Robot Kitchen Market Size 2024-2028

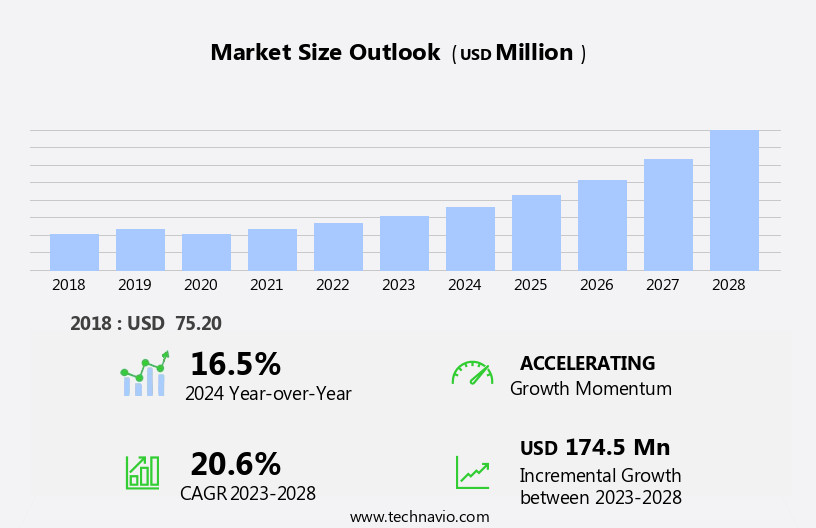

The robot kitchen market size is forecast to increase by USD 174.5 million at a CAGR of 20.6% between 2023 and 2028.

- The market is experiencing significant growth due to increasing demand from end-users for automated solutions in food preparation. Robots and artificial intelligence are transforming the culinary world, enhancing fine dining with precise molecular compatibility. This trend is being driven by the convenience and efficiency offered by robot kitchens, which can work round the clock without breaks and can handle multiple orders simultaneously.

- Additionally, marketing initiatives by companies are increasing awareness about the benefits of robot kitchens, leading to increased adoption. However, a lack of awareness among consumers about the availability and affordability of these systems may hinder market growth. It is essential for market participants to focus on educating consumers about the advantages of robot kitchens and making them more accessible and affordable like major home appliances to a wider audience.Overall, the market is poised for robust growth in the coming years.

What will be the Size of the Robot Kitchen Market During the Forecast Period?

- The market represents a fundamental shift In the way we prepare and consume food, driven by advances in automated kitchen technology and the increasing demand for convenience and efficiency in daily life. Robotics and artificial intelligence are revolutionizing the culinary world, offering molecular compatibility for fine dining experiences and streamlining the production of prepackaged meals.

- Early adopters In the restaurant industry are embracing this technology to enhance the customer experience, with robots handling recipe execution and ensuring consistency. However, societal dynamics surrounding the art of cooking, cultural traditions, and ethical disruptions In the human domain persist. The relationship between food, health, and nutrition remains a priority, with robots offering potential solutions for microwave ovens.

- Despite these advancements, the role of robots In the kitchen raises questions about the communal and creative aspects of cooking, and the potential impact on family traditions and cultural events. Ultimately, the market represents an intriguing intersection of technology and the utilitarian act of preparing meals.

How is this Robot Kitchen Industry segmented and which is the largest segment?

The robot kitchen industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Commercial

- Residential

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- APAC

- Japan

- Middle East and Africa

- South America

- North America

By Application Insights

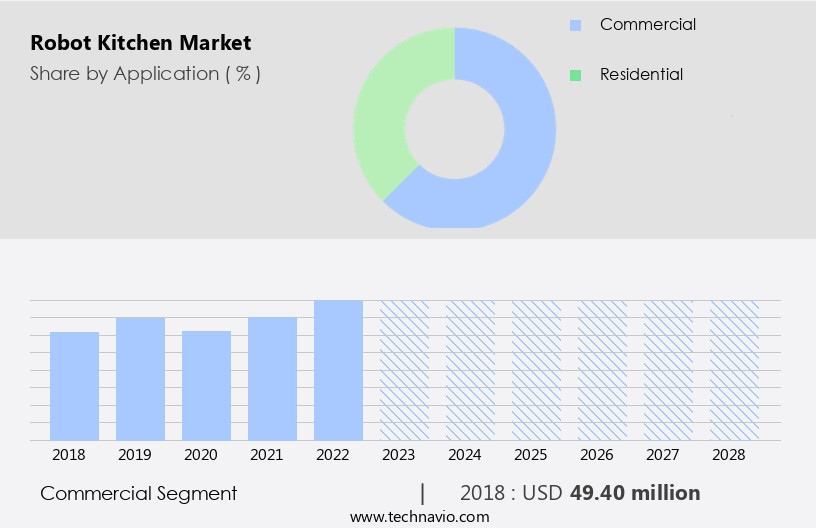

- The commercial segment is estimated to witness significant growth during the forecast period.

The market is experiencing substantial growth, particularly In the commercial sector. This segment encompasses hotels, fast casual restaurants, and fast-food establishments, which are increasingly adopting robot kitchens due to the expanding foodservice industry. Robot kitchens streamline food preparation and cleaning tasks, ensuring consistency and efficiency. Their primary advantage lies in improving customer service through standardized processes and expedited kitchen operations. Enhanced customer experience contributes to customer retention, a crucial factor In the competitive foodservice industry. Furthermore, urbanization and the growing preference for dining out are expected to fuel market growth In the commercial segment during the forecast period. Robot kitchens incorporate advanced technology, including robot arms for stirring, mixing, and temperature adjustment, as well as 3D food printers and pre-portioned ingredients. These innovations contribute to increased productivity and versatility.

Get a glance at the Robot Kitchen Industry report of share of various segments Request Free Sample

The Commercial segment was valued at USD 49.40 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

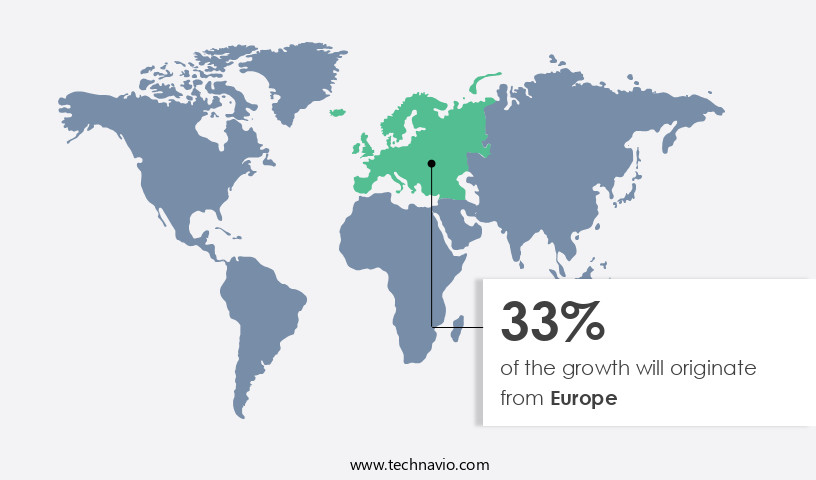

- Europe is estimated to contribute 33% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American market leads the global robot kitchen industry, projected to expand further In the coming years. The thriving restaurant and hotel sectors significantly fueled market growth in North America in 2023. Additionally, the increasing preference for quick food consumption, particularly in fast food establishments, is boosting demand for automated kitchens. Younger demographics in North America, with their active lifestyles, increasingly opt for eating out. Advanced technology, including robot arms, 3D food printers, and pre-portioned ingredients, streamlines food preparation and delivery In these establishments. The integration of algorithms, sensors, and human-like movements in robotic systems enhances efficiency and precision, catering to the demand for high-quality, consistent dishes. The market's expansion is further driven by the integration of food apps, built-in refrigerators, dishwashers, and other kitchen appliances in automated kitchens.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Robot Kitchen Industry?

Increasing demand from end-users is the key driver of the market.

- The automated kitchen market, driven by the integration of technology and robots in food preparation, has witnessed substantial growth in various industries, particularly in hotels and restaurants. This trend is attributed to the fundamental benefits robot kitchens offer, such as increased efficiency, enhanced safety, and the ability to cater to special dietary needs and allergies with molecular compatibility. Robot kitchens enable restaurants to serve customers faster and more accurately, reducing wait times and improving overall dining experiences. According to data, approximately 300,000 people suffer kitchen-related injuries annually worldwide. Robot kitchens, with their human-like movements and precision, eliminate the risk of injuries, making them a preferred choice for many establishments.

- These kitchens employ robot arms, stirring and mixing tools, and temperature adjusters to prepare various dishes, from fine dining creations like crab bisque to simpler recipes such as cherries jubilee. Companies like Moley Robotics and Shadow Robot Company have developed dexterous robots capable of performing intricate cooking techniques, challenging the art of cooking's human domain. The technology behind robot kitchens is not limited to robot arms; it also includes sensors, motors, and algorithms that ensure the food is prepared to perfection. Moreover, 3D recordings of chefs' cooking techniques and built-in refrigerators, dishwashers, and pre-portioned ingredients further streamline the process.

- As the demand for robot kitchens grows, consumer electronics shows have featured retail versions, showcasing the potential of this technology for daily life. The market for robot kitchens is expected to expand further, driven by societal dynamics and ethical disruptions In the culinary industry. The relationship between human workers and robots is a topic of ongoing debate, with some viewing it as a creative event and others as a utilitarian act. Regardless of the perspective, robot kitchens represent a significant shift In the way we prepare and consume food, offering convenience, improved nutrition, and a more scientific approach to cooking, encompassing disciplines like microbiology, physics, chemistry, and materials science.

What are the market trends shaping the Robot Kitchen Industry?

Increasing marketing initiatives is the upcoming market trend.

- In the realm of automated culinary experiences, The market is witnessing significant advancements. Food preparation is no longer a fundamental aspect of daily life confined to the human domain. Instead, technology has infiltrated this domain, with robots and automated kitchens revolutionizing the way we cook and consume food. companies in this market employ integrated marketing communication strategies, utilizing various channels to promote their offerings. Newspapers, magazines, and social media platforms are leveraged for advertising campaigns. Television commercials are followed by marketing initiatives, including internet pre-roll, social media and blogging programs, and interactive websites. These creative strategies enhance brand authenticity and recognition, piquing consumer interest.

- Social media plays a crucial role in marketing efforts, with visual content driving customer engagement and fostering online brand communities. companies also utilize Instagram to exhibit innovative uses of their products for education and entertainment. Robot arms, stirring and mixing capabilities, and adjusting temperature are just a few of the features offered by these advanced kitchen appliances. Molecular compatibility, once a preserve of fine dining establishments, is now accessible to the masses through pre-portioned ingredients and robot noodle-slicers. 3D food printers and human workers collaborate to create unique dishes, merging art and science. Nutrition and health are at the forefront of these developments, with special diets, allergies, and cooking techniques catered to through science education In the fields of microbiology, physics, chemistry, and materials science.

- The consumer electronics showcase has become a platform for introducing the latest robot kitchen innovations. Companies like Moley Robotics and Shadow Robot Company unveil dexterous robots capable of creating dishes such as crab bisque and cherries jubilee. These developments challenge societal dynamics, blurring the lines between convenience, communal experiences, cultural traditions, and ethical disruptions. The integration of robotics into the kitchen landscape is a testament to the transformative power of technology. As these advancements continue to evolve, the role of humans In the kitchen may shift, but the art of cooking remains an essential part of our lives.

What challenges does the Robot Kitchen Industry face during its growth?

Lack of awareness among consumers is a key challenge affecting the industry growth.

- The market in developed countries, including the US, is experiencing significant growth due to the fundamental shift towards automated food preparation. Technology plays a pivotal role in this transformation, as robots are increasingly being adopted in kitchens to execute recipes with molecular compatibility, ensuring fine dining experiences. Early adopters, such as restaurants and hotels, are embracing this utilitarian act to enhance efficiency and consistency. However, societal dynamics and ethical disruptions surrounding the human domain of cooking are emerging concerns. While some view robot kitchens as a creative event that frees up human workers for more complex tasks, others argue that it may disrupt cultural traditions and relationships built around the art of cooking.

- Major players in this field, like Moley Robotics and Shadow Robot Company, are developing dexterous robots with human-like movements, sensors, motors, and joints, capable of stirring, mixing, adjusting temperature, and even creating 3D recordings of cooking processes. These robots can be integrated with food apps and retail versions of automated kitchens, featuring built-in refrigerators, dishwashers, and pre-portioned ingredients. Kitchen appliances, such as robot arms and noodle-slicers, are also being developed, along with 3D food printers. As the market evolves, the role of science education in areas like microbiology, physics, chemistry, materials science, and math becomes increasingly important. Despite this progress, challenges remain, particularly in developing and underdeveloped countries where awareness about robot kitchens is still limited.

- The reliance on manpower In these regions restricts the demand for robot kitchens, and it is expected that this lack of awareness will pose a significant challenge to the growth of the market during the forecast period.

Exclusive Customer Landscape

The robot kitchen market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the robot kitchen market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, robot kitchen market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Connected Robotics Inc. - The company specializes in automated food preparation solutions, featuring a robot kitchen integration of a soba robot, soft serve robot, and French fries robot. These advanced culinary automatons streamline food production processes, ensuring consistency and efficiency in various cuisine offerings.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Connected Robotics Inc.

- Dexai Robotics

- Essilor Instruments USA

- Mellow Inc.

- Miso Robotics Inc.

- Moley Robotics

- QSR Automations Inc.

- Samsung Electronics Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The automated kitchen market represents a significant shift In the food industry, driven by the integration of advanced technology and robots. This sector encompasses a range of applications, from commercial kitchens in restaurants to personal kitchens in homes. Automated kitchens offer numerous benefits, including increased efficiency, consistency, and precision. The technology enables the automation of various kitchen tasks, such as stirring, mixing, adjusting temperature, and even cooking complex recipes. These capabilities cater to the demands of early adopters, who seek convenience and innovation In their daily lives. The societal dynamics surrounding food have evolved, with an emphasis on health and nutrition becoming increasingly important.

Automated kitchens offer solutions for special diets and allergies, ensuring that individuals can enjoy a wide range of meals prepared to their specifications. Furthermore, the integration of science education into automated kitchens allows for a deeper understanding of the molecular compatibility of food ingredients. The art of cooking has long been a communal and cultural tradition, but automated kitchens challenge these norms. The utilitarian act of preparing meals becomes more efficient and streamlined, allowing for more time to focus on relationships and traditions. Ethical disruptions In the food industry, such as the use of prepackaged meals and microwave ovens, are being addressed through the development of automated kitchens that prioritize freshness and quality.

The technology behind automated kitchens is a fusion of various scientific disciplines, including physics, chemistry, materials science, and mathematics. Robotics companies are at the forefront of this innovation, developing dexterous robots with human-like movements, sensors, and motors. These robots are capable of intricate tasks, such as creating fine dining dishes like crab bisque or cherries jubilee. The integration of automation into kitchen appliances, such as built-in refrigerators, dishwashers, and even cooking robots, is transforming the consumer electronics industry. Companies like Moley Robotics and Cooki Robot are leading the charge, showcasing their automated kitchen solutions at major events like the Consumer Electronics Show.

The future of automated kitchens is promising, with advancements in 3D recordings, algorithms, and food apps enabling a retail version of the technology for home use. The development of robot noodle-slicers and 3D food printers further expands the possibilities for automated food preparation. However, the role of human workers In the food industry remains a topic of debate, as the integration of automation raises questions about job displacement and the human domain. In conclusion, the automated kitchen market represents a significant disruption in the food industry, driven by advances in technology and robotics. This innovation offers numerous benefits, including increased efficiency, precision, and convenience, while also addressing societal demands for healthier, more personalized meal options.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

125 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 20.6% |

|

Market growth 2024-2028 |

USD 174.5 million |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

16.5 |

|

Key countries |

US, UK, Canada, Germany, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Robot Kitchen Market Research and Growth Report?

- CAGR of the Robot Kitchen industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the robot kitchen market growth of industry companies

We can help! Our analysts can customize this robot kitchen market research report to meet your requirements.