Security Information And Event Management Market Size 2024-2028

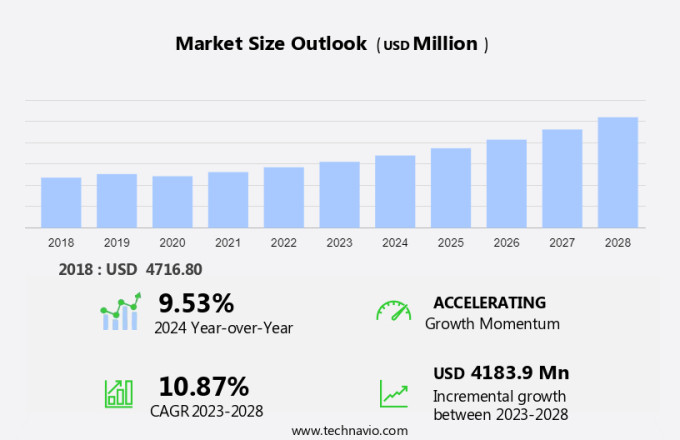

The security information and event management market size is forecast to increase by USD 4.18 billion at a CAGR of 10.87% between 2023 and 2028.

- Increase in cybercrime is the key driver of the market. The growing popularity of managed security service providers is the upcoming trend in the market. Threat from open-source SIEM software is a key challenge affecting the market growth. The SIEM market is expanding as businesses face escalating cyber threats and data breaches, prompting the need for advanced security solutions. SIEM technology provides real-time monitoring and threat detection by analyzing event logs and leveraging AI and machine learning.

- The rise of digital technologies, such as the metaverse, also increases cybersecurity risks, pushing businesses to adopt robust SIEM solutions. However, the availability of open-source SIEM software presents a challenge by offering a low-cost alternative, impacting market growth.

What will be the Security Information And Event Management Market Size During the Forecast Period?

- The market is experiencing significant growth due to the increasing number of cyberattacks and data breaches threatening enterprises' business operations. Digital technologies have expanded IT infrastructure, creating interconnected systems and assets that require strong data protection. SIEM technology plays a crucial role in mitigating cyber threats by analyzing real-time event logs from IT & Telecom networks. SIEM solutions enable security operations to monitor network architecture for risks and vulnerabilities, providing log analysis capabilities to identify and respond to ransomware attacks and other cybersecurity landscape challenges. The technology's ability to provide real-time data analysis is essential for safeguarding critical infrastructure and ensuring the continuity of business operations.

- In addition, skilled personnel are in high demand to manage and optimize SIEM systems, making the market for this technology a thriving one. As enterprises continue to invest in cybersecurity to protect their digital assets, the SIEM market is poised for continued growth. The increasing complexity of cyber threats necessitates advanced security solutions, making SIEM technology an indispensable component of modern IT security strategies.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Deployment

- On-premise

- SaaS-based

- End-user

- Government

- BFSI

- Telecom

- Healthcare

- Others

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- Middle East and Africa

- South America

- North America

By Deployment Insights

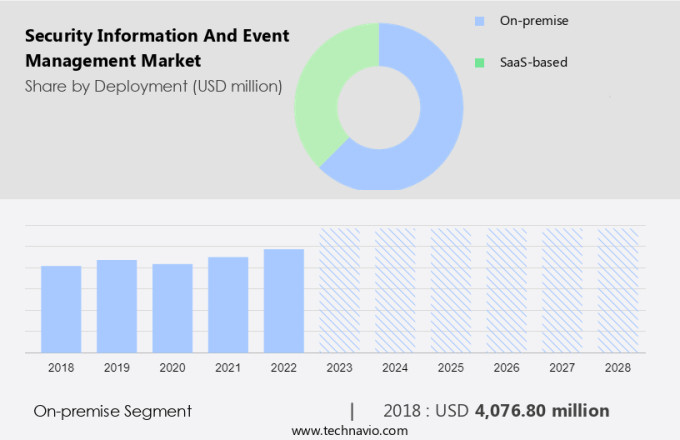

- The on-premise segment is estimated to witness significant growth during the forecast period.

