Soil Fumigants Market Size 2024-2028

The soil fumigants market size is forecast to increase by USD 142.5 billion at a CAGR of 4.83% between 2023 and 2028. The market is experiencing significant growth due to the increasing demand for root and tuber crops, fruits, and vegetables. Food security concerns are driving the need for effective soil disinfection methods to ensure high crop yields and prevent crop losses. However, the market faces challenges due to the harmful effects of accumulated residues on the environment. Methyl bromide, a widely used soil fumigant, is being phased out due to its ozone-depleting properties. In response, alternative solutions such as potassium chloride are gaining traction as safer options for soil disinfection. These alternatives help mitigate environmental impact while maintaining effective crop protection, ensuring the long-term sustainability of agricultural practices.

Market Analysis

The global agricultural sector is under immense pressure to meet the demands of a growing population while combating various crop diseases that lead to significant post-harvest losses. Soil fumigants have emerged as a crucial solution to enhance agricultural productivity and ensure food security. Soil fumigants are essential chemicals used to control pests and diseases in the soil, thereby improving the overall health and productivity of crops. However, the current agricultural productivity is insufficient to meet this demand, making the use of soil fumigants an indispensable tool for farmers. Crop diseases pose a significant threat to agricultural productivity, leading to substantial post-harvest losses. The use of soil fumigants is particularly important for crops such as cereals, roots and tubers, fruits, and vegetables, which are highly susceptible to soil-borne diseases. These crops form a significant portion of the global food supply, making the effective use of soil fumigants essential for maintaining food security.

Additionally, methyl bromide, a widely used soil fumigant, has been effective in controlling a broad spectrum of pests and diseases. However, its production and use have been phased out due to environmental concerns. These alternatives provide similar benefits while minimizing environmental impact. In conclusion, soil fumigants play a vital role in enhancing agricultural productivity and ensuring food security in the face of rising food demand and crop diseases.

Market Segmentation

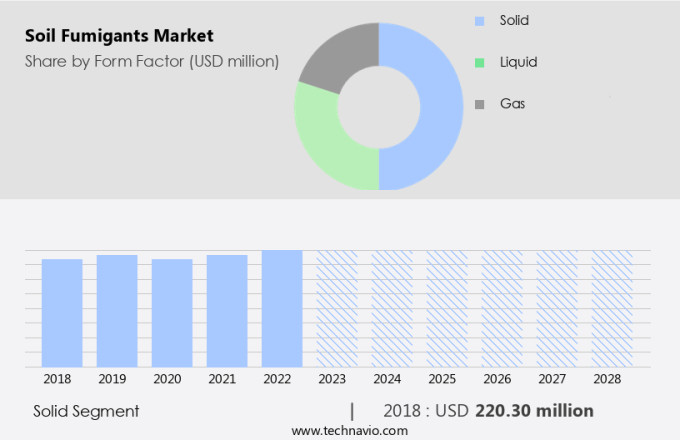

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Form Factor

- Solid

- Liquid

- Gas

- Geography

- APAC

- China

- India

- Japan

- North America

- US

- Europe

- UK

- South America

- Middle East and Africa

- APAC

By Form Factor Insights

The solid segment is estimated to witness significant growth during the forecast period. Soil fumigants are essential pesticide formulations that transform from a liquid or solid into a gas state to eliminate soil-borne pests. These pesticides are available as granules, liquefied gases, or volatile liquids, which are applied to the soil. Upon application, the fumigant is absorbed into the soil, allowing hazardous molecules to pass through the soil's air pores. The volatile nature of these chemicals causes them to volatilize immediately, making it crucial for the pests to come into contact with a lethal concentration for an extended period.

Further, methyl bromide is a widely used soil fumigant, effective against various pests that threaten the growth of root and tuber crops, fruits, and vegetables. The application of these pesticides ensures the protection of crops from soil pests, enhancing agricultural productivity. The high volatility of soil fumigants necessitates proper application techniques to maximize their efficacy and minimize potential environmental risks.

Get a glance at the market share of various segments Request Free Sample

The solid segment accounted for USD 220.30 million in 2018 and showed a gradual increase during the forecast period.

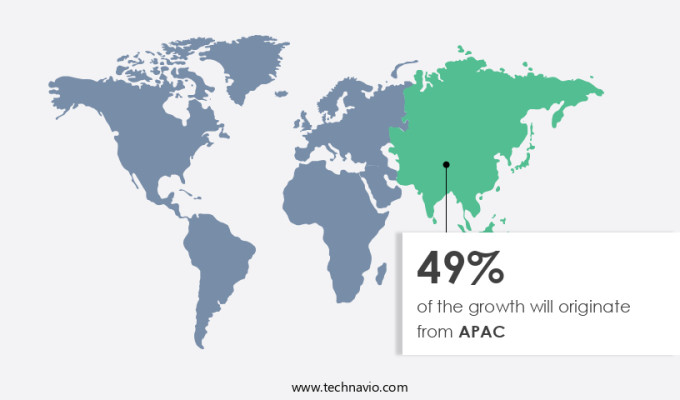

Regional Insights

APAC is estimated to contribute 49% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The Asia Pacific (APAC) region dominates The market due to increasing agricultural productivity and food demand. With a growing population and rising incomes, consumer preferences in this region are shifting towards healthier and nutritious food options. This has led to an increase in demand for agricultural products, particularly in developing countries like China and India. However, the phase-out of methyl bromide, a commonly used soil fumigant, has been approved by most countries. Yet, some nations, such as China, continue to use it extensively for soil decontamination. In its place, alternatives like Ammonia gas fumigation, Phosphine, and Sulfuryl fluoride are gaining popularity.

