Smart Bed Market Size 2024-2028

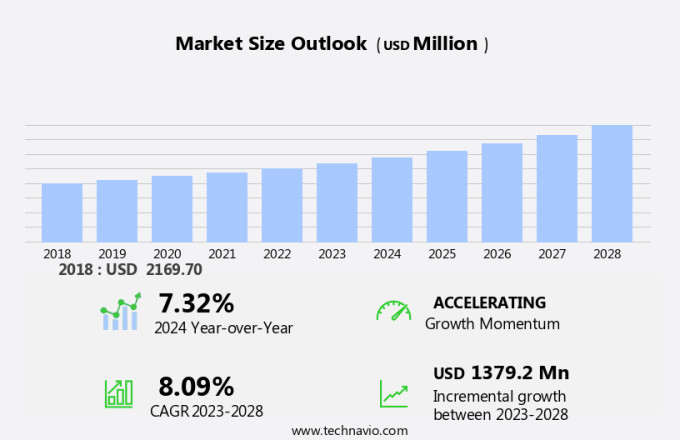

The smart bed market size is forecast to increase by USD 1.38 billion at a CAGR of 8.09% between 2023 and 2028.

- The market is experiencing significant growth due to several key trends. Firstly, there is an increasing investment in sleep technology, as people become more conscious of the importance of quality sleep for overall health and well-being. This has led to the rising adoption of technology-driven beds that offer features such as adjustable firmness, temperature control, and sleep tracking. The integration of AI, machine learning, and big data analytics enhances user experience and provides cardiovascular disorder management, alarm systems for heart attacks, and anti-snoring features. However, the market also faces challenges, including the presence of counterfeit products that may compromise consumer safety and trust. Manufacturers must ensure the authenticity and quality of their products to maintain market competitiveness and customer loyalty.

What will be the Size of the Smart Bed Market During the Forecast Period?

- The market is experiencing significant growth as sleep technology integrates with the expanding smart home industry. Homeowners are prioritizing quality sleep and investing in advanced solutions to enhance their residential living experiences. Smart beds offer body temperature regulation, adjustable bases, and sleep tracking features, addressing individual comfort needs and improving overall sleep quality. These beds also cater to healthcare facilities for patient care, with state governments recognizing the importance of patient management and recovery through enhanced healthcare solutions.

- Cardiovascular disorders, sleep apnea, and snoring are among the health conditions that smart beds aim to address, providing user-friendly experiences and seamless integration with IoT, home automation systems, and smart fabric technology. The young population's increasing focus on health and wellness further fuels market demand, making smart beds an attractive option for both residential and commercial purposes.

How is this Smart Bed Industry segmented and which is the largest segment?

The smart bed industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Healthcare

- Residential

- Hospitality

- Distribution Channel

- Offline

- Online

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- APAC

- Japan

- South America

- Middle East and Africa

- North America

By Application Insights

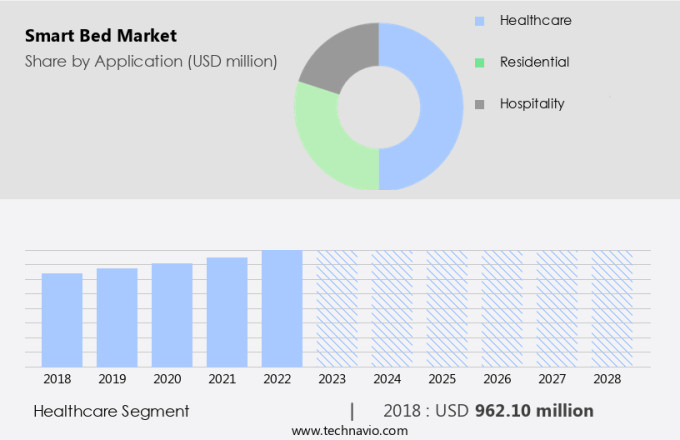

- The healthcare segment is estimated to witness significant growth during the forecast period.

The market is experiencing growth due to its increasing application In the healthcare sector, where it plays a crucial role in enhancing patient care. In hospitals, smart beds are utilized for patient management and recovery, offering numerous health benefits. The healthcare segment's expansion of smart bed technology is driven by ongoing advancements, enabling hospitals to provide superior care. Government investments in hospital technology upgrades and the integration of IoT in healthcare applications are expected to further fuel market growth. Homeowners, too, are embracing smart beds for residential purposes, seeking enhanced comfort and personalized sleeping solutions. The market expansion is also influenced by the growing awareness of sleep health, the aging population, and the prevalence of lifestyle diseases.

Smart beds offer climate control, adjustable firmness, sleep tracking, and connectivity to home automation systems, making them an attractive option for both residential and commercial uses.

Get a glance at the Smart Bed Industry report of share of various segments Request Free Sample

The healthcare segment was valued at USD 962.10 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

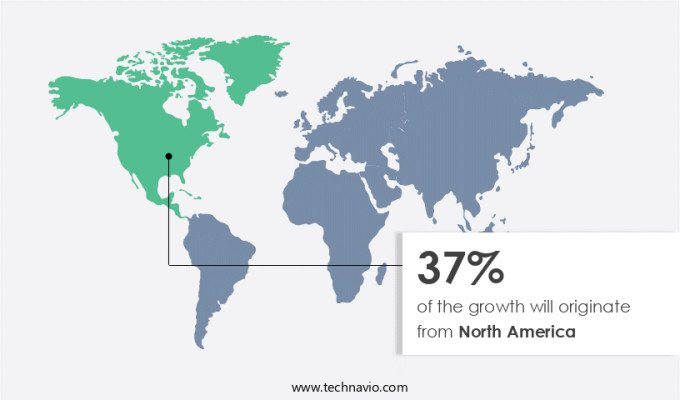

- North America is estimated to contribute 37% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American market dominates the global smart bed industry due to the growing popularity of smart homes and the increasing demand for comfort and luxury among homeowners. Consequently, expenditure on smart home products, including smart beds, has risen significantly. These beds offer advanced features such as sleep tracking, climate control, adjustable firmness, and temperature control, catering to the user's comfort and health needs.

Additionally, the aging population and the rise of lifestyle diseases have fueled the demand for enhanced healthcare solutions, including smart beds, in both residential and commercial settings, such as hospitals, patient care facilities, and hotels. The integration of IoT, smart home connectivity, and voice command technology further enhances the user experience and convenience.

Market Dynamics

Our smart bed market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Smart Bed Industry?

Increasing investments in sleep technology is the key driver of the market.

- The market In the US is experiencing significant growth due to the increasing demand for technology-driven home solutions that prioritize quality sleep and comfort. Smart homes, a key trend in residential and commercial sectors, are integrating advanced sleep technology into their offerings. This includes sleep tracking, climate control, adjustable bases, and anti-snoring features. The Sleep Number survey indicates that 62% of Americans prioritize sleep health awareness, making personalized sleeping solutions a priority. State governments and patient care facilities In the healthcare sector are also adopting smart beds for patient management and recovery, enhancing healthcare services. Specialty stores, supermarkets, hospitality industries, and even luxury bedding brands are catering to this demand.

- IoT and smart home connectivity are integral to these products, allowing users to control their sleep environment with voice commands and smart home integration. The young population and aging population, both susceptible to lifestyle diseases and cardiovascular disorders, are major consumer groups. Smart beds offer alarm systems for heart attacks and sleep apnea, making them essential for patient care. Manual, semi-automatic, and fully automatic smart beds cater to various user preferences and needs. Advancements in smart fabric technology, adjustable firmness, and temperature control further add value to these connected devices. Big data analytics, artificial intelligence, and machine learning are being employed to customize user experiences and optimize sleep patterns. The future of smart beds lies In their ability to improve overall health and well-being, making them an investment worth considering.

What are the market trends shaping the Smart Bed Industry?

The rising adoption of technology-driven devices is the upcoming market trend.

- The market is experiencing significant growth due to the increasing demand for technology-driven solutions that prioritize quality sleep and overall health. Homeowners, particularly the young population, are embracing sleep technology as a means to enhance their residential experiences and address lifestyle diseases. Smart beds offer advanced features such as climate control, adjustable bases, sleep tracking, and IoT connectivity, providing users with personalized sleeping solutions. In healthcare settings, smart beds have become essential tools for patient management and recovery, offering enhanced healthcare benefits for cardiovascular disorders, sleep apnea, and heart attack patients. These beds often include alarm systems and manual, semi-automatic, or fully-automatic adjustments for patient comfort and recovery.

- The integration of artificial intelligence, machine learning, and big data analytics further elevates the user experience by providing customized temperature control, voice commands, and smart home integration. Luxury bedding brands and hospitality industries are also adopting these advanced technologies to cater to commercial purposes. The market is continually evolving, with market companies introducing innovative products. As sleep health awareness increases, the market is expected to grow further, offering a range of connected devices and adjustable firmness options to cater to diverse consumer needs.

What challenges does the Smart Bed Industry face during its growth?

The presence of counterfeit products is a key challenge affecting the industry's growth.

- The market In the US is experiencing significant growth due to the increasing adoption of sleep technology in both residential and commercial purposes. Smart homes have become a popular trend, with homeowners integrating advanced features to enhance comfort and improve health benefits. Sleep technology, including smart beds, is a key component of this trend. Quality sleep is a priority for many Americans, leading to an increased demand for smart beds with climate control, sleep tracking, adjustable firmness, and anti-snoring features. According to a Sleep Number survey, 62% of Americans prioritize comfort when it comes to their mattresses. This preference has opened up opportunities for manufacturers to produce smart beds with advanced features.

- Patient care facilities, hospitals, and specialty stores are also adopting smart beds for patient management and recovery, enhancing healthcare services. IoT and smart home connectivity have made it possible to integrate these beds with home automation systems, allowing users to control temperature, alarm settings, and other features using voice commands or smartphone apps. The aging population and lifestyle diseases such as cardiovascular disorders have further boosted the demand for smart beds. Artificial intelligence, machine learning, and big data analytics are being used to develop personalized sleeping solutions, providing users with enhanced comfort and health benefits. Despite the market's potential, the availability of counterfeit smart beds poses a challenge.

Exclusive Customer Landscape

The smart bed market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the smart bed market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, smart bed market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Arjo AB

- Balluga Ltd.

- Baxter International Inc.

- Besco Medical Ltd.

- Boyd Sleep

- CVB Inc.

- Dires LLC

- Eight Sleep Inc.

- Invacare Corp.

- IOF srl

- Joerns Healthcare LLC

- LINET Group SE

- PARAMOUNT BED HOLDINGS CO. LTD.

- ReST

- Rize Home

- SK Furniture and Decoraters

- Sleep Number Corp.

- Stryker Corp.

- The Sleep Co.

- Ultimate Smart Bed

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is experiencing significant growth as homeowners increasingly prioritize quality sleep and seek innovative solutions to enhance their overall well-being. Sleep technology, a key component of the smart home revolution, has gained popularity due to its ability to provide customized comfort and health benefits. Smart beds are not just mattresses; they are advanced systems designed to optimize the user experience. These beds offer climate control, adjustable firmness, and temperature regulation, among other features. Some models even incorporate smart fabric technology and IoT connectivity, allowing users to monitor their sleep patterns and adjust settings through voice command or home automation systems.

Moreover, the demand for smart beds is driven by various factors. The young population's growing awareness of sleep health and the aging population's need for enhanced healthcare solutions are significant contributors. Additionally, the integration of artificial intelligence, machine learning, and big data analytics in sleep technology has led to personalized sleeping solutions that cater to individual needs. Cardiovascular disorders, sleep apnea, and other lifestyle diseases are increasingly common health concerns. Smart beds offer anti-snoring features and alarm systems that can detect and respond to potential health issues, making them an attractive option for those seeking improved patient management and recovery.

Furthermore, the market for smart beds is diverse, with applications ranging from residential to commercial purposes. Specialty stores and supermarkets offer a wide range of options, while hospitality industries use these beds to provide guests with a luxurious and comfortable experience. The integration of smart beds into the home automation ecosystem offers numerous benefits. Users can synchronize their bed settings with other smart home devices, creating a cohesive and convenient living environment. This connectivity enhances the overall user experience and makes it easier for individuals to prioritize their health and well-being.

|

Smart Bed Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

167 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.09% |

|

Market Growth 2024-2028 |

USD 1.38 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.32 |

|

Key countries |

US, Germany, Canada, UK, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Smart Bed Market Research and Growth Report?

- CAGR of the Smart Bed industry during the forecast period

- Detailed information on factors that will drive the Smart Bed market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution to the industry in focus on the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the smart bed market growth of industry companies

We can help! Our analysts can customize this smart bed market research report to meet your requirements.