Soy Beverages Market Size 2024-2028

The soy beverages market size is forecast to increase by USD 3.03 billion, at a CAGR of 4.5% between 2023 and 2028.

- The market is experiencing significant growth due to the rising consumer preference for plant-based alternatives to dairy products. The increasing number of lactose-intolerant and vegan consumers is fueling this trend, creating a substantial market opportunity for soy beverage manufacturers. However, this market is not without challenges. The availability of substitute functional beverages, such as almond, oat, and rice milk, poses a threat to soy beverage market share.

- Moreover, the continuous launch of new soy beverage products intensifies the competition, necessitating innovative marketing strategies and product differentiation. Companies in this market must navigate these challenges to capitalize on the growing demand for soy beverages and maintain their competitive edge.

What will be the Size of the Soy Beverages Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market trends shaping its growth across various sectors. High-pressure processing (HPP) is revolutionizing soy milk production, ensuring product safety and extending shelf life without the need for added preservatives. Consumer preference for plant-based alternatives drives the formulation of soy yogurt, with optimization of processing techniques to enhance texture and flavor. Lecithin extraction and filtration techniques are crucial in improving fat globule size and ultrafiltration membrane efficiency, leading to superior product quality. Phytoestrogen levels, sensory evaluation, and saponin removal techniques are integral components of the fermentation process, ensuring optimal soybean processing.

Texture modification and microbial contamination are key concerns in soy concentrate properties and product formulation, necessitating continuous research and innovation. Packaging materials, tofu manufacturing, and lectin reduction methods are also essential areas of focus, with a growing emphasis on shelf life extension and allergen declaration. Nutritional labeling, soy protein isolate, emulsion stability, protein denaturation, and edible soy protein are essential quality control parameters. Heat treatment effects, enzymatic hydrolysis, and isoflavone content are critical factors influencing consumer perception and market demand. Soybean oil extraction and flavor compounds are integral aspects of soy product development, with ongoing research into reducing processing costs and enhancing taste profiles. The market's continuous evolution underscores the importance of staying abreast of the latest trends and advancements in soy beverage production.

How is this Soy Beverages Industry segmented?

The soy beverages industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Soy milk

- Soy-based drinkable yogurt

- Product Type

- Flavored Soy Beverages

- Unflavored Soy Beverages

- Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

- Specialty Stores

- Pharmacies

- Others

- Geography

- North America

- US

- Europe

- Germany

- UK

- Middle East and Africa

- South Africa

- UAE

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The soy milk segment is estimated to witness significant growth during the forecast period.

Soy milk, a popular alternative to dairy milk for individuals with lactose intolerance or those following a vegan diet, is a significant player in the market. Manufacturers cater to diverse consumer preferences by producing unsweetened organic soy milk, free from additives and artificial flavorings. Moreover, the market offers soy milk products that do not contain ingredients derived from genetically modified organisms (GMOs). Consumer health and convenience drive the market's growth, leading companies to expand their product offerings with a variety of flavored and unsweetened soy milk options. The soy yogurt formulation also gains popularity due to its nutritional benefits and versatility.

Processing optimization techniques, such as high-pressure processing and filtration, ensure product consistency and quality. Lecithin extraction and texture modification enhance the sensory experience. Microbial contamination and saponin removal are critical concerns in soy milk production, addressed through advanced filtration techniques and heat treatment. Soy concentrate properties, formulation, and packaging materials are essential factors influencing product shelf life. Fermentation process and enzymatic hydrolysis contribute to the isoflavone content, a key health benefit. Quality control parameters, such as protein denaturation, emulsion stability, and protein isolate, ensure product consistency and safety. Soybean oil extraction and nutritional labeling are essential for transparency and consumer trust.

The Soy milk segment was valued at USD 7.44 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

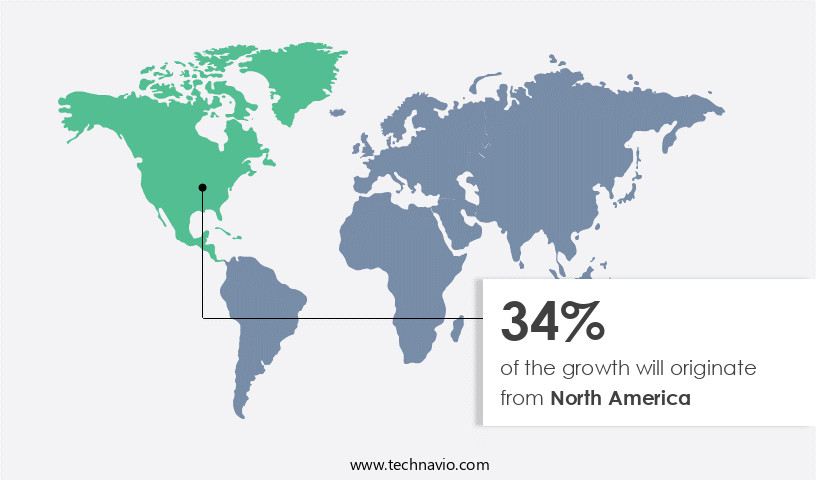

North America is estimated to contribute 34% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The soy beverage market in North America, specifically in the US and Canada, has witnessed significant growth due to increasing consumer preference for dairy-free alternatives and healthier options. Soy milk production has gained popularity, with various flavored and sugar-free variants available. Prominent brands like Danone and Hershey's offer organic soy milk products, catering to this trend. The vegan population's growth and health concerns related to dairy-based beverages are driving this demand. Soy yogurt formulation is another segment experiencing growth, with processing optimization techniques ensuring consistent texture and emulsion stability. Lecithin extraction and filtration techniques are crucial in maintaining fat globule size and ultrafiltration membrane efficiency.

Phytoestrogen levels are a consideration in product formulation, with fermentation processes used to reduce saponin levels and improve texture modification. Microbial contamination is a concern, necessitating stringent quality control parameters, including heat treatment effects and enzymatic hydrolysis. Allergen declaration and nutritional labeling are essential for consumer transparency. Soy protein isolate is used to enhance protein content and improve protein denaturation. Shelf life extension is achieved through various methods, including lectin reduction and flavor compound addition. Soybean oil extraction is a byproduct of soy processing, with isoflavone content a key consideration for health-conscious consumers. Tofu manufacturing also benefits from these trends, with lectin reduction methods and packaging materials essential for maintaining product quality.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

B2B soy drink solutions leverage plant-based processing technologies for vegan diets. Soy beverage opportunities 2024 include soy milk for cafes and non-GMO soy drinks, addressing health trends. Soy supply chain tools optimize logistics, while soy beverage competitive insights feature brands like Silk. Sustainable soy farming aligns with eco-friendly beverage trends. Soy beverage regulations 2024-2028 guide soy drink demand in North America 2024. Premium soy beverages and soy market forecasts boost growth. Soy drinks for retail chains and custom soy formulations target niches. Soy beverage barriers and strategies tackle allergen concerns, with soy sourcing innovations and soy cost management improving profitability. Soy market intelligence and plant-based drink advancements drive expansion.

What are the key market drivers leading to the rise in the adoption of Soy Beverages Industry?

- The increasing preference among lactose-intolerant and vegan consumers for soy beverages serves as the primary market driver.Soy beverages, such as soy milk, have gained significant popularity as a lactose-free alternative to cow's milk. The prevalence of lactose intolerance, a condition that affects the digestion of lactose, is on the rise in various European countries, including Italy, Germany, Spain, Turkey, Poland, France, and the UK. This condition results in symptoms like bloating, cramps, diarrhea, and nausea upon consumption of dairy products. To cater to this growing consumer base, the demand for soy beverages is increasing rapidly. Soy beverages are produced through various methods, including enzymatic hydrolysis, which breaks down the complex proteins into simpler forms, making them easier to digest.

- Soy protein isolate is a common ingredient in soy beverages, providing essential nutrients like protein and calcium. The stability of the emulsion, which is crucial for the texture and appearance of soy beverages, is maintained through protein denaturation, a process that alters the protein structure. Soy protein, derived from edible soy, is used in various applications, including soy flour, which is a versatile ingredient in the food industry. Nutritional labeling and allergen declaration are essential considerations in the production and marketing of soy beverages, ensuring transparency for consumers with specific dietary requirements. The market dynamics for soy beverages are influenced by these factors, driving growth and innovation in the sector.

What are the market trends shaping the Soy Beverages Industry?

- The trend in the market is toward new product launches. The market is experiencing significant growth due to increasing consumer preference for plant-based alternatives to dairy products. companies are investing in research and development, leading to the launch of various organic, flavored, and unflavored soy beverages. Hershey India, for instance, expanded its plant-based drink offerings in India in October 2021, catering to the rising demand for such products. Soy milk production is undergoing processing optimization through high-pressure processing and filtration techniques like ultrafiltration membrane to enhance product quality and consistency.

- Lecithin extraction is another focus area to improve the emulsion stability and reduce fat globule size. Soy yogurt formulation is also being refined to meet consumer expectations for taste and texture. Overall, the market is expected to continue its growth trajectory, driven by consumer health consciousness and the increasing availability of innovative product offerings.

What challenges does the Soy Beverages Industry face during its growth?

- The growth of the functional beverage industry is significantly impacted by the increasing availability of substitute beverage options.

- The market faces competition from various functional beverages and plant-based alternatives, such as rice, oats, potato, coconut, hemp, and cashew milk. These substitutes cater to consumers seeking nutrients like protein, calcium, vitamin D, vitamin A, vitamin B12, potassium, phosphorus, riboflavin, and niacin. The increasing consumer awareness of functional beverages' benefits poses a potential threat to the market. Soy beverage production involves soybean processing, which includes phytoestrogen levels assessment and fermentation process implementation. Sensory evaluation, saponin removal techniques, texture modification, and microbial contamination control are essential aspects of soy concentrate properties development.

- Product formulation is crucial in creating a desirable taste and texture for consumers. Despite these challenges, the market continues to evolve, focusing on innovation and improvement. Brands are investing in research and development to enhance product offerings, ensuring consumer satisfaction and market competitiveness.

Exclusive Customer Landscape

The soy beverages market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the soy beverages market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, soy beverages market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

American Soy Products Inc. - This company specializes in producing a range of soy beverages, including soymilk, catering to consumers seeking plant-based alternatives. Their product line reflects a commitment to innovation and sustainability within the beverage industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- American Soy Products Inc.

- Atlante Srl

- Devansoy Inc.

- Eden Foods Inc.

- Jaffe Bros Inc

- Kikkoman Sales USA Inc.

- Life Health Foods

- Nestle SA

- Pacific Foods of Oregon LLC

- PureHarvest

- Sanitarium Health Food Co.

- SolhFagito

- SunOpta Inc.

- Takeda Pharmaceutical Co. Ltd.

- The Hain Celestial Group Inc.

- The Hershey Co.

- TOFUSAN Co. Ltd.

- Urban Platter

- Vitasoy International Holdings Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Soy Beverages Market

- In January 2024, Danone Manifesto Ventures, a subsidiary of Danone, announced the acquisition of New Zealand-based plant-based food company, Open Farm, to expand its presence in the market. The deal was valued at NZD 140 million (approximately USD 94 million) (Danone Manifesto Ventures, 2024).

- In March 2024, Silk, a leading soy milk brand owned by Danone, launched a new line of oat milk beverages in the United States. The product expansion aimed to cater to the growing demand for plant-based alternatives to dairy milk (Silk, 2024).

- In April 2025, WhiteWave Foods, a leading player in the market, entered into a strategic partnership with Starbucks to supply plant-based milk alternatives, including soy milk, for Starbucks' stores in the United States and Canada (WhiteWave Foods, 2025).

- In May 2025, The Quaker Oats Company, a subsidiary of PepsiCo, received regulatory approval from the U.S. Food and Drug Administration (FDA) to fortify its soy milk with additional nutrients, including calcium and vitamin D. The move aimed to enhance the nutritional value of the product and attract health-conscious consumers (FDA, 2025).

Research Analyst Overview

- The soy beverage market is characterized by a focus on nutrient bioavailability and product innovation. Companies are investing in vitamin enrichment and sensory attribute improvements to enhance consumer perception. Beverage formulation is a key area of interest, with sodium reduction and calcium fortification being prominent trends. Protein digestibility and vegan alternatives are also driving market growth. Quality assurance is paramount, with texture analysis and rheological properties being crucial factors. Soy milk composition is being optimized for plant-based protein content and energy efficiency. Supply chain management and sustainable production are essential for reducing waste and minimizing environmental impact. Sugar content is a concern for many consumers, leading to the development of low-sugar and no-added-sugar options.

- Ingredient sourcing is a critical aspect of soy beverage production, with a focus on health benefits and functional properties. Product stability and sustainable production methods are also important considerations for companies seeking to meet consumer demands and stay competitive. Iron content and environmental impact are increasingly important factors in the market, with processing technology being used to improve both. Soy protein functionality is a key area of research, with potential applications in various industries beyond the beverage sector.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Soy Beverages Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

134 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 3034.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Key countries |

US, UK, Germany, China, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Soy Beverages Market Research and Growth Report?

- CAGR of the Soy Beverages industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the soy beverages market growth of industry companies

We can help! Our analysts can customize this soy beverages market research report to meet your requirements.