Slot Machine Market Size 2025-2029

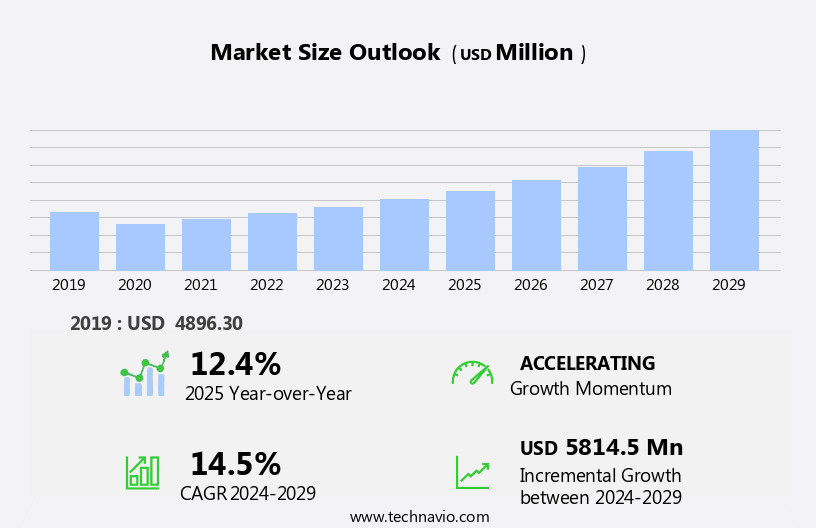

The slot machine market size is forecast to increase by USD 5.81 billion, at a CAGR of 14.5% between 2024 and 2029.

- The market is witnessing significant growth, driven by the increasing involvement of companies in this sector. This expanding industry is fueled by favorable regulatory policies that encourage the establishment and operation of casinos and gaming venues. However, the market faces challenges, primarily in the form of rising fraud cases. These incidents threaten the integrity and reputation of slot machine operators, necessitating robust security measures to mitigate risks and maintain customer trust. Companies must navigate these challenges while capitalizing on the market's potential for growth. By implementing advanced security technologies and adhering to regulatory guidelines, businesses can effectively address fraud concerns and strengthen their market position.

- This strategic approach will enable them to thrive in the dynamic and evolving the market.

What will be the Size of the Slot Machine Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market activities unfolding across various sectors. Player authentication and anti-money laundering (AML) measures are increasingly integrated into slot machines to ensure regulatory compliance and maintain a secure gaming environment. Network infrastructure, including network switches and sound systems, are essential components that enable seamless gameplay and enhance the overall casino experience. Loyalty programs and bonus rounds offer incentives to keep players engaged, while fraud prevention and game engine technologies ensure fair play and maintain the integrity of the games. Data security and payment processing are crucial elements that protect player information and ensure secure transactions.

Mobile optimization and mobile casinos have gained significant traction, with software providers focusing on UI/UX design and game development to cater to the unique needs of mobile users. Quality assurance (QA) and technical support are essential to ensure the smooth functioning of games and address any player concerns. Game testing, responsible gaming, customer support, and server capacity are other critical areas that require continuous attention to maintain player satisfaction and ensure a positive gaming experience. Sound effects and touchscreen displays add to the immersive gaming experience, while energy efficiency and social responsibility are becoming increasingly important considerations for casino operators.

Risk management and gaming regulation are ongoing concerns for the industry, with free spins and other promotional offers requiring careful monitoring to prevent fraudulent activities. Overall, the market is characterized by continuous innovation and adaptation to meet the evolving needs and preferences of players.

How is this Slot Machine Industry segmented?

