Decorative Paper Market Size 2025-2029

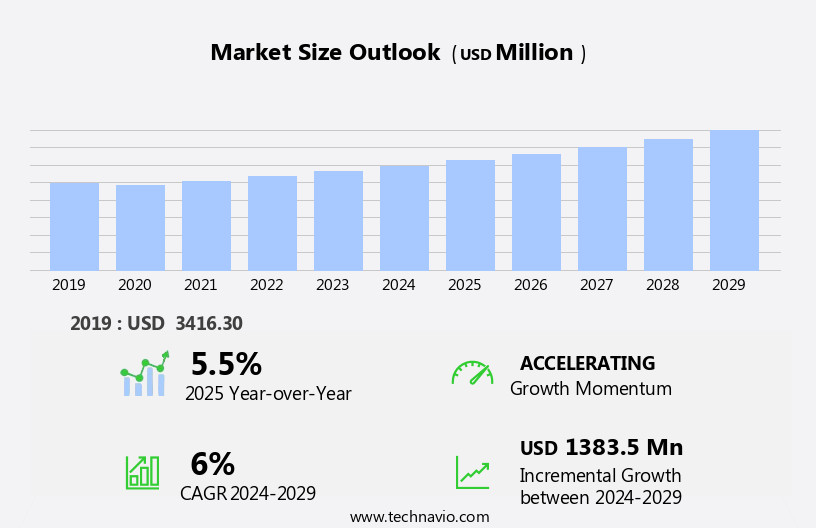

The decorative paper market size is forecast to increase by USD 1.38 billion at a CAGR of 6% between 2024 and 2029.

- The market is experiencing significant growth due to various trends and factors. Economic growth and urbanization are driving the demand for decorative paper in various applications, including packaging for luxury brands, spa and wellness centers, and home decor. Advancements in digital printing technology enable the production of high-quality, customized decorative papers, making them increasingly popular for specialty applications such as jewelry boxes, books, and wallcoverings. However, the increasing rate of deforestation poses a challenge to the sustainability of the decorative paper industry. To mitigate this, alternative raw materials like pulp from non-wood sources and recycled paper are being explored. Furthermore, decorative papers are finding new applications in niche markets such as flooring, glass, insulation, and construction, offering opportunities for market expansion.

What will be the Size of the Decorative Paper Market During the Forecast Period?

- The market encompasses a diverse range of products, including decorative sheets for furniture surfaces, lamination supports for decorative laminates, and impregnated decorative papers used in construction activity for buildings and home decor. These papers offer desirable attributes such as impregnability, surface quality, dimensional stability, and color consistency. The market caters to various industries, including furniture manufacturing, woodworking, and building materials. Decorative papers are utilized in numerous applications, from paneling and flooring to decorative laminates for furniture and disposable crockery. Consumer preferences for eco-friendly and sustainable alternatives have led to increased demand for decorative papers derived from renewable resources, mitigating concerns related to deforestation.

- Machinesmoothed decorative papers, and decor paper for party supplies continue to gain popularity due to their versatility and aesthetic appeal. Overall, the market is experiencing steady growth, driven by increasing construction activity and the expanding home decor sector.

How is the Decorative Paper Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Furniture

- Flooring

- Wall panels

- Others

- Distribution Channel

- Offline

- Online

- Product Type

- Print base paper

- Absorbent kraft paper

- Decorative laminates paper

- Specialty decorative paper

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- APAC

- China

- India

- Japan

- South America

- Middle East and Africa

- North America

By Application Insights

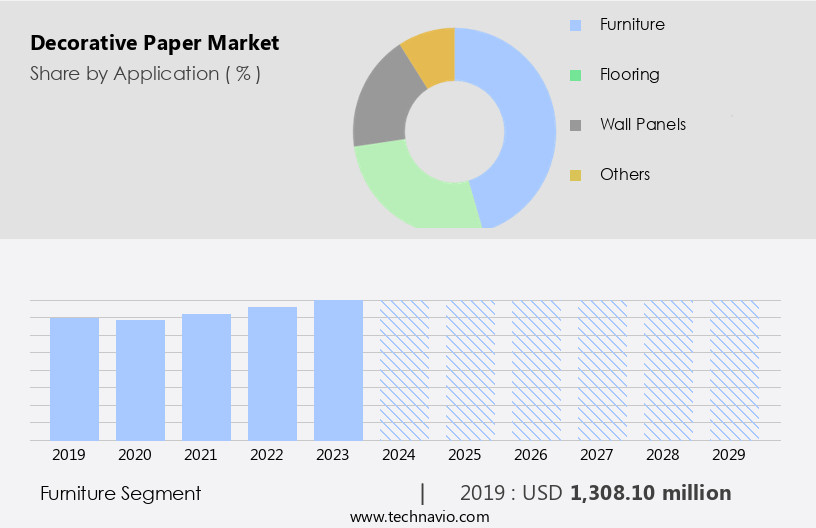

- The furniture segment is estimated to witness significant growth during the forecast period.

Decorative paper plays a pivotal role in the furniture industry, with its use primarily focused on enhancing the visual appeal and durability of furniture surfaces. This market segment is driven by the rising demand for personalized and customized furniture designs, as consumers seek unique pieces that align with their style and preferences. Decorative paper is typically impregnated with resins and laminated onto substrates like particleboard or MDF to create long-lasting and attractive finishes for various furniture items, including cabinets, tables, chairs, and wardrobes. Infrastructure and construction activities, as well as interior fitting projects, are other significant application areas for decorative paper.

The market for decorative paper is expanding in emerging economies due to increasing disposable income and the growing trend of home decorating. Decorative sheets, print base, decorative laminates, and impregnable surfaces are popular types of decorative paper used in various applications. Color consistency, surface quality, dimensional stability, and weight are essential factors influencing consumer preferences in the market. Decorative paper is also used in home décor, such as decorative glass, décor polystyrene, luxury furniture, and store fixtures. The market for decorative paper is expected to grow, driven by these trends and the increasing demand for sustainable and eco-friendly alternatives to traditional materials like wood.

Get a glance at the market report of share of various segments Request Free Sample

The Furniture segment was valued at USD 1.31 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

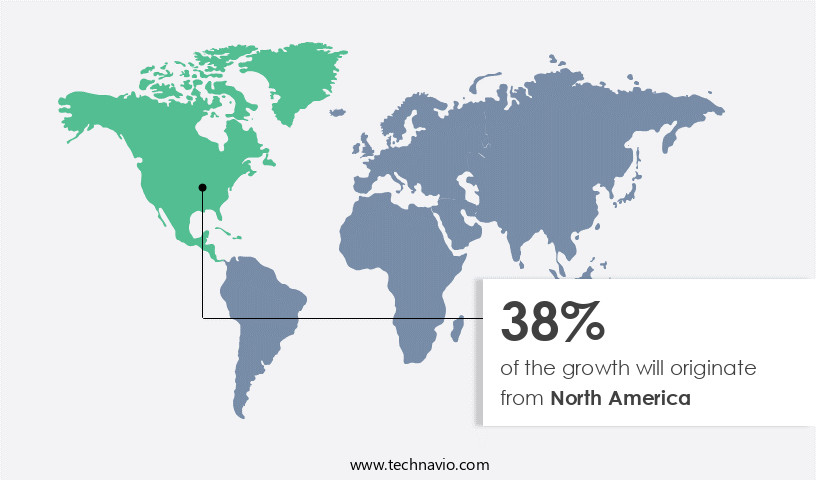

- North America is estimated to contribute 38% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in North America is driven by the growing construction industry and increasing consumer preferences for enhanced interior aesthetics. With a strong economy and high disposable income levels, the region exhibits significant demand for these products. The building and construction sector's steady expansion, particularly in residential and commercial projects, fuels the market's growth. Innovative building designs and materials are being supported and funded by various organizations. Additionally, the trend of home renovation and remodeling projects contributes to the rising demand for decorative paper. The paper finds extensive applications in various sectors, including furniture surfaces, paneling, flooring, decorative sheets, print base, decorative laminates, and disposable crockery.

The market offers impregnable, high-quality, dimensionally stable, and color-consistent products. Key applications include interior fitting, wooden materials, decorative paper plates, home decorating paper, home decor, decor glass, decor polystyrene, luxury furniture, and commercial types. The market's growth is influenced by factors such as consumer preferences, deforestation concerns, and strategic decisions regarding weights and colors.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Decorative Paper Industry?

Economic growth and urbanization is the key driver of the market.

- The market is driven by economic growth and urbanization, leading to increased consumer spending on home improvement and interior decoration. Urbanization, characterized by population migration from rural to urban areas, results in the construction of new residential and commercial buildings, creating demand in various applications such as wall coverings, furniture laminates, and decorative sheets. The rapid urbanization in emerging economies, particularly in Asia Pacific and South America, has significantly boosted market growth. Countries like China and India are experiencing significant urban expansion, leading to a rise in construction activities. The paper is used for enhancing the visual appearance of furniture surfaces, paneling, flooring, and other interior fitting applications.

- Decorative laminates, impregnated with colors and weights, are popular choices for furniture and store fixtures. Decorative paper, The plates and disposable crockery are used for parties and home decor. Decorative glass and polystyrene are also decorated with decorative paper for luxury furniture and home décor. The demand is influenced by consumer preferences, and companies are focusing on offering a wide range of colors, weights, and raw materials, including Kraft paper, print base paper, UNI paper, and base paper.

What are the market trends shaping the Decorative Paper Industry?

Advancements in digital printing technology is the upcoming market trend.

- The market has experienced significant growth due to the adoption of digital printing technology. This innovation offers unparalleled flexibility and efficiency in the production process, enabling high-quality, customizable designs to be printed directly onto decorative paper. Compared to traditional methods, digital printing reduces production time and cost, expanding market accessibility. The technology's ability to produce intricate designs with high resolution has revolutionized the interior design industry, where unique and personalized pieces are highly sought after. Decorative paper applications include furniture surfaces, paneling, flooring, decorative sheets, print base, decorative laminates, and various home décor items like framed paper, wallpaper, and wallcovering laminates.

- Consumers and businesses value the impregnability, surface quality, dimensional stability, color consistency, and various weights and colors that decorative paper offers. The emergence of decorative paper plates, disposable crockery, decorative glass, and decorative polystyrene further expands the market's scope. Wooden materials, store fixtures, and commercial type decorative papers are also essential segments. Consumer preferences for sustainable and eco-friendly options have led to the increased use of Kraft paper, print base paper, UNI paper, and base paper in the market.

What challenges does the Decorative Paper Industry face during its growth?

Increasing rate of deforestation is a key challenge affecting the industry growth.

- Decorative paper plays a significant role in various industries, including furniture surfaces, paneling, flooring, and home décor. The demand for decorative sheets, print base, decorative laminates, and other related products is driven by construction activity and infrastructure development in emerging economies. However, the production contributes to deforestation, as trees are a primary source of raw materials. According to the UN Food and Agricultural Organization (FAO), only about 30.5% of the world's total land area is covered by forests. Deforestation is caused by expanding industries, the wooden materials sector, and urbanization. Governments worldwide have implemented regulations to preserve forests and promote sustainable practices.

- Decorative paper manufacturers are focusing on impregnability, surface quality, dimensional stability, color consistency, and other essential attributes to meet consumer preferences. The market includes various applications, such as decorative paper plates, decorative paper, disposable crockery, decorative glass, decorative polystyrene, luxury furniture, interior fitting, and store fixtures. The market is expected to grow due to the increasing demand for home decorating paper and wallpaper, as well as commercial type wallcovering laminates.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Ahlstrom - The market encompasses a range of product offerings, including white and solid colored decor papers, print base papers, and pre-impregnated varieties.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BMK Group GmbH and Co. KG

- Cartiera Giacosa S.p.A.

- Decotec Printing S.A.

- DIC Corp.

- Felix Schoeller Holding GmbH and Co KG

- Hans Schmid GmbH and Co. KG

- Impress Surfaces GmbH

- Interprint GmbH

- Lamigraf S.A.

- Laminate Works

- Papeteries de Genval S.A.

- Papierfabrik August Koehler SE

- Pfleiderer

- Schattdecor AG

- Stora Enso Oyj

- Suddekor GmbH

- SURTECO GmbH

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Decorative paper plays a significant role in various industries, adding aesthetic value to infrastructure projects and home decor applications. This market encompasses a wide range of products, including decorative sheets for furniture surfaces, paneling, flooring, and decorative laminates. These papers offer impregnability, superior surface quality, and dimensional stability, making them ideal for use in furniture, interior fitting, and home decor. The market is driven by the growing construction activity and the increasing demand for visually appealing surfaces in buildings. The market caters to diverse applications, from decorative paper plates and disposable crockery for parties to home decorating paper and home décor items such as framed paper and wallcovering laminates.

Moreover, it is used extensively in the furniture industry, enhancing the visual appeal of wooden materials. The paper's ability to mimic various textures and colors makes it a popular choice for interior designing projects. In the building and construction sector, it is used as a base for various materials like glass, polystyrene, and luxury furniture. The emergence of emerging economies and their growing infrastructure development has created significant revenue pockets in the market. Consumer preferences for high-quality, eco-friendly, and sustainable products have led manufacturers to focus on improving the color consistency, weights, and raw materials used in the production.

Furthermore, impregnating decorative paper with various colors and weights is a common practice to enhance its functionality and visual appeal. Kraft paper, print base paper, Uni paper, base paper, and other types of decorative paper are widely used in various industries due to their versatility and durability. The market is continually evolving, with manufacturers focusing on innovation and sustainability. The use of recycled raw materials and the development of biodegradable decorative papers are some of the strategic decisions being made to cater to the growing demand for eco-friendly products.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

221 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6% |

|

Market growth 2025-2029 |

USD 1.38 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.5 |

|

Key countries |

US, Canada, China, UK, Germany, Japan, India, France, Italy, and The Netherlands |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.