For instance, Penicillium digitatum and Penicillium italicum, fungi that produce gases like Ammonia and Phosphine, are being explored as natural alternatives to synthetic fumigants. Acrylonitrile, another soil fumigant, is also gaining traction due to its effectiveness against pests and diseases. These developments are expected to shape the future of the market in the APAC region.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Growing awareness of organic soil fumigants is the key driver of the market. In the agricultural sector, there has been a notable decline in soil health due to the extensive application of chemical fertilizers and pesticides. To mitigate this issue, farmers are shifting towards the adoption of organic and bio soil fumigants. These alternatives decompose naturally in the soil, releasing carbon dioxide, methane, and water, which enhance the nutrient content of the soil. Organic soil fumigants are eco-friendly and pose no harm to the soil. Their long-term usage is beneficial in reducing costs and environmental concerns. Some common organic soil fumigants include Carbonyl sulfide, Ethyl formate, Hydrogen cyanide, Carbon disulfide, Methyl iodide, and Methyl isothiocyanate.

These sustainable fumigants help eliminate harmful residues from the soil and promote better farming practices. By incorporating organic soil fumigants into their cultivation methods, farmers can improve soil health and ensure the production of healthier crops.

Market Trends

Food security issues is the upcoming trend in the market. The global food demand is projected to increase by approximately 70% by the year 2050, according to the Food and Agriculture Organization (FAO) of the United Nations. With the world's population continuing to grow at an accelerated rate, an estimated 200,000 new individuals joining the global community every day, ensuring food security has become a pressing concern. Post-harvest losses, primarily due to pests, mites, rodents, and birds, are estimated to waste around 1,300 million metric tons of food annually. To mitigate these losses and maintain agricultural productivity, the application of soil fumigants has emerged as a crucial solution in the global agricultural sector. Further, these substances help manage crop diseases, thereby contributing to the overall success of farming operations. The use of soil fumigants is essential to meet the increasing food demand and maintain global food security.

Market Challenge

The harmful effects of accumulated residue on environment is a key challenge affecting market growth. Soil fumigants, which consist of chemicals such as heavy metals, ammonium nitrate, potassium chloride, and cadmium, are widely used in agriculture to control resistant insects and prevent pest infestations. However, the application of these fumigants comes with challenges. Labor costs for certified fumigators and the use of gas measurement devices add to the overall expense. Governing bodies have set regulations for the safe use of these chemicals to minimize their impact on the environment and human health. Ammonium nitrate, a common component of soil fumigants, is an odorless, colorless, or white crystal salt produced from ammonia and nitric acid. While it is an essential ingredient in fertilizer mixtures, it is also hazardous to the environment and human health and can be used in the manufacture of explosives.

To ensure effective pest control, it is crucial to adhere to the guidelines set by governing bodies and employ the expertise of pest control professionals.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

American Vanguard Corp.: The company offers soil fumigants such as K-PAM HL which is used for the control or suppression of weeds, soil-borne diseases and nematodes.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bayer AG

- China National Chemical Corp. Ltd.

- Corteva Inc.

- Detia Degesch GmbH

- Douglas Products

- Draslovka Services Pty Ltd.

- Eastman Chemical Co.

- Ecotec Fumigation

- Imtrade CropScience

- Isagro Spa

- Lanxess AG

- Nippon Chemical Industrial Co. Ltd.

- Royal Agro Organic Pvt. Ltd.

- Solvay SA

- Tessenderlo Group NV

- TriCal Group Inc.

- TriEst Ag Group Inc.

- Trinity Manufacturing Inc.

- UPL Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The soil fumigant market is driven by the increasing demand for food due to the global population growth and the need to prevent post-harvest losses. Crop diseases and pest attacks are significant challenges in agriculture, leading to decreased agricultural productivity and food security. Soil fumigants play a crucial role in preventing these issues by killing pests and diseases in the soil before planting. Methyl bromide, phosphine, sulfuryl fluoride, acrylonitrile, carbonyl sulfide, ethyl formate, hydrogen cyanide, carbon disulfide, methyl iodide, and methyl isothiocyanate are some of the active ingredients used in soil fumigants. Farmers rely on these products to ensure crop quality and prevent losses caused by diseases and pests.

Moreover, the use of soil fumigants is not without challenges. Residue accumulation and the development of resistant insects are significant concerns. Moreover, labor costs and regulations from governing bodies add to the complexity of fumigant application. Pest control experts and certified fumigators play a vital role in ensuring the safe and effective use of these products. Soil fumigants are essential in the production of various crops, including cereals, roots and tubers, fruits, and vegetables. Penicillium digitatum and Penicillium italicum are common diseases that affect citrus fruits, making soil fumigation crucial for their production. The market for soil fumigants is expected to grow as farmers continue to seek effective solutions to maintain agricultural productivity and prevent post-harvest losses.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

140 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.83% |

|

Market growth 2024-2028 |

USD 142.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.37 |

|

Regional analysis |

APAC, North America, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 49% |

|

Key countries |

US, China, Japan, India, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

American Vanguard Corp., Bayer AG, China National Chemical Corp. Ltd., Corteva Inc., Detia Degesch GmbH, Douglas Products, Draslovka Services Pty Ltd., Eastman Chemical Co., Ecotec Fumigation, Imtrade CropScience, Isagro Spa, Lanxess AG, Nippon Chemical Industrial Co. Ltd., Royal Agro Organic Pvt. Ltd., Solvay SA, Tessenderlo Group NV, TriCal Group Inc., TriEst Ag Group Inc., Trinity Manufacturing Inc., and UPL Ltd. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch