Sonobuoy Market Size 2025-2029

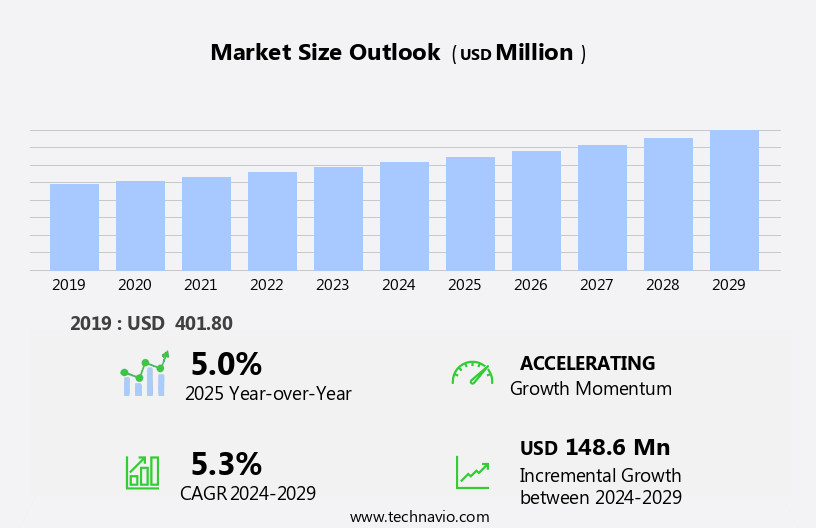

The sonobuoy market size is forecast to increase by USD 148.6 million at a CAGR of 5.3% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by increasing defense budgets worldwide. This trend is fueled by the ongoing geopolitical tensions and the need for advanced naval surveillance technologies. However, the market's growth is not without challenges. Regulatory hurdles impact adoption due to stringent environmental and safety regulations, necessitating extensive testing and certification processes. The advancements in acoustic sensors and electromagnetic technologies are also driving market growth. Furthermore, supply chain inconsistencies temper growth potential, as the market relies on a limited number of suppliers for critical components.

- To capitalize on the market's opportunities, companies must focus on partnerships and collaborations to mitigate these challenges and enhance their competitive position. Technological advancements in acoustic sensors and electromagnetic technologies enable SONAR systems to provide more detailed and accurate data, leading to increased demand. By addressing these issues and staying abreast of technological advancements, players can effectively navigate the market's strategic landscape and seize growth opportunities.

What will be the Size of the Sonobuoy Market during the forecast period?

- The market is witnessing significant advancements in technology, driven by research collaborations and the integration of sophisticated techniques such as spectral analysis, multibeam sonar, and matched field processing. Acoustic modeling and propagation modeling are essential components of sonobuoy systems, ensuring data security and validation through data transmission and sharing. Seabed mapping and environmental impact assessment require high data integrity, which is maintained through signal-to-noise ratio enhancement, data archiving, and management. Quality control is paramount, with ambient noise reduction and acoustic modem implementation crucial for underwater communication.

- Time-frequency analysis and wavelet analysis contribute to improved data processing, while regulatory compliance is ensured through data storage and data management best practices. Industry partnerships foster innovation, with data sharing and sound velocity profile analysis driving progress in side-scan sonar and synthetic aperture sonar applications. Data security and noise floor management remain critical challenges for market participants.

How is this Sonobuoy Industry segmented?

The sonobuoy industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Active

- Passive

- Special purpose

- End-user

- Defense

- Commercial

- Deployment

- Pneumatic

- Spring

- Free fall

- Cartridges

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

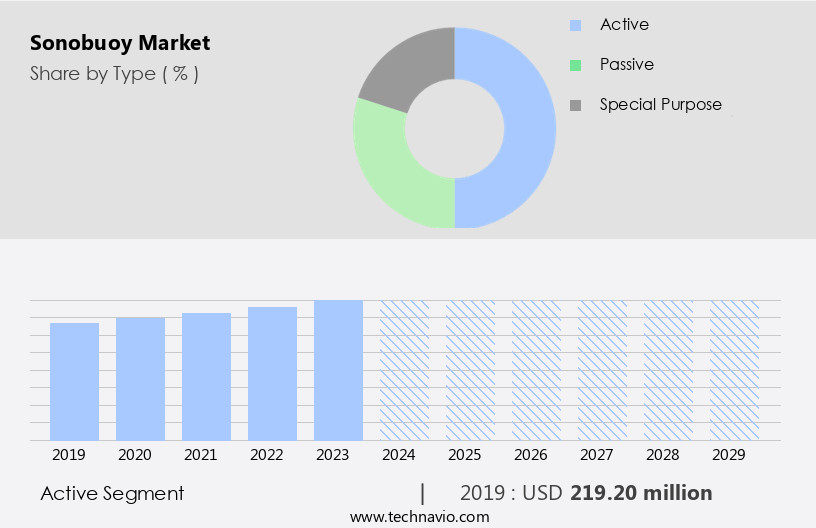

The active segment is estimated to witness significant growth during the forecast period. Active sonobuoys play a crucial role in modern anti-submarine warfare (ASW) through direct and precise detection of underwater threats. Different from passive sonobuoys, active sonobuoys emit acoustic pulses and listen for returning echoes, enabling accurate measurements of target range and bearing. This technique is particularly effective for detecting quiet or stationary submarines and mines, which may not produce detectable noise. Active sonobuoys are essential during target acquisition and confirmation phases of ASW missions, where immediate and accurate location data is necessary. Autonomous underwater vehicles (AUVs) and remotely operated vehicles (ROVs) are increasingly utilized for sonobuoy deployment and retrieval, enhancing operational efficiency.

Bioacoustic studies and wildlife conservation also benefit from sonobuoy technology, offering insights into marine life behavior and population dynamics. Acoustic telemetry and oceanographic research further expand the applications, with remote sensing and calibration procedures ensuring accurate data. In offshore exploration, sonobuoys support oil and gas industry operations by monitoring pipelines and infrastructure, ensuring safety and operational efficiency. Overall, the market continues to evolve, driven by technological advancements and diverse applications.

The Active segment was valued at USD 219.20 million in 2019 and showed a gradual increase during the forecast period. Sensor networks and acoustic arrays expand the coverage area and improve data acquisition, while real-time monitoring and data analysis enable quick response to emerging threats. Hydrographic surveys, marine research, environmental monitoring, pipeline monitoring, and fisheries management also benefit from sonobuoy technology. Seismic surveying, vessel detection, and signal processing further expand the applications, with underwater acoustics and data interpretation playing significant roles in understanding complex underwater environments. Maintenance protocols ensure the longevity and reliability of sonobuoys, while defense applications, such as submarine detection and anti-submarine warfare, remain a primary focus. Geophysical surveys, data visualization, and infrastructure monitoring are additional markets that leverage sonobuoy technology.

