Solar Shingles Market Size 2024-2028

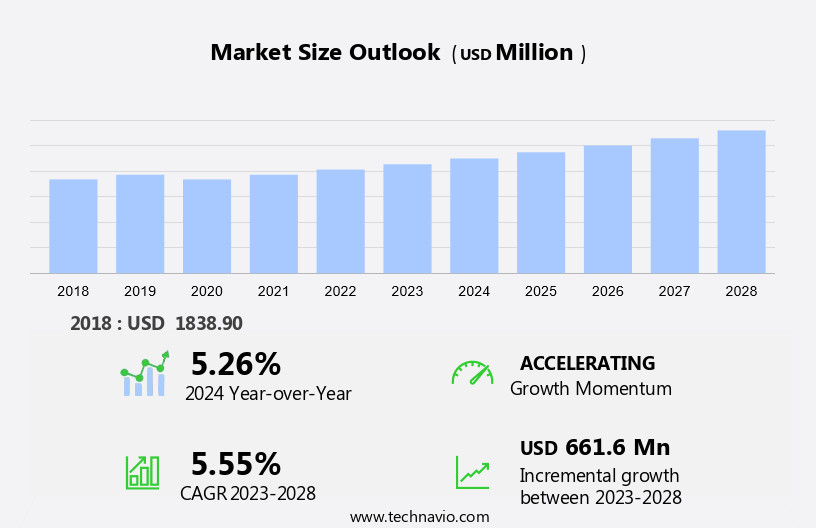

The solar shingles market size is forecast to increase by USD 661.6 million at a CAGR of 5.55% between 2023 and 2028.

- The market is experiencing significant growth due to several key trends. Firstly, the increasing investments In the renewable energy sector are driving market expansion. Secondly, the development of zero-energy buildings is creating a demand for solar shingles as a cost-effective and aesthetically pleasing solution for integrating solar energy into building designs. However, the intermittent nature of solar power remains a challenge for the market. To mitigate this, advancements in energy storage technology are being explored to ensure a consistent power supply. Overall, the market is poised for growth as it offers a sustainable and cost-effective alternative to traditional roofing materials while contributing to energy independence and reducing carbon emissions.

What will be the Size of the Market During the Forecast Period?

- The market represents a significant growth opportunity In the building sector, as more residential and commercial buildings integrate solar energy production into their designs. Solar shingles, also known as photovoltaic shingles or solar roof tiles, offer a unique alternative to traditional solar panels. These innovative shingles blend seamlessly with asphalt roofs, providing both rain protection and solar energy production. The aesthetic looks of solar shingles make them an attractive option for those seeking to minimize the visual impact of solar installations. Key market drivers include the increasing demand for renewable energy sources, the desire to reduce energy bills, and the availability of incentives such as tax credits, net metering programs, and feed-in tariffs.

- Solar shingles offer several advantages over traditional solar panels, including their lightweight design and integration with roof structures. However, they come with a higher upfront cost compared to traditional solar panels. Rain and solar energy production are not mutually exclusive, as solar shingles are designed to withstand various weather conditions. The market is expected to experience steady growth, as more building owners recognize the long-term benefits of solar energy and the aesthetic appeal of solar shingles. The shift away from fossil fuels and the global push towards sustainable energy sources continue to fuel the demand for solar shingles and other solar photovoltaic solutions.

How is this Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Silicon photovoltaic

- CIGS thing film photovoltaic

- Geography

- APAC

- China

- Japan

- North America

- US

- Europe

- Germany

- UK

- South America

- Middle East and Africa

- APAC

By Type Insights

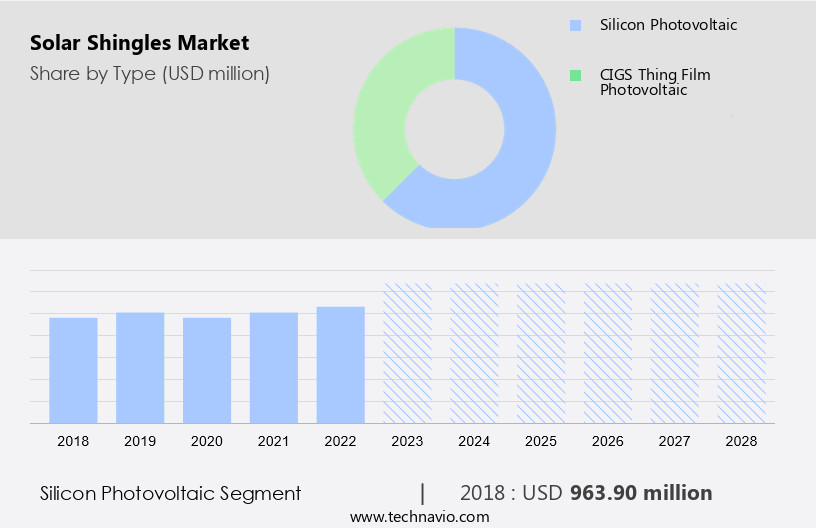

- The silicon photovoltaic segment is estimated to witness significant growth during the forecast period. The market primarily consists of silicon photovoltaic shingles, which are integrated into various roof types, including shake, slate, and concrete. These shingles are made from monocrystalline and polycrystalline silicon. Monocrystalline silicon shingles are more efficient due to their single crystal structure, enabling greater electron flow. Consequently, they are more costly than polycrystalline shingles. The silicon photovoltaics segment is poised for significant expansion due to increasing initiatives by China, the EU, and the US to install solar power systems. These offer both solar energy production and rain protection, making them an attractive alternative to traditional solar panels for residential and commercial buildings.

Get a glance at the market report of share of various segments Request Free Sample

The silicon photovoltaic segment was valued at USD 963.90 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

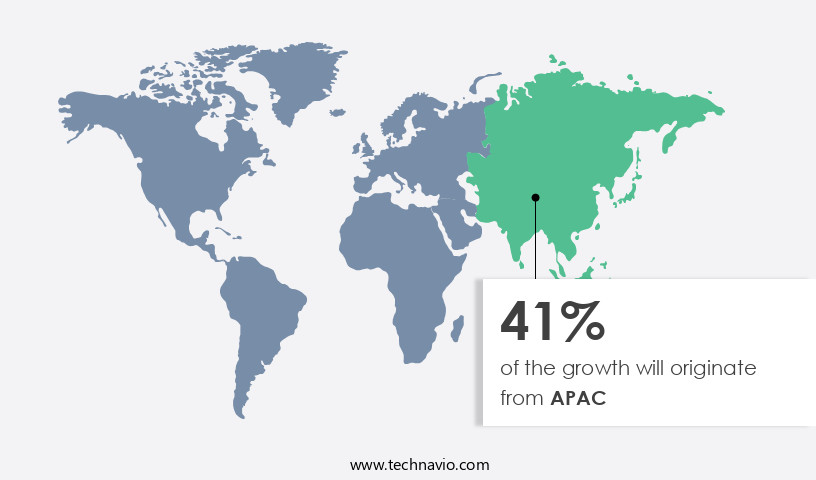

- APAC is estimated to contribute 41% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The market is experiencing significant growth due to increasing environmental concerns, escalating energy demands, and favorable government regulations. China, India, and Japan are key contributors to this market, with China leading the way in solar power generation, surpassing the US in annual solar installed capacity. The Asia Pacific region has seen remarkable growth In the solar systems industry. According to the International Energy Agency (IEA), China's dominance in solar power generation is expected to continue, as it has already surpassed its 2020 solar energy targets. These offer advantages such as rain protection, solar energy production, and aesthetic looks, making them an attractive alternative to traditional solar panels for both residential and commercial buildings.

For more insights on the market size of various regions, Request Free Sample

Moreover, these lightweight shingles can be installed on various roof structures, including asphalt, concrete, tile, slate, and even new or reroofing projects for residential, commercial, and industrial applications. Solar shingles, also known as solar tiles or photovoltaic shingles, are made from silicon or CIGS (Copper Indium Gallium Selenide) semiconductors. They are integrated into the roofing system, providing clean energy and reducing carbon emissions. Government incentives such as tax credits, net metering programs, and feed-in tariffs further encourage the adoption of solar shingles as renewable energy sources. As fossil fuels continue to face criticism and scrutiny, the demand for sustainable development and renewable energy technologies will only increase, making it a promising investment for CXOs and homeowners alike.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Solar Shingles Industry?

- Increasing investments in renewable energy sector is the key driver of the market. Solar shingles, an innovative fusion of solar technology and roofing, are gaining traction in both the residential and commercial sectors. These shingles, also known as solar tiles or photovoltaic shingles, are designed to replace traditional asphalt roofs, slate roofs, and tile roofs. These offer the benefits of solar energy production, rain protection, and aesthetic looks, making them an attractive option for sustainable development and carbon reduction. The market is witnessing significant growth due to the increasing demand for clean energy and the competitive cost of solar energy production. Traditional solar panels, such as silicon solar shingles and CIGS solar shingles, have been a popular choice for new roof installations and reroofing projects.

- Solar Roof V3, a recent innovation by Tesla, is a lightweight solar roof structure that seamlessly integrates with various roof structures, including concrete and tile roofs. Solar energy production is a significant factor driving the growth of the market. Solar energy is a renewable energy source that offers numerous benefits, such as energy independence, reduced energy bills, and a lower carbon footprint. These provide an efficient solution for integrating solar energy production into the roof structure of buildings, making them a popular choice for CXOs looking to invest in sustainable development. Government incentives, such as tax credits, net metering programs, and feed-in tariffs, also contribute to the growth of the market.

What are the market trends shaping the Solar Shingles Industry?

- The development of zero-energy buildings is the upcoming market trend. The market is witnessing significant growth as solar energy production becomes increasingly important for reducing carbon emissions and energy bills in both residential and commercial buildings. Traditional solar panels, while effective, can be bulky and may not blend well with the aesthetic looks of asphalt roofs or other roof types such as concrete tile, slate, or slate. Solar shingles, also known as solar tiles or photovoltaic shingles, offer a solution by integrating solar technology into roofing materials, providing rain protection and solar energy production in a lightweight and sleek design. Solar shingles come in various types, including silicon and CIGS (Copper Indium Gallium Selenide) solar shingles, which are gaining popularity due to their flexibility and efficiency.

- Solar Roof V3, a product by Tesla, is a notable example of solar shingles that can be installed as part of new roofing projects or during reroofing. The market is driven by the increasing adoption of renewable energy technologies and sustainable development initiatives. Solar technology, including solar modules and photovoltaic cells, is becoming more accessible and cost-effective, making it a viable option for a broader range of applications. Government incentives, such as tax credits, net metering programs, and feed-in tariffs, also contribute to the growth of the market. As energy efficiency becomes a priority, the electronics sector, including semiconductors, is also investing in solar shingles for industrial applications.

What challenges does the Solar Shingles Industry face during its growth?

- Intermittent nature of solar power is a key challenge affecting the industry growth. Solar shingles, an innovative solution In the solar energy production landscape, offer a viable alternative to traditional solar panels for residential and commercial buildings. These shingles, which function as both residential roofing material and solar energy generators, are gaining popularity due to their aesthetic looks, rain protection, and lightweight design. These are available in various types, including silicon and CIGS solar shingles, and can be installed on asphalt roofs, concrete tiles, slate roofs, and even during new roofing or reroofing projects. The market growth is driven by the increasing demand for renewable energy technologies, sustainable development, and carbon reduction.

- The electronics sector, specifically semiconductors, plays a significant role In the development and advancement of solar technology. Solar roof installation, such as Tesla's Solar Roof V3, provides homeowners with energy independence, reduced energy bills, and the potential for tax credits, net metering programs, and feed-in tariffs. Despite the initial investment, the long-term benefits outweigh the costs. However, the intermittent nature of solar energy production remains a challenge. Weather conditions, geographical location, and time of day can impact the availability and output of solar energy. To mitigate this issue, energy storage solutions and the integration of solar power with the grid are becoming increasingly important.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Agni Solar System Pvt. Ltd.

- Alternative Energy Store Inc.

- Anu Solar Power Pvt. Ltd.

- Canadian Solar Inc.

- CertainTeed

- E Solar

- FlexSol Solutions BV

- Hanergy Thin Film Power EME BV

- JA Solar Technology Co. Ltd.

- Luma Solar

- PV Technical Services Inc.

- Solarmass Energy Group Ltd.

- Sunflare

- SunPower Corp.

- SunTegra Solar

- Tesla Inc.

- Trina Solar Co. Ltd.

- Vikram Solar Ltd.

- Yingli Green Energy Holding Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Solar shingles, an innovative solution merging solar energy production and roofing, have emerged as a significant contender In the renewable energy technologies landscape. These advanced alternatives to traditional solar panels offer numerous benefits for both residential and commercial buildings. Solar shingles are designed to blend seamlessly with asphalt roofs, providing rain protection while generating clean energy. The aesthetic looks of solar shingles mimic conventional roofing materials such as tiles, slate, or concrete, making them an attractive option for those seeking sustainability without compromising the architectural integrity of their structures. Solar energy production through solar shingles is a game-changer In the electronics sector.

In addition, the integration of solar technology into roofing materials signifies a major leap forward In the adoption of renewable energy sources. Silicon and CIGS (Copper Indium Gallium Selenide) solar shingles are two popular types, each offering unique advantages in terms of efficiency and cost. Unlike traditional solar panels, solar shingles are lightweight and can be installed directly onto existing roof structures. This feature eliminates the need for extensive roof modifications or reroofing projects, making solar shingle installation more accessible and cost-effective. The market is driven by several factors. The growing demand for clean energy, carbon reduction, and sustainable development are key factors propelling the market forward.

Additionally, solar energy production offers significant cost savings on energy bills, making it an attractive investment for both residential and commercial sectors. Tax credits, net metering programs, and feed-in tariffs are incentives that further boost the adoption of solar shingles. These policies encourage the use of renewable energy sources by offering financial incentives to consumers, thereby reducing their reliance on fossil fuels. The market caters to various segments, including residential, commercial, and industrial applications. CXOs and property managers recognize the long-term benefits of solar energy and are increasingly turning to solar shingles as a cost-effective and aesthetically pleasing solution.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

131 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.55% |

|

Market growth 2024-2028 |

USD 661.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.26 |

|

Key countries |

US, China, Japan, Germany, and UK |

|

Competitive landscape |

Leading Companies, market growth and forecasting, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the Solar Shingles industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.