Security Printing Market Size 2024-2028

The security printing market size is forecast to increase by USD 5.92 billion at a CAGR of 4.83% between 2023 and 2028. The market is driven by several key factors. One significant trend is the growing emphasis on outsourcing the printing of critical documents such as cheques, identity cards, passports, stock certificates, postage stamps, and currency. This outsourcing is due to the need for advanced security features, including intaglio printing, holography, specialty paper, microprint, and copying marks. Another trend is the transition toward a cashless economy, which is leading to an increased demand for secure digital printing solutions for items like digital currencies, secure documents, and identification cards. Additionally, there is a focus on creating durable solutions for printing currency to prevent counterfeiting. These factors are shaping the growth of the market.

What will the size of the market be during the forecast period?

The market encompasses the production and supply of secure technology for various applications, including banknotes, cheques, identity cards, passports, stock certificates, postage stamps, and other valuable documents. Economic loss and reputation damage due to tampering, counterfeiting, and corruption are significant concerns in this market. Secure technology includes hybrid papers, intaglio printing, holography, specialty paper, microprint, counterfeiting practices, digital watermarks, secure inks, EMV smart cards, and biometrics. Currency production is a major segment of the market, with a focus on preventing counterfeiting through advanced security measures such as holography and microprint. Monetary loss and reputation loss due to counterfeit attacks are major drivers for the market. Other applications, such as payments, identity cards and passports, also require high levels of security to prevent tampering and identity theft. Security measures in the market include authentication technologies like holography, colour printing, specialty paper, and secure inks. Counterfeiting practices, such as the use of digital technologies and polymers, continue to evolve, requiring ongoing innovation in security technology to stay ahead. The market is expected to grow significantly due to the increasing demand for secure identity documents and the need to prevent monetary and reputation losses from counterfeit attacks.

Market Segmentation

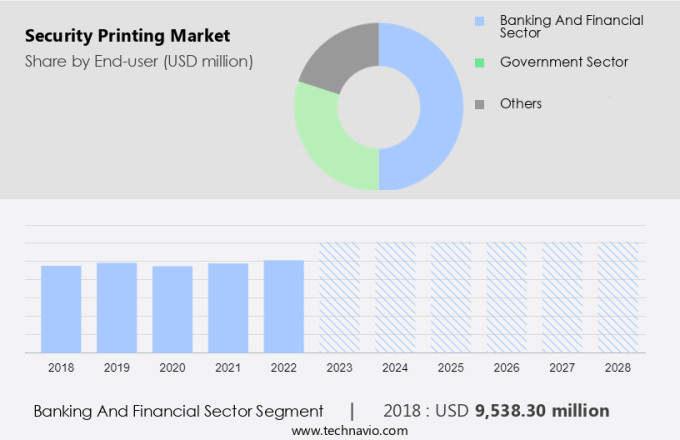

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Banking and financial sector

- Government sector

- Others

- Geography

- APAC

- China

- Japan

- North America

- US

- Europe

- Germany

- UK

- Middle East and Africa

- South America

- APAC

By End-user Insights

The banking and financial sector segment is estimated to witness significant growth during the forecast period. The market encompasses various applications, including cheques, identity cards, passports, stock certificates, and postage stamps. This industry is experiencing significant growth due to the increasing demand for secure and authentic documents. The banking and financial sector is a major contributor to this market, as cash remains a significant mode of transaction in many economies. With the growing global population and the increasing number of automated teller machines (ATMs), cash circulation has been on the rise. However, the push for cashless transactions and the increasing popularity of digital payments may negatively impact the demand for cash and, consequently, the market. Security printing involves specialized techniques such as intaglio printing, holography, and the use of specialty paper to create secure and authentic documents.

Further, the use of advanced technologies such as holography and intaglio printing is expected to drive the growth of the market. Holography, in particular, offers unique security features that are difficult to replicate, making it an ideal choice for high-security applications such as passports and identity cards. In conclusion, the market is expected to witness steady growth due to the increasing demand for secure and authentic documents in various applications, particularly in the banking and financial sector. The use of advanced technologies such as holography and intaglio printing is expected to drive market growth, while the push for cashless transactions may present a challenge.

Get a glance at the market share of various segments Request Free Sample

The banking and financial sector segment accounted for USD 9.54 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

APAC is estimated to contribute 61% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market is dominated by the Asia Pacific region, with many countries outsourcing their banknote production to reduce costs. China, in particular, hosts major players such as China Banknote Printing and Minting Corporation, which supplies banknotes to several countries including Thailand, Bangladesh, Sri Lanka, Malaysia, Pakistan, and Nepal. The Belt and Road Initiative, launched in 2013, has significantly contributed to the cost savings of these countries by enabling them to outsource their security printing requirements to China. This trend is expected to boost the growth of the banknote printing market in China throughout the forecast period. Security printing encompasses various techniques such as letterpress printing, screen printing, digital printing, and lithographic printing.

In conclusion, the market is witnessing significant growth due to the increasing demand for advanced security features and the adoption of new technologies such as RFID. The Asia Pacific region, with its focus on cost savings and advanced technology adoption, is expected to remain a major contributor to the market's growth. Companies in the security printing industry must stay updated with the latest trends and technologies to maintain their competitive edge and meet the evolving needs of their clients.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Increased focus of countries to outsource printing of currencies is the key driver of the market. In the market, counterfeit attacks continue to pose a significant challenge for ID Card issuers, particularly those producing Smart Cards. To mitigate this risk, many countries with smaller populations and limited resources opt to outsource the production of their currencies and ID Cards to specialized companies. Outsourcing allows these countries to access advanced security features such as biometrics, holograms, digital watermarks, and EMV Smart Cards. These technologies help prevent counterfeiting and ensure the authenticity of their currencies and ID Cards.

Moreover, outsourcing enables these countries to avoid the significant upfront investment required to purchase expensive presses and update their technology. Companies offering Security Printing services are capitalizing on this trend by providing advanced security solutions and expertise. They invest heavily in research and development to offer the latest security features, such as specialized inks and cutting-edge printers. Geopolitical factors, such as political instability and economic conditions, can also impact the market's growth. However, the demand for secure and authentic ID Cards and currencies remains constant, making this a stable and growing industry. In conclusion, the market is essential for maintaining the integrity of currencies and ID Cards.

Market Trends

The use of durable solutions for printing currencies is the upcoming trend in the market. Central banks in the United States are increasingly adopting secure technology for the production of banknotes to mitigate economic losses from tampering, counterfeiting, corruption, and money laundering. Instead of traditional paper notes, they are turning to advanced substrates such as pure polymer, hybrid papers, and paper/polymer composites. These materials offer enhanced security features and durability, ensuring the longevity of currencies and facilitating their recirculation for extended periods. Polymer notes, for instance, are more resilient than paper notes, being harder to tear, waterproof, and resistant to folding, soiling, and microorganisms. Advanced security features integrated into polymer substrates include see-through windows, quills, and serialized numbers, making them difficult to forge.

Moreover, these currencies exhibit superior performance in automated teller machines (ATMs) and sorting operations, with fewer mechanical defects. Incorporating these advanced security features into banknotes is crucial for maintaining public trust and confidence in the currency system. By utilizing superior substrates and security features, central banks can effectively combat counterfeiting and fraud, ensuring the integrity and authenticity of their currencies.

Market Challenge

The transition toward cashless economy is a key challenge affecting the market growth. The market has experienced significant changes in response to various economic and political factors. Trade policies and economic sanctions have influenced the industry's growth, leading to regulatory changes and increased demand for secure payment methods. Political instability in certain regions has also driven the need for advanced security features in currency and documents. Military spending and national security concerns have further boosted the market's expansion, with a focus on polymer substrates, security paper, and security fibers. Counterfeit activities continue to pose a challenge, necessitating the development of more sophisticated security measures. In recent times, the shift towards electronic payments and contactless transactions has gained momentum.

In conclusion, the market is undergoing a transformation driven by various economic, political, and technological factors. The need for secure payment methods and advanced security features remains a priority, with electronic payments and contactless transactions gaining popularity. Companies in the industry must stay informed of regulatory changes, consumer trends, and technological advancements to remain competitive.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

ANY Security Printing Plc - The company offers security printing that includes documents security solutions, tax stamps, securities, paper-based documents and security inks, and many more, under the brand name of ANY Security Printing Plc.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- A1 Security Print Ltd.

- Authentix Inc.

- China Banknote Printing and Minting Corp.

- De La Rue PLC

- Donggang Co.Ltd.

- DREWSEN SPEZIALPAPIERE GmbH and Co. KG

- ELTRONIS UK Ltd.

- FNMT RCM

- Giesecke Devrient GmbH

- Integrity Print Ltd.

- Joint Stock Co. Goznak

- Madras Security Printers Pvt. Ltd.

- Orell Füssli AG

- Oriental Holding Group

- RAINBOW PRINTING LTD.

- Schwarz Druck GmbH

- Security Papers Ltd.

- Security Printing and Minting Corp. Of India Ltd.

- Simpson Security Papers Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is a critical sector that focuses on producing authentic and secure documents to prevent economic loss caused by tampering, counterfeiting, and fraudulent activities. The market encompasses various types of documents such as banknotes, cheques, identity cards, passports, stock certificates, postage stamps, and more. Security printing technologies employ advanced techniques like intaglio printing, holography, specialty paper, microprint, copying marks, anti-magnetic inks, watermarks, serial numbers, security inks, and RFID technology to ensure document authenticity. Counterfeiting practices pose significant challenges to the security printing industry, leading to monetary loss and reputation damage. Law enforcement agencies and regulatory bodies employ various security measures to combat these attacks, including digital innovations, automated workflows, remote monitoring systems, and contactless production.

Further, the printing type used in security printing includes letterpress printing, screen printing, digital printing, and lithographic printing. Geopolitical factors like trade policies, economic sanctions, regulatory changes, political instability, military spending, and the use of polymer substrates and security fibers significantly impact the market. Security inks, holograms, specialized inks, EMV smart cards, and biometrics are some of the key technologies that enhance document security. The market also focuses on addressing counterfeit activities in various sectors, including currency production, monetary transactions, and identity verification.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

144 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.83% |

|

Market growth 2024-2028 |

USD 5.92 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.37 |

|

Regional analysis |

APAC, North America, Europe, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 61% |

|

Key countries |

US, China, Japan, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

A1 Security Print Ltd., ANY Security Printing Plc, Authentix Inc., China Banknote Printing and Minting Corp., De La Rue PLC, Donggang Co.Ltd., DREWSEN SPEZIALPAPIERE GmbH and Co. KG, ELTRONIS UK Ltd., FNMT RCM, Giesecke Devrient GmbH, Integrity Print Ltd., Joint Stock Co. Goznak, Madras Security Printers Pvt. Ltd., Orell Füssli AG, Oriental Holding Group, RAINBOW PRINTING LTD., Schwarz Druck GmbH, Security Papers Ltd., Security Printing and Minting Corp. Of India Ltd., and Simpson Security Papers Inc. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch