Rugged Tablet Market Size 2024-2028

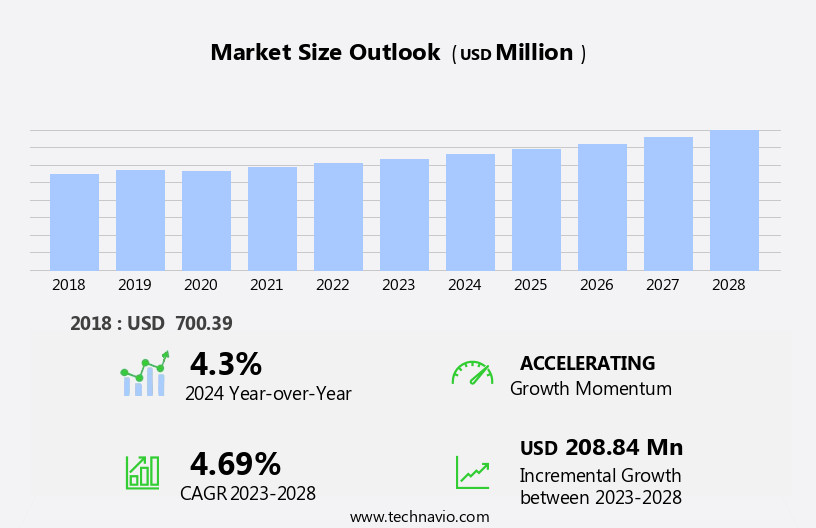

The rugged tablet market size is forecast to increase by USD 208.84 million at a CAGR of 4.69% between 2023 and 2028.

- The market is experiencing significant growth, driven primarily by increasing demand from the defense sector and a growing preference for feature-rich devices. These devices are essential for military personnel and first responders, who require reliable and durable IOT technology to operate in harsh environments. The defense sector's demand is expected to continue, fueling market expansion. However, the high initial procurement cost of rugged tablets remains a significant challenge for both consumers and organizations. Despite this hurdle, companies can capitalize on market opportunities by offering competitive pricing and financing options. Additionally, continued innovation in rugged tablet technology, such as advanced security features and longer battery life, will further differentiate market offerings and attract buyers.

- In summary, the market is poised for growth due to increasing demand from the defense sector and a preference for feature-rich devices, but high initial procurement costs present a significant challenge that companies must address to capitalize on market opportunities.

What will be the Size of the Rugged Tablet Market during the forecast period?

- The market continues to evolve, driven by the increasing demand for reliable and durable mobile computing solutions across various sectors. These devices, characterized by their ruggedized design, long battery life, and data logging capabilities, are finding applications in law enforcement, public safety, industrial automation, workforce management, and more. The integration of mobile device management systems ensures seamless deployment and maintenance of these devices. Rugged tablets feature capacitive touchscreens, offering improved user experience and compatibility with various applications. Biometric authentication adds an extra layer of security, making these devices ideal for data-sensitive industries. Machine control and remote monitoring applications benefit from their robust design and long battery life.

- Point of sale systems, field data collection, enterprise mobility, asset tracking, emergency response, and meter reading are just a few of the many applications that rugged tablets support. The integration of mobile payments, virtual reality, and augmented reality further expands their potential use cases. Rugged tablets undergo rigorous testing, adhering to standards such as mil-std-810g and IP rating, ensuring their ability to withstand harsh environments. Hot-swappable batteries, tablet PCs, and drop resistance add to their versatility and reliability. The ongoing development of operating systems, edge computing, cloud computing, and the Internet of Things further enhances the capabilities of rugged tablets, making them indispensable tools for businesses and organizations in need of mobile computing solutions.

How is this Rugged Tablet Industry segmented?