Regional Analysis

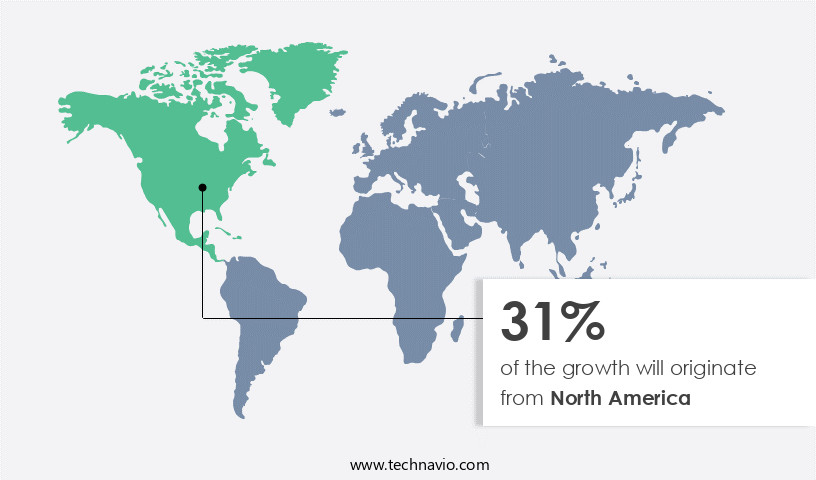

North America is estimated to contribute 31% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is witnessing significant growth, driven by advancements in underwater acoustics and increasing demand for real-time monitoring in various industries. In particular, defense applications continue to dominate the market due to the importance of underwater surveillance and anti-submarine warfare (ASW) capabilities. The United States, with its substantial defense budget and strategic military investments, is leading this market. In 2024, the U.S. Defense budget increased by 5.7%, reaching USD 997 billion, making it the largest military spender globally. This investment fuels the procurement and development of advanced sonar and surveillance systems, including large-scale sonobuoy acquisitions. Passive SONAR systems, which rely on listening to underwater sounds, are gaining popularity due to their ability to detect quiet targets, such as submarines and underwater mines.

For instance, the U.S. Navy has been investing in sonobuoy procurement, as evidenced by contracts with Ultra Maritime. Autonomous underwater vehicles (AUVs) and remotely operated vehicles (ROVs) are also playing a crucial role in sonobuoy deployment strategies, enabling efficient data acquisition and underwater exploration. Hydrographic surveys, pipeline monitoring, environmental monitoring, marine research, and seismic surveying are other sectors that benefit from sonobuoy technology. Furthermore, sensor networks, acoustic arrays, and signal processing enhance the overall operational efficiency of sonobuoy systems. In addition, there is growing interest in using sonobuoy technology for wildlife conservation, fisheries management, and infrastructure monitoring.

Sonobuoy systems are essential for data interpretation, vessel detection, submarine detection, and anti-submarine warfare. Geophysical surveys, data visualization, and calibration procedures are also integral parts of the market. Offshore exploration and infrastructure monitoring are expected to be the next significant growth areas for this market.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Sonobuoy market drivers leading to the rise in the adoption of Industry?

- The increasing defense budgets serve as the primary catalyst for market growth. The market is experiencing significant growth due to increasing defense budgets, driven by geopolitical tensions and a focus on enhancing defense capabilities. In 2024, global military expenditure reached an unprecedented USD2.718 trillion, marking a 9.4% increase from the previous year. The US, the world's largest military spender, allocated USD 997 billion to its defense budget, accounting for 37% of the global military expenditure. This substantial investment underscores the priority given to defense capabilities. Autonomous underwater vehicles (AUVs) and remotely operated vehicles (ROVs) are increasingly being used for noise reduction in sonobuoy technology. Hydrographic surveys, cable monitoring, and pipeline monitoring are key applications for sonobuoys.

- Unmanned surface vehicles (USVs) and sensor networks are also being integrated with sonobuoy systems for enhanced functionality. Acoustic arrays are used for sound propagation and detection, making sonobuoy technology an essential tool for defense and commercial applications. Deployment strategies for sonobuoys are being optimized for efficiency and cost-effectiveness. Understanding sound propagation and optimizing deployment strategies are crucial for effective sonobuoy usage. The market dynamics for sonobuoy technology are influenced by advancements in technology, increasing demand for underwater surveillance, and the need for cost-effective solutions for defense and commercial applications.

What are the Sonobuoy market trends shaping the Industry?

- Focusing on partnerships and collaborations is currently a significant market trend. In today's business landscape, forming strategic alliances with other companies or organizations can lead to mutual growth and success. The market is experiencing substantial growth due to the increasing demand for environmental monitoring, marine research, seismic surveying, and vessel detection. Advanced signal processing technologies and underwater acoustics are driving operational efficiency in industries such as oil and gas exploration and military applications. Companies in the market are responding by advancing their sonobuoy and acoustic processing technologies to meet the demand for sophisticated ASW strategies. Acoustic monitoring plays a crucial role in wildlife conservation efforts, further expanding the market's scope. Collaborations and strategic partnerships are on the rise, as demonstrated by the recent agreement between Ultra Maritime and Bharat Dynamics Limited for the production of advanced sonobuoys.

- This joint initiative, part of the U.S.-India Initiative on Critical and Emerging Technologies, underscores the importance of sonobuoys in enhancing maritime security and interoperability across various platforms. By focusing on maintenance protocols and data acquisition, market participants can ensure the continuous improvement of sonobuoy technology, meeting the evolving needs of diverse industries.

How does Sonobuoy market faces challenges face during its growth?

- The growth of the industry is significantly impacted by the complex interplay of environmental and regulatory constraints. These factors pose a significant challenge, requiring businesses to navigate a intricate web of compliance and sustainability requirements. Sonobuoys, acoustic devices used for water column profiling and submarine detection in naval operations, face environmental and regulatory challenges. The accumulation of debris from single-use sonobuoys contributes to marine pollution, specifically from plastics, metals, and battery components. Over time, these materials can degrade, releasing harmful substances into the ocean. Concerns regarding the U.S. Navy's use of sonobuoys contributing to marine contaminants have been raised. Additionally, underwater noise pollution is a significant challenge. Sonobuoys emit sounds during operation, which can disrupt marine life and impact communication between species. Furthermore, the integration of artificial intelligence (AI) and machine learning (ML) in SONAR systems, sensor fusion, and data integration are enhancing the capabilities of these systems.

- These environmental concerns necessitate compliance with various legal frameworks and ongoing research in bioacoustic studies to minimize the impact on marine ecosystems. Real-time monitoring and data analysis are crucial for effective data interpretation and naval applications, making the development of eco-friendly sonobuoys a priority for military applications.

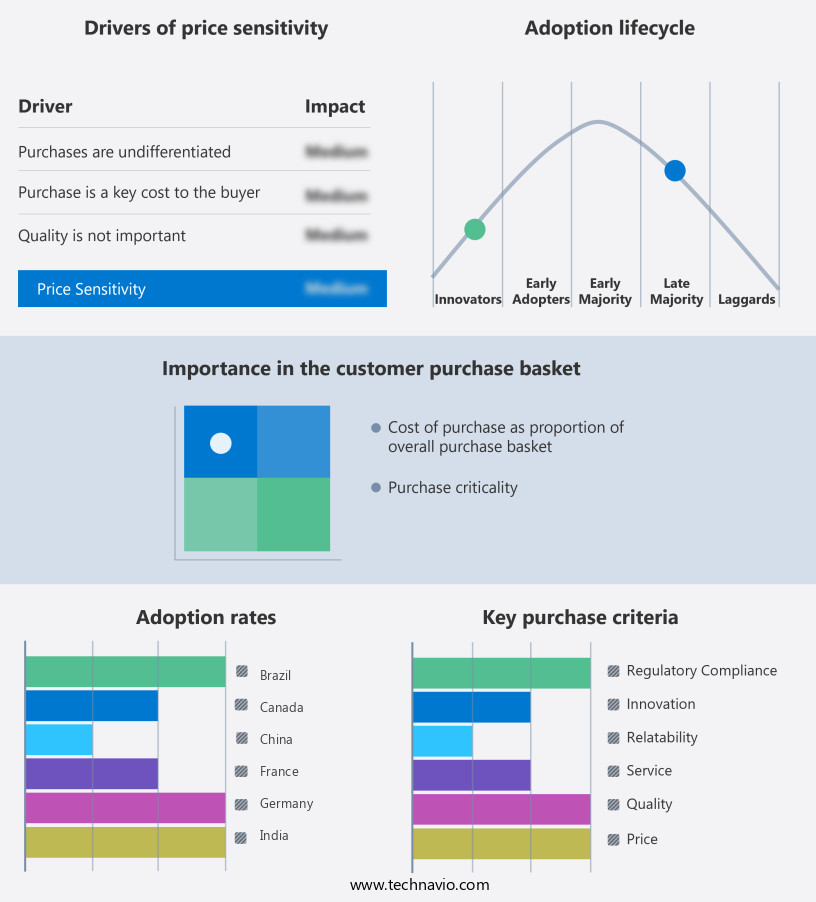

Exclusive Customer Landscape

The sonobuoy market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the sonobuoy market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, sonobuoy market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ASELSAN AS - The company offers sonobuoy such as aselBUOY 100P. This sonobuoy is a passive directional system designed for use in anti-submarine warfare, search and rescue, and underwater acoustic rescue.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ASELSAN AS

- Bharat Dynamics Ltd.

- General Dynamics Mission Systems Inc.

- Lockheed Martin Corp.

- RADIXON Group Pty. Ltd.

- SeaLandAire Technologies Inc.

- Sociedad Anonima de Electronica Submarina

- Sparton Corp.

- Tata Advanced Systems Ltd.

- Thales Group

- Ultra Electronics Holdings Plc

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Sonobuoy Market

- In February 2024, Thales, a leading technology company, announced the launch of a new generation of sonobuoy systems, integrating artificial intelligence and machine learning capabilities to enhance underwater acoustic detection (Thales Press Release, 2024). This innovation significantly improves the accuracy and efficiency of sonobuoy technology in detecting and locating underwater threats.

- In May 2025, Lockheed Martin and Raytheon Technologies entered into a strategic partnership to collaborate on the development and production of advanced sonobuoy systems for military applications (Lockheed Martin Press Release, 2025). This collaboration combines the expertise of both companies in defense technology and sonobuoy manufacturing, aiming to deliver more advanced and cost-effective solutions to their clients.

- In August 2024, Saab, a Swedish defense and security company, secured a major contract from the Swedish Armed Forces to supply sonobuoy systems for their submarine fleet (Saab Press Release, 2024). The contract is valued at approximately SEK 3.1 billion (USD 338 million), marking a significant expansion of Saab's presence in the market.

- In January 2025, the U.S. Navy awarded a contract to Honeywell International to produce and deliver over 10,000 sonobuoys for their fleet (U.S. Department of Defense, 2025). The contract, worth USD 117 million, underscores the continued demand for sonobuoy technology in military applications and Honeywell's position as a key supplier in the market.

Research Analyst Overview

The market continues to evolve, driven by the expanding applications across various sectors. These include environmental monitoring, marine research, seismic surveying, vessel detection, signal processing, underwater acoustics, maintenance protocols, operational efficiency, acoustic monitoring, data acquisition, and wildlife conservation. The integration of technologies such as noise reduction, autonomous underwater vehicles (AUVs), and remotely operated vehicles (ROVs) has revolutionized sonobuoy deployment strategies. The evolving market dynamics are shaped by advancements in sound propagation, sensor networks, acoustic arrays, pipeline monitoring, and real-time monitoring. Unmanned surface vehicles (USVs) and cable monitoring have emerged as critical components of the sonobuoy ecosystem, enhancing data acquisition and interpretation capabilities. Machine learning (ML) and artificial intelligence (AI) are increasingly integrated into SONAR systems for data integration, sensor fusion, and smart inverters, enhancing their capabilities.

Applications in defense, naval operations, and military applications continue to expand, with sonobuoys playing a pivotal role in submarine detection and anti-submarine warfare. Geophysical surveys, data visualization, and fisheries management are other sectors benefiting from the ongoing innovation in sonobuoy technology. Bioacoustic studies, target classification, water column profiling, acoustic signature analysis, and calibration procedures are essential components of the sonobuoy system, ensuring operational efficiency and accuracy. The integration of data analysis, interpretation, and remote sensing further enhances the value proposition of sonobuoys in various industries. Deep learning strategies, such as feature improvement, random noise with different shapes, and style learning, are proposed to enhance SONAR image target detection speed and accuracy. Infrastructure monitoring, pipeline monitoring, and offshore exploration are emerging areas of growth for the market, driven by the need for reliable and accurate underwater data acquisition and analysis. The ongoing innovation in sonobuoy technology is expected to continue unfolding, shaping the market dynamics and expanding its applications.

Dive into Technavio's strong research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Sonobuoy Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

212 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.3% |

|

Market growth 2025-2029 |

USD 148.6 million |

|

Market structure |

Concentrated |

|

YoY growth 2024-2025(%) |

5.0 |

|

Key countries |

US, China, UK, France, Germany, Canada, Japan, India, Brazil, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Sonobuoy Market Research and Growth Report?

- CAGR of the Sonobuoy industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the sonobuoy market growth and forecasting

We can help! Our analysts can customize this sonobuoy market research report to meet your requirements.