The slot machine industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Casino

- Others

- Product

- Digital

- Mechanical

- Geography

- North America

- US

- Canada

- Europe

- France

- Italy

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

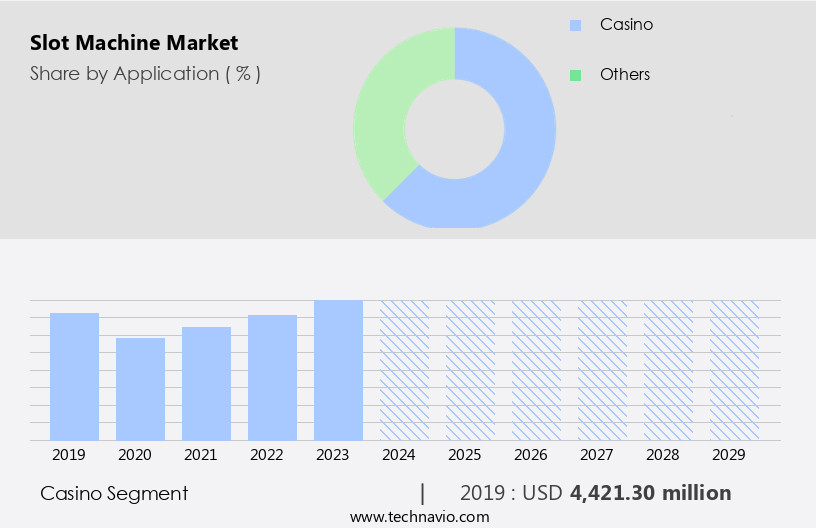

The casino segment is estimated to witness significant growth during the forecast period.

The market is experiencing notable growth within the casino industry, driven by the increasing popularity of casinos as entertainment destinations in regions such as North America, Europe, and APAC. This expansion is fueled by the introduction of advanced slot machines featuring innovations like virtual reality, touchscreens, and mobile connectivity. These technologies enhance the player experience, attracting more patrons to casinos. Game testing plays a crucial role in ensuring the fairness and functionality of these machines. Scatter symbols and wild symbols are integral components of slot machines, adding excitement and potential for increased winnings. Hit frequency, the average number of spins it takes for a player to win, is another essential factor influencing player engagement.

Progressive jackpots, which increase each time the game is played but not won, add to the allure of slot machines. Data analytics and mobile optimization enable casinos to better understand player behavior and preferences, tailoring promotions and rewards through loyalty programs and bonus rounds. Quality assurance, player authentication, and anti-money laundering measures are essential for maintaining a secure and responsible gaming environment. Network infrastructure, including network switches and sound systems, ensures seamless connectivity and an immersive gaming experience. Fraud prevention, game engine, data security, and payment processing are critical components in maintaining the integrity of the market.

Game development, risk management, and technical support ensure the continuous improvement and evolution of slot machines. Online casinos and mobile casinos offer convenience and accessibility, further expanding the market's reach. Social responsibility and customer support are essential in ensuring a positive player experience. Server capacity, user interface, software provider, gaming terminals, and responsible gaming initiatives are key considerations for casino operators. Energy efficiency and environmental impact are increasingly important factors in the development and implementation of slot machines. Sound effects and touchscreen displays add to the overall gaming experience, making slot machines a dynamic and engaging form of entertainment.

The Casino segment was valued at USD 4.42 billion in 2019 and showed a gradual increase during the forecast period.

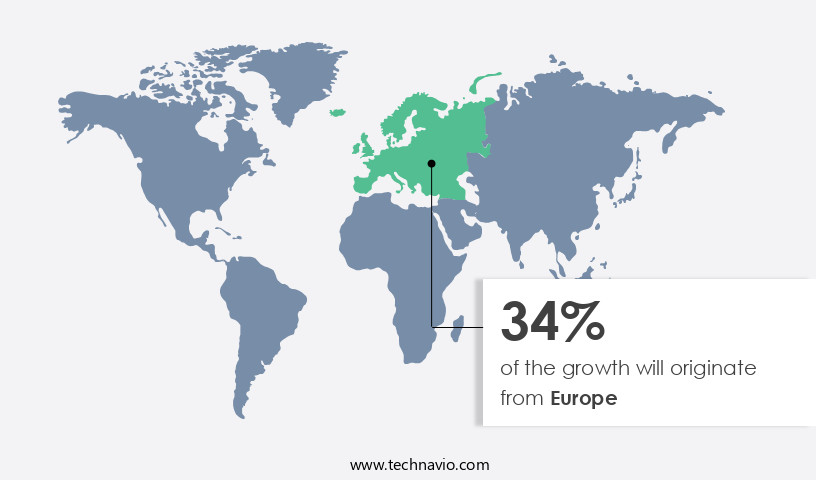

Regional Analysis

Europe is estimated to contribute 34% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The European the market is experiencing significant growth, fueled by the evolving regulatory landscape in key countries such as the UK, Germany, Italy, Spain, Sweden, Poland, the Netherlands, Morocco, and Ireland. European governments are implementing regulations to liberalize gambling, ensuring equitable and transparent gaming experiences for consumers. The EU sets guidelines for member states, focusing on consumer protection. This includes measures to prevent fraud and manipulation, data security, player authentication, anti-money laundering, and responsible gaming. Slot machine development incorporates advanced technologies, such as data analytics, mobile optimization, and user interface design. Mobile casinos have gained popularity, offering convenience and accessibility to players.

Game testing, quality assurance, and risk management are crucial to maintaining fair play and player satisfaction. Slot machines feature essential elements like scatter symbols, wild symbols, hit frequency, and bonus rounds, creating engaging and immersive gaming experiences. Progressive jackpots and loyalty programs incentivize players, while sound systems and touchscreen displays enhance the overall gaming experience. Network infrastructure, server capacity, and technical support are essential components of the market, ensuring seamless gameplay and minimal downtime. Software providers collaborate with operators to deliver innovative games, incorporating features like game engines, fraud prevention, and energy efficiency. Gaming regulation, player behavior analysis, and social responsibility are essential aspects of the market, ensuring a safe and enjoyable gaming environment for all players.

Payment processing and data security are crucial to maintaining customer trust and protecting sensitive information.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Slot Machine Industry?

- The active participation of growing companies significantly contributes to market expansion and growth.

- The market is experiencing significant growth due to the increasing number of land-based casinos and the subsequent demand for advanced gaming solutions. Companies in this market are responding by introducing new product launches to expand their offerings and attract consumers with innovative features. These new slot machines often include enhancements such as scatter symbols and wild symbols to increase hit frequency and excitement. Furthermore, the market is seeing a shift towards mobile optimization and mobile casinos, requiring companies to invest in data analytics and quality assurance (QA) to ensure seamless user experiences.

- Progressive jackpots continue to be a popular feature, driving consumer interest and sales. Companies are also focusing on game testing and research and development to deliver high-quality, immersive, and harmonious gaming experiences.

What are the market trends shaping the Slot Machine Industry?

- Professional and knowledgeable assessment: Favorable regulatory policies represent a significant market trend in the business landscape. This trend signifies increasing government support for industries through regulatory frameworks that encourage growth and innovation.

- Slot machines have become a significant contributor to the global economy, with governments relaxing regulations and allowing casinos to generate revenue. The gambling industry's importance is evident in various countries, contributing substantially to their Gross Domestic Product. The payout percentage for slot machines is regulated by government laws, with casinos allowed to set rates above 85%. Any change to a slot machine's payout rate requires approval from the gambling commission and an inspection. To ensure a fair and secure gaming environment, various technological advancements have been integrated into slot machines. Player authentication and anti-money laundering (AML) systems are essential components, safeguarding both the casino and the players.

- Network infrastructure, including network switches, is crucial for seamless communication between machines and the casino's management system. Sound systems and loyalty programs add to the immersive experience for players, while bonus rounds and game engines offer engaging and interactive features. Fraud prevention measures, such as data security and game integrity checks, are essential to protect both the casino and the players from potential threats. With the increasing importance of data security, advanced encryption techniques and secure data storage solutions are employed to protect sensitive information. In conclusion, the market is a dynamic and evolving industry, driven by technological advancements and regulatory requirements.

- The integration of player authentication, AML systems, network infrastructure, sound systems, loyalty programs, bonus rounds, fraud prevention, game engines, and data security ensures a secure and engaging gaming experience for players.

What challenges does the Slot Machine Industry face during its growth?

- The escalating prevalence of fraud cases poses a significant challenge to the industry's growth trajectory.

- The market is a dynamic and evolving industry, driven by advancements in game development, payment processing, and user interface (UI). Game developers continuously innovate to create immersive and harmonious gaming experiences, utilizing the latest software and technologies. Payment processing solutions ensure secure and efficient transactions, while customer support and responsible gaming initiatives prioritize social responsibility. However, the industry faces challenges from illegal activities, such as tampering with slot machines. Some casino owners alter machines to limit betting options, draining potential revenue from the regulated gambling sector. Unregulated gaming terminals, or gray machines, also pose a threat. Installed in non-traditional locations like gas stations, veterans homes, union halls, and fraternal lodges, these machines operate outside the gambling ecosystem and evade taxes and fees.

- To maintain a professional and trustworthy environment, it's crucial for stakeholders to adhere to ethical business practices and regulatory guidelines. This not only ensures fair play but also fosters consumer confidence and trust in the industry. By focusing on innovation, security, and social responsibility, the market can continue to grow and thrive.

Exclusive Customer Landscape

The slot machine market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the slot machine market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, slot machine market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Accel Entertainment Inc. - The company specializes in providing a diverse range of slot machine solutions, including those from WMS and ARISTOCRAT.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accel Entertainment Inc.

- AMATIC Industries GmbH

- APEX pro gaming s.r.o

- APOLLO SOFT s.r.o.

- Aries Technology LLC

- Aristocrat Leisure Ltd.

- Aruze Gaming America Inc.

- Eclipse Gaming Systems

- Everi Holdings Inc.

- Incredible Technologies Inc.

- Inspired Entertainment Inc.

- Interblock dd

- International Game Technology plc

- JPM Interactive Ltd.

- Konami Group Corp.

- NOVOMATIC AG

- PlayAGS Inc.

- Recreativos Franco SAU

- Scientific Games LLC

- Universal Entertainment Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Slot Machine Market

- In January 2024, International Game Technology (IGT) announced the launch of its new multi-game progressive system, MegaJackpots Cleopatra, in partnership with Caesars Entertainment. This strategic collaboration expanded IGT's presence in the US land-based casino market and marked a significant development in the slot machine industry (IGT Press Release).

- In March 2024, Scientific Games Corporation completed the acquisition of Playzido, a leading developer of real money and social casino games. This strategic move enabled Scientific Games to expand its digital gaming portfolio and strengthen its position in the rapidly growing online casino market (Scientific Games Press Release).

- In May 2024, the Malta Gaming Authority (MGA) granted a license to Aristocrat Technologies for its new online casino platform, Aristocrat Play. This regulatory approval marked a major milestone in Aristocrat's digital transformation strategy and allowed the company to enter the European online gaming market (MGA Press Release).

- In April 2025, Konami Gaming unveiled its new SYNKROS 360 casino management system at the Global Gaming Expo. This technological advancement offered enhanced analytics and marketing capabilities, enabling casinos to optimize their slot machine operations and player engagement strategies (Konami Gaming Press Release).

Research Analyst Overview

- In the dynamic market, network security and server security are paramount as machine learning (ML) and artificial intelligence (AI) integration increase. Cashless gaming, a key trend, necessitates hardware upgrades and maintenance schedules. Gamified experiences and interactive content require platform compatibility, while augmented reality (AR) and virtual reality (VR) implementations demand performance monitoring and user experience (UX) enhancements. Betting options expand with blockchain technology integration and cryptocurrency acceptance. Sustainability practices, including energy-saving features and software updates, are essential for long-term success.

- Security protocols and data encryption safeguard player data. Game optimization, win lines, and bonus features continue to drive design innovation. Game integration and cloud computing enable seamless user experiences. Game mechanics and ML algorithms offer new ways to engage players, ensuring a competitive edge in this ever-evolving market.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Slot Machine Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

190 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 14.5% |

|

Market growth 2025-2029 |

USD 5814.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

12.4 |

|

Key countries |

US, China, UK, Italy, France, Canada, Japan, Brazil, India, and UAE |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Slot Machine Market Research and Growth Report?

- CAGR of the Slot Machine industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the slot machine market growth of industry companies

We can help! Our analysts can customize this slot machine market research report to meet your requirements.