Vietnam Retail Market Size 2025-2029

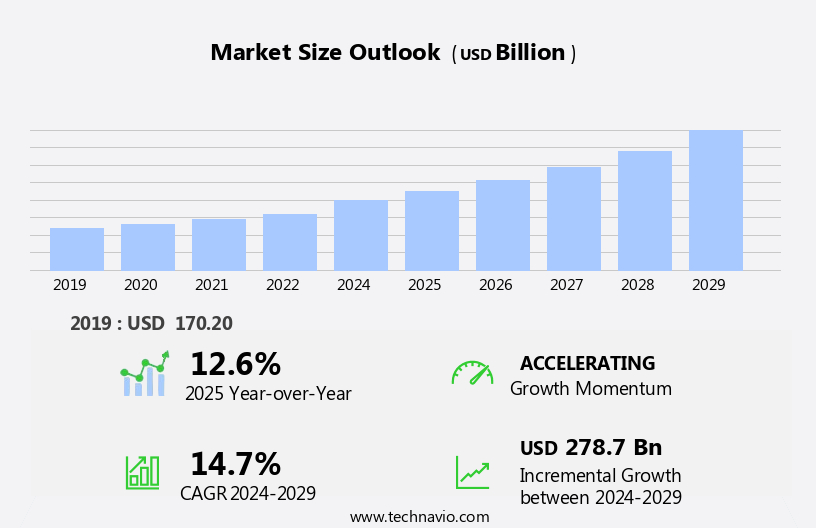

The Vietnam retail market size is forecast to increase by USD 278.7 billion, at a CAGR of 14.7% between 2024 and 2029. The Vietnam Retail Market is segmented by distribution channel (Offline, Online), type (Grocery, Electronics and Appliances, Home and Garden, Health and Beauty, Others), channel (Cash, Digital Payment, Buy Now Pay Later (BNPL)), store type (Supermarkets, Convenience Stores, Online, Specialty Stores), consumer segment (Urban Middle Class, Rural Consumers, Young Shoppers), and geography (APAC: Vietnam). This segmentation reflects the market's diversity, driven by strong demand for Grocery and Health and Beauty products among Urban Middle Class and Young Shoppers, growing Online channels with Digital Payment and BNPL options, and the dominance of Supermarkets and Convenience Stores for Offline purchases catering to both Rural Consumers and urban preferences across Vietnam in the APAC region.

Major Market Trends & Insights

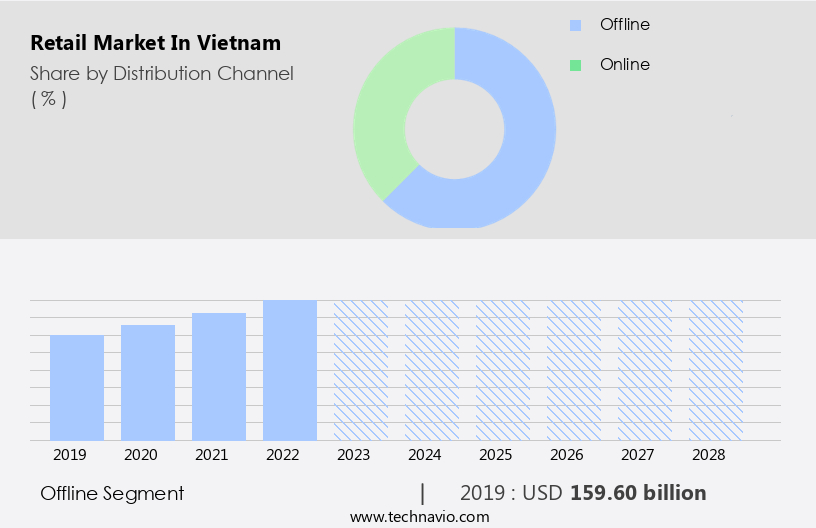

- Based on the Distribution Channel, the offline segment led the market and was valued at USD 212.20 billion of the global revenue in 2023.

- Based on the Type, the Grocery segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- Market Opportunities: USD 299.79 Billion

- Future Opportunities: USD 278.7 Billion

- CAGR (2024-2029): 14.7%

The market is experiencing significant growth, driven primarily by the increasing demand for convenience food products. This trend is closely linked to the emergence of urban lifestyles, as more consumers in Vietnam's cities seek out quick and easy meal solutions. However, this growth comes with challenges. Logistical and supply chain issues persist, posing significant obstacles for retailers looking to meet the surging demand for convenience foods. Efficiently managing the distribution and delivery of these products is essential for companies aiming to capitalize on this market opportunity and maintain a competitive edge. Navigating these challenges requires strategic planning and innovative solutions to ensure the timely and cost-effective delivery of convenience food products to consumers in Vietnam's urban areas. Companies that can effectively address these logistical hurdles will be well-positioned to thrive in this dynamic and expanding market.

What will be the size of the Vietnam Retail Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

- In Vietnam's dynamic retail market, pricing optimization plays a crucial role in staying competitive. Consumer spending habits continue to shape the industry, with franchise models adapting to local preferences. Sustainability initiatives and compliance standards are increasingly important, driving retailers to prioritize environmental impact and social responsibility. Merchandising strategies and sales forecasting help businesses optimize profit margins and performance metrics, while product recall procedures and food safety regulations ensure customer satisfaction and protect against product liability. E-commerce fraud and intellectual property rights pose challenges, necessitating robust risk management and business intelligence. Sales data analysis and employee training are essential for addressing inventory shrinkage and supply chain disruptions. The grocery segment is the second largest segment of the type and was valued at USD 101.20 billion in 2023.

- Competitor mapping and store security systems are crucial for market penetration and maintaining regulatory compliance. Consumer confidence is influenced by economic indicators, with private label brands gaining popularity. Retailers must navigate complex import/export regulations and adhere to consumer protection laws. Adopting a proactive approach to corporate governance and regulations compliance is vital for long-term success. Market trends include a focus on food safety, sustainability, and digital transformation. Retailers must balance these priorities with managing their workforce, implementing merchandising strategies, and addressing product liability concerns. Effective risk management and supply chain resilience are essential for mitigating the impact of potential crises.

How is this market segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Type

- Grocery

- Electronics and appliances

- Home and garden

- Health and beauty

- Others

- Channel

- Cash

- Digital payment

- Buy now pay later (BNPL)

- Store Type

- Supermarkets

- Convenience Stores

- Online

- Specialty Stores

- Consumer Segment

- Urban Middle Class

- Rural Consumers

- Young Shoppers

- Geography

- APAC

- Vietnam

- APAC

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period. The segment was valued at USD 212.20 billion in 2023. It continued to the largest segment at a CAGR of 9.19%.

In Vietnam's retail market, the integration of technology and traditional retail formats creates a dynamic business environment. Big data and market research guide retail strategies, from inventory management and pricing to customer segmentation and competition analysis. Augmented reality (AR) and virtual reality (VR) technologies enhance the shopping experience, while e-commerce platforms and mobile apps expand reach. Fair trade and ethical sourcing are essential considerations, shaping consumer behavior. Distribution networks and supply chain management are crucial for efficient operations, with delivery services ensuring timely product availability. Loyalty programs and data privacy are key to building brand loyalty and trust.

Department stores and convenience stores cater to diverse demographic trends, offering personalized shopping experiences. Visual merchandising and store design create inviting spaces, while customer service and point-of-sale (POS) systems streamline transactions. Hygiene standards and food safety are critical in grocery stores and supermarkets. Omnichannel retail and digital marketing, including email marketing, pay-per-click (PPC), and social media marketing, expand market reach. Trade agreements and economic factors influence import-export regulations and purchasing decisions. Machine learning and artificial intelligence (AI) optimize retail operations and improve customer experience. Returns and refunds, fraud prevention, and blockchain technology ensure secure transactions and maintain trust.

Social commerce and influencer marketing capitalize on the growing influence of social media. Payment gateways and credit/debit cards facilitate seamless transactions. Cloud computing and retail technology underpin efficient operations and data analytics. Despite the digital revolution, physical stores remain dominant, providing a tactile shopping experience. Supermarkets offer a one-stop-shop for daily needs, while convenience stores cater to on-the-go consumers. Shelf placement and product display maximize sales, while customer experience is a key differentiator. Overall, the market is a complex, evolving ecosystem, requiring a nuanced understanding of various factors.

The Offline segment was valued at USD 159.60 billion in 2019 and showed a gradual increase during the forecast period.

Market Dynamics

The Vietnam Retail Market thrives on diverse offerings like food and beverages, personal care and household, electronics and household appliances, and health and beauty products, catering to urban middle class and young shoppers (15-35). Hypermarkets and supermarkets like Co.opmart and convenience stores like WinMart+ dominate, while e-commerce platforms like Shopee drive online delivery and quick commerce (q-commerce). Digital payments and social commerce, including livestream shopping trends Vietnam, fuel growth, with best grocery delivery Vietnam, online retail Vietnam 2025, health and beauty e-commerce Vietnam, and best apparel brands online Vietnam reflecting digital trends. Sustainable packaging and innovative retail solutions meet evolving consumer needs across Vietnam’s dynamic market.

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic and burgeoning retail landscape of Vietnam, international and local players engage consumers with an enticing array of offerings. From Hanoi's Old Quarter to Ho Chi Minh City's Ben Thanh Market, retail experiences encompass traditional wet markets, modern shopping malls, and e-commerce platforms. Consumers explore a diverse range of products, including electronics, fashion, food, and home appliances. Retailers implement effective marketing strategies, employing social media, promotions, and loyalty programs. Sustainability and convenience drive trends, with eco-friendly packaging and online shopping gaining popularity. Vietnam's retail sector continues to evolve, providing exciting opportunities for both local entrepreneurs and multinational corporations. Global brands tap into the growing middle class, while local businesses leverage cultural nuances. Amidst this vibrant retail ecosystem, consumers enjoy an ever-expanding selection of goods and services.

What are the Vietnam Retail Market drivers leading to the rise in adoption of the Industry?

- The increasing preference for convenient food solutions is the primary factor fueling market growth in this sector.

- In Vietnam's retail market, the preference for convenience food products is on the rise due to the increasing number of working individuals and their hectic schedules. This trend is reflected in the growing demand for processed meat and poultry products, which require minimal preparation before consumption. The decline in time spent on household chores has led to a shift in consumer behavior, with more people opting for eating out or ordering delivery services instead of cooking at home. Retailers are leveraging big data and market research to gain insights into consumer preferences and tailor their offerings accordingly.

- Augmented reality (AR) technology is being used in store design and visual merchandising to enhance the shopping experience. Distribution networks are being optimized through supply chain management and delivery services to ensure the timely and efficient delivery of products. Demographic trends, such as an aging population and increasing urbanization, are influencing retail marketing strategies. Loyalty programs and data privacy are becoming essential components of retail marketing efforts. Retailers are also exploring fair trade practices and sustainable sourcing to differentiate themselves and cater to the changing values of consumers. Convenience stores are a significant part of the retail landscape, offering a wide range of products and services to cater to the on-the-go lifestyle of consumers.

- Pricing strategies are being carefully formulated to remain competitive in this dynamic market. Despite the challenges, the market presents significant opportunities for businesses looking to expand their reach and grow their customer base.

What are the Vietnam Retail Market trends shaping the Industry?

- The emergence of urban lifestyles is currently a significant market trend in Vietnam. Urbanization is leading to an increasing demand for modern consumer goods and services.

- Vietnam's retail market is experiencing significant growth due to urbanization and shifting consumer preferences among young urban populations. This trend is driving the expansion of contemporary retail channels, including convenience stores and e-commerce. Online retail sales have seen a substantial increase, with both established and private retailers effectively selling their products through e-commerce platforms. The rise of online distribution channels reduces the need for physical stores, merchandise, and salespeople, leading retailers to focus more on digital sales. Additionally, the significant growth in Internet and smartphone penetration in Vietnam provides retailers with an opportunity to expand their reach and offer their products online.

- Retailers are utilizing various digital marketing strategies, such as content marketing, influencer marketing, and machine learning, to enhance the customer experience and build brand loyalty. Inventory management, customer service, and payment gateways are also crucial elements in the success of e-commerce businesses. Returns and refunds, omnichannel retail, and mobile apps are other essential aspects of the modern retail landscape in Vietnam.

How does Vietnam Retail Market face challenges during its growth?

- The growth of the industry is significantly impacted by complex issues in logistics and supply chain operations.

- In Vietnam's retail market, online retail is a growing segment driven by economic factors, customer segmentation, and trade agreements. Fraud prevention and ethical sourcing are key concerns for retailers, with blockchain technology and social commerce emerging as potential solutions. Consumer behavior is influenced by social media marketing and data analytics, leading to promotional activities and food safety becoming crucial elements in retail strategies. Import-export regulations and credit card usage are also significant factors shaping the market dynamics. Back-end processes, such as supply chain management, are complex due to the developing infrastructure and the need for coordinated logistics activities, including transportation, inventory management, and handling returns and exchanges.

- Artificial intelligence (AI) is increasingly being adopted to streamline these processes and improve operational efficiency. Retailers must navigate these challenges to succeed in Vietnam's dynamic retail landscape.

Exclusive Vietnam Retail Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AEON Co. Ltd.

- Big C Supercenter (Central Group)

- B’s Mart

- Co.opmart (Saigon Co.op)

- Con Cung

- Circle K Vietnam

- FamilyMart Vietnam

- Guardian Vietnam

- Lotte Mart Vietnam

- Ministop Vietnam

- Mobile World Group (The Gioi Di Dong)

- Phu Nhuan Jewelry JSC (PNJ)

- Phuc Long Coffee & Tea

- Sendo.vn

- Shopee Vietnam

- Tiki Corporation

- VinMart (Vingroup)

- Vinatex

- WinMart (Masan Group)

- ZaloPay (VNG Corporation)

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Retail Market In Vietnam

- In January 2024, Vietnam's largest retailer, VinMart, announced the launch of its new e-commerce platform, VinMart Online, aiming to capture a larger share of the growing online retail market (VinGroup Press Release).

- In March 2024, local retail giant, MET Group, formed a strategic partnership with South Korea's Lotte Shopping to expand its footprint in the Vietnamese market, opening several hypermarkets under the Lotte Mart brand (MET Group Press Release).

- In May 2024, the Vietnamese government approved the establishment of the Vietnam Retail Association, aiming to promote the development of the retail sector and protect the interests of retailers (Vietnam News).

- In January 2025, the American retail giant, Walmart, announced a significant investment of USD 100 million in its Vietnamese subsidiary, BestPrice, to expand its store network and improve its supply chain capabilities (Wall Street Journal).

Research Analyst Overview

In the dynamic retail market of Vietnam, various sectors continue to evolve, integrating advanced technologies and strategies to meet shifting consumer demands. Brands prioritize inventory management through data-driven insights, ensuring optimal stock levels and reducing wastage. Hygiene standards remain a top priority, with stringent measures in place to maintain clean and safe shopping environments. Department stores innovate with customer experience, offering personalized services and immersive experiences. Influencer marketing and content marketing strategies are increasingly adopted, leveraging social media platforms to reach wider audiences. Payment gateways and e-commerce platforms facilitate seamless transactions, while machine learning algorithms optimize pricing strategies and customer segmentation.

Returns and refunds are streamlined with digital processes, ensuring a hassle-free experience for customers. Omnichannel retailing is on the rise, with retailers adopting an integrated approach to reach consumers across multiple channels. Customer service is enhanced through AI-powered chatbots and mobile apps, providing instant support and personalized recommendations. Shelf placement and product display are optimized through data analytics, ensuring maximum visibility and sales. Digital marketing and email marketing campaigns are tailored to specific consumer segments, driving purchasing decisions. Supply chain management and distribution networks are strengthened through technology, ensuring timely delivery and reducing operational costs. Fraud prevention and data privacy are prioritized, with retailers implementing robust security measures to protect sensitive customer information.

Ethical sourcing and sustainable practices are gaining importance, with retailers adopting fair trade and organic product offerings. The retail landscape in Vietnam continues to unfold, with new trends and technologies shaping the market. From convenience stores and food safety regulations to import-export agreements and economic factors, retailers must remain agile and adapt to the ever-changing market dynamics.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Retail Market in Vietnam insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

172 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 14.7% |

|

Market growth 2025-2029 |

USD 278.7 billion |

|

Market structure |

Concentrated |

|

YoY growth 2024-2025(%) |

12.6 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Vietnam

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch