Residential Water Heater Market Size 2025-2029

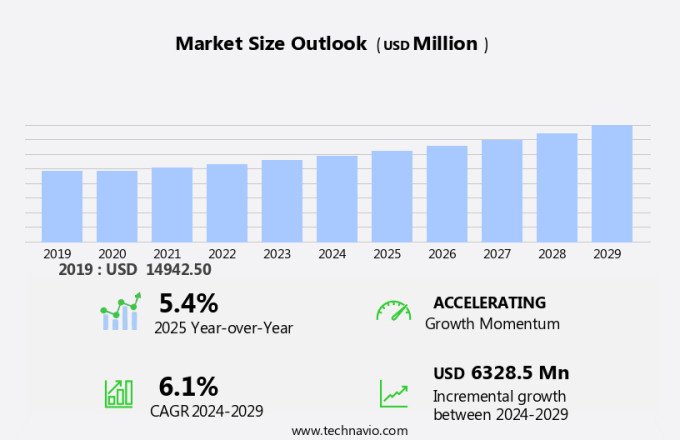

The residential water heater market size is forecast to increase by USD6.33 billion at a CAGR of 6.1% between 2024 and 2029.

- The market is experiencing significant growth due to several key factors. One major trend is the increasing adoption of alternative water heating solutions, such as solar products and hybrid water heaters. These innovative technologies offer energy efficiency and cost savings for homeowners. Additionally, the market is witnessing an uptick in funding for research and development of advanced water heating technologies, including tankless products and high-efficiency storage tanks. However, the high initial cost of these technologies remains a challenge for some consumers, limiting their widespread adoption. Overall, the market is poised for continued growth as consumers seek sustainable and cost-effective water heating solutions for their homes.

What will be the Size of the Market During the Forecast Period?

- This market encompasses various types of water heating systems, including electric, gas, solar, and tankless products, designed to meet the hot water needs of households. Energy efficiency and environmental concerns have emerged as key drivers in the market. Consumers are increasingly seeking energy-efficient solutions to reduce their carbon footprint and save on utility bills. Consequently, there is a growing demand for water heating systems that comply with stringent energy efficiency standards and offer reduced greenhouse gas (GHG) emissions. One trend gaining traction in the market is the integration of wi-fi connectivity.

- This feature enables remote monitoring and control of water heating systems using smartphone apps, offering convenience and energy savings. Additionally, smart grids and rural electrification projects are expected to further boost the adoption of wi-fi-enabled water heaters in the US. Another trend is the growing popularity of hybrid water heating systems. These systems combine various energy sources, such as electric, gas, and solar, to provide hot water efficiently and cost-effectively. Hybrid water heaters offer the benefits of multiple energy sources while minimizing the reliance on a single fuel source, making them an attractive option for consumers. The construction industry plays a crucial role in the market.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Electric

- Gas

- Solar

- Distribution Channel

- Specialty stores

- Department stores and supermarkets

- Online retailers

- Others

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- South America

- Middle East and Africa

- APAC

By Type Insights

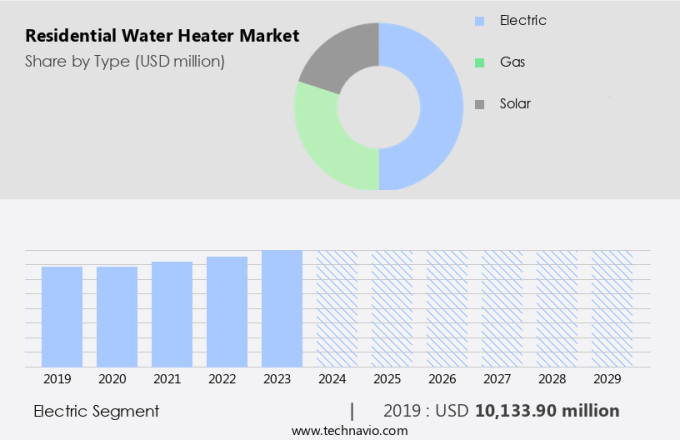

- The electric segment is estimated to witness significant growth during the forecast period.

The market in the United States is divided into various types, with electric water heaters holding a substantial share. The growth of this segment can be attributed to technological advancements and the rising preference for energy-efficient and eco-friendly alternatives. Notably, integrated systems that merge heating, cooling, and water heating into a solitary, all-electric solution are gaining popularity. For instance, Villara Corporation's AquaThermAire system, which received the 2024 Sacramento Inno Award on November 2024, is a prime example. This system overcomes the constraints of conventional heat pumps by providing a comprehensive solution that aligns with California's ambitious 2050 carbon-free objectives. Raw materials and aftermarket services are essential components of the residential water heater industry.

