Singapore 3PL Market Size 2024-2028

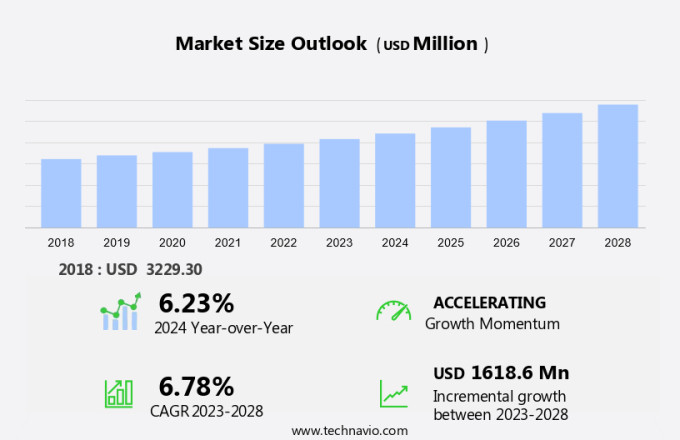

The Singapore 3PL market size is forecast to increase by USD 1.62 billion at a CAGR of 6.78% between 2023 and 2028. In Singapore's 3PL market, international deliveries continue to rise due to the increasing number of e-commerce companies setting up shop in the region. To manage this growth, many businesses are establishing in-house logistics teams and investing in advanced logistics software for freight-management and shipment management. The use of technology, such as logistics software and government systems, is essential for monitoring the delivery process and ensuring last-mile connectivity. Additionally, the collaboration between shipowners, cargo agents, freight forwarders, and other stakeholders plays a crucial role in the efficient movement of goods. However, the high operational costs associated with running a 3PL business can be a significant challenge.

What will the size of the market be during the forecast period?

The market has been a crucial component of the country's economic strength, playing a significant role in supporting businesses in managing their core operations more effectively. This market caters to various industries, including but not limited to, e-commerce, trading activities, and international deliveries. The 3PL industry in Singapore offers a range of services, including inventory management, logistics and distribution, cross-docking, and customer experience management. These services enable businesses to focus on their core competencies while outsourcing the complexities of managing their supply chain.

Furthermore, scalability is a key benefit of engaging a 3PL provider in Singapore. Businesses can leverage the provider's resources and expertise to expand their operations without the need for significant capital investments in infrastructure and technology. Additionally, 3PLs offer risk mitigation solutions, ensuring businesses are protected against unforeseen events that could impact their supply chain. The market is known for its asset utilization and asset sharing alliances. These collaborations allow businesses to optimize their transportation modes and service types, leading to cost savings and improved efficiency. Dedicated contract carriage is also an option for businesses seeking a more customized logistics solution.

Moreover, Singapore's strategic location as a global trading hub and its advanced infrastructure make it an attractive destination for businesses looking to penetrate the overseas market. The national logistics portal facilitates seamless communication and coordination between stakeholders, ensuring a long-term partnership that benefits all parties involved. Parts distribution is another area where 3PLs in Singapore excel. By providing efficient and reliable distribution services, businesses can reduce their inventory holding costs and improve their overall supply chain performance. The economic strength of Singapore, coupled with its strong business environment, makes it an ideal location for businesses looking to establish a presence in the Asia Pacific region.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Service

- Transportation

- Warehousing and distribution

- Value-added services

- End-user

- Manufacturing

- Automotive

- Consumer goods

- Food and beverage

- Others

- Geography

- Singapore

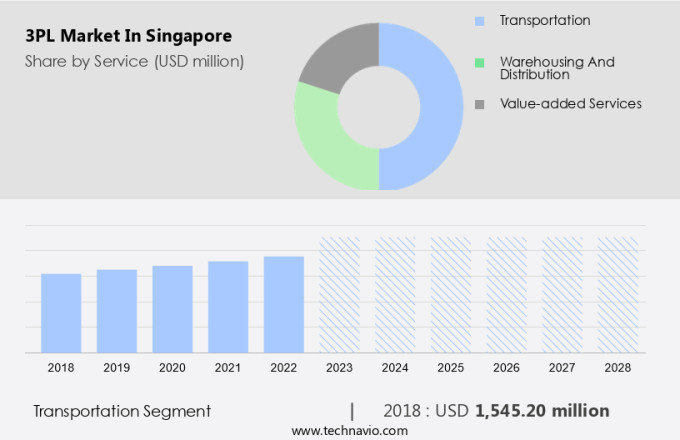

By Service Insights

The Transportation segment is estimated to witness significant growth during the forecast period. In Singapore's 3PL market, businesses outsource their transportation needs to specialized providers due to the significant investment and expertise required. This sector encompasses various modes, such as road, rail, air, and sea. Outsourcing freight delivery enables companies to gain a competitive edge, as 3PL suppliers ensure efficient and timely shipments. The 3PL industry offers a range of services, including freight forwarding, project logistics, network design, cargo insurance, optimization, and customs brokerage. With technological advancements, the transportation segment of the market continues to evolve. International deliveries are facilitated through advanced logistics software, enabling real-time shipment management and delivery process monitoring. Last-mile connectivity solutions streamline the final leg of the delivery process.

Furthermore, government systems collaborate with 3PLs, freight-management companies, shipowners, cargo agents, and freight forwarders to ensure seamless cross-border trade. Overall, the market plays a crucial role in the efficient and effective movement of goods, enabling businesses to focus on their core competencies.

Get a glance at the market share of various segments Request Free Sample

The transportation segment accounted for USD 1.54 billion in 2018 and showed a gradual increase during the forecast period.

Our market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Singapore 3Pl Market Driver

Growing import-export activity on sea lanes is the key driver of the market. The market experiences continuous expansion due to the rise in international trade, particularly in the import and export of raw materials for prescription drugs and mass production goods. According to the International Chamber of Shipping, approximately 11 billion tons of cargo are transported via ships annually. This global trend is driven by increasing economic interconnectedness. Major imports to Singapore include machinery and transport equipment, as well as crude petroleum. Conversely, refined petroleum products are the primary exports. Key trading partners include China, the US, Indonesia, Malaysia, and Japan. Logistics providers such as Maersk and CEVA Logistics play a crucial role in facilitating the transportation of these goods.

Furthermore, advanced technologies like MRI scanners, Cath labs, and digital radiography, as well as CT scanners, are essential in the pharma industry for ensuring product quality and compliance with regulations. Singapore's strategic location and well-established infrastructure make it an ideal hub for these logistics activities. The Singaporean government supports the growth of the 3PL market through initiatives like the Goods and Services Tax (GST) and Foreign Direct Investment (FDI) regulations. Additionally, the Sagarmala project aims to modernize India's ports, creating new opportunities for Singaporean logistics companies. By streamlining supply chain processes, 3PLs contribute significantly to the efficiency and competitiveness of the pharma industry in Singapore and beyond.

Singapore 3Pl Market Trends

Technology advancement bolstering market growth is the upcoming trend in the market. Three-party logistics (3PL) providers in Singapore are leveraging advanced technologies to enhance their logistics and distribution services. Inventory management, cross-docking, and customer experience are key areas where technology is making a significant impact. By implementing automation and robotic technologies, 3PLs are able to streamline their operations and mitigate risks associated with labor constraints and supply chain challenges. Moreover, data-driven ordering, warehousing, and transportation solutions are enabling better communication and increased visibility for all stakeholders. These technologies allow for real-time tracking of inventory levels, optimized transportation modes, and improved service types. As a result, 3PLs are able to offer more scalable solutions, asset utilization, and asset sharing alliances to their clients.

The adoption of technology in logistics is expected to drive growth in the market during the forecast period. 3PLs are adopting a range of transportation modes and service types to cater to the diverse needs of their clients. Dedicated contract carriage is a popular choice for businesses seeking reliable and consistent transportation solutions. By partnering with 3PLs, businesses can benefit from their expertise in logistics and distribution, while focusing on their core business operations. Overall, the use of technology in logistics is transforming the industry, offering opportunities for business growth and improved customer experiences.

Singapore 3Pl Market Challenge

High operation costs is a key challenge affecting the market growth. In the logistics sector, third-party logistics (3PL) providers face challenges due to escalating fuel costs. These expenses account for a significant portion of their business operations, making high fuel prices detrimental to revenue. The logistics industry's competitiveness has intensified, with an increasing demand for value-added services (VAS) and specialized professional supply chain solutions.

Consequently, providers are under immense pressure to maintain low service prices. The escalating fuel costs will increase operational expenses, potentially hindering market growth during the forecast period. In Singapore, key players include Jhajjar from Haryana, India, as well as Groupe ADP, GMR Airports, and GMR Infrastructure. Additionally, international players like DP World and National Investment Infrastructure are also present in the market. These companies offer a range of services, from freight forwarding to warehousing and transportation management, to cater to diverse client needs.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Agility Public Warehousing Co. - The company offers third-party logistics with quality and quantity inspections and arranges outbound processes for automotive components.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Agility Public Warehousing Co. K.S.C.P

- Bertschi AG

- CEVA Logistics

- CWT Pte. Ltd.

- DB Schenker

- Deutsche Post AG

- GEODIS

- Kuehne Nagel Management AG

- MXHL Pte Ltd.

- Naigai Nitto Singapore Pte Ltd.

- Ninja Van Group

- Nippon Express Holdings Inc.

- Rhenus SE and Co. KG

- SDR LOGISTICS PTE. LTD.

- Singapore Post Ltd.

- Toll Holdings Ltd.

- United Parcel Service Inc.

- Whitebox Pte Ltd.

- XPO Inc.

- Yang Kee Logistics Pte. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is a vital component of the country's logistics and distribution sector, playing a crucial role in inventory management, customer experience, business growth, and core operations for various industries. With a focus on scalability and risk mitigation, 3PL providers offer a range of services, including cross-docking, freight management, and transportation modes, catering to e-commerce companies, international deliveries, and trading activities. Singapore's economic strength and central location make it an essential hub for global trade, with a diverse range of service types, including dedicated contract carriage, cold chain, and coastal transportation. The country's logistics infrastructure is strong, with container freight stations, inland container depots, and logistics parks, ensuring efficient movement of goods through railways, aviation, and road networks.

Furthermore, the healthcare sector, particularly the pharma industry, benefits significantly from 3PL services, with the secure and timely delivery of prescription drugs, MRI scanners, cath labs, and digital radiography equipment. The government's initiatives, such as the National Logistics Portal and Sagarmala, further enhance the country's logistics capabilities, fostering long-term partnerships and asset sharing alliances. E-commerce companies and in-house teams leverage advanced logistics software for shipment management, delivery process monitoring, and last-mile connectivity, ensuring seamless crossborder trade and economic growth. The regulatory environment, including GST and FDI regulations, supports the growth of 3PL providers, enabling them to cater to the diverse needs of businesses in Singapore and the overseas market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

133 |

|

Base year |

2023 |

|

Historic period |

2017-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.78% |

|

Market growth 2024-2028 |

USD 1.61 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.23 |

|

Key companies profiled |

Agility Public Warehousing Co. K.S.C.P, Bertschi AG, CEVA Logistics, CWT Pte. Ltd., DB Schenker, Deutsche Post AG, GEODIS, Kuehne Nagel Management AG, MXHL Pte Ltd., Naigai Nitto Singapore Pte Ltd., Ninja Van Group, Nippon Express Holdings Inc., Rhenus SE and Co. KG, SDR LOGISTICS PTE. LTD., Singapore Post Ltd., Toll Holdings Ltd., United Parcel Service Inc., Whitebox Pte Ltd., XPO Inc., and Yang Kee Logistics Pte. Ltd. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles,market forecast , fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Singapore

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch