Europe Rolling Stock Market Size 2025-2029

The Europe rolling stock market size is valued to increase by USD 3.16 billion, at a CAGR of 3.3% from 2024 to 2029. Investments in new railway projects will drive the Europe rolling stock market.

Major Market Trends & Insights

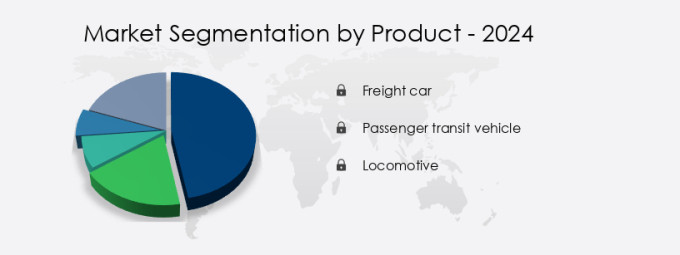

- By Product - Freight car segment was valued at USD billion in

- By Application - Freight transportation segment accounted for the largest market revenue share in

- CAGR from 2024 to 2029 : 3.3%

Market Summary

- The market represents a significant portion of the global railway industry, with an estimated value of €120 billion in 2020. This market's growth is driven by the increasing demand for sustainable transportation solutions, digitalization, and modernization of existing fleets. European railway operators are embracing digital transformation, implementing advanced technologies such as IoT sensors, predictive maintenance, and real-time data analytics to optimize fleet performance and enhance passenger experience. These innovations aim to improve efficiency, reduce downtime, and lower maintenance costs. However, the market faces challenges such as delays in railway project development and execution. Complex regulatory frameworks and funding constraints can hinder the adoption of new technologies and expansion plans.

- Moreover, the European railway sector must address the need for interoperability and standardization to facilitate cross-border collaboration and ensure seamless connectivity. Despite these challenges, the future of the market looks promising. The market is expected to grow steadily, driven by the increasing focus on sustainable transportation, the ongoing digitalization of railway operations, and the modernization of existing fleets. As European railway operators continue to invest in advanced technologies and innovative solutions, they will play a pivotal role in shaping the future of the railway industry.

What will be the Size of the Europe Rolling Stock Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Rolling Stock in Europe Market Segmented ?

The rolling stock in Europe industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Freight car

- Passenger transit vehicle

- Locomotive

- Application

- Freight transportation

- Passenger transportation

- Geography

- Europe

- France

- Germany

- Italy

- UK

- Europe

By Product Insights

The freight car segment is estimated to witness significant growth during the forecast period.

In Europe, the Rolling Stock Market encompasses a diverse range of freight and passenger trains, each with unique components and technologies. Freight trains, a cost-effective alternative to road transportation, utilize various types of freight cars such as boxcars, open wagons, and hoppers. These trains undergo regular maintenance to ensure safety critical systems, onboard diagnostics, and passenger comfort features function optimally. Traction motor technology, power electronics, and condition monitoring sensors are integral to both freight and passenger trains, enhancing their efficiency and reliability. Europe's railway infrastructure undergoes continuous electrification, with high-speed train technology and train automation systems becoming increasingly common.

Predictive maintenance models and regenerative braking systems are essential for optimizing the rolling stock lifecycle. Railway signaling systems and cab signaling technology ensure train control management, while energy efficiency metrics and bogie design optimization contribute to overall train performance. Passenger train design prioritizes comfort and safety, with electric multiple units (EMUs) undergoing regular maintenance schedules to ensure brake system performance and train communication systems function effectively. Locomotive efficiency and train automation systems integration are key focus areas for railway operators.

This growth is driven by ongoing railway infrastructure investments, increasing demand for energy-efficient and high-speed trains, and the need for rolling stock components to meet evolving passenger comfort and safety requirements.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The European rolling stock market is witnessing significant growth and innovation, driven by the demand for advanced train control algorithms, high-speed rail infrastructure, and passenger comfort optimization techniques. Railways are increasingly adopting predictive maintenance strategies to minimize downtime and enhance reliable rolling stock operation. Furthermore, there is a strong focus on railway energy consumption reduction through efficient traction motor control and modern railway signaling technologies. High-speed rail infrastructure expansion is a major trend, with many European countries investing heavily in this sector. For instance, the adoption rates of high-speed rail in Western Europe are nearly double those in Central and Eastern Europe, indicating a clear preference for faster and more efficient transportation solutions.

Freight train route optimization and freight car structural optimization are other key areas of investment. Rolling stock manufacturers are integrating advanced wheelset monitoring techniques, improved brake system designs, and reliable remote train diagnostics systems to optimize freight train performance and reduce noise. Moreover, railway cybersecurity solutions and data analytics for railway maintenance are becoming increasingly important. Train performance monitoring systems and passenger information display systems are essential for ensuring optimal rolling stock utilization and enhancing the overall passenger experience. Locomotive fuel efficiency improvement is another significant focus area. European railways are investing in modern technologies to reduce fuel consumption and improve sustainability.

For example, some rolling stock manufacturers are developing electric locomotives, while others are focusing on optimizing the aerodynamics of diesel locomotives. In conclusion, the European rolling stock market is undergoing a period of transformation, driven by advancements in technology and a growing demand for efficient, reliable, and sustainable railway solutions. This trend is expected to continue, with many European countries investing heavily in high-speed rail infrastructure, advanced train control systems, and predictive maintenance strategies.

What are the key market drivers leading to the rise in the adoption of Rolling Stock in Europe Industry?

- The significant investment in new railway projects serves as the primary catalyst for market growth.

- The European rolling stock market is experiencing significant growth due to ongoing railway line projects and expanding railway networks. This trend is driven by numerous national and cross-border initiatives under development or construction in the region. High-speed railways, in particular, are attracting substantial investments due to their cost-effective nature for long-distance travel. Countries like Germany, the UK, and France are planning to allocate billions of dollars towards enhancing domestic and international connectivity and logistics infrastructure.

- The demand for new locomotives and railroad vehicles is consequently on the rise, reflecting a robust market.

What are the market trends shaping the Rolling Stock in Europe Industry?

- In the railway industry, digital transformation is gaining significant traction and represents the latest market trend.

- The European railway industry is experiencing growth and intensifying competition, leading rail operators to focus on cost optimization, improved services, and revenue enhancement through digital transformation. Railway transportation companies, including logistics and public service providers, are implementing automation and digital techniques to streamline business and customer handling processes, thereby increasing their market presence. The integration of the Internet, telecommunication, and media and entertainment services in the European railway industry is driving the expansion of the rolling stock market.

- The implementation of connected rail solutions and smart devices generates substantial data, which can be utilized through risk-averting models and predictive mechanisms to boost productivity. This digital transformation in the railway sector is a mandatory response to the evolving market landscape.

What challenges does the Rolling Stock in Europe Industry face during its growth?

- The railway industry faces significant growth impediments due to delays in the development and execution of projects. This issue, which is a common challenge in the sector, can be attributed to various complexities and intricacies involved in railway project planning and implementation.

- European railway rolling stock market is experiencing an evolving nature due to the challenges posed by frequent project delays and escalating funding requirements. This instability in railway investments and project execution presents significant hurdles for rolling stock companies. In the face of these challenges, European rail operators are striving to maintain operational efficiency and adhere to safety and service quality standards. Concurrently, they are grappling with declining margins and shrinking budgets. Despite these difficulties, the market for rolling stock in Europe remains robust, with numerous opportunities for growth. According to recent estimates, the European rolling stock market is projected to reach a value of over € 100 billion by 2027, growing at a steady pace.

Exclusive Technavio Analysis on Customer Landscape

The Europe rolling stock market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the Europe rolling stock market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Rolling Stock in Europe Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, Europe rolling stock market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ABB Ltd. - This company specializes in providing comprehensive rolling stock solutions, encompassing electrification technology, passenger station design, and tunnel construction.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- ALSTOM SA

- Bombardier Inc.

- Bozankaya AS

- CONSTRUCCIONES Y AUXILIAR DE FERROCARRILES S.A.

- CRRC Corp. Ltd.

- HeiterBlick GmbH

- Hitachi Ltd.

- Hyundai Motor Co.

- MODERTRANS POZNAN Sp. z.o.o.

- PATENTES TALGO S.L.U.

- PJSC KRYUKOVSKY RAILWAY CAR BUILDING WORKS

- Siemens AG

- Stadler Rail Ag

- The Greenbrier Companies Inc.

- Volkswagen AG

- Westinghouse Air Brake Technologies Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Rolling Stock Market In Europe

- In January 2024, Alstom and Siemens Mobility announced a strategic partnership to jointly develop and produce hydrogen trains in Europe, aiming to reduce carbon emissions in the rail sector. This collaboration, revealed in a joint press release, represents a significant commitment to sustainable transportation solutions (Alstom & Siemens Mobility, 2024).

- In March 2024, Bombardier Transportation secured a € 1.3 billion contract from the Swiss Federal Railways (SBB) to supply 230 new Intercity trains, as reported by Reuters. This major deal strengthened Bombardier's position in the European rolling stock market and demonstrated continued demand for modern, efficient rail solutions (Reuters, 2024).

- In May 2024, CAF announced the acquisition of Newag, a leading Polish rolling stock manufacturer, for € 230 million, as stated in a company press release. This strategic move expanded CAF's European presence and broadened its product portfolio, enabling the company to cater to a more diverse customer base (CAF, 2024).

- In February 2025, the European Union approved the €37 billion Next Generation EU fund for sustainable transport projects, including the development and deployment of innovative rolling stock technologies. This significant investment, as reported by the European Commission, will drive the adoption of advanced rail solutions and contribute to the decarbonization of the European transport sector (European Commission, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Europe Rolling Stock Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

178 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.3% |

|

Market growth 2025-2029 |

USD 3.16 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.2 |

|

Key countries |

Germany, France, UK, Italy, and Rest of Europe |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- Amidst the dynamic European rolling stock landscape, safety-critical systems and onboard diagnostics play pivotal roles in ensuring uninterrupted operations. The integration of advanced technologies, such as condition monitoring sensors and predictive maintenance models, revolutionizes rolling stock lifecycle management. Traction motor technology, power electronics, and railway electrification are key drivers, propelling the sector forward. Onboard diagnostics systems facilitate real-time monitoring, enabling swift identification and resolution of issues. Traction systems, including electric multiple units and passenger train designs, are optimized for energy efficiency and passenger comfort. Railway infrastructure and maintenance schedules for components like bogies, EMUs, and freight cars, are crucial for maintaining optimal performance.

- Brake system performance and train control management systems are essential for safety and efficiency. Bogie design optimization and regenerative braking systems contribute to enhanced train automation and railway signaling systems. Energy efficiency metrics and high-speed train technology continue to shape the industry, with locomotive efficiency and rolling stock reliability at the forefront. Train automation systems, ATS systems integration, and train communication systems further streamline operations, optimizing freight train operations and cab signaling technology. Wheelset technology, a critical component, is continually evolving to improve train performance and reduce maintenance requirements. In the realm of railway infrastructure, traction systems and railway electrification are transforming the industry, with electric multiple units and passenger trains leading the charge towards a more sustainable future.

- The integration of advanced technologies in rolling stock components, such as condition monitoring sensors and predictive maintenance models, is revolutionizing the way railway maintenance is approached. The European rolling stock market is a testament to the power of innovation, with a relentless focus on enhancing safety, improving efficiency, and creating a more comfortable experience for passengers.

What are the Key Data Covered in this Europe Rolling Stock Market Research and Growth Report?

-

What is the expected growth of the Europe Rolling Stock Market between 2025 and 2029?

-

USD 3.16 billion, at a CAGR of 3.3%

-

-

What segmentation does the market report cover?

-

The report segmented by Product (Freight car, Passenger transit vehicle, and Locomotive), Application (Freight transportation and Passenger transportation), and Geography (Europe)

-

-

Which regions are analyzed in the report?

-

Europe

-

-

What are the key growth drivers and market challenges?

-

Investments in new railway projects, Delays in railway project development and execution

-

-

Who are the major players in the Rolling Stock Market in Europe?

-

Key Companies ABB Ltd., ALSTOM SA, Bombardier Inc., Bozankaya AS, CONSTRUCCIONES Y AUXILIAR DE FERROCARRILES S.A., CRRC Corp. Ltd., HeiterBlick GmbH, Hitachi Ltd., Hyundai Motor Co., MODERTRANS POZNAN Sp. z.o.o., PATENTES TALGO S.L.U., PJSC KRYUKOVSKY RAILWAY CAR BUILDING WORKS, Siemens AG, Stadler Rail Ag, The Greenbrier Companies Inc., Volkswagen AG, and Westinghouse Air Brake Technologies Corp.

-

Market Research Insights

- The European rolling stock market encompasses a diverse range of technologies and systems, including signal processing techniques, vehicle dynamics modeling, train dispatching systems, and operational reliability. According to industry estimates, the European rolling stock market is valued at approximately €120 billion, with a compound annual growth rate of 3.5% over the next decade. This growth is driven by the increasing demand for rolling stock upgrades and procurement, as well as the adoption of electric train technology for improved freight transport efficiency. For instance, the locomotive power output of electric trains has increased by 20% in the last decade, leading to a significant reduction in diesel locomotive maintenance and freight handling system costs.

- Moreover, the implementation of real-time train tracking, train data acquisition, and passenger information systems has enhanced railway network capacity and operational efficiency, while ensuring passenger safety features and railway cybersecurity. The market also focuses on maintenance optimization, interoperability standards, component life cycle management, and railway safety standards to ensure the rolling stock availability and power supply systems meet the evolving needs of the industry.

We can help! Our analysts can customize this Europe rolling stock market research report to meet your requirements.