Rugged Devices Market Size 2025-2029

The rugged devices market size is forecast to increase by USD 1.31 billion at a CAGR of 4.7% between 2024 and 2029.

- The market is witnessing significant growth due to the increasing demand for data management systems in various industries. The need for real-time data access and analysis in sectors such as transportation, logistics, and field services is driving the adoption of rugged devices. Additionally, the emergence of new applications in industries like healthcare and construction is expanding the market's scope.

- However, the use of consumer-grade devices in place of rugged devices poses a challenge to market growth. Despite this, the market is expected to continue its upward trajectory, fueled by advancements in technology and the growing recognition of the benefits of rugged devices in mission-critical applications. The market trends and analysis report provides a comprehensive study of these factors and more, offering valuable insights for stakeholders and industry participants.

What will be the Size of the Rugged Devices Market During the Forecast Period?

- The market encompasses a range of durable devices, including rugged smartphones and tablets, designed to withstand harsh environments and meet the unique demands of various industries. According to multiple sources, this market is experiencing significant growth due to the increasing adoption of data management solutions in sectors such as aerospace and defense, military and defense, and the utilities sector. Strategic collaborations between companies and logistics services are driving innovation, expanding customer reach, and enhancing operational efficiency.

- Additionally, android-based devices are gaining popularity due to their flexibility and compatibility with machine learning and big data applications. Upcoming trends include the integration of advanced technologies such as synthetic sensors and artificial intelligence to improve data collection and analysis in warehouses and logistics operations. Untapped opportunities exist in geographic areas with extreme climates and challenging terrains, making rugged devices an essential tool for businesses seeking to optimize their operations and enhance productivity.

How is this Rugged Devices Industry segmented and which is the largest segment?

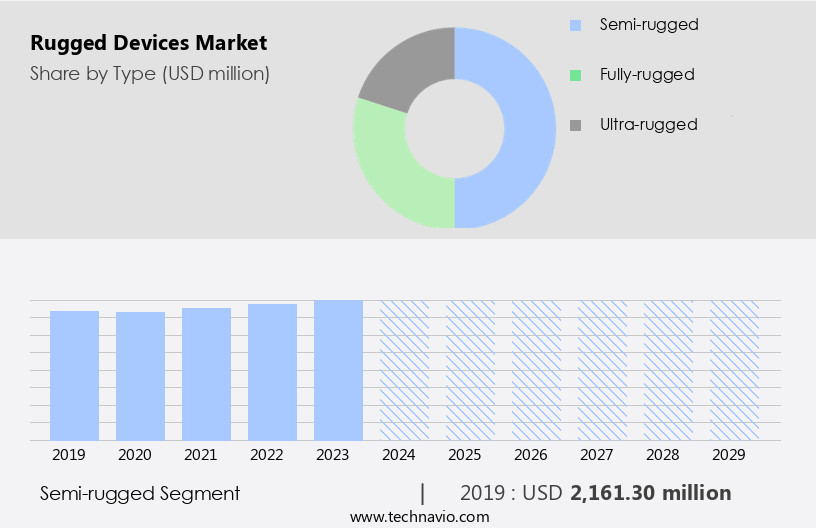

The rugged devices industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Semi-rugged

- Fully-rugged

- Ultra-rugged

- Product

- Rugged mobile computers and smartphones

- Rugged tablets and notebooks

- Rugged scanners

- Rugged air quality monitors

- End-user

- Industrial

- Commercial

- Military and defense

- Government

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- APAC

- China

- India

- Japan

- South America

- Brazil

- Middle East and Africa

- North America

By Type Insights

The semi-rugged segment is estimated to witness significant growth during the forecast period. The market encompasses a range of semi-rugged and fully rugged devices designed for industrial applications. These devices prioritize durability and functionality over aesthetics, catering to industries with harsh working conditions. Semi-rugged devices, a subset of rugged devices, offer enhanced hardware protection to consumer-grade devices. Features such as advanced tempered glass, shockproof casing, spill-resistant components, and protective layers make semi-ruged devices suitable for industries like hospitality, healthcare, and retail, where working conditions are less demanding. Data management is a significant market facet, with Android-based devices dominating due to their flexibility and compatibility with various applications. Strategic collaborations among market participants, such as OEMs and software providers, are crucial for market growth.

Additionally, upcoming trends include the integration of the Internet of Things, data centers, machine learning, and artificial intelligence for operational efficiency. The market is influenced by regulatory standards, such as IP ratings, RFID technology, GPS, and customer reach. Untapped opportunities lie in sectors like aerospace and defense, military and defense, utilities, power and marine, automotive, public spending, construction, and logistics and transportation.

Get a glance at the share of various segments. Request Free Sample

The semi-rugged segment was valued at USD 2.16 billion in 2019 and showed a gradual increase during the forecast period.

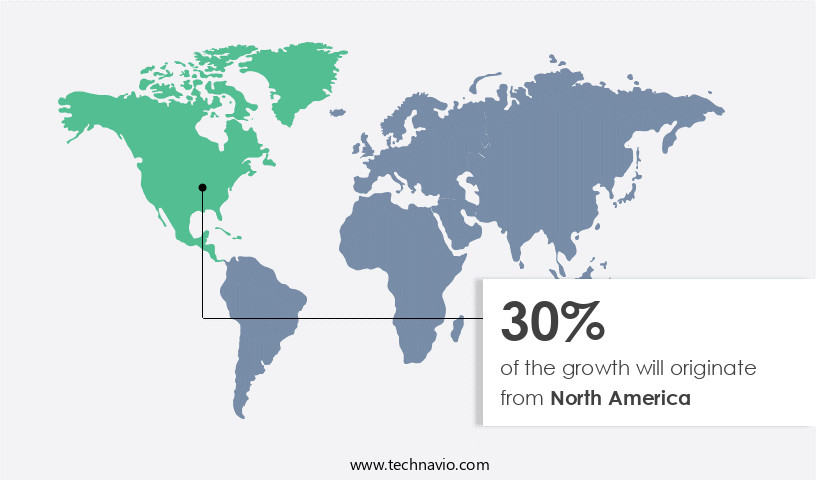

Regional Analysis

North America is estimated to contribute 30% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American market is primarily driven by the defense sector and the logistics industry. In the defense sector, rugged devices are utilized for various applications such as GPS navigation, fleet tracking, and securing confidential data. These devices are customized and priced higher than those used in other industries. In the logistics sector, the implementation of rugged mobile computers in distribution centers, warehouses, and transportation has accelerated market growth.

Additionally, the integration of technologies like machine learning, big data, and artificial intelligence in rugged devices is expected to enhance operational efficiency in various industries, including aerospace and defense, military and defense, utilities, power and marine, automotive, public spending, construction, and logistics and transportation. Upcoming trends include the increasing use of rugged smartphones and the Internet of Things in various industries. Data management and pricing are critical factors influencing market profitability. Strategic collaborations among market participants and industry influencers continue to shape the market.

Market Dynamics

Our rugged devices market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Rugged Devices Industry?

Growing demand for data management systems is the key driver of the market.

- The market is experiencing significant growth due to the increasing requirement for data management in various industries. These devices enable the collection and storage of accurate data, replacing traditional paper-based processes. The industrial and commercial sectors are witnessing an automation trend, leading to increased demand In the logistics industry, rugged devices facilitate efficient raw material procurement management. In warehouse systems, they ensure optimal inventory management and increased storage capacity. In industrial facilities, rugged devices enhance production capacity and machinery management. In transportation and fleet management, they utilize GPS tracking and navigation for optimal asset and vehicle allocation.

- In the construction industry, on-site data management is streamlined with rugged devices. These devices are essential for instant and secure data updates in supply chain management. The Internet of Things (IoT) and data centers are also driving the market landscape, with applications in the aerospace and defense, military and defense, utilities sector, power and marine, automotive sector, public spending, and construction sector. Upcoming trends include the integration of machine learning, artificial intelligence, and big data for operational efficiency. company collaborations and company analysis are crucial for market participants in this competitive market scenario.

What are the market trends shaping the Rugged Devices Industry?

Emerging applications of rugged devices are the upcoming market trend.

- The market is witnessing significant growth due to the increasing digitalization and advancements in communication technologies. These devices, designed to operate in harsh environments, are increasingly being adopted as alternatives to consumer handheld devices across various industries. The integration of features such as Bluetooth, walkie-talkie, data/voice communication, and Wi-Fi is driving the demand for rugged computing devices, including smartphones and tablets. These offer numerous benefits to industries, including improved supply chain management, inventory management, and operational efficiency. In addition, they enhance customer experience in sectors such as retail and hospitality. The market landscape is characterized by strategic collaborations among market participants to expand their product offerings and customer reach.

- Additionally, upcoming trends in the market include the integration of the Internet of Things (IoT), data centers, machine learning, and artificial intelligence. The use in industries such as aerospace and defense, military and defense, utilities sector, power and marine, automotive sector, public spending, and construction sector is expected to increase. Data management is a critical facet of the market, with companies focusing on providing solutions that meet regulatory standards. Rugged smartphones and tablets are gaining popularity in sectors such as logistics and transportation, construction, and warehouses. GPS, RFID technology, and IP ratings are essential features for rugged devices in these industries.

What challenges does the Rugged Devices Industry face during its growth?

The use of consumer-grade devices in place of rugged devices is a key challenge affecting the industry's growth.

- The market scenario is influenced by the increasing preference for consumer-grade devices among various end-users, despite the potential risks of using non-rugged devices in harsh environments. This trend is observed in sectors such as aerospace and defense, military and defense, utilities, power and marine, automotive, public spending, construction, and logistics and transportation. While some industrial end-users opt for consumer-grade devices due to their affordability, these devices often fail to meet the necessary regulatory standards for ruggedness and durability. To address this challenge, strategic collaborations among market participants are on the rise.

- Additionally, company selection and analysis are crucial in this market, with companies offering rugged devices featuring IP ratings, RFID technology, GPS, and machine learning capabilities. Upcoming trends in the market include the integration of artificial intelligence and big data for operational efficiency, the Internet of Things (IoT) in data centers, and the use of rugged smartphones in warehouses and logistics services. Market research reports from multiple sources indicate that the overall market is expected to grow, driven by the need for data management, customer reach, and profitability in various industries. Pricing and profitability are key considerations for companies, as they strive to meet the needs of their customers while remaining competitive in the market.

Exclusive Customer Landscape

The rugged devices market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the rugged devices market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, rugged devices market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ARBOR Technology Corp. - The company offers RISC computing, embedded computing, rugged mobile computers, and medical computing. The key offerings of the company include rugged handheld devices such as handheld devices under 5.5, tablets 5.5 to 10, and panels above 10.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Advantech Co. Ltd.

- ARBOR Technology Corp.

- Bluebird Inc.

- Caterpillar Inc.

- CipherLab Co. Ltd.

- Datalogic SpA

- DT Research Inc.

- Handheld Group AB

- Honeywell International Inc.

- JLT Mobile Computers AB

- KYOCERA Corp.

- MilDef Group AB

- MiTAC Holdings Corp.

- Panasonic Holdings Corp.

- RUGGED SCIENCE

- Samsung Electronics Co. Ltd.

- Touchstar Plc

- Unitech Computer Co. Ltd.

- WIDEUM SOLUTIONS S.L.

- Zebra Technologies Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a diverse range of products engineered to withstand harsh environments and conditions. These devices, which include rugged smartphones, tablets, and laptops, are increasingly becoming essential tools for various industries and applications. The market is driven by several factors. One key factor is the growing demand for data management and connectivity in industries such as aerospace and defense, automotive, construction, and utilities. In these sectors, workers and operations often take place in challenging environments, making it indispensable. Another factor fueling the market is the adoption of emerging technologies such as the Internet of Things (IoT), data centers, and machine learning. These technologies require reliable and strong devices to operate effectively in extreme conditions. Strategic collaborations and partnerships between market participants are also shaping the landscape. companies are forming alliances to expand their product offerings, enhance their capabilities, and reach new customer segments.

Additionally, the integration of RFID technology, GPS, and IP ratings to improve customer reach and operational efficiency. Another trend is the use of artificial intelligence and big data analytics to enhance the functionality and value proposition. The market is characterized by a diverse company landscape. companies offer a range of products catering to different industries and applications. Some companies focus on specific industries, such as aerospace and defense or construction, while others offer a broader product range. Despite the market's growth potential, there are challenges that companies must address. Regulatory standards and compliance requirements can pose significant hurdles for companies looking to enter or expand in certain industries.

Moreover, pricing pressures and profit margins can be tight in some sectors, making it essential for companies to differentiate themselves through innovation and value-added services. In summary, the market is poised for growth, driven by the increasing demand for data management and connectivity in challenging environments and the adoption of emerging technologies. Thus, companies must navigate regulatory requirements, pricing pressures, and competition to succeed in this dynamic market. The market offers untapped opportunities for companies looking to expand their reach and offerings in various industries, including logistics and transportation, utilities, and construction.

|

Rugged Devices Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

228 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.7% |

|

Market growth 2025-2029 |

USD 1.31 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.4 |

|

Key countries |

US, Germany, China, UK, Japan, Brazil, Canada, France, UAE, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Rugged Devices Market Research and Growth Report?

- CAGR of the Rugged Devices industry during the forecast period

- Detailed information on factors that will drive the Rugged Devices growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the rugged devices market growth of industry companies

We can help! Our analysts can customize this rugged devices market research report to meet your requirements.