The global market is experiencing significant growth due to the increasing prevalence of cyberattacks and data breaches. Digital technologies, such as IoT and workflow automation, are driving the demand for advanced SIEM technology among enterprises. SIEM solutions enable real-time data analysis of event logs, facilitating the detection and remediation of cyber threats. Machine learning and AI technology are integral components of modern SIEM systems, providing error detection and incident response capabilities. The importance of SIEM technology in the cybersecurity landscape is underscored by the risks associated with interconnected systems in various sectors, including financial services, critical infrastructure, and healthcare.

Get a glance at the market report of share of various segments Request Free Sample

The on-premise segment was valued at USD 4.08 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

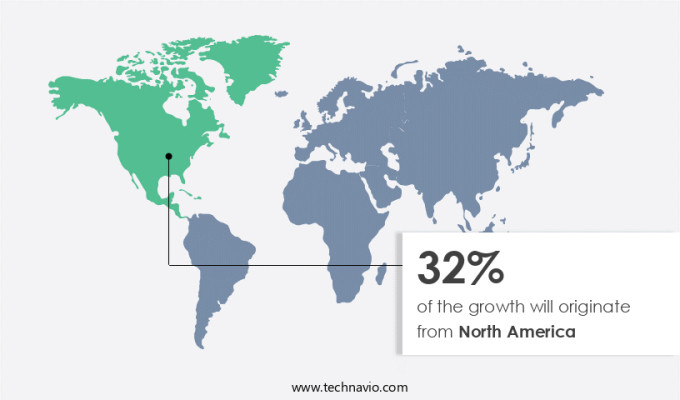

- North America is estimated to contribute 32% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market is a critical component of an organization's cybersecurity infrastructure. Compliance mandates, such as HIPAA for health insurance firms, necessitate the implementation of SIEM solutions to ensure holistic visibility into network areas and detect potential breaches. SIEM solutions employ statistical modeling and pattern modeling to identify anomalous behavior and dwelling threats. Data manipulation techniques are used to normalize and correlate data from various sources, enhancing event detection capabilities. Potential breaches can originate from various sources, including staff, doctors, or patients. SIEM solutions monitor these areas and provide real-time alerts for suspicious activity.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Security Information And Event Management Market?

Increase in cybercrime is the key driver of the market.

- In the digital age, cyberattacks and data breaches pose significant risks to enterprises, threatening business operations and IT infrastructure. SIEM technology plays a crucial role in mitigating these threats by monitoring event logs in real-time. Machine learning and AI technology enhance SIEM capabilities, enabling the identification of anomalous behavior and potential cyber threats. The cybersecurity landscape is evolving, with hackers targeting network layers and interconnected systems. DoS attacks, ransomware, and malware continue to pose risks to financial sectors, critical infrastructure, and other industries. Skilled personnel are essential for effective security operations, including log analysis and incident response. SIEM technology automates error detection and remediation, ensuring continuous monitoring and compliance with certifications and regulations.

- In addition, digital technologies, such as the metaverse, VR headsets, and smart glasses, introduce new risks and require strong security measures. Large enterprises rely on SIEM technology to protect their assets and data, including sensitive information in healthcare, IT & telecom, manufacturing, and other sectors. Continuous monitoring and incident response are critical components of effective cybersecurity strategies. Network architecture plays a significant role in cybersecurity, with interconnected systems increasing the risks of data breaches. Real-time data analysis and automation are essential for effective threat detection and response. Cybersecurity is a top priority for businesses, with the need for skilled personnel and advanced technologies to protect against evolving cyber threats.

What are the market trends shaping the Security Information And Event Management Market?

Growing popularity of managed security service providers is the upcoming trend in the market.

- In today's digital business landscape, enterprises face escalating cyber threats and data breaches, necessitating advanced security solutions. The Security Information and Event Management (SIEM) market plays a pivotal role in safeguarding IT infrastructure and business operations from cyberattacks. SIEM technology collects and analyzes event logs from network and IT systems in real-time, leveraging machine learning and AI technology for accurate threat detection. Cyber threats, including ransomware and malware, pose significant risks to critical infrastructure, financial sectors, healthcare, IT & Telecom, manufacturing, and other industries. SIEM solutions enable continuous monitoring, incident response, and compliance with certifications and regulations. SIEM technology's ability to analyze vast amounts of data from interconnected systems and assets in real-time is crucial in the ever-evolving cybersecurity landscape.

- Furthermore, advanced features like automation, error detection, and remediation further enhance its value. The adoption of digital technologies, such as metaverse, VR headsets, and smart glasses, introduces new vulnerabilities, necessitating strong SIEM solutions. As businesses expand globally, managing cybersecurity becomes increasingly complex. Skilled personnel are in high demand to ensure effective security operations and log analysis. In conclusion, SIEM technology is an essential component of an enterprise's cybersecurity strategy, providing real-time data analysis, threat detection, and incident response capabilities. Its role in mitigating risks and ensuring data protection is more critical than ever in the current business environment.

What challenges does Security Information And Event Management Market face during the growth?

Threat from open-source SIEM software is a key challenge affecting the market growth.

- In today's digital age, cyberattacks and data breaches pose significant risks to business operations and IT infrastructure. Enterprises of all sizes are increasingly relying on Security Information and Event Management (SIEM) technology to safeguard their assets and ensure compliance with regulatory requirements. SIEM solutions enable real-time data analysis, log analysis, and automation of error detection and remediation. However, the adoption of open-source SIEM solutions is posing a challenge to market growth. Digital technologies such as machine learning and AI are making open-source SIEM solutions increasingly sophisticated, making them a popular choice among small-scale enterprises in developing economies like India and China.

- In addition, these economies cannot afford expensive on-premises and cloud-based SIEM solutions. The increasing use of open-source SIEM solutions is reducing the overall revenue generated in the global SIEM market. Cyber threats, including ransomware and malware, continue to target financial sectors, critical infrastructure, and interconnected systems, necessitating continuous monitoring and incident response. Skilled personnel are essential for effective security operations, but the shortage of cybersecurity experts is a significant challenge. Network architecture and security operations require constant attention to mitigate risks and ensure data protection. The cybersecurity landscape is evolving rapidly, with emerging technologies such as the metaverse, VR headsets, and smart glasses presenting new risks and challenges.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Assuria

- AT and T Inc.

- Broadcom Inc.

- Dell Technologies Inc.

- Fortinet Inc.

- Hewlett Packard Enterprise Co.

- International Business Machines Corp.

- Logpoint

- LogRhythm Inc.

- McAfee LLC

- Open Text Corporation

- Rapid7 Inc.

- Securonix Inc.

- SolarWinds Corp.

- Splunk Inc.

- Tenable Holdings Inc.

- TIBCO Software Inc.

- Trend Micro Inc.

- Trustwave Holdings Inc.

- Zoho Corp. Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Security Information and Event Management (SIEM) is a critical solution in the current digital landscape, designed to monitor, collect, analyze, and respond to security events in real-time. SIEM technologies utilize advanced algorithms and machine learning to identify potential threats and vulnerabilities, ensuring the protection of an organization's critical assets. The market is experiencing significant growth due to the increasing complexity of IT environments and the rising number of cyber threats. The market is driven by factors such as the growing adoption of cloud computing, the need for regulatory compliance, and the increasing awareness of cybersecurity risks. SIEM solutions provide organizations with actionable insights, enabling them to respond quickly and effectively to security incidents.

Furthermore, these solutions also offer integration with various security tools and technologies, providing a centralized view of an organization's security posture. The market is expected to continue its growth trajectory in the coming years, driven by the increasing demand for advanced security solutions and the need to protect against sophisticated cyber threats. The market is also expected to be influenced by the ongoing digital transformation and the increasing adoption of IoT and AI technologies. SIEM companies offer a range of solutions catering to different organizational needs and budgets, from on-premises solutions to cloud-based offerings. These solutions provide organizations with the flexibility to choose the best fit for their specific requirements and budget. In conclusion, the market is a vital component of an organization's cybersecurity strategy, providing real-time threat detection and response capabilities. The market is expected to continue its growth trajectory, driven by the increasing complexity of IT environments and the rising number of cyber threats.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

184 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.87% |

|

Market growth 2024-2028 |

USD 4.18 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

9.53 |

|

Key countries |

US, China, Germany, UK, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch