Rose Extract Market Size 2024-2028

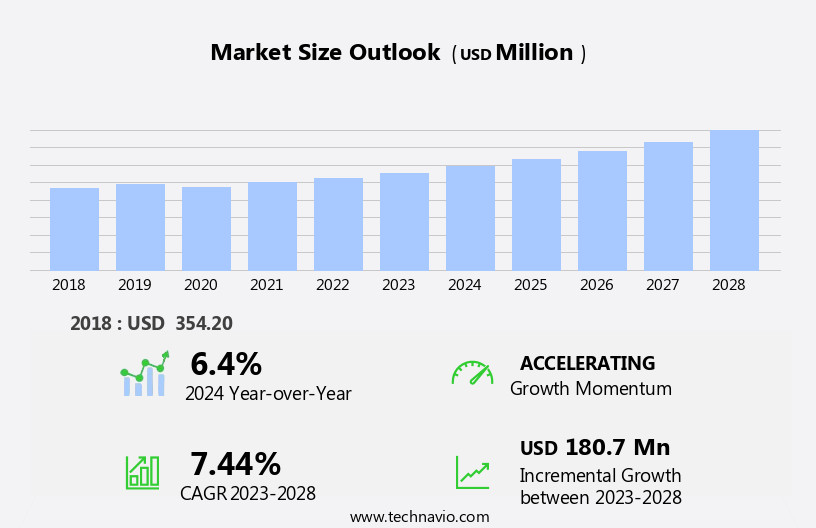

The rose extract market size is forecast to increase by USD 180.7 million at a CAGR of 7.44% between 2023 and 2028.

- The market is experiencing significant growth, driven primarily by increasing applications in the food and beverage industry. This sector's demand for rose extract is fueled by its unique flavor and aroma, making it an essential ingredient in various food and beverage products. Furthermore, the growing preference for aromatherapy for stress relief is another key driver for the market. However, the high price of rose extract remains a significant challenge for market growth. The extraction process of rose extract is complex and labor-intensive, leading to higher production costs. As a result, manufacturers face pressure to keep prices competitive while maintaining profitability.

- Companies seeking to capitalize on market opportunities must focus on optimizing their production processes and exploring alternative sourcing options to mitigate the impact of high production costs. Additionally, collaborating with key players in the food and beverage industry to develop innovative products that cater to consumers' evolving preferences can help companies differentiate themselves in the market. Overall, the market presents significant opportunities for growth, but companies must navigate the challenges of high production costs to remain competitive.

What will be the Size of the Rose Extract Market during the forecast period?

- The market continues to evolve, driven by the versatility and demand for this natural ingredient across various sectors. From fragrances and flavors to cosmetics and health applications, the market dynamics are shaped by ongoing research and development. Rose botanical extract and distillate are at the forefront of innovation, with anti-aging properties and certification gaining traction. The focus on social responsibility and sustainability is a key trend, influencing production methods and supply chain practices. Quality assurance and e-commerce platforms are essential for meeting consumer demand and ensuring product authenticity. Market leaders are investing in formulation development, online sales, and regulatory compliance to stay competitive.

- Environmental impact is a growing concern, leading to the exploration of rose phytochemicals and antioxidants in sustainable sourcing and manufacturing processes. The beauty industry is embracing rose essential oils, hydrosols, and tinctures for their skincare benefits. The rose market is a complex web of players, from cultivators and processors to distributors and retailers. Ongoing research and innovation are shaping the future of this dynamic industry, with a focus on transparency, safety standards, and consumer trust.

How is this Rose Extract Industry segmented?

The rose extract industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Rose oil

- Rose hip fruit extract

- Rose water

- Application

- Fragrance and cosmetics

- Pharmaceuticals

- Food and beverages

- Source

- Organic

- Conventional

- Distribution Channel

- Online Retail

- Specialty Stores

- Direct Sales

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

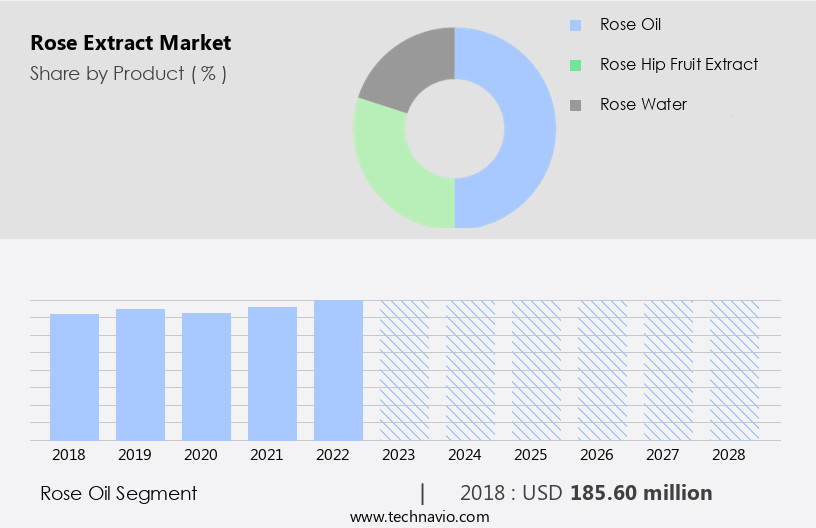

By Product Insights

The rose oil segment is estimated to witness significant growth during the forecast period.

Rose oil, derived from the petals of Rosa damascena and Rosa centifolia, is a prized ingredient in perfumes, aromatherapy, cosmetics, and skincare products. The primary producers of these rose species include Bulgaria, Syria, Turkey, Russia, Pakistan, India, Uzbekistan, Iran, China, Morocco, France, and Egypt. Two main extraction methods are employed: steam distillation, which yields rose otto or attar of roses and rose water as by-products, and solvent extraction, resulting in rose absolute. Quality control is paramount in the rose oil industry, ensuring ethical sourcing, organic ingredients, and adherence to safety standards. The market trends reflect a growing consumer demand for natural, sustainable, and ethically produced rose products.

E-commerce platforms and online sales have surged, with rose-infused body care, skincare, and aromatherapy items increasingly popular. Rose oil's antioxidant properties and phytochemicals contribute to anti-aging and wellness applications. The rose market share is expanding, with innovation in rose formulations, product development, and branding. Certification, regulatory compliance, and standardization are essential aspects of the industry, as is sustainability and responsible sourcing. Rose essential oil, rosewater, rose hydrosol, rose extract powder, and rose concrete are integral components of various industries, including fragrance, food, and cosmetics. The market dynamics are influenced by factors such as consumer preferences, market trends, and technological advancements.

Competitor analysis and supply chain optimization are crucial for businesses to maintain a competitive edge. Rose oil's versatility extends to aromatherapy, where it is used for its calming and therapeutic properties. In skincare, rose oil is known for its anti-inflammatory and anti-aging benefits. The rose market is expected to continue growing, driven by increasing consumer awareness and demand for natural, high-quality ingredients.

The Rose oil segment was valued at USD 185.60 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

Europe is estimated to contribute 45% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the global rose market, Bulgaria is a significant player as the leading producer of rose oil, accounting for approximately 40% of the global supply. Nearly 30% of this oil is exported to major markets such as France, the US, Japan, and Ireland. Additionally, Bulgaria and Turkey rank second and third, respectively, in the production of rose hip fruit extract. European buyers are increasingly preferring natural processing techniques for botanical extracts, leading to a surge in demand for rose extract in the region. The CO2 extraction method is gaining popularity over ethanol-based extraction due to its superior quality and safety standards.

The rose market encompasses various applications, including perfumes, aromatherapy, cosmetics, and skincare. Rose essential oil, hydrosol, absolute, and extract powder are popular forms of rose extract used in these industries. Rose water, a byproduct of the distillation process, is also in high demand for its use in food and beverage industries. The market trends reflect a growing preference for organic and sustainable sourcing, with an increasing number of certifications and standards being implemented. Rose's natural antioxidants and phytochemicals make it a sought-after ingredient in anti-aging and wellness products. The rose market is also witnessing innovation in areas such as formulation, technology, and e-commerce.

The demand for rose extract is expected to continue its upward trajectory due to its versatility and health benefits.

Market Dynamics

The Rose Extract Market thrives on the versatility of its products, from pure rose extract and fragrant rose oil benefits to refreshing rosewater uses. Consumers increasingly seek organic rose extract and other natural skincare ingredients like rose extract for skin. The therapeutic properties of rose oil aromatherapy and its inclusion in rose extract in cosmetics drive demand. The nutritional advantages of rosehip extract benefits further broaden its appeal, particularly for rose extract for anti-aging. Many incorporate rosewater as facial toner in their routines, while rose essential oil blends offer customized aromatic experiences. For those looking to buy organic rose extract, understanding reliable rose extract suppliers is crucial. The market also caters to the demand for natural fragrances and the calming effects of aromatherapy with rose oil. Available in forms like rose extract powder, it addresses needs for rose extract for sensitive skin, emphasizing the importance of sustainable rose extract sourcing across various rose extract applications.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Rose Extract Industry?

- The food and beverage industry's expanding application sector serves as the primary market growth catalyst.

- The market is driven by its expanding usage in the food and beverage sector as a natural flavoring agent. With its delightful aroma and taste, rose extract is incorporated into various food and beverage items, such as cakes, pastries, chocolates, ice cream, and beverages, including tea and alcoholic drinks. The demand for rose extract is escalating due to its capacity to enhance the taste and aroma of products without introducing any artificial flavors. Rose innovation continues to shape the skincare industry with the introduction of advanced rose technologies, including rose extract powder and rose hydrosol. These innovations offer numerous benefits, such as anti-inflammatory properties, making them popular in the production of cosmetics and personal care products.

- Rose safety standards are stringently adhered to during rose manufacturing processes, ensuring the highest quality and purity of rose extracts. From rose infusion and rose concrete to rose floral water, rose absolute, and rose technology, various methods are employed to extract the essence of rose petals. The rose product industry emphasizes transparency and accurate labeling to maintain consumer trust, providing detailed information about the origin and extraction process of rose extracts. Overall, the market for rose extracts is thriving due to the increasing consumer preference for natural and organic ingredients.

What are the market trends shaping the Rose Extract Industry?

- The increasing popularity of aromatherapy as a stress relief solution is a notable market trend. This holistic approach to wellness is gaining significant traction among consumers seeking effective ways to manage stress.

- The market is witnessing significant growth due to the increasing consumer demand for natural ingredients in perfumes, cosmetics, and aromatherapy products. Rose extract, derived from the distillation of rose petals, is known for its pleasant aroma and therapeutic properties. In the realm of aromatherapy, rose extract is widely used for stress relief and relaxation. Its sweet, floral scent is believed to have a soothing effect on the mind and body, making it a popular choice for holistic healing treatments. Furthermore, rose extract possesses anti-inflammatory properties, making it an effective natural remedy for pain and discomfort caused by stress and tension.

- Quality control and ethical sourcing are essential aspects of the marketing. Producers ensure the highest standards of rose cultivation, processing, and distillation to maintain the integrity of the product. Organic ingredients are increasingly preferred in rose extract production to cater to the growing demand for natural and sustainable products. Rose extract is used extensively in various industries, including perfumes, cosmetics, and aromatherapy. The rose aroma is a staple in perfume production, while rose water is a popular ingredient in skin care products. Rose extract is also used in research to explore its potential benefits in various therapeutic applications.

- Effective distribution channels and efficient packaging are crucial for the growth of the market. Producers focus on maintaining a consistent supply chain to meet the increasing consumer demand while ensuring the product remains fresh and potent. With its numerous applications and therapeutic benefits, the market is poised for continued growth in the coming years.

What challenges does the Rose Extract Industry face during its growth?

- The escalating costs of products pose a significant challenge to the industry's growth trajectory.

- The market is characterized by a focus on social responsibility, quality assurance, and certification as key market trends. The high cost of rose extract products is a significant challenge, primarily due to the intricate cultivation and harvesting process of roses, the complex oil extraction methods, and transportation and storage requirements. Rose extract is derived from rose botanical extract or rose distillate, which is obtained through various methods such as steam distillation or solvent extraction. Rose extract is widely used in the beauty industry for its anti-aging properties and fragrance in various formulations for rose body care and rose flavor in food and beverage applications.

- The rise of e-commerce and online sales has significantly impacted the market, enabling easy access to a global consumer base. To ensure the highest quality and consistency, rose extract producers emphasize standardization and certification, such as organic and fair trade certifications. The environmental impact of rose cultivation and production is also a growing concern, leading to increased focus on sustainable farming practices and ethical labor conditions. In conclusion, the market is driven by consumer demand for high-quality, sustainable, and ethically-sourced products, and producers must navigate the challenges of high production costs and complex extraction processes to meet this demand.

Exclusive Customer Landscape

The rose extract market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the rose extract market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, rose extract market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Alteya Organics - The company specializes in providing high-quality rose extracts, including rose hips, for various applications.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alteya Organics

- Arysta LifeScience

- Berjé Inc.

- Bontoux SAS

- Bulgarian Rose Co.

- Cargill Inc.

- Döhler GmbH

- Ernesto Ventós S.A.

- Firmenich SA

- Givaudan SA

- International Flavors & Fragrances Inc.

- Mane SA

- Mondelez International

- Mountain Rose Herbs

- Robertet SA

- Symrise AG

- Synthite Industries Ltd.

- Takasago International Corp.

- The Lebermuth Co. Inc.

- Young Living Essential Oils

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Rose Extract Market

- In February 2024, Firmenich, a leading global flavor and fragrance company, announced the launch of a new rose extract, Rosa Centifolia Absolute, produced using a sustainable and innovative extraction method. This new product offers a more intense and authentic rose aroma, appealing to the growing demand for natural and high-quality ingredients in the food and beverage industry (Firmenich press release, 2024).

- In June 2024, International Flavors & Fragrances Inc. (IFF) and Symrise AG, two major players in the market, entered into a strategic partnership to expand their combined capabilities in rose extract production. The collaboration aims to enhance their offerings, improve efficiency, and cater to the increasing demand for natural rose extracts in various industries, including food, beverage, and cosmetics (IFF press release, 2025).

- In October 2024, DSM, a leading global science-based company in nutrition, health, and sustainable living, completed the acquisition of Givaudan's nutritional ingredients business. This acquisition included Givaudan's rose extract production facilities, significantly expanding DSM's presence in the market and strengthening its position as a key player in the global rose extract industry (DSM press release, 2024).

- In March 2025, the European Commission approved the use of rose extract as a natural food colorant, opening new opportunities for its application in various food and beverage products. This regulatory approval is expected to boost the market growth and increase demand for natural rose extracts as consumers continue to seek out clean-label products (European Commission press release, 2025).

Research Analyst Overview

The market encompasses a diverse range of products, including rose facial mists, skin serums, bath salts, body washes, aromatherapy kits, body oils, diffusers, perfume oils, hand creams, candles, and various rose varieties such as damask rose, Bulgarian rose, and Grasse rose. These extracts are derived from rose flowers and offer numerous benefits for personal care and wellness. Rose otto, a precious essential oil, is a key component in many of these products. It is known for its calming and soothing properties, making it popular in skincare and aromatherapy applications. Rosehip seed oil, another essential rose extract, is rich in antioxidants and essential fatty acids, making it a sought-after ingredient in moisturizers and body butters.

The market for rose extracts is driven by increasing consumer demand for natural and organic personal care products. Rose-infused items, such as rosewater spray, toner, and tea, have gained popularity due to their gentle, soothing properties and versatile uses. Rose body scrubs, massage oils, and bath bombs provide a relaxing, spa-like experience at home. Rose flavoring is also in demand in the food and beverage industry, with rose syrup, jam, and rose hip extract used to add a subtle, delicate taste to various dishes and beverages. The market for rose extracts is expected to continue growing, as consumers seek out natural, plant-based alternatives to synthetic ingredients.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Rose Extract Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

165 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.44% |

|

Market growth 2024-2028 |

USD 180.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.4 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Rose Extract Market Research and Growth Report?

- CAGR of the Rose Extract industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the rose extract market growth of industry companies

We can help! Our analysts can customize this rose extract market research report to meet your requirements.