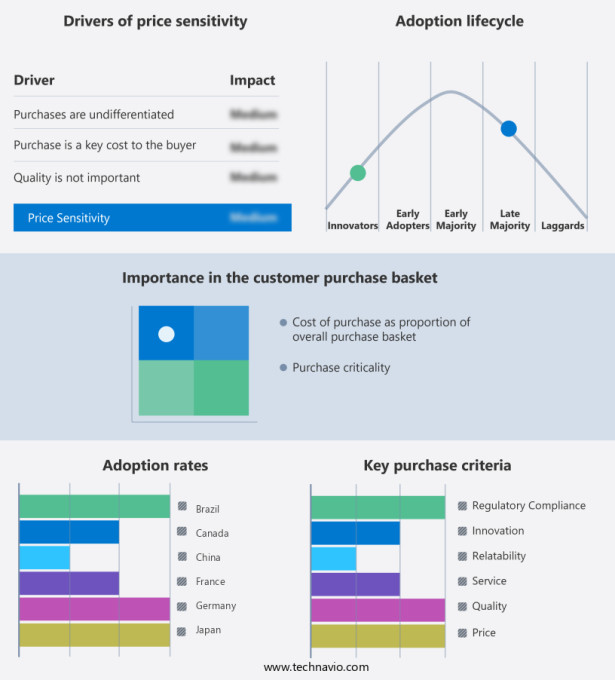

Exclusive Customer Landscape

The cooking grills market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the cooking grills market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, cooking grills market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Blackstone Products - The company specializes in providing a diverse range of high-performance cooking grills.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Blackstone Products

- Broilmaster

- Cal Flame

- Cuisinart

- Empire Comfort Systems Inc

- Firebox Stove

- Kalamazoo Outdoor Gourmet LLC

- L.L. Bean Inc.

- LANDMANN Germany GmbH

- Masterbuilt Manufacturing LLC

- Nexgrill Industries Inc.

- Pit Boss Grills

- Spectrum Brands Holdings Inc.

- The Coleman Co. Inc.

- The Middleby Corp.

- Traeger Inc.

- W.C. Bradley Co.

- Weber Stephen Products HK Ltd.

- Wolf Steel Ltd.

- ZGRILLS INC.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Cooking Grills Market

- In February 2024, Char-Broil, a leading outdoor cooking product manufacturer, introduced the TRU-Infrared Hy-Grade 505 Stainless Steel 4-Burner Cabinet Gas Grill, marking a significant new product launch in the market (Char-Broil Press Release, 2024). This innovative grill utilizes infrared technology to evenly distribute heat and lock in the flavors, setting a new standard for cooking performance.

- In July 2024, Weber LLC and Traeger Grills, two major competitors in the market, announced a strategic partnership to expand their offerings and enhance their customer experience through cross-promotion and co-branded products (Traeger Press Release, 2024). This collaboration represents a key strategic move to strengthen their market positions and cater to the evolving consumer preferences.

- In March 2025, Camp Chef, a prominent player in the outdoor cooking market, completed a successful Series C funding round, raising USD 30 million to accelerate its product development and expand its market reach (Camp Chef Press Release, 2025). This significant investment underscores the growing demand for high-quality cooking grills and the potential for continued market growth.

Research Analyst Overview

- The grills market encompasses various segments, including consumer demographics, retail landscape, design trends, fuel efficiency, safety standards, and more. One notable trend is the integration of smart grill technology, such as remote control features and apps for monitoring and automation. Consumers increasingly prioritize eco-friendly grilling solutions, leading to innovation in material usage and manufacturing processes. Retailers adapt to these shifts by implementing sustainable marketing campaigns and certification programs.

- Grill manufacturers focus on energy consumption reduction and emissions, while supply chain optimization and distribution channels ensure efficient delivery. Influencer marketing and data analytics further enhance brand loyalty and market segmentation. Overall, the grills industry continues to evolve, prioritizing innovation, sustainability, and consumer preferences.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Cooking Grills Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

203 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.5% |

|

Market growth 2025-2029 |

USD 2004.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.4 |

|

Key countries |

US, Canada, Germany, Japan, UK, Brazil, South Korea, Mexico, France, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Cooking Grills Market Research and Growth Report?

- CAGR of the Cooking Grills industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the cooking grills market growth of industry companies

We can help! Our analysts can customize this cooking grills market research report to meet your requirements.