Manufacturers focus on utilizing high-quality materials to ensure product durability and efficiency. Additionally, aftermarket services, including maintenance, repairs, and upgrades, are crucial for retaining customers and expanding market reach. GE Appliances, a leading home appliance company, offers various water heater solutions, including electric models, that cater to diverse consumer needs. In conclusion, the market in the United States is driven by the increasing demand for energy-efficient and eco-friendly solutions. Electric water heaters, with their technological advancements and comprehensive integrated systems, are leading the market's growth. Companies like GE Appliances are capitalizing on this trend by offering high-quality products and aftermarket services to cater to the evolving needs of consumers.

Get a glance at the market report of share of various segments Request Free Sample

The Electric segment was valued at USD 10133.90 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 47% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in the Asia-Pacific region is witnessing significant growth due to factors such as urbanization, rising disposable incomes, and a growing awareness of energy-efficient appliances. This region, which comprises major markets like China, India, Japan, and Southeast Asian countries, is a prime focus for manufacturers and retailers. The Asia-Pacific market for residential water heaters exhibits a high demand for both conventional and advanced water heating solutions. The expanding middle class and burgeoning real estate sector of the region are major contributors to this demand. For instance, India's the market in the region has an annual demand of approximately 5 million units, with a consistent growth rate of 10%-12% year over year.

In the era of digitalization, smart water heating solutions are gaining popularity. Wi-Fi-enabled water heaters and remote monitoring systems are becoming increasingly common, with smartphone apps allowing users to control their water heating systems from anywhere. Energy-efficient water heaters are also a priority for consumers, as they help reduce energy consumption and lower utility bills.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage. Builders and contractors are increasingly incorporating energy-efficient water heating systems into new homes to meet regulatory requirements and consumer demand. Aftermarket services, such as installation, repair, and maintenance, are also essential components of the market, ensuring the longevity and optimal performance of water heating systems. Manufacturers of residential water heaters, such as Ge Appliances and other home appliance and smart home companies, are focusing on innovation and product development to cater to the evolving needs and preferences of consumers. Electric solutions, including storage tank and tankless products, as well as gas water heaters and solar products, continue to be popular choices. Fuel sources, including natural gas, fuel oil, and renewable energy, also influence the market. Natural gas remains a dominant fuel source due to its affordability and availability, while renewable energy sources, such as solar, are gaining traction due to their environmental benefits and government incentives. In conclusion, the market is driven by trends such as energy efficiency, wi-fi connectivity, and the integration of multiple energy sources. The market caters to various fuel sources and is influenced by regulatory requirements, consumer preferences, and technological advancements. Manufacturers and builders continue to innovate and adapt to meet the evolving needs of consumers, ensuring the market's growth and sustainability.

What are the key market drivers leading to the rise in adoption of Residential Water Heater Market ?

Product launches is the key driver of the market.

- The market in the United States is experiencing significant growth due to the introduction of technologically advanced products. These innovations cater to the evolving needs and preferences of consumers, driving market expansion and competition. For instance, Havells India recently launched the Otto and Orizzonte water heaters, which boast cutting-edge features to meet modern demands. The Otto model showcases a circular design and a color-shifting LED indicator that transitions from blue to amber as water heats. It comes equipped with a shock-safe plug, feroglas coating technology, and a temperature-adjusting knob for customized heating. Announced in December 2022, these advanced features aim to enhance energy efficiency and reduce GHW emissions.

- Furthermore, the integration of Wi-Fi connectivity in these water heaters allows for seamless integration with smart grids and smart cities, contributing to rural electrification efforts and sustainable energy solutions. As the market continues to evolve, we can expect more groundbreaking innovations that cater to the changing needs of consumers.

What are the market trends shaping the Residential Water Heater Market?

Growing fundings is the upcoming trend in the market.

- The market is experiencing notable growth due to the rising investment in sustainable energy solutions. Companies specializing in this sector are attracting substantial financing to innovate and align with the global transition towards eco-friendly energy sources. An illustrative instance is Camus Energy, a grid management platform dedicated to a fully electrified future. Recently, Camus Energy secured over USD25 million in Series A funding, which included a USD10 million extension. This funding round was led by Congruent Ventures, a climate-focused venture capital firm, and Wave Capital, a marketplace investor. Other participants in this round were Align Impact, Remarkable Ventures Climate Fund (RVC), and Groundswell Ventures, as announced in November 2024. This investment will enable Camus Energy to further develop and expand its offerings in the market.

What challenges does Residential Water Heater Market face during the growth?

High cost of residential water heaters is a key challenge affecting the market growth.

- The market in the United States is driven by the demand for energy savings and reduced carbon emissions. Heating solutions that provide hot water efficiently are highly sought after by consumers. The market for water heaters is diverse, with various types, fuel sources, sizes, and brands influencing the cost. Conventional water heaters, which are commonly used, can cost between USD700 and USD1,000. Electric water heaters, an affordable alternative, range from USD300 to USD800, while gas water heaters have a price range of USD400 to USD1,200. Tankless water heaters, which offer significant energy savings, are more expensive, with prices ranging from USD1,000 to USD3,000.

- The high cost of water heaters is a significant challenge for the market, as it can deter consumers from upgrading to more efficient models, thereby impacting overall growth.

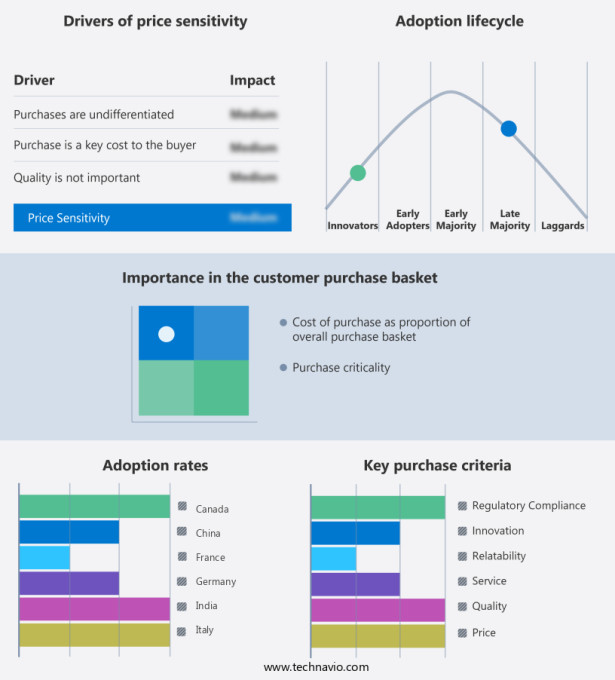

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast , partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

A. O. Smith Corp. - This company provides a range of energy-efficient residential water heating solutions, including the Signature Series, which boasts ENERGY STAR certification and various options such as gas, electric, tankless, and hybrid heat pump models. These water heaters prioritize energy savings and sustainability, ensuring homeowners in the US can make an eco-friendly and cost-effective choice for their household needs.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- A. O. Smith Corp.

- Ariston Holding NV

- Bradford White Corp.

- Eemax Inc.

- General Electric Co.

- Haier Smart Home Co. Ltd.

- Havells India Ltd.

- Lennox International Inc.

- Modine Manufacturing Company

- Navien Inc.

- Noritz Corp.

- Rheem Manufacturing Co.

- Rinnai America Corp.

- STIEBEL ELTRON GmbH & Co

- Transform Holdco LLC

- Vaillant Group International GmbH

- Westinghouse Electric Corp

- Whirlpool Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing demand for energy-efficient water heating solutions. Wi-fi-enabled water heaters and smartphone apps are becoming increasingly popular, allowing homeowners to monitor and control their water heating systems remotely, resulting in energy savings. The integration of wi-fi connectivity and smart grids is enabling rural electrification and the expansion of smart cities. Carbon emissions are a major concern, and the market is shifting towards renewable energy sources for water heating. Solar heaters, electric solutions, and hybrid water heaters are gaining popularity due to their low carbon footprint. The construction industry is also embracing energy-efficient water heating systems, with storage water heaters, tankless products, and hybrid solutions being preferred for their heating capacity and fuel efficiency.

Energy savings are a key driver for the market, with consumers seeking ways to reduce their utility bills. Aftermarket services are also gaining traction, with companies offering maintenance and repair services to ensure the optimal performance of water heating systems. Overall, the market is expected to grow steadily, driven by the increasing demand for sustainable and cost-effective water heating solutions.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

208 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.1% |

|

Market growth 2025-2029 |

USD 6328.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.4 |

|

Key countries |

China, US, India, Japan, South Korea, Germany, Canada, France, UK, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch