Safety Blood Collection Needle Market Size 2024-2028

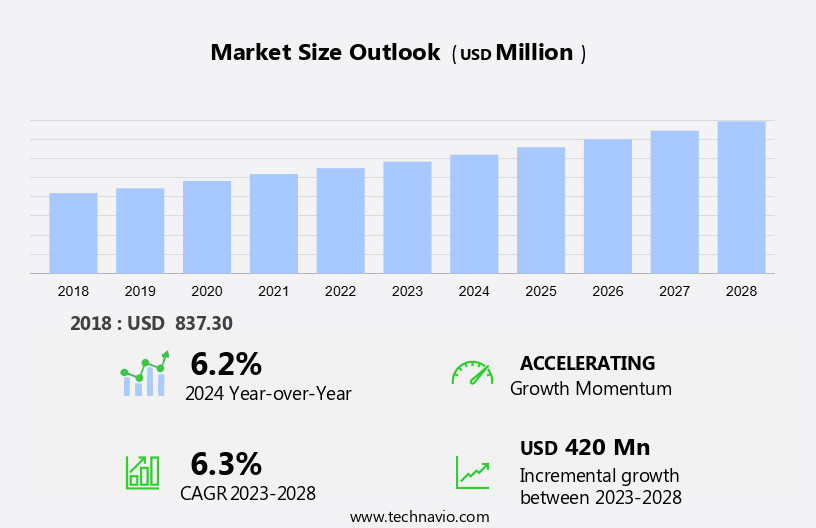

The safety blood collection needle market size is forecast to increase by USD 420 million, at a CAGR of 6.3% between 2023 and 2028.

- The market is experiencing significant growth, driven by the rising prevalence of chronic diseases necessitating frequent blood tests. This trend is expected to continue as the global population ages and the incidence of chronic conditions increases. Another key driver is the continuous innovation and new product launches by companies, introducing advanced safety features to minimize needlestick injuries and improve patient safety. However, growing concerns for companies over product recalls pose a significant challenge. With increasing scrutiny on product safety and quality, companies must invest heavily in research and development to ensure their products meet stringent regulatory requirements and consumer expectations.

- Effective risk management strategies and robust quality control measures will be essential for companies seeking to capitalize on market opportunities and navigate challenges effectively. The market's strategic landscape is characterized by intense competition, with companies focusing on product innovation, strategic partnerships, and geographic expansion to gain a competitive edge. Companies that can successfully address the challenges and capitalize on the opportunities presented by this market will be well-positioned for long-term growth.

What will be the Size of the Safety Blood Collection Needle Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by the ongoing pursuit of enhancing patient safety and improving collection efficiency across various sectors. Innovations in needle technology include reduced needle lengths, which minimize trauma and the risk of needle sticks. Advanced needle hub designs offer improved connectivity and ease of use, while syringe and winged blood collections streamline the process. Needle bevel designs and insertion angles are engineered to minimize pain and reduce the risk of hematoma formation. Needle sterilization methods ensure blood sample integrity and prevent contamination. Vein visualization technology and anticoagulant additives in blood collection tubes facilitate smoother venipuncture procedures.

Multi-sample needles and closed tube systems enable the collection of multiple samples with minimal needle insertions. Safety engineered needles and sharps disposal systems prioritize the prevention of needle sticks and proper disposal. Vacuum blood collection and automated blood collection methods expedite the process, ensuring accuracy and efficiency. Capillary blood collection devices and dermal puncture systems cater to non-invasive applications, while single-use needles minimize the risk of cross-contamination. The market's dynamic nature continues to unfold, with ongoing research and development in needle technology shaping the future of blood collection practices.

How is this Safety Blood Collection Needle Industry segmented?

The safety blood collection needle industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Manual safety blood collection needles

- Automatic safety blood collection needles

- End-user

- Hospitals

- Clinics

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Type Insights

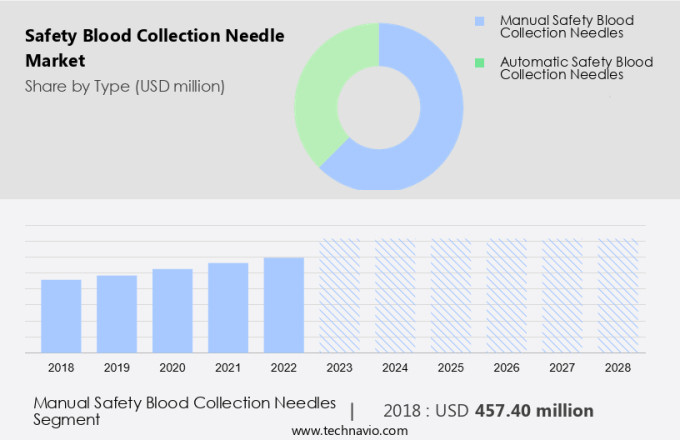

The manual safety blood collection needles segment is estimated to witness significant growth during the forecast period.

Manual safety blood collection needles have gained popularity in healthcare settings due to their integrated safety features that minimize the risk of needlestick injuries. These needles, which include needle retraction mechanisms and safety engineered designs, require manual engagement of the safety mechanism after use for secure needle coverage before disposal. This manual engagement makes them a cost-effective option compared to automated safety needles. BD, a leading company in this market, offers a range of manual safety blood collection needles, such as the BD Eclipse safety needle. The BD Vacutainer Eclipse blood collection needle is a safety-engineered, multi-sample solution that combines vein visualization technology with a vacuum blood collection system.

It also features a reduced needle length, heparinized blood tube, and needle hub design to enhance blood sample integrity. The needle's safety features include a needle bevel design that minimizes hematoma formation and a needle sterilization method that ensures hygiene. Additionally, the needle comes with a closed tube system and a blood draw technique that reduces the risk of contamination. BD's automated blood collection systems and capillary blood collection devices are also available for healthcare professionals who require those options. Overall, the market for safety blood collection needles continues to evolve, with a focus on enhancing patient safety, improving blood sample integrity, and streamlining the blood collection process.

The Manual safety blood collection needles segment was valued at USD 457.40 million in 2018 and showed a gradual increase during the forecast period.

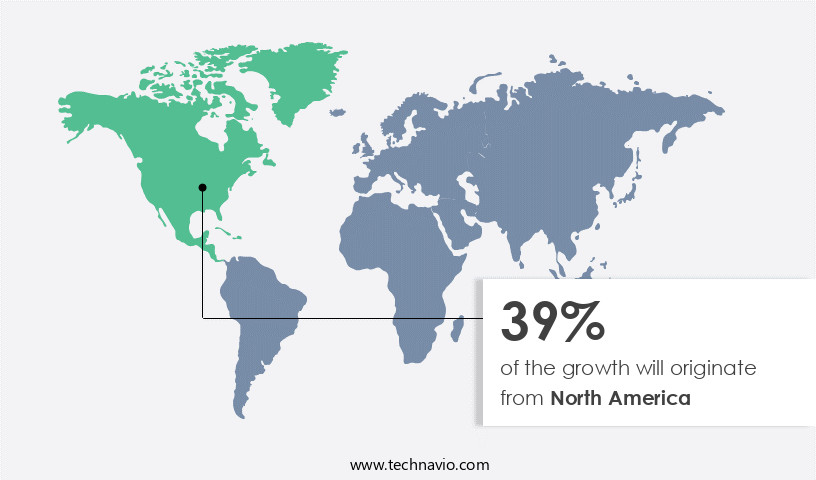

Regional Analysis

North America is estimated to contribute 39% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the market, North America leads due to advanced healthcare infrastructure, stringent regulations, and a high incidence of chronic diseases requiring frequent blood tests. The US dominates this market, driven by major medical device manufacturers, robust R&D activities, and OSHA safety regulations. Safety blood collection needles are in high demand due to the prevention of needlestick injuries and hematoma formation. Technologies such as vein visualization, needle retraction mechanisms, and safety engineered needles enhance patient safety. The evacuated tube system, multi-sample needles, and blood volume monitoring ensure sample integrity. Reduced needle lengths and needle hub designs facilitate easier use.

Needle sterilization methods and anticoagulant additives maintain blood sample quality. Vacuum blood collection and closed tube systems ensure sterility and prevent contamination. Automated blood collection and capillary blood collection methods offer convenience and efficiency. Single-use needles and dermal puncture devices cater to various patient needs. The market continues to evolve with innovations in needle design, blood draw techniques, and syringe and winged blood collections.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses a diverse range of products designed to minimize risks and ensure patient safety during the blood collection process. With considerations like needle-stick injuries, cross-contamination, and hemolysis being of utmost importance, manufacturers are focusing on advanced technologies and innovative designs to cater to this growing demand. Key areas involve the development of safety-engineered needles, such as retractable needles and needles with protective sheaths. Through methods such as vacuum-assisted blood collection and automated blood collection systems, safety mechanisms are integrated into the entire process, reducing the likelihood of complications. Safety blood collection needles are gaining significant traction in various healthcare settings, including hospitals, diagnostic laboratories, and blood banks. These needles are essential for the collection of blood samples for diagnostic tests, transfusions, and research purposes. Moreover, they are increasingly being used in self-collection applications, such as home health testing and point-of-care testing. The market's evolution is driven by factors like the growing awareness of patient safety, the increasing prevalence of chronic diseases requiring frequent blood tests, and the rising demand for minimally invasive procedures. Furthermore, regulatory bodies are mandating the use of safety blood collection needles to minimize risks for healthcare professionals and patients alike. In conclusion, the market represents a vital segment within the medical devices industry, as it addresses critical safety concerns and enhances overall patient care. Manufacturers are continually exploring new technologies and designs to improve safety, convenience, and efficiency, ensuring the market's continued growth and relevance.

What are the key market drivers leading to the rise in the adoption of Safety Blood Collection Needle Industry?

- The escalating incidence of chronic diseases serves as the primary catalyst for market growth.

- The market is experiencing significant growth due to the increasing prevalence of chronic diseases. Chronic diseases, such as diabetes, heart disease, cancer, and respiratory disorders, are becoming more common as populations age and unhealthy lifestyle habits persist. According to the World Health Organization (WHO), chronic diseases, also known as noncommunicable diseases (NCDs), are responsible for 41 million deaths annually, accounting for 74% of all global fatalities. Among these premature deaths, 17 million occur before the age of 70, with 86% occurring in low- and middle-income countries, where 77% of all NCD-related fatalities are concentrated. To address the risks associated with blood collection, innovative technologies are being adopted to enhance patient safety.

- These include patient safety devices, such as needle retraction mechanisms, vein visualization technology, and blood volume monitoring systems. Additionally, evacuated tube systems and multi-sample needles facilitate efficient and safe blood collection. Safety needle disposal is also a critical consideration to prevent needle stick injuries. These advancements are essential in ensuring the safety and wellbeing of patients and healthcare professionals.

What are the market trends shaping the Safety Blood Collection Needle Industry?

- The trend in the market is characterized by frequent new product launches from companies. This professional and knowledgeable observation reflects the dynamic nature of business industries.

- The market is experiencing significant growth due to the increasing demand for safer and more efficient tools in healthcare settings. Companies are responding to this demand by launching innovative safety-engineered needles with advanced features, such as integrated sharps disposal systems, hematoma prevention mechanisms, and improved blood sample integrity. These enhancements help minimize the risk of needlestick injuries and ensure the integrity of blood samples during the venipuncture procedure. For instance, BD (Becton, Dickinson and Company) recently introduced its next-generation needle-free blood draw technology, PIVO Pro, which received FDA 510(k) clearance on November 2, 2023.

- This new device is compatible with various blood collection tubes, including heparinized blood tubes, and is designed to work with both integrated and long peripheral IV catheters. By focusing on these advancements, companies aim to meet the stringent safety regulations while catering to the growing demand for safer devices in healthcare settings.

What challenges does the Safety Blood Collection Needle Industry face during its growth?

- The escalating issue of product recalls, which raises significant concerns among companies, poses a substantial challenge to the industry's growth trajectory.

- The market faces significant challenges due to product recalls, which negatively impact both manufacturers and healthcare providers. Recalls can result from various issues, including defective designs, insufficient testing, or contamination problems. When a safety blood collection needle is recalled, it not only damages the manufacturer's reputation but also raises concerns about patient safety and trust in medical devices. For example, on August 5, 2023, Fresenius Medical Care initiated a Class I recall of its Sanxin Single Use Sterile Syringes due to reports of leakages and the presence of an unknown black material inside the syringes.

- Other factors contributing to recalls include needle hub design, needle bevel design, needle insertion angle, needle sterilization method, syringe blood collection, and winged blood collection. Addressing these challenges requires continuous improvement in manufacturing processes, rigorous testing, and collaboration between manufacturers, regulatory agencies, and healthcare providers to ensure patient safety and trust in medical devices.

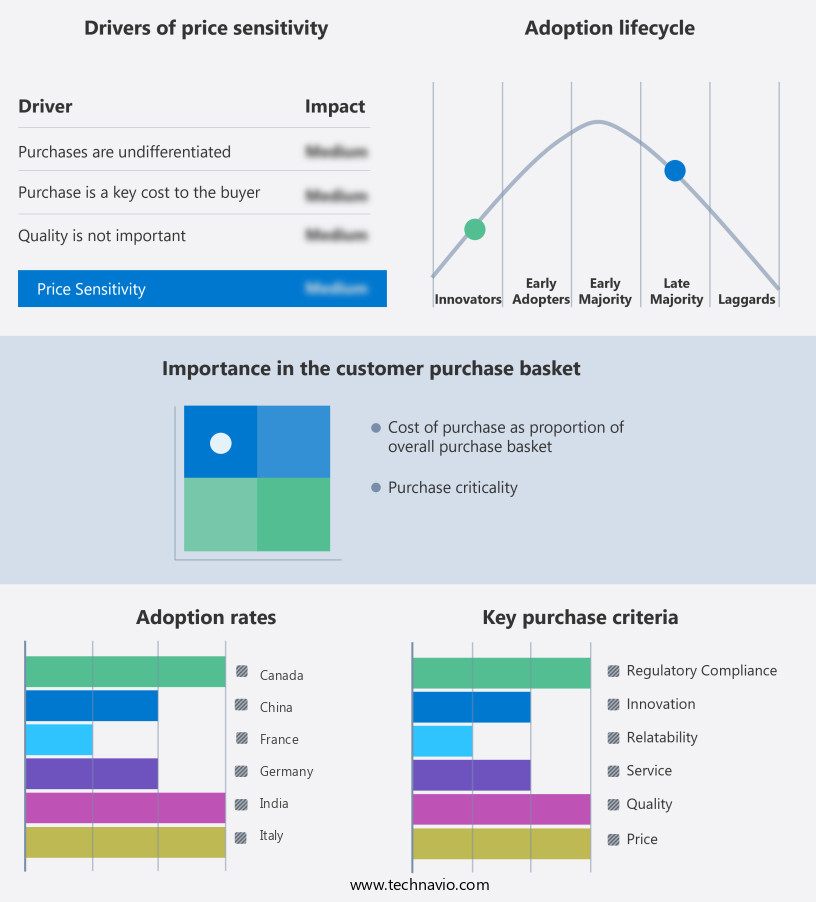

Exclusive Customer Landscape

The safety blood collection needle market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the safety blood collection needle market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, safety blood collection needle market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AdvaCare Pharma - The company specializes in providing safety blood collection needles, including models with gauges of 22 G x 1.25 and 21 G x 1.25.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AdvaCare Pharma

- Becton Dickinson and Co.

- Berpu Medical Technology Co Ltd

- BioMerieux SA

- Cardinal Health Inc.

- Cook Group Inc.

- FL MEDICAL srl Unipersonale

- GBUK Group Ltd.

- Greiner Bio One International GmbH

- Hindustan Syringes and Medical Devices Ltd.

- Jiangsu Rongye Technology Co Ltd.

- KB MEDICAL INC

- LIUYANG SANLI MEDICAL TECHNOLOGY DEVELOPMENT CO. LTD.

- Medline Industries LP

- Medtronic Plc

- Nipro Corp.

- Poly Medicure Ltd.

- SARSTEDT AG and Co. KG

- Thermo Fisher Scientific Inc.

- Vygon SAS

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Safety Blood Collection Needle Market

- In January 2024, B. Braun, a leading medical device manufacturer, announced the launch of its new Safety Blood Collection Needle System, Saf-T-Blood, featuring a retractable needle design to minimize needlestick injuries (B. Braun press release, 2024).

- In March 2024, Terumo Corporation and Grifols, two major players in the blood collection devices market, entered into a strategic collaboration to develop and commercialize innovative blood collection systems (Reuters, 2024).

- In April 2025, Medtronic plc completed the acquisition of Hospira, Inc.'s infusion business, significantly expanding its portfolio in the safety blood collection needles market (Medtronic SEC filing, 2025).

- In May 2025, the European Commission approved the use of Becton, Dickinson and Company's (BD) new Safety Blood Collection Needle System, Vacutainer Pro Plus, featuring a unique design to minimize needlestick injuries (European Commission press release, 2025).

Research Analyst Overview

- The market is experiencing significant advancements, driven by the demand for enhanced thrombosis prevention and reduced hemolysis. Tube compatibility testing and needle insertion force are critical factors in hemoconcentration prevention, ensuring efficient blood collection workflows. Needle manufacturing processes focus on improved needle design, needle sharpness testing, and needle material selection to minimize post-draw complications. Venous access devices integrate needle shield mechanisms for infection control and needle durability testing. Anticoagulant efficiency and needle reuse prevention are essential considerations in the blood collection process.

- Blood specimen handling requires low-deadspace needles to minimize blood loss and maintain sample integrity. Needle tip geometry and needle breakage prevention are crucial for patient comfort and safety. Overall, the market prioritizes needle durability, blood draw efficiency, and infection control while minimizing complications such as blood clot formation and needle sharpness issues.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Safety Blood Collection Needle Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

199 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.3% |

|

Market growth 2024-2028 |

USD 420 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.2 |

|

Key countries |

US, Germany, UK, China, France, Canada, Japan, Spain, Italy, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Safety Blood Collection Needle Market Research and Growth Report?

- CAGR of the Safety Blood Collection Needle industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the safety blood collection needle market growth of industry companies

We can help! Our analysts can customize this safety blood collection needle market research report to meet your requirements.