The rugged tablet industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- OS

- Android

- IOS

- Windows

- Technology

- Semi-rugged

- Fully-rugged

- Ultra-rugged tablets

- Size

- Under 8 Inches

- 8-10 Inches

- Over 10 Inches

- Distribution Channel

- Online Retail

- Direct Sales

- Distributors

- Geography

- North America

- US

- Mexico

- Europe

- France

- Germany

- Italy

- Spain

- UK

- Middle East and Africa

- UAE

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

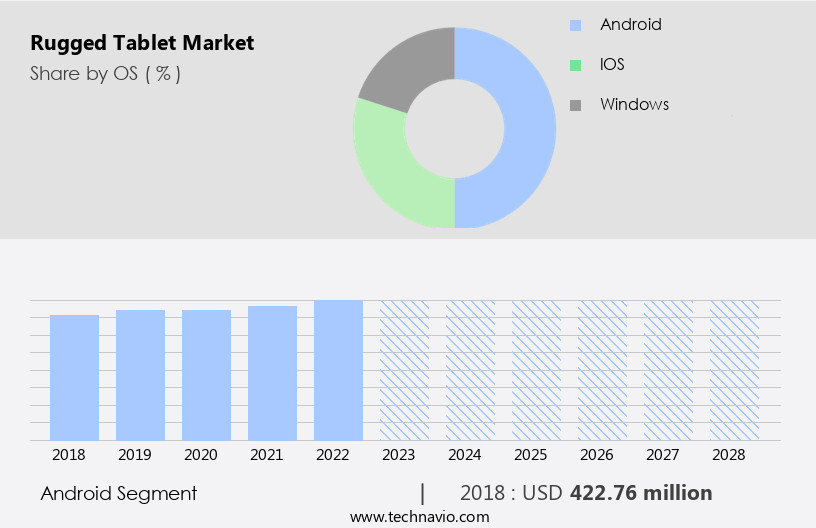

By OS Insights

The android segment is estimated to witness significant growth during the forecast period.

In the dynamic and evolving the market, the Android operating system holds a significant presence, catering to various industries' demands for durability and functionality. Rugged tablets, characterized by their ruggedized design and long battery life, are engineered to thrive in harsh environments. The Android OS, with its user-friendly interface and versatility, is a popular choice for these devices. Industries such as manufacturing, logistics, healthcare, and field services are adopting rugged tablets with Android OS for their unique advantages. In manufacturing, these tablets enable real-time data access, inventory management, and process monitoring on the factory floor. In logistics, they optimize supply chain visibility, asset tracking, and delivery management.

The healthcare sector leverages Android rugged tablets for patient data management, medical imaging, and point-of-care applications. Industrial automation and machine control applications benefit from rugged tablets' capacitive touchscreens and high display resolution, ensuring clear visuals for precise control. Law enforcement and public safety personnel rely on these tablets for data logging, remote monitoring, emergency response, and asset tracking. In the field of workforce management, rugged tablets facilitate efficient data collection, enabling real-time reporting and analysis. Rugged tablets' ruggedized design, with mil-std-810g certification and high drop resistance, ensures their durability in challenging conditions. Additionally, features like hot-swappable batteries, mobile device management, and mobile computing enable seamless integration into enterprise mobility solutions.

The integration of edge computing, cloud computing, and the Internet of Things further enhances their capabilities in various applications. In the realm of patient care, rugged tablets with high contrast ratio and Android OS facilitate efficient data management and communication between healthcare professionals. Virtual and augmented reality technologies, integrated into rugged tablets, offer immersive experiences for training, simulation, fingerprint sensor, and remote assistance. In summary, The market is witnessing significant growth, with the Android operating system playing a pivotal role in catering to the diverse needs of industries. Rugged tablets' capabilities, including data security, biometric authentication, machine control, industrial automation, workforce management, data logging, remote monitoring, asset tracking, emergency response, and patient care, make them indispensable tools for various sectors.

The Android segment was valued at USD 422.76 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 33% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the dynamic business landscape of North America, the adoption of advanced technologies is at an all-time high, particularly in the industrial and defense sectors. These industries prioritize ruggedized solutions to maintain competitiveness and thrive in the technology-driven business environment. The region, home to some of the world's most advanced and developing economies, is a significant market for rugged tablets. The defense and military segment is the primary driver of demand for rugged tablets due to the need for robust, shockproof devices. Furthermore, the growth of the logistics and retail sectors has increased the demand for rugged tablets in the region.

These devices offer essential features such as biometric authentication, projected capacitive touchscreens, and long battery life, making them ideal for machine control, data logging, and field data collection. In addition, rugged tablets are increasingly being used in industrial automation, workforce management, remote monitoring, asset tracking, emergency response, and meter reading. The integration of technologies like mil-std-810g, edge computing, cloud computing, and the Internet of Things further enhances their capabilities. Rugged tablets cater to various industries, including law enforcement, public safety, patient care, and field service, offering solutions for point of sale, mobile payments, virtual reality, and augmented reality applications.

With features like hot-swappable batteries, ruggedized design, and high-resolution displays, these tablets are ideal for use in harsh environments and demanding applications. The operating system and ip rating ensure seamless integration with mobile device management systems, ensuring data security and efficient mobile computing.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The Global Rugged Tablet Market grows with rugged tablets for military and IP68 rugged tablets for industry. Rugged tablet market trends highlight rugged tablets for logistics and rugged tablets with 5G connectivity. Rugged tablets for construction and rugged tablets for healthcare ensure durability, per rugged tablet market forecast. MIL-STD-810G rugged tablets leverage rugged tablets with IoT integration, while rugged tablets for field services enhance mobility. Rugged tablets for oil and gas and rugged tablets for public safety drive demand. Rugged tablets for warehouse management, high-performance rugged tablets, and rugged tablets for outdoor use optimize operations. Rugged tablets for transportation, sustainable rugged tablet designs, rugged tablets for mining, advanced rugged tablet processors, rugged tablet market supply chain, and rugged tablets for remote work fuel growth through forecast year.

What are the key market drivers leading to the rise in the adoption of Rugged Tablet Industry?

- The defense sector's escalating demand serves as the primary catalyst for market growth.

- In the defense sector, maximizing productivity is a top priority, and secure wireless and cellular broadband technologies have become essential components of military information infrastructures. Rugged tablets play a crucial role in facilitating the secure flow of information between personnel through these networks. The adoption of rugged tablets in the defense sector is driven by the real-time transmission and review of data, which is a significant advantage in critical situations. The emergence of secure networks in both wireless LAN and cellular broadband has enabled military personnel to access vital information from anywhere, enhancing situational awareness and decision-making capabilities. The ruggedness of these tablets ensures they can withstand harsh environments and drop resistance, making them ideal for use in various military applications.

- Moreover, the integration of edge computing and cloud computing technologies with rugged tablets has expanded their functionality. Edge computing allows data processing to occur at the source, reducing latency and improving response times, while cloud computing enables secure access to vast amounts of data and applications from anywhere. The Internet of Things (IoT) and field service applications are also benefiting from the use of rugged tablets in the defense sector. These technologies enable real-time monitoring and control of equipment and systems, improving efficiency and reducing downtime. Overall, rugged tablets are a critical component of modern military technology, enabling command and control, warehouse management, and various other applications in a secure and efficient manner.

What are the market trends shaping the Rugged Tablet Industry?

- The increasing demand for feature-rich devices represents a significant market trend. Professionals and consumers alike prioritize devices that offer advanced functionalities and capabilities.

- The market has experienced significant growth due to the increasing demand for portable devices that offer superior data security and durability in various industries, such as law enforcement, public safety, machine control, industrial automation, and workforce management. While most rugged tablets still run on Windows CE or Windows Mobile OS, there has been an effort to introduce Android-based industrial handheld devices in the past five years. However, the market for Android-powered rugged tablets has not yet matched the growth of the Windows-based market. Manufacturers have responded to the evolving technology landscape by upgrading the hardware of rugged tablets, including processors, storage, memory, and displays, to accommodate newer operating systems.

- Notable trends in the market include the broader acceptance of capacitive multi-touch technology, increased display sizes, and the integration of advanced features such as radio-frequency identification (RFID), Global Positioning System (GPS), high-quality imagers and scanners, multi-sensor technology, and integrated high-resolution cameras. These advancements enhance the functionality and versatility of rugged tablets, making them indispensable tools for businesses and organizations that require reliable, secure, and durable mobile computing solutions.

What challenges does the Rugged Tablet Industry face during its growth?

- The high initial procurement cost of rugged tablets poses a significant challenge to the industry's growth trajectory. Rugged tablets, known for their durability and resistance to harsh environments, come with a premium price tag that can hinder market expansion. This cost barrier may deter potential buyers, particularly small and medium-sized enterprises, from investing in these devices, thereby limiting the industry's growth potential.

- Rugged tablets are specialized mobile computing devices designed for data logging and mobile computing in challenging environments. Their ruggedized design ensures quality control in industries requiring field data collection, point of sale transactions, remote monitoring, asset tracking, emergency response, and mobile device management. Despite their higher initial procurement cost, rugged tablets offer lower total cost of ownership (TCO) due to their durability and reliability throughout their product life cycle. However, commercial-grade tablets are increasingly challenging the market as they can perform similar functions.

- Rugged tablets offer ingress protection against solid substances, shockproofing, and drop resistance, which are essential for certain applications. Yet, many commercial and industrial applications do not necessitate high ingress protection or protection against liquids. Regardless, rugged tablets remain indispensable for industries where data integrity and operational efficiency are paramount.

Exclusive Customer Landscape

The rugged tablet market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the rugged tablet market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, rugged tablet market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Panasonic

- Getac

- Zebra Technologies

- DT Research

- Xplore Technologies

- Dell

- HP

- Lenovo

- Samsung

- Apple

- Microsoft

- Trimble

- MobileDemand

- AAEON

- Advantech

- Kontron

- MilDef

- Winmate

- RuggON

- Logic Instrument

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Rugged Tablet Market

- In February 2023, Panasonic Corporation announced the launch of its newest rugged tablet, the Toughbook FZ-X1, featuring an Intel vPro platform and a detachable keyboard, catering to enterprise customers in industries such as public safety, transportation, and logistics (Panasonic Corporation Press Release, 2023).

- In May 2024, Honeywell and Microsoft entered into a strategic partnership to integrate Microsoft's Azure IoT and Power BI services with Honeywell's rugged tablets, enhancing the capabilities of these devices for industrial applications and enabling real-time data analysis (Microsoft News Center, 2024).

- In September 2024, Getac Technology Corporation raised USD50 million in a Series C funding round, led by WI Harper Group, to accelerate its research and development efforts and expand its global presence in the market (Getac Technology Corporation Press Release, 2024).

Research Analyst Overview

The market is experiencing significant advancements, with a focus on enhancing device functionality and security. Predictive maintenance and remote diagnostics enable proactive problem-solving, reducing downtime and maintenance costs. Thermal shock resistance ensures uninterrupted performance in extreme temperatures. Device security is a priority, with features such as secure boot, hardware encryption, and data encryption safeguarding sensitive information. Bar code scanners and RFID readers streamline inventory management, while voice control and glove-friendly touchscreens improve usability. Wearable computing and mobile application development expand tablet applications, enabling remote access and asset management. GPS tracking and geospatial mapping provide real-time location data for improved efficiency and productivity.

Big data, data analytics, and machine learning facilitate informed decision-making, while artificial intelligence and facial recognition enhance user experience. Durability testing and network security ensure device longevity and data protection. Vibration resistance and solar readability cater to industrial applications, and stylus support and custom software solutions cater to specific business needs. Software updates and device lifecycle management ensure optimal performance and longevity.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Rugged Tablet Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

171 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.69% |

|

Market growth 2024-2028 |

USD 208.84 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.3 |

|

Key countries |

US, China, Germany, Japan, UK, Australia, India, France, Brazil, UAE, Rest of World (ROW), Saudi Arabia, France, South Korea, Mexico, Italy, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Rugged Tablet Market Research and Growth Report?

- CAGR of the Rugged Tablet industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the rugged tablet market growth of industry companies

We can help! Our analysts can customize this rugged tablet market research report to meet your requirements.