Software Localization Market Size 2025-2029

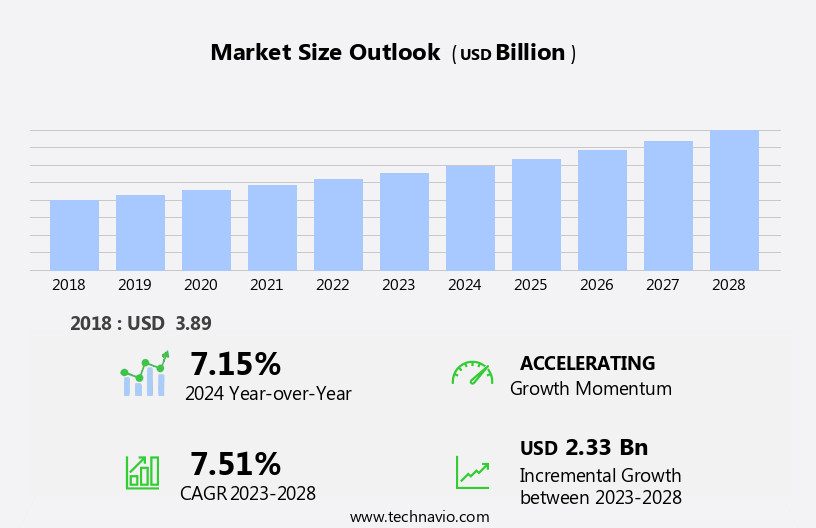

The software localization market size is forecast to increase by USD 2.69 billion at a CAGR of 8% between 2024 and 2029.

- The market is experiencing significant growth, driven by the digital transformation and increasing software adoption in businesses worldwide. Companies are recognizing the importance of expanding their reach into new markets by offering locally relevant software solutions. However, the market also faces challenges, primarily the linguistic and cultural complexity associated with software localization. Navigating these complexities requires a deep understanding of the target market's language, culture, and business practices. Effective localization strategies must balance technical accuracy with cultural sensitivity to ensure user acceptance and satisfaction.

- Companies seeking to capitalize on market opportunities and navigate challenges effectively should invest in building a strong localization team or partnering with experienced localization service providers. By addressing these challenges, businesses can successfully expand their software offerings into new markets, driving growth and increasing their competitive edge. Use of artificial intelligence (AI) for enhanced translation and localization processes will help in market expansion, enabling faster and more accurate localization.

What will be the Size of the Software Localization Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

- The market encompasses the processes and technologies required to adapt digital content, including websites and applications, to linguistic and cultural requirements of various regions. The market is experiencing significant growth, driven by the increasing importance of language diversity in business to expand global reach. Localization metrics analysis plays a crucial role in evaluating the success of localization initiatives, while language pair selection is a critical aspect of localization company selection. Brand localization strategies require cultural sensitivity and linguistic analysis to ensure effective communication with international audiences. Technical documentation localization and help desk localization are essential components of the localization process, which also includes subtitling services, translation services, interpretation services, and voiceover services. Localization reporting and project management tools facilitate efficient localization outsourcing and in-house localization.

- The localization ecosystem encompasses a range of global marketing, as well as localization training and consulting. Software localization testing ensures quality and accuracy in the localization lifecycle, while the use of localization testing tools streamlines the process. The localization team must navigate the localization process, from content localization to globalization services, to successfully expand a business's global reach.

How is this Software Localization Industry segmented?

The software localization industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Large enterprises

- SMEs

- Component

- Software

- Service

- Type

- Computer-assisted TS

- Machine TS

- TMS

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

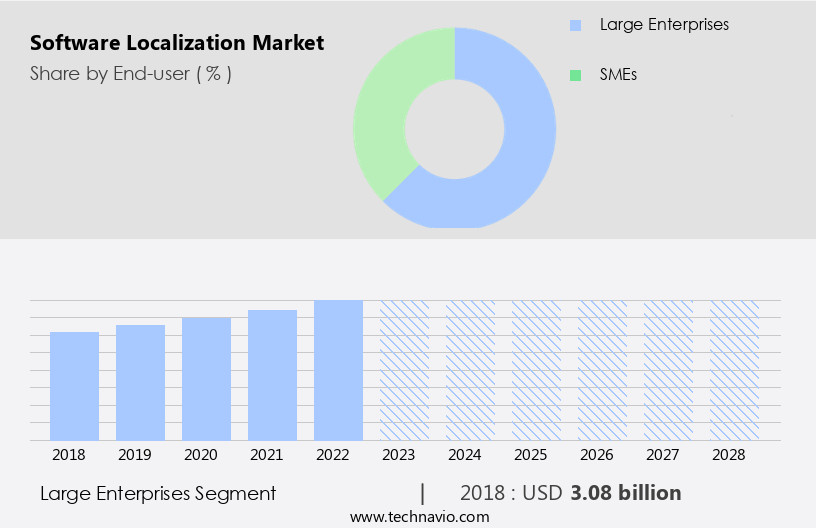

By End-user Insights

The large enterprises segment is estimated to witness significant growth during the forecast period. The market is a significant and growing sector, with large enterprises leading the charge. These businesses, which often have a global presence, recognize the importance of tailoring software products to diverse linguistic and cultural contexts. Localization goes beyond mere language translation, involving customization of user interfaces, content, and functionalities to meet the unique preferences of each target market. This includes adjustments to date formats, currency symbols, legal terminology, and more. Usability testing and linguistic quality assurance are crucial components of the localization process to ensure a seamless user experience. Localization automation, translation memory, and machine translation are essential tools in this regard.

Content management systems and localization platforms facilitate the efficient management of multilingual content. Localization engineering and project management tools help streamline the localization workflow. E-commerce localization and mobile app localization are increasingly important as businesses expand their online presence. APIs and software development kits enable seamless integration of localized functionalities. Localization costs can be mitigated through the use of terminology management and translation memory systems. Style guides ensure consistency across translations. Marketing materials localization and user experience localization are essential for effective global marketing campaigns. Game localization and cultural adaptation are important considerations for businesses targeting specific markets. Backend code internationalization and the use of translation memory, software, dictionaries, and other language assets facilitate efficient and consistent localization.

The Large enterprises segment was valued at USD 3.28 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

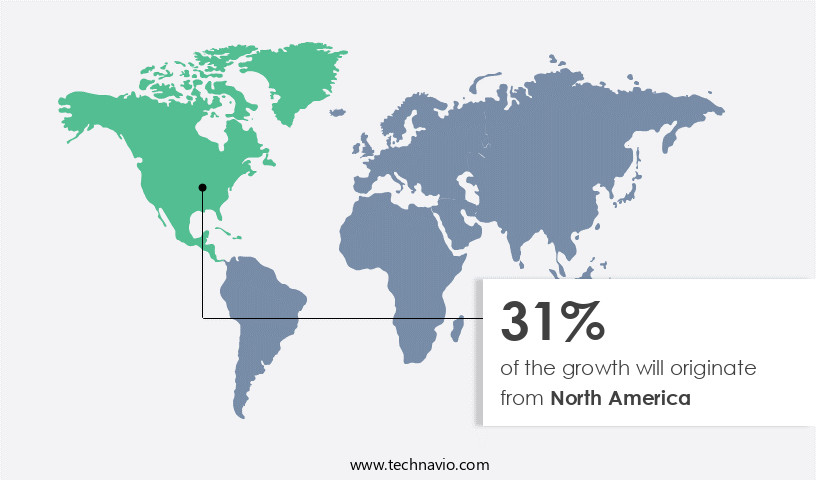

North America is estimated to contribute 45% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the North American market, businesses are recognizing the significance of software localization as they expand their global operations. With over 350 languages spoken in the region, catering to the linguistic and cultural preferences of international users is essential for seamless market entry and user adoption. Localization involves adapting software products to specific languages and cultural nuances, enabling businesses to reach diverse markets. Localization metrics, such as return on investment and linguistic quality assurance, play a crucial role in ensuring the success of globalization strategies. Usability testing and style guides are employed to maintain consistency and user experience across different languages and platforms.

Localization testing, translation memory, and machine translation are integral to the localization process, while localization engineering and project management tools facilitate efficient workflows. E-commerce localization, mobile app localization, and website localization are increasingly important in today's digital landscape. API integration and localization standards ensure compatibility and seamless integration with existing systems. Cloud-based localization and content management systems enable real-time updates and centralized management of multilingual content. Language service providers, translation management systems, and localization platforms offer expertise and solutions to businesses looking to expand their reach. Neural machine translation and user experience localization enhance the overall user experience, while cultural adaptation and game localization cater to specific markets. Terminology management and software development kits ensure consistency and accuracy in the localized content. Localization best practices, such as cultural awareness and localization expertise, are essential for successful global expansion. Companies must prioritize these aspects to effectively penetrate new markets and build a strong brand presence.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Software Localization market drivers leading to the rise in the adoption of Industry?

- Digital transformation and the adoption of software solutions are essential drivers propelling market growth in businesses. The market experiences significant growth due to the increasing globalization strategies of businesses and the need for market penetration in diverse regions. As companies expand their digital presence, they recognize the importance of providing software solutions that cater to various languages, cultures, and user preferences. Localization processes, including usability testing, style guides, localization testing, marketing materials localization, and user interface localization, ensure a deep user experience. Linguistic quality assurance is a crucial component of software localization, as it guarantees the accuracy and appropriateness of translated content.

- The return on investment from software localization is substantial, as it allows businesses to reach new audiences and increase customer engagement.

What are the Software Localization market trends shaping the Industry?

- Artificial intelligence (AI) is increasingly being utilized for advanced translation and localization in the market, which in turn is a major trend shaping the industry. This trend reflects the importance of AI in enhancing the accuracy and efficiency of language services. The market is experiencing notable growth due to the increasing requirement for localized software solutions among businesses aiming to expand their global presence. Artificial Intelligence (AI) is revolutionizing the industry, providing enhancements in machine translation (MT) and natural language processing (NLP) that improve localization accuracy, efficiency, and cost-effectiveness. AI-driven tools automate repetitive tasks, such as content analysis, translation, and terminology management, enabling human linguists to concentrate on tasks demanding cultural expertise and contextual comprehension. This automation leads to expedited localization workflows and cost savings, enabling businesses to localize their software products for a broader range of languages and markets.

- Content management systems, localization automation, translation memory, and localization engineering are essential components of this process, adhering to localization standards for e-commerce, mobile apps, and API integration.

How does Software Localization market face challenges during its growth?

- The linguistic and cultural complexities inherent in software localization is a major challenge that the market is currently facing. The market caters to the growing demand for global expansion in the tech industry. With over 7,000 languages worldwide, accurately translating software content is a complex process that necessitates deep linguistic expertise and cultural understanding. Cloud-based localization solutions and language service providers offer translation management systems to help businesses manage their localization projects more efficiently. Terminology management is crucial for maintaining consistency in translations, especially for software containing technical jargon and industry-specific terminology. Website localization is essential for businesses aiming to reach a global audience. User experience localization ensures that software adapts to the cultural sensitivities, values, and preferences of the target audience.

- This may involve modifying user interfaces, adapting imagery, and tailoring content to resonate with local customs and traditions. Localization best practices prioritize the importance of preserving the original intent and meaning of the content while ensuring it is culturally appropriate. Game localization poses unique challenges due to its multimedia content and deep nature. Localizing games requires a deep balance between maintaining the game's original tone and adapting it to the target audience. Cultural nuances and language complexities further complicate the process. By following localization best practices and utilizing advanced translation technologies, businesses can successfully expand their software offerings to new markets and reach a broader audience.

Exclusive Customer Landscape

The software localization market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the software localization market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, software localization market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Adobe Inc. - This company specializes in software localization services, encompassing computer software, SaaS applications, mobile software, and technical documentation.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adobe Inc.

- Alchemy Software Development Ltd.

- Alconost, Inc.

- Alphabet Inc.

- ARGOS TRANSLATIONS Sp. z o.o.

- Babylon Software Ltd.

- International Business Machines Corp.

- Lionbridge Technologies LLC

- MateCat

- MemoQ Translation Technologies Ltd.

- Memsource AS

- Microsoft Corp.

- RWS Holdings PLC

- Salesforce Inc.

- SAP SE

- Smartcat Platform Inc.

- Smartling Inc.

- SYSTRAN SA

- Transifex

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Software Localization Market

- In February 2024, leading software localization provider, OneSky, announced the launch of its advanced Neural Machine Translation (NMT) engine, significantly improving translation speed and accuracy for software companies expanding globally (OneSky press release).

- In May 2024, Smartling, another major player in the market, unveiled a strategic partnership with Microsoft to offer seamless localization services for Microsoft Azure customers, expanding Smartling's reach in the cloud computing sector (Smartling press release).

- In August 2024, Memsource, a software localization platform, secured a USD20 million Series C funding round, enabling the company to expand its product offerings and enhance its AI-driven translation technology (Memsource press release).

Research Analyst Overview

The localization market continues to evolve, driven by the globalization strategies of businesses seeking to expand their market penetration. Usability testing and return on investment are key metrics in this dynamic industry, with language proficiency and localization automation playing essential roles. Content management systems and translation memory are integral components of the localization process, enabling seamless handling of marketing materials and maintaining consistency. Machine translation and localization engineering are also vital, with neural machine translation and cloud-based localization pushing the boundaries of technological innovation. E-commerce localization and mobile app localization have gained significant traction, requiring localization workflows that ensure API integration and adherence to localization standards.

The software localization market is thriving as businesses expand globally, making localization strategy essential for seamless adaptation. Companies invest in a localization budget to optimize resources while maintaining localization quality, ensuring culturally relevant and linguistically accurate products. A well-defined localization roadmap helps streamline processes from user manual localization to localization for marketing. Expert localization consulting provides insights into localization vendor selection and whether to opt for localization inhouse or external specialists. Leveraging language data enhances precision, crucial for localization and boosting visibility across diverse markets. Effective localization project management drives efficiency, ensuring success in global expansion.

User interface localization and website localization are also critical, requiring cultural adaptation and linguistic quality assurance. Project management tools and localization platforms facilitate efficient localization processes, while language service providers and translation management systems offer expert linguistic resources and best practices. Localization costs are a constant concern, with terminology management and style guides essential for maintaining consistency and reducing expenses. The localization industry encompasses various sectors, including software development, gaming, and multilingual content creation. Cultural awareness and localization expertise are paramount, with CAT tools and localization tools essential for managing the complexities of the localization process.

Global expansion and user experience localization are ongoing priorities, necessitating continuous adaptation to emerging trends and technologies.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Software Localization Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

203 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8% |

|

Market growth 2025-2029 |

USD 2.69 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.4 |

|

Key countries |

US, China, Germany, Canada, UK, Japan, India, France, Brazil, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Software Localization Market Research and Growth Report?

- CAGR of the Software Localization industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the software localization market growth of industry companies

We can help! Our analysts can customize this software localization market research report to meet your requirements.