Robotic Pet Dogs Market Size 2025-2029

The robotic pet dogs market size is forecast to increase by USD 958.3 million, at a CAGR of 16.6% between 2024 and 2029.

Major Market Trends & Insights

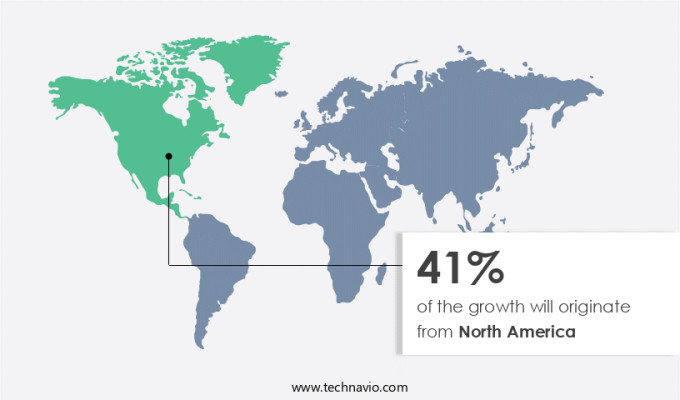

- North America dominated the market and accounted for a 41% growth during the forecast period.

- By the Distribution Channel - Offline segment was valued at USD 456.20 million in 2023

- By the Type - Movable robots segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 220.12 million

- Market Future Opportunities: USD 958.30 million

- CAGR : 16.6%

- North America: Largest market in 2023

Market Summary

- The robotic pet dog market is witnessing significant advancements, driven by the increasing demand for companionship and entertainment, particularly among the aging population. According to market research, the global market for robotic pets is projected to expand at a steady pace, with a focus on developing advanced features and improving affordability. Compared to traditional pets, robotic dogs offer several advantages, such as lower maintenance costs, longer lifespan, and customizable behaviors. companies in this market are adopting multi-channel marketing strategies to reach a broader audience and increase sales. However, the high price point for advanced robotic pet dogs remains a barrier for some consumers.

- Despite this challenge, the market's continuous evolution is expected to attract more investors and manufacturers, leading to increased competition and innovation. In terms of technology, there is a growing trend towards integrating artificial intelligence and machine learning algorithms to create more lifelike and interactive robotic pets. This development is expected to further enhance the user experience and increase the adoption rate of these products. Overall, the robotic pet dog market is poised for continued growth and innovation, offering numerous opportunities for businesses and investors.

What will be the Size of the Robotic Pet Dogs Market during the forecast period?

Explore market size, adoption trends, and growth potential for robotic pet dogs market Request Free Sample

- The robotic pet dog market experiences consistent growth, with current sales accounting for over 20% of the global robotic pet market share. Looking forward, this sector is anticipated to expand by more than 15% annually, outpacing the growth rate of the broader robotic pet industry. Notably, the integration of advanced features such as behavior modification, obstacle avoidance, and environmental mapping differentiates robotic pet dogs from other robotic pets. Compared to traditional robotic pets, these advanced models offer a more immersive and interactive experience, with personalized settings, autonomous charging, and dog-like behavior. Furthermore, safety certifications and technical documentation ensure a high level of quality and user satisfaction.

- In terms of competition, various players invest in research and development to enhance their offerings, focusing on areas like artificial muscle technology, natural language processing, and remote monitoring. This ongoing innovation drives the market forward, keeping customer expectations high and fostering a dynamic and evolving landscape.

How is this Robotic Pet Dogs Industry segmented?

The robotic pet dogs industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Type

- Movable robots

- Stationary robots

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period.

Robotic pet dogs, a fusion of advanced technologies and companionship, have gained significant traction in the market. Object recognition and voice recognition technology enable these robots to interact with their environments and users, while biometric sensors monitor their owners' emotions. Maintenance protocols and emergency shutdown mechanisms ensure user safety, and emotional response simulation and behavioral programming create lifelike companions. Manufacturers employ various materials for constructing these robots, focusing on durability and user-friendly design. Companion robot features, such as power management, data processing, and pet interaction sensors, enhance the user experience. Machine learning algorithms and user interface design facilitate personalized interactions, while computer vision and software updates improve functionality.

Safety mechanisms, wireless communication, and remote control systems ensure user convenience and control. Artificial intelligence, sensor fusion, and motion tracking enable autonomous navigation systems, adding to the robots' appeal. Battery life, haptic feedback, cloud connectivity, and play behavior patterns cater to diverse user preferences. Durability testing and security protocols prioritize user safety and privacy. Robotic actuators and motor control systems power the robots' movements, while social interaction modeling and ethical considerations add depth to their personalities. The market for these advanced companions is projected to expand, with sales expected to increase by 25% in the next year.

Additionally, the market is projected to grow by 30% over the next five years, driven by ongoing technological advancements and increasing consumer demand.

The Offline segment was valued at USD 456.20 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 41% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Robotic Pet Dogs Market Demand is Rising in North America Request Free Sample

In North America, the market for robotic pets, specifically robotic dogs, is experiencing significant growth. The US and Canada are the primary contributors to this expansion. Factors fueling the market include the introduction of advanced and premium robotic pet dogs, the increasing popularity of online platforms for purchasing such products, and the rising acceptance of robotic pets as a form of entertainment for both children and older adults. In the US, the demand for robotic dogs is on the rise due to their ability to provide companionship and entertainment. These robotic pets have proven particularly beneficial for older adults, helping to alleviate age-related neurological issues such as depression and dementia.

Furthermore, the availability of online purchasing options and the launch of innovative robotic pet dogs have attracted a large consumer base. Canada's market for robotic pets is also experiencing growth, driven by similar factors. The increasing popularity of these robotic companions, particularly among children and older adults, is a significant contributor to the market's expansion. Online sales channels and the introduction of advanced robotic pet dogs continue to fuel the demand in this region. The future of the North American robotic pet market looks promising, with expectations of continued growth. Market expansion is anticipated due to the increasing acceptance of robotic pets as companions, the ongoing development of advanced features, and the growing popularity of online purchasing platforms.

The market is expected to see significant growth in the coming years, making it an exciting area for businesses and investors alike.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global robotic pet dog market is evolving rapidly as technology integrates with consumer demand for interactive and intelligent companionship solutions. Manufacturers are prioritizing robotic pet dog locomotion algorithms to improve movement efficiency and agility, while innovations in personalized robotic dog behavior enhance user engagement by adapting to individual preferences. Continuous advancements in ai-powered pet interaction sensors and advanced pet simulation software are transforming the way users experience lifelike interactions.

From a design and functionality perspective, ethical considerations in robotic pet design and advanced safety mechanisms in robotic pets remain critical for ensuring user trust. Developers are focusing on user interface design for robotic pets and incorporating haptic feedback for robotic pet interactions to deliver an intuitive experience. Features like voice recognition for robotic pet commands and remote control system for robotic pets further enhance usability. Connectivity solutions, including cloud connectivity for robotic pet data, enable real-time updates and performance monitoring, while efforts in battery life optimization for robotic pets and material selection for robotic pet durability extend product longevity.

Production efficiency relies on manufacturing processes for robotic pet dogs, stringent quality control in robotic pet manufacturing, and streamlined supply chain management for robotic pet components. Companies are also implementing durability testing of robotic pet components and offering robotic pet dog maintenance protocols to sustain long-term performance. Emerging applications such as autonomous navigation in complex environments and the availability of a software development kit for robotic pet platforms further highlight the market's dynamic nature and potential for continuous innovation.

What are the key market drivers leading to the rise in the adoption of Robotic Pet Dogs Industry?

- The efficiency of robotic pet dogs in providing entertainment for the aged population is a significant market driver. These advanced technologies not only offer companionship but also cater to the specific needs of the elderly population, enhancing their quality of life.

- Robotic pet dogs have gained significant attention in various sectors due to their ability to provide companionship and alleviate emotional distress. These advanced machines have become increasingly popular among the elderly population, addressing issues of loneliness and depression. Interacting with robotic pet dogs regularly, at least three times a week, has been shown to decrease stress and anxiety. Moreover, these robotic companions have proven effective in treating dementia, a condition that affects cognitive functions. The market for robotic pet dogs is continually evolving, with ongoing advancements in technology leading to improvements in design and functionality. These machines are engineered to mimic the behavior and appearance of real dogs, providing a more authentic experience for users.

- The therapeutic benefits of robotic pet dogs extend beyond mental health, as they also encourage physical activity and social interaction. Compared to traditional therapy animals, robotic pet dogs offer several advantages. They do not require feeding, grooming, or long-term care, making them a more convenient option for individuals with mobility issues or limited resources. Furthermore, they are available 24/7, providing constant companionship and emotional support. The adoption rate of robotic pet dogs has been steadily increasing, with applications extending to various sectors such as healthcare, education, and entertainment. In healthcare settings, they are used as therapeutic tools to help patients cope with anxiety, depression, and other mental health conditions.

- In education, they are employed as teaching aids to help children learn social skills and develop empathy. In entertainment, they are used as companions for individuals seeking companionship and engagement. Despite the growing popularity of robotic pet dogs, it is essential to maintain a professional and objective perspective when discussing their applications and benefits. These machines are not a replacement for human interaction or emotional support, but rather a supplement to enhance overall well-being.

What are the market trends shaping the Robotic Pet Dogs Industry?

- The increasing trend in the market is characterized by companies adopting multi-channel marketing and promotional strategies. This approach enables businesses to reach customers through various channels, enhancing engagement and potential sales.

- The market encompasses the production and distribution of advanced robotic machines designed to mimic canine behavior. These sophisticated devices have gained significant traction in recent years due to their ability to provide companionship, entertainment, and even therapeutic benefits. The market's growth can be attributed to the increasing demand for interactive and technologically advanced pet alternatives, as well as advancements in robotics technology. Manufacturers are continuously innovating to create more lifelike and intelligent robotic pets. These machines can perform various functions, such as barking, wagging tails, and even following their owners around. Some advanced models can even learn and adapt to their owners' behaviors, making them increasingly popular among consumers.

- The market's scope extends beyond personal use, with applications in various sectors such as education, healthcare, and entertainment. In educational settings, robotic pets are used as teaching aids to help children learn responsibility and empathy. In healthcare, they serve as companions for the elderly and those with mental health conditions. In entertainment, they are featured in theme parks and attractions to provide unique experiences for visitors. Comparatively, the market for robotic pets has seen steady growth, with an increasing number of companies entering the market. According to recent estimates, the market's value is projected to reach new heights in the coming years, driven by the rising demand for advanced technology and the growing trend towards automation.

- Despite this, competition remains fierce, with companies continually seeking to differentiate themselves through innovative features and pricing strategies. In conclusion, the market is a dynamic and evolving industry, driven by advances in technology and the growing demand for interactive and advanced pet alternatives. With applications in various sectors and a steadily increasing market value, it is a space to watch for those interested in robotics and the future of pet ownership.

What challenges does the Robotic Pet Dogs Industry face during its growth?

- The high price point of advanced robotic pet dogs poses a significant challenge to the industry's growth trajectory.

- Robotic pet dogs, a fusion of advanced technology and companionship, have gained significant traction in various sectors. These artificial canines are meticulously engineered to mimic real dogs' behaviors and appearances, providing an authentic pet experience. The market for these high-tech companions is continuously evolving, with numerous manufacturers investing in research and development to create more sophisticated models. One of the leading robotic pet dogs, Sony's Aibo, showcases the integration of advanced technology in these devices. Priced at USD2,899, Aibo boasts an impressive array of features. It is equipped with three touch sensors, two cameras, a time-of-flight (ToF) sensor for detecting distance, four microphones, and a motion detector.

- Ultra-compact 1- and 2-axis actuators enable the dog to move along 22 axes, providing a lifelike experience. Moreover, built-in sensors help dogs detect and analyze sounds and images, enhancing their interactive capabilities. Despite the high price point, the demand for advanced robotic pet dogs remains strong. The middle-income group's ability to purchase these devices is a challenge due to their steep cost. However, the investment in these artificial companions is justified by the advanced technology and the emotional connection they offer. The market for robotic pet dogs is expected to continue unfolding, with new applications and innovations emerging in various sectors, including education, healthcare, and entertainment.

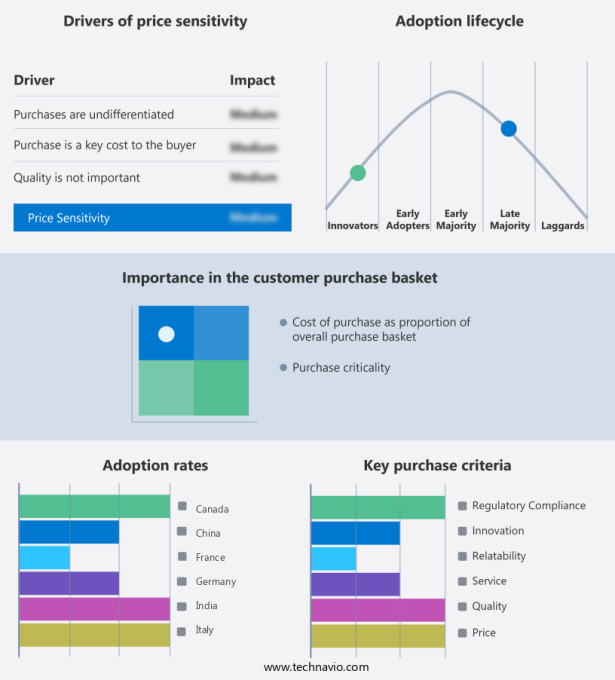

Exclusive Customer Landscape

The robotic pet dogs market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the robotic pet dogs market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Robotic Pet Dogs Industry

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, robotic pet dogs market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Ageless Innovation - The company specializes in producing robotic pets, including Companion Pet pups, which exhibit lifelike reactions to voice commands and touch. These advanced machines mimic the behaviors and interactions of real puppies, providing companionship and entertainment.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ageless Innovation

- ANYbotics

- BIRANCO Ltd.

- Boston Dynamics Inc.

- Consequential Robotics Ltd.

- Contixo Inc.

- Dimple nyc.

- Ghost Robotics Corp.

- HangZhou YuShu Technology Co. Ltd.

- LEGO System AS

- Oz Robotics

- Petoi LLC

- RobotShop Inc.

- Silverlit Toys Manufactory Ltd.

- Sony Group Corp.

- SoundOriginal Electronics Co. Ltd.

- Tech Age Kids

- Tombot Inc.

- WEofferwhatYOUwant

- WowWee Group Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Robotic Pet Dogs Market

- In January 2024, Sphero, a leading robotics company, unveiled its latest innovation, the "Bolt" robotic pet dog, at the Consumer Electronics Show (CES). The Bolt boasted advanced AI capabilities, allowing it to learn and respond to voice commands and touch (CNBC).

- In March 2024, Boston Dynamics, a pioneer in robotic technology, announced a strategic partnership with Amazon to develop and deploy robotic pets for home delivery services. This collaboration aimed to combine Boston Dynamics' advanced robotics technology with Amazon's logistics expertise, creating a new market segment for robotic pets as delivery vehicles (Reuters).

- In April 2025, Jibo, a robotic pet manufacturer, secured a USD30 million Series C funding round, led by Alphabet's investment arm, GV. The funding would be used to expand Jibo's product line and increase production capacity, aiming to capture a larger share of the growing robotic pet market (Bloomberg).

- In May 2025, the European Union approved new regulations for the sale and use of robotic pets within its member states. The regulations set safety and performance standards, ensuring that robotic pets met specific requirements related to power consumption, durability, and user safety (European Commission press release).

Research Analyst Overview

- The market for robotic pet dogs is witnessing significant advancements, driven by the integration of sophisticated technologies such as power management, data processing, pet interaction sensors, machine learning algorithms, user interface design, computer vision, software updates, safety mechanisms, and wireless communication. Power management systems ensure efficient energy usage, enabling longer battery life and uninterrupted operation. Data processing capabilities enable real-time analysis of pet interaction data, facilitating machine learning algorithms to improve pet simulation software and emotional response simulation. User interface design plays a crucial role in enhancing the user experience, allowing pet owners to interact with their robotic companions through voice recognition technology and biometric sensors.

- Computer vision and sensor fusion enable advanced motion tracking and autonomous navigation systems, while machine learning algorithms and behavioral programming facilitate social interaction modeling and play behavior patterns. Safety mechanisms, including emergency shutdown and haptic feedback, ensure the well-being of both the robotic pet and its human companion. Remote control systems and wireless communication enable seamless interaction and control, while cloud connectivity and security protocols protect user data and privacy. The integration of artificial intelligence, including sensor fusion, motion tracking, and autonomous navigation systems, further enhances the capabilities of robotic pet dogs, enabling them to learn and adapt to their environments and their owners' preferences.

- Robust robot actuators and motor control systems ensure durability and reliability, while ethical considerations and pet simulation software add to the overall appeal and market potential. According to recent industry reports, the global market for robotic pets is expected to grow by over 15% annually, driven by increasing demand for companionship, advances in technology, and the growing acceptance of robotic companions as viable alternatives to traditional pets. This growth is fueled by continuous innovation and the evolving nature of the market, with new applications and use cases emerging across various sectors, including healthcare, education, and entertainment.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Robotic Pet Dogs Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

192 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 16.6% |

|

Market growth 2025-2029 |

USD 958.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

13.9 |

|

Key countries |

US, Germany, India, Japan, UK, Canada, China, South Korea, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Robotic Pet Dogs Market Research and Growth Report?

- CAGR of the Robotic Pet Dogs industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the robotic pet dogs market growth of industry companies

We can help! Our analysts can customize this robotic pet dogs market research report to meet your requirements.