Road Transportation Fuel Market Size 2025-2029

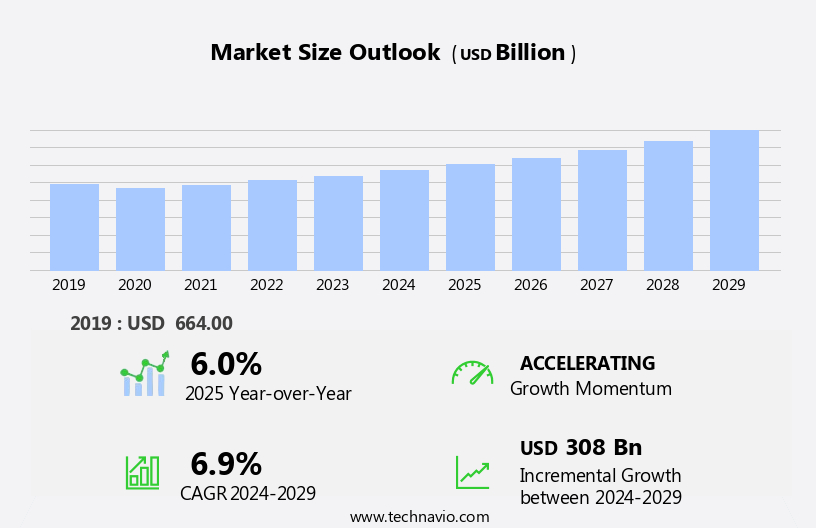

The road transportation fuel market size is forecast to increase by USD 308 billion at a CAGR of 6.9% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the increasing number of automobiles on roads worldwide. This trend is fueled by urbanization, rising disposable income, and improving road infrastructure in developing economies. Another key factor propelling market expansion is the adoption of bio-based and clean fuels, as governments and consumers seek to reduce greenhouse gas emissions and mitigate the environmental impact of traditional fossil fuels. However, market growth faces challenges. Regulatory hurdles impact the adoption of alternative fuels, as governments and regulatory bodies implement stringent standards and certification processes. Additionally, supply chain inconsistencies temper growth potential, as the production and distribution of bio-based and clean fuels require complex logistical networks and significant investment. Simultaneously, the rising demand for fuel supplies to power these automobiles has become a critical concern. To address this challenge, alternative fuel energy solutions such as electric vehicles and renewable fuel sources are gaining popularity.

- Fluctuations in global oil and gas prices further complicate market dynamics, as they can significantly impact the cost competitiveness of various fuel types. Companies seeking to capitalize on market opportunities must navigate these challenges effectively, focusing on regulatory compliance, supply chain optimization, and price competitiveness.

What will be the Size of the Road Transportation Fuel Market during the forecast period?

- The market is experiencing significant dynamics and trends, driven by advancements in fuel efficiency and emissions reduction. Battery range improvement and fuel efficiency standards are pushing automakers to innovate, leading to more fuel-efficient vehicles. Fuel consumption data analysis and fuel performance analysis are crucial for optimizing fleet operations and reducing costs. Fuel blending ratios, fuel additives research, and renewable fuel mandates are shaping the fuel mix, with hydrogen fuel production and biodiesel production gaining traction. Fuel price deregulation and fuel tax reform influence market competition, while fuel infrastructure development and fuel delivery systems ensure reliable supply. Emissions trading and fuel quality control are essential components of the regulatory landscape. These fuels include crude oil derivatives such as gasoline and diesel, as well as alternative fuels like biofuels, compressed natural gas (CNG), aviation turbine fuel (ATF), and synthetic fuels.

- Fuel cost management and fleet electrification strategies are key considerations for businesses in the sector. Fuel market intelligence and fuel economy testing provide valuable insights into market trends and consumer preferences. Fuel blending technologies and renewable diesel production are also transforming the industry.

How is this Road Transportation Fuel Industry segmented?

The road transportation fuel industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Gasoline

- Diesel

- Biofuels

- Natural gas

- Vehicle Category

- Light-duty vehicles

- Heavy-duty vehicles

- Distribution Channel

- Gas stations

- EV charging stations

- Fleet fueling

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By End-user Insights

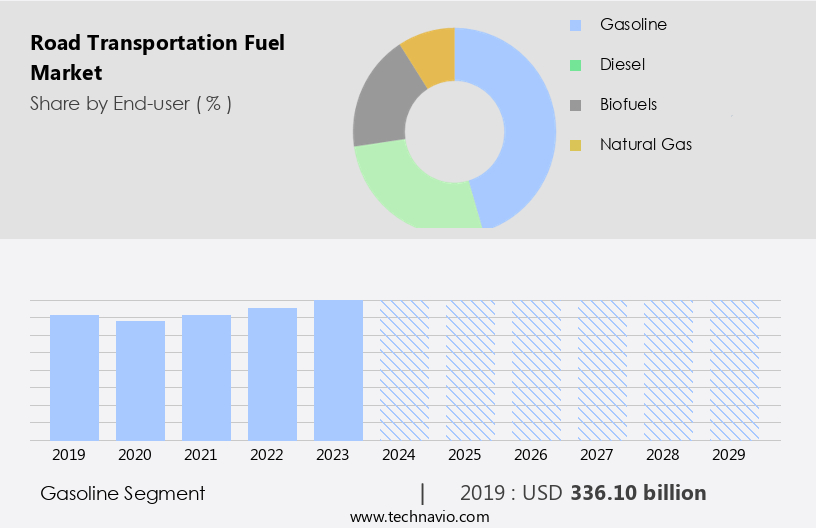

The gasoline segment is estimated to witness significant growth during the forecast period. In the road transportation sector, gasoline serves as the primary fuel for powering internal combustion engines in a range of vehicles, including passenger cars, two-wheelers, and light trucks. To ensure optimal performance and engine protection, gasoline must be free from knocking or premature detonation. Consequently, rigorous fuel testing is essential to maintain the required specifications. Any gasoline failing to meet these standards is returned to the refinery for reprocessing. The demand for gasoline is influenced by the number of passenger vehicles and light trucks in operation, with urbanization and rising disposable income driving their adoption. Alternative fuels, such as diesel, biofuels, hydrogen, and electricity, are gaining traction in the market due to environmental concerns and regulatory pressures. Biofuel blends, such as E10 and B20, are becoming increasingly common in the market. Sustainable aviation fuels, liquefied natural gas, and specialty fuels for off-road vehicles and premium grade fuels are other emerging trends in the biofuels market.

Fuel processing, distribution, and infrastructure development are essential components of the fuel supply chain. Renewable diesel and biofuel production are key areas of focus for reducing carbon emissions and promoting sustainable mobility. The fuel market is subject to various regulations and evolving consumer preferences, making it a dynamic and complex landscape.

The Gasoline segment was valued at USD 336.10 billion in 2019 and showed a gradual increase during the forecast period. Fleet management systems and connected vehicles enable fuel optimization, emissions reduction, and real-time fuel monitoring. Battery technology, fuel cell technology, and renewable energy sources are shaping the energy transition. Fuel price volatility and subsidies impact the market dynamics, while fuel taxes, blending, and hedging influence the pricing structure. Fuel quality, efficiency, and economy are critical factors for commercial vehicles, heavy-duty trucks, and green transportation. Engine technology, fuel additives, and fuel sensors contribute to enhancing fuel performance and reducing carbon footprint. The integration of electric, hybrid, and autonomous vehicles in the market is driving the demand for fuel data analytics and price forecasting.

Regional Analysis

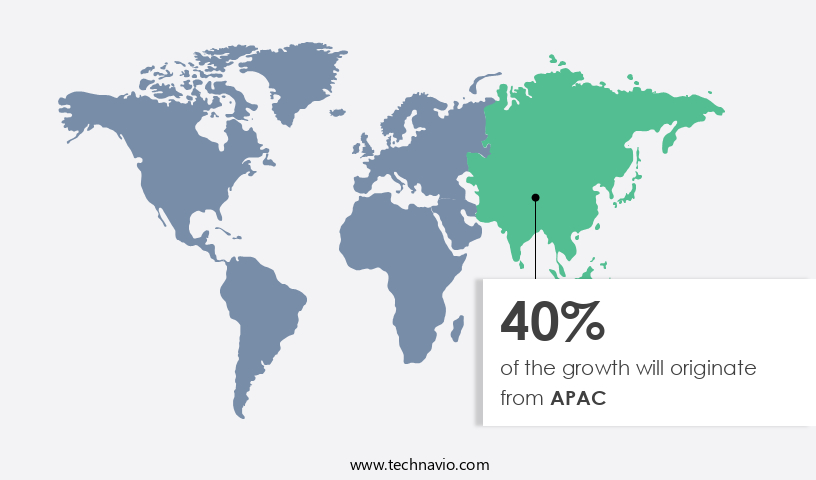

APAC is estimated to contribute 40% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing significant shifts as economic growth in populous nations, particularly India and China, expands the middle class and increases demand for mobility solutions. Road transportation is a critical catalyst for social development, enabling access to education, employment, and healthcare services. In the coming decades, India and China are projected to account for approximately 90% of the growth in global road freight fuel demand from 2017 levels, according to the International Energy Agency (IEA). Fleet management and emissions reduction are becoming top priorities for businesses as stricter environmental regulations are implemented. Alternative fuels, such as battery technology, renewable diesel, hydrogen fuel, and biofuel production, are gaining traction as sustainable mobility solutions.

Connected vehicles, fuel optimization, and fuel price forecasting are also essential components of modern fleet management systems. Commercial vehicles, including heavy-duty trucks, are major contributors to fuel demand. Engine technology, fuel efficiency, and fuel economy are key areas of focus for manufacturers to reduce fuel consumption and improve overall performance. The energy transition towards renewable energy sources is also influencing the fuel market dynamics, with fuel refining and distribution adapting to the changing landscape. Passenger vehicles, including electric vehicles and hybrid vehicles, are becoming increasingly popular as consumers seek to reduce their carbon footprint. Fuel taxes, fuel blending, and fuel monitoring are essential elements of fuel infrastructure and supply chain management.

Fuel price volatility and fuel subsidies continue to impact market trends, with fuel hedging and fuel data analytics playing crucial roles in managing risk and optimizing fuel consumption. Autonomous vehicles and fuel cell technology are emerging trends that could significantly impact the market in the future. The integration of fuel sensors and fuel quality testing ensures that fuel meets the necessary standards for optimal engine performance. Overall, the market is undergoing transformative changes, driven by a combination of economic, environmental, and technological factors.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Road Transportation Fuel market drivers leading to the rise in the adoption of Industry?

- The significant increase in the number of automobiles on roads serves as the primary catalyst for market growth. The market is driven by the increasing demand for automobiles, which serve as essential links for connecting people and facilitating the movement of goods and services. The global population growth and urbanization have led to significant infrastructure development in the transportation sector, fostering the production of more vehicles. In 2023, passenger car production experienced a substantial increase of over 18.70% compared to 2010, underscoring the growing demand for passenger cars. Environmental regulations and emissions reduction targets are major factors influencing the shift towards alternative fuels, such as battery technology and fuel additives, in the transportation sector.

- Fleet management companies are increasingly adopting fuel optimization strategies to mitigate fuel price volatility and reduce overall operational costs. Connected vehicles are also gaining popularity, enabling real-time fuel analysis and improving overall fleet efficiency. Diesel fuel remains a significant player in the fuel market, but the trend towards alternative fuels and emissions reduction is expected to continue. Fuel subsidies and government initiatives aimed at promoting the adoption of cleaner fuels are also contributing to market growth. Overall, the market is characterized by its dynamic nature, with ongoing advancements in technology and evolving regulatory requirements shaping its future.

What are the Road Transportation Fuel market trends shaping the Industry?

- The adoption of bio-based and clean fuels is an emerging market trend. These fuels, derived from renewable sources, offer significant environmental benefits and are increasingly preferred over traditional fossil fuels. Transportation fuels, derived from fossil fuels, power the engines of conventional passenger and commercial vehicles, contributing substantially to global CO2 emissions and increasing greenhouse gas effects. In response to this environmental concern, biofuels have emerged as a viable alternative. Biofuels, such as ethanol and biodiesel, are produced from various types of biomass using advanced fuel processing technologies. Ethanol is derived from carbohydrate-rich biomass through fermentation, while biodiesel is produced from vegetable oil, animal fats, or recycled cooking grease. Biofuels play a crucial role in reducing vehicle emissions and promoting carbon neutrality. With the increasing emphasis on energy transition and carbon footprint reduction, biofuels are gaining significance as the preferred transportation fuel.

- Moreover, the advent of fuel management systems, fuel sensors, and fuel quality monitoring technologies further enhances the efficiency and reliability of biofuel usage. The evolution of autonomous vehicles and fuel cell technology is also expected to revolutionize the transportation fuel market. Autonomous vehicles will require efficient and reliable fuel storage and management systems, while fuel cell technology will enable the production of hydrogen fuel on-demand, reducing the need for traditional transportation fuels. The transportation fuel market is undergoing a significant transformation, driven by the need for cleaner, more sustainable fuel sources. Biofuels, with their ability to reduce emissions and promote carbon neutrality, are at the forefront of this transition.

- The integration of advanced fuel management systems, fuel sensors, and emerging technologies such as fuel cell technology and autonomous vehicles will further propel the growth of the transportation fuel market.

How does Road Transportation Fuel market faces challenges face during its growth?

- The volatile global oil and gas prices pose a significant challenge to the industry's growth trajectory. The market experiences significant volatility due to fluctuating crude oil prices, influenced by various factors such as supply and demand imbalances, geopolitical tensions, and production costs. These price fluctuations impact the entire fuel value chain, from fuel production to distribution and consumption. To mitigate the risks associated with fuel price volatility, market participants are increasingly adopting advanced fuel data analytics and fuel price forecasting solutions. Additionally, the shift towards sustainable mobility, including the use of renewable diesel and other alternative fuels, is gaining momentum. Fuel taxes and fuel blending policies are also driving the adoption of fuel monitoring systems and engine technology improvements to enhance fuel efficiency and fuel economy.

- Heavy-duty trucks, a significant consumer of fuel in the transportation sector, are undergoing technological advancements to reduce fuel consumption and improve overall fuel efficiency. The infrastructure development for alternative fuel stations and the expansion of fuel infrastructure for electric and hydrogen vehicles are further boosting the market. The integration of fuel efficiency and green transportation initiatives is expected to remain a key trend in the market.

Exclusive Customer Landscape

The road transportation fuel market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the road transportation fuel market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, road transportation fuel market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Acciona SA - The company specializes in providing road transportation fuel alternatives, specifically hydrogen fuels.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Acciona SA

- Avril SCA

- Bharat Petroleum Corp. Ltd.

- BP Plc

- Chevron Corp.

- China Petrochemical Corp.

- Chubb Ltd.

- CNG Fuels Ltd.

- Dangote Industries Ltd.

- Eni SpA

- Equinor ASA

- Exxon Mobil Corp.

- Green Plains Inc.

- Hindustan Petroleum Corp. Ltd.

- Indian Oil Corp. Ltd.

- Kuwait National Petroleum Co.

- PJSC LUKOIL

- Reliance Industries Ltd.

- Shell plc

- TotalEnergies SE

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Road Transportation Fuel Market

- In February 2024, Shell and BMW announced a strategic collaboration to develop and test hydrogen fuel cell technology for heavy-duty trucks, aiming to reduce carbon emissions in road transportation fuel (Shell, 2024). This partnership represents a significant step towards the commercialization of hydrogen fuel cell technology in the transportation sector.

- In June 2025, Tesla, the electric vehicle (EV) market leader, unveiled its new Supercharger V3, capable of charging an EV in just 15 minutes, marking a significant technological advancement in EV charging infrastructure (Tesla, 2025). This development is expected to boost the adoption of electric vehicles, further challenging the dominance of traditional road transportation fuels.

- In August 2024, BP and Reliance Industries Limited announced a strategic partnership to develop a 1.2 million metric tonnes per annum bio-refinery in India, focusing on the production of bio-diesel and other advanced biofuels (BP, 2024). This initiative marks a key geographic expansion for BP in the rapidly growing Indian market and underscores the company's commitment to reducing carbon emissions through renewable fuels.

- In December 2025, the European Union (EU) approved the Fit for 55 package, a comprehensive set of legislative proposals to reduce greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels (European Commission, 2021). This policy change is expected to significantly impact the market, driving the adoption of alternative fuels and technologies to meet the ambitious emission reduction targets.

Research Analyst Overview

The market continues to evolve, shaped by various dynamics and applications across multiple sectors. Fuel quality and fuel management systems remain key considerations, as fleet operators strive for emissions reduction and adherence to environmental regulations. Connected vehicles and fuel optimization technologies enable real-time fuel analysis, while battery technology and fuel price volatility influence the shift towards alternative fuels, such as renewable diesel and hydrogen. Passenger vehicles and commercial vehicles, including heavy-duty trucks, are transitioning towards electric and autonomous models, driving demand for energy storage solutions and fuel cell technology. The energy transition also impacts fuel storage and infrastructure, as renewable energy sources gain prominence in the fuel supply chain.

Fuel sensors and fuel data analytics play a crucial role in monitoring fuel consumption and fuel price forecasting, while fuel taxes, fuel blending, and fuel monitoring help shape fuel market dynamics. Engine technology and fuel efficiency continue to be critical factors in reducing the carbon footprint and promoting sustainable mobility. Biofuel production and fuel refining are essential components of the fuel market, as the industry navigates the complexities of the fuel supply chain and fuel hedging strategies. The ongoing unfolding of these market activities highlights the continuous nature of the market and the need for adaptability and innovation.

Dive into Technavio's strong research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Road Transportation Fuel Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

224 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.9% |

|

Market growth 2025-2029 |

USD 308 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.0 |

|

Key countries |

US, China, Canada, Germany, Japan, India, UK, South Korea, Italy, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Road Transportation Fuel Market Research and Growth Report?

- CAGR of the Road Transportation Fuel industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the road transportation fuel market growth of industry companies

We can help! Our analysts can customize this road transportation fuel market research report to meet your requirements.