Roti Maker Market Size 2025-2029

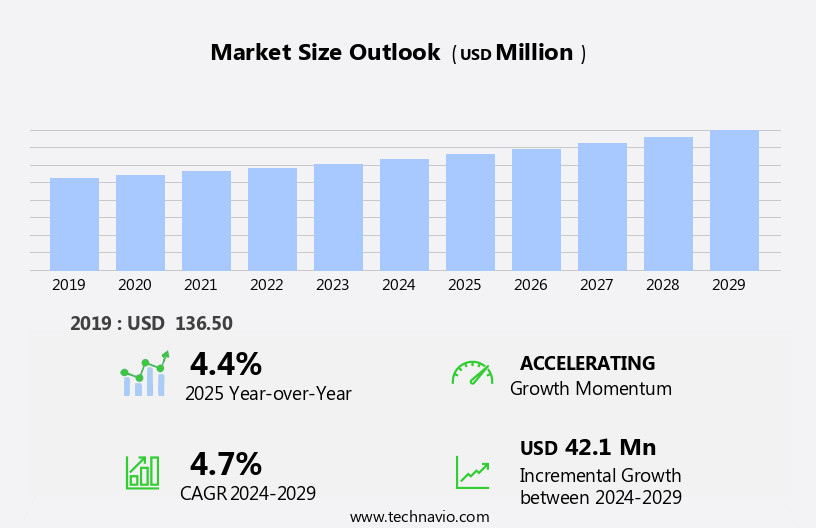

The roti maker market size is forecast to increase by USD 42.1 million at a CAGR of 4.7% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing trend towards online sales and the adoption of smart household appliances. Consumers, particularly in the US, are increasingly turning to e-commerce platforms to purchase traditional kitchen appliances like roti makers, seeking the convenience and ease of shopping from the comfort of their homes. Additionally, the growing popularity of smart appliances, which offer features such as temperature control and automatic shut-off, is fueling demand for advanced roti makers. However, the market is not without challenges. Fluctuations in raw material prices and operational costs continue to pose significant challenges for manufacturers.

- The price volatility of key raw materials, such as aluminum and stainless steel, can impact the profitability of roti maker production. Furthermore, rising operational costs, including labor and energy, can put pressure on manufacturers to increase prices or reduce margins. Companies seeking to capitalize on market opportunities and navigate these challenges effectively must focus on innovation, operational efficiency, and strategic partnerships. By investing in research and development to create advanced, energy-efficient roti makers, and forming strategic alliances with suppliers and distributors, manufacturers can differentiate themselves in a competitive market and maintain profitability.

What will be the Size of the Roti Maker Market during the forecast period?

- The market encompasses a range of electric and semi-automatic kitchen appliances designed for the production of chapatis and other flatbreads, commonly used in Indian households. The market encompasses a range of electric and semi-automatic kitchen appliances designed for the production of chapatis and other flatbreads in both household and commercial settings. These machines, also referred to as roti presses or chapati makers, automate the traditional process of making roti from dough using a griddle or flat surface. The market is driven by the growing demand for time-saving devices in kitchens, particularly in regions where fiber-rich foods like roti are a staple. Both household and commercial consumers seek energy-efficient, user-friendly, and innovative appliances to meet their roti production needs. The market is also influenced by trends towards smart appliances and automation in food preparation.

- Factors such as the availability of cooking gas, natural gas, LPG cylinders, and petroleum prices impact the adoption of roti makers, as many consumers seek cost-effective alternatives to traditional cooking methods. Overall, the market is poised for growth as more households and commercial kitchens embrace the convenience and efficiency of these modern kitchen appliances.

How is this Roti Maker Industry segmented?

The roti maker industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Commercial

- Residential

- Distribution Channel

- Offline

- Online

- Type

- Fully automatic roti makers

- Manual roti makers

- Semi-automatic roti makers

- Geography

- APAC

- Australia

- China

- India

- Japan

- South Korea

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- Middle East and Africa

- South America

- APAC

By End-user Insights

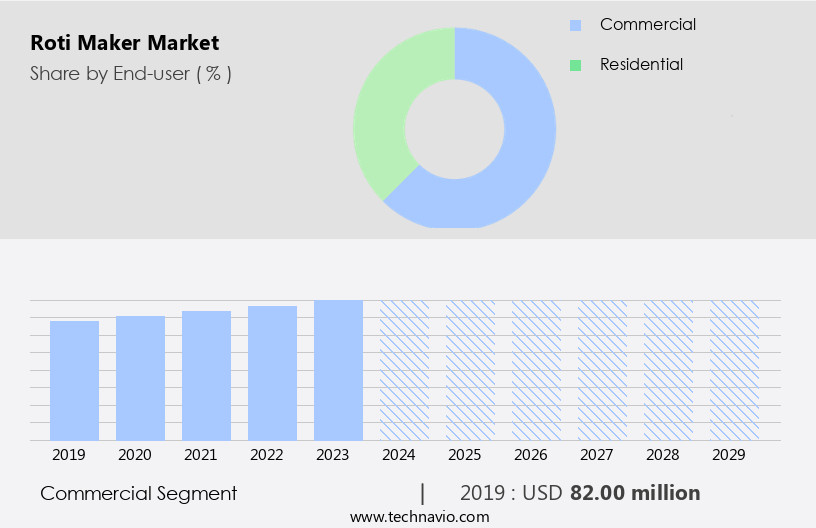

The commercial segment is estimated to witness significant growth during the forecast period. The market is witnessing significant growth, particularly in the commercial segment. The primary factors fueling this growth include the increasing preference for fiber-rich, indigenous food products like roti or chapati, a growing elderly population, and the convenience of mass-producing rotis using roti makers. These appliances offer a high production rate with optimal cooking or roasting, reducing the need for additional labor costs. Furthermore, roti makers ensure the hygienic preparation of chapatis in a short time, benefiting various institutional departments such as industrial canteens, restaurants, railway and defense facilities, hospitals, schools, and college dormitories.

The household segment is also expanding due to the time-saving benefits and cost-effectiveness of using roti makers. Roti makers are available in various forms, including fully automatic and semi-automatic models, catering to diverse consumer needs in urban, suburban, and remote areas. The market, commercial segment, household segment, time-saving, cost-effective, industrial canteens, restaurants, hospitals, and schools.

Get a glance at the market report of share of various segments Request Free Sample

The Commercial segment was valued at USD 82.00 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

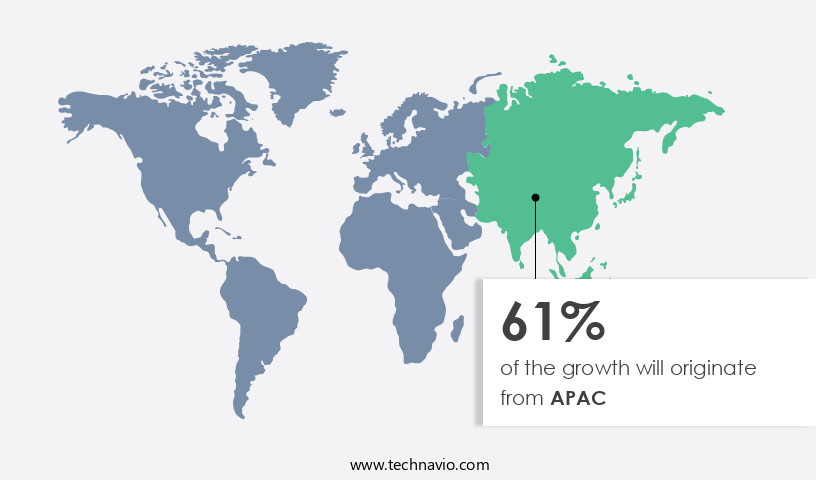

APAC is estimated to contribute 61% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in Asia Pacific (APAC) is experiencing significant growth due to the increasing demand for traditional fiber-rich food items, such as roti and chapati, in countries like India, China, Japan, and South Korea. The region's population is witnessing rising disposable income, facilitated by urbanization, enabling consumers to afford advanced household appliances, including roti makers. Manufacturers are capitalizing on this trend by advertising innovative and attractive roti makers, creating a competitive market environment. Consumers consider roti makers essential products and are willing to invest in them.

The market's growth is further driven by the shift towards energy-efficient electric roti makers, which offer time-saving benefits for both commercial and household segments, including food service units, restaurants, catering services, institutional kitchens, and urban, suburban, and remote households.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Roti Maker Industry?

- Growth in online sales is the key driver of the market. The global market for household appliances, including roti makers, is experiencing significant growth due to the increasing accessibility of the Internet and the proliferation of smartphones and advanced technologies. Consumers are turning to online platforms to purchase these appliances for the convenience, ease of access to products, better promotions, and on-time delivery. E-commerce sites offer a wide range of options, enabling consumers to compare prices and make informed decisions.

- Third-party retailers, such as Amazon and Flipkart, are major contributors to this trend, providing a seamless shopping experience and ensuring timely delivery. Overall, the online sale of household appliances is a growing trend that is expected to continue due to the benefits it offers to consumers.

What are the market trends shaping the Roti Maker Industry?

- Growing adoption of smart household appliances is the upcoming market trend. The market for smart household appliances is experiencing significant growth due to the increasing demand for advanced and user-friendly devices. These appliances offer energy savings through Energy Star certification and hassle-free maintenance, making them attractive to consumers. Additionally, the integration of various features into one device provides users with increased convenience and efficiency. Smart household appliances are not only energy-efficient but also require minimal maintenance, making them a worthwhile investment for households.

- The technology incorporated into these appliances enables users to explore multiple applications on a single device, further enhancing their value. The market for smart household appliances is poised for continued growth as technology advances and consumer preferences shift towards more efficient and convenient solutions.

What challenges does the Roti Maker Industry face during its growth?

- Fluctuations in raw material prices and operational costs is a key challenge affecting the industry's growth. The price of household appliances, including roti makers, is influenced by various factors such as manufacturing costs, labor costs, raw material prices, and marketing expenses. The cost of raw materials, including steel, iron, plastic, glass, electronic equipment, and paints, significantly impacts the final product price and the profitability of manufacturers. These materials' prices are subject to international market fluctuations, making it essential for manufacturers to closely monitor and adapt to changes.

- Metallic raw goods and components used in the production of kitchen appliances are particularly expensive, adding to the overall manufacturing cost. These market dynamics is crucial for businesses seeking to remain competitive in the household appliance market.

Exclusive Customer Landscape

The roti maker market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the roti maker market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, roti maker market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Bajaj Vacco Electricals - The company offers roti makers such as BAJAJ VACCO Electric Go-Ezzee maker.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bajaj Vacco Electricals

- Brentwood Appliance Inc.

- Fortune Engineering

- Girnar Machine Pvt. Ltd.

- Hobbit Kitchen Equipment

- iBELL

- Jackson Machine

- Jaipan Industries Ltd.

- JDC Technology Pvt. Ltd.

- JKS Engineering Works

- LEENOVA KITCHEN EQUIPMENTS Pvt. Ltd.

- Miyako Appliance Ltd.

- Nexgen India Food Machine Industries

- Prabhat Machine Tools

- Radix Food Machine Pvt. Ltd.

- Sunflame Enterprises Pvt. Ltd.

- Treasure Retail Pvt. Ltd.

- TTK Prestige Ltd.

- Vijay Engineering

- Zimplistic India Pvt Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a wide range of kitchen appliances designed to facilitate the preparation of flatbreads, such as chapatis and roti, a staple in many households, particularly in regions with a strong cultural connection to Indian cuisine. This market includes both commercial and household units, with variations in automation level, including fully automatic and semi-automatic models. The demand for roti makers is driven by the culinary needs of consumers, both in urban and suburban areas, as well as in remote regions. The market has witnessed significant growth due to several factors, including the time-saving benefits of these appliances and the increasing urbanization and rising disposable income levels in many regions.

In recent years, there has been a notable trend towards the adoption of electric roti makers, as opposed to traditional manual appliances or those fueled by cooking gas, natural gas, or LPG cylinders. This shift can be attributed to the cost-effectiveness of electric energy and the convenience of not having to constantly monitor the availability of fuel sources. The market is segmented into the commercial and household sectors. The commercial segment includes food service units, such as restaurants and catering services, as well as institutional kitchens. In this segment, the demand for roti makers is driven by the need to efficiently produce large quantities of flatbreads for a diverse consumer base.

On the other hand, the household segment caters to individual consumers and their culinary needs. In this segment, the adoption of roti makers is driven by the convenience and time-saving benefits they offer, particularly for working women and families with busy schedules. Product innovation is a key trend in the market, with manufacturers continuously striving to improve the functionality and design of their offerings. This includes the development of fully automatic appliances, which require minimal user input, and the integration of electronic parts to enhance the overall user experience. The market is expected to continue its growth trajectory, driven by the increasing popularity of Indian cuisine globally and the ongoing urbanization and rising living standards in many regions. Urbanization and rising living standards have led to an increased demand for time-saving kitchen appliances made from materials like steel and plastic, while e-commerce platforms have further fueled the market by providing convenient access to these products for consumers.

Despite this, challenges such as the availability and cost of raw materials, as well as the impact of economic and political factors on energy prices, may impact the market's growth. The market is a dynamic and growing industry that caters to the culinary needs of consumers in various sectors. With a focus on product innovation, cost-effectiveness, and convenience, roti makers continue to gain popularity and are poised for continued growth in the coming years.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

199 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.7% |

|

Market growth 2025-2029 |

USD 42.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.4 |

|

Key countries |

India, US, Australia, Japan, UK, China, South Korea, Canada, Germany, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Roti Maker Market Research and Growth Report?

- CAGR of the Roti Maker industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the roti maker market growth and forecasting

We can help! Our analysts can customize this roti maker market research report to meet your requirements.