Specialty Bakery Market Size 2025-2029

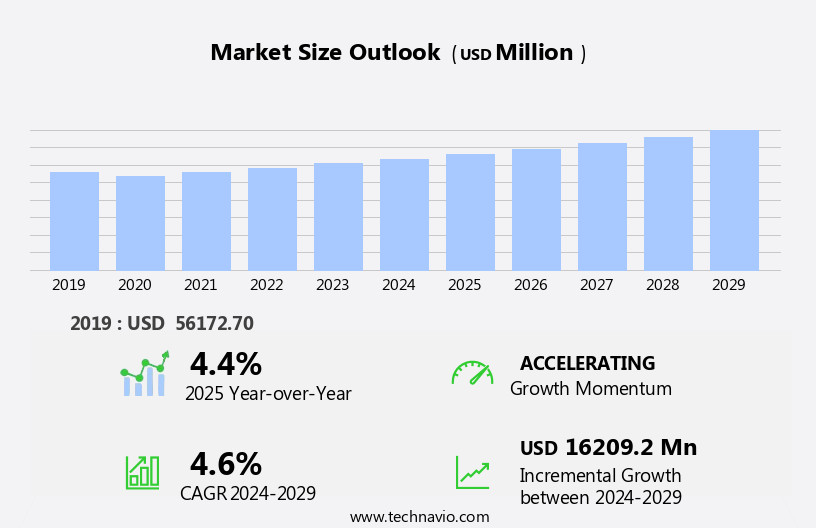

The specialty bakery market size is forecast to increase by USD 16.21 billion, at a CAGR of 4.6% between 2024 and 2029.

- The market is experiencing significant growth driven by the increasing demand for functional ingredients in baked goods. Consumers are increasingly seeking bakery products that offer added health benefits, leading to a surge in demand for functional ingredients such as protein, fiber, and vitamins. Furthermore, the trend toward organic and gluten-free options continues to gain momentum, presenting both opportunities and challenges for specialty bakeries. On the one hand, catering to these consumer preferences can help differentiate brands and attract a loyal customer base. On the other hand, ensuring the availability of high-quality organic and gluten-free ingredients and maintaining production efficiency can be complex and costly.

- However, the market faces a potential challenge in the form of declining popularity of specialty bakery products. With the rise of convenience foods and busy lifestyles, consumers are increasingly opting for quick and easy meal solutions. This trend, coupled with the high price point of specialty bakery items, could limit market growth. To navigate this challenge, specialty bakeries must focus on innovation and differentiation, offering unique and high-value products that cater to specific consumer needs and preferences. Additionally, implementing efficient production processes and exploring alternative distribution channels, such as e-commerce, can help maintain competitiveness and reach a broader customer base.

What will be the Size of the Specialty Bakery Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market activities unfolding across various sectors. Retail bakeries are prioritizing food safety standards and product presentation to attract customers. Danish pastries and other intricately designed pastry items are gaining popularity, necessitating advanced baking techniques and high-quality ingredients. Community involvement and charitable giving are essential components of brand development, as consumers increasingly seek authentic and socially responsible businesses. Pricing strategies are being reevaluated to balance affordability and profitability, with staff training and social media marketing becoming crucial tools for customer engagement. Sustainability practices, such as energy efficiency and waste reduction, are becoming industry standards, driving innovation in baking equipment and packaging materials.

Seasonal offerings, including organic baking ingredients and limited-edition products, cater to consumer trends and generate excitement. Artisan bread and specialty desserts, such as wedding cakes, require unique baking techniques and high-quality ingredients, making ingredient sourcing and supplier relationships essential. Expansion strategies, including franchise opportunities and wholesale baking, require careful financial projections and HACCP compliance. Business models are evolving to accommodate online ordering and delivery services, while natural leaven and sourdough starter are gaining recognition for their health benefits and unique flavor profiles. Corporate social responsibility, awards recognition, and decorating tools are becoming essential components of a successful bakery business.

The food service industry and restaurant supply companies offer valuable resources for bakeries looking to optimize their operations and improve texture consistency. Flour mills and sugar refineries are essential partners in ensuring ingredient quality, while trade shows and baking competitions provide opportunities for learning and networking. Profitability analysis, store layout, and ingredient sourcing are critical components of a sustainable and profitable bakery business. Bakeries that prioritize these areas and adapt to evolving market trends will thrive in this dynamic and ever-changing industry.

How is this Specialty Bakery Industry segmented?

The specialty bakery industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Application

- Specialty bread

- Specialty cakes and pastries

- Specialty cookies

- Specialty crackers and pretzels

- Others

- Product Type

- Gluten-free products

- Vegan and plant-based offerings

- Allergen-free products

- Organic products

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Distribution Channel Insights

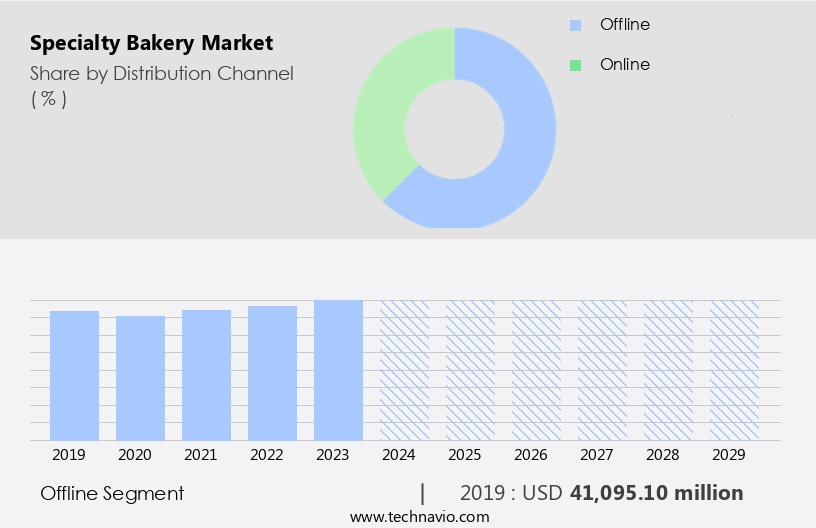

The offline segment is estimated to witness significant growth during the forecast period.

The market showcases a vibrant landscape, with retail bakeries emerging as a significant player. Danish pastries, artisan bread, and specialty desserts are popular offerings, often showcased with enticing product presentations. Retail bakeries prioritize food safety standards, ensuring customer trust. Community involvement is a key focus, with charitable giving and local sourcing of organic ingredients contributing to their appeal. Pricing strategies vary, balancing affordability and premium positioning. Staff training is essential for maintaining texture consistency and pastry techniques. Social media marketing and online ordering facilitate customer engagement and convenience. Haccp compliance and sustainable practices are integral to modern bakery operations.

Expansion strategies include franchising and partnerships, with a growing emphasis on energy efficiency and corporate social responsibility. Seasonal offerings, limited-edition products, and custom cakes cater to consumer trends. Ingredient sourcing from trusted suppliers, including flour mills and sugar refineries, ensures ingredient quality. Bakery design prioritizes interior aesthetics and functionality, while baking equipment and proofing boxes support efficient production. Market research informs product innovation and business models. The food service industry represents a lucrative market for wholesale baking. Investment opportunities arise from the increasing demand for gluten-free baking and natural leaven. Chocolate suppliers and ethical sourcing practices add value to product offerings.

Baking competitions and awards recognition boost brand development. Waste reduction and decorating tools are essential for optimizing operations and enhancing customer experience. Customer loyalty programs foster repeat business, with delivery services expanding reach and convenience. The industry events calendar is filled with trade shows and industry conferences, offering networking opportunities and industry insights. Overall, the market is a dynamic and evolving industry, driven by consumer preferences and technological advancements.

The Offline segment was valued at USD 41.1 billion in 2019 and showed a gradual increase during the forecast period.

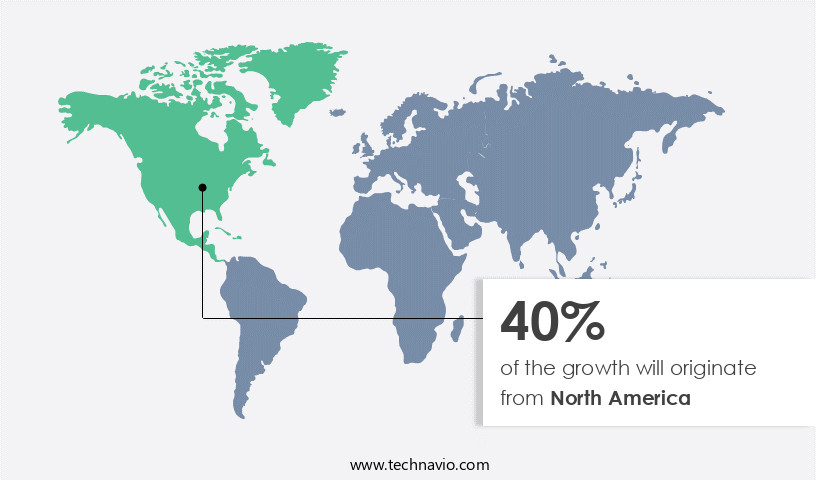

Regional Analysis

North America is estimated to contribute 40% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing steady growth, fueled by the increasing preference for convenient foods and on-the-go snacks among consumers. Retail bakeries in the US, Mexico, and Canada are key players in this market, with artisanal bakery products, including danish pastries, leading the segment. Consumer trends towards healthier options and experimentation with functional ingredients, such as probiotics, fiber, and protein, are driving innovation in the sector. Natural leaven and sourdough starters, organic ingredients, and ethical sourcing from chocolate suppliers are becoming increasingly important. Sustainability practices, such as energy efficiency and waste reduction, are also gaining traction.

Haccp compliance and franchise opportunities are essential for bakeries to ensure food safety and expand their reach. Social media marketing, online ordering, and custom cakes cater to evolving consumer preferences. Pastry techniques, texture consistency, and ingredient sourcing are crucial factors in product presentation and brand development. Market research, business models, and baking equipment are essential tools for bakeries seeking to stay competitive. Seasonal offerings, such as specialty desserts and artisan bread, add to the market's diversity. Corporate social responsibility, awards recognition, and decorating tools further enhance the customer experience and foster customer loyalty. Wholesale baking, proofing boxes, and shelf life management are essential for bakeries to optimize their operations and maintain profitability.

The market's future growth is expected to be influenced by consumer trends, industry events, and financial projections.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the thriving market, artisanal bakers create unique, handcrafted pastries using premium ingredients. From artisan breads and croissants to decadent cakes and exquisite macarons, these bakeries offer a diverse range of delicious treats. The market caters to consumers seeking authentic, high-quality baked goods, often made with locally sourced, organic ingredients. Specialty bakeries prioritize traditional baking techniques, ensuring each product boasts an unparalleled taste and texture. Gluten-free, vegan, and other dietary options are increasingly popular, reflecting the market's commitment to inclusivity. Customized cakes for special occasions and seasonal flavors add to the allure, making the market a delightful and ever-evolving niche within the food industry.

What are the key market drivers leading to the rise in the adoption of Specialty Bakery Industry?

- The market is propelled forward by the increasing demand for functional ingredients.

- The market is witnessing significant growth due to the increasing demand for functional and health-conscious baked goods. In response, bakery manufacturers are incorporating a variety of nutrient-rich ingredients, such as whole grains, sprouted grains, prebiotics, and probiotics, to meet evolving consumer preferences. These ingredients not only enhance fiber content and protein levels but also contribute to more nutritious baked goods. Moreover, the market is witnessing a surge in demand for gluten-free and dairy-free options, leading to the use of alternative flours like rice, almond, and tapioca, as well as plant-based milk substitutes such as almond and coconut milk.

- Functional ingredients, including enzymes and emulsifiers, play a vital role in improving texture, shelf life, and overall product quality. Brand development and customer experience are essential factors driving growth in the market. Many bakeries are investing in charitable giving and customer loyalty programs to build strong relationships with their customers. Industry events, baking competitions, and innovative packaging materials also contribute to market growth. Chocolate suppliers are focusing on ethical sourcing to meet the growing demand for sustainable and ethically produced ingredients. Limited-edition products and delivery services are also gaining popularity, providing consumers with unique and convenient options.

- Natural leaven and HACCP compliance are essential considerations for bakery manufacturers to ensure product safety and consistency. Investment opportunities exist for businesses looking to capitalize on these trends and innovate within the market. The market is expected to continue growing as consumers seek healthier, more sustainable, and more personalized baked goods.

What are the market trends shaping the Specialty Bakery Industry?

- The trend in the baking industry is shifting towards organic and gluten-free products due to rising consumer demand. These items are increasingly popular choices for health-conscious consumers.

- The market is experiencing significant growth due to increasing consumer preferences for artisan bread, seasonal offerings, and high-quality ingredients. Franchise opportunities in this sector provide entrepreneurs with proven business models, allowing them to invest in baking equipment, interior design, and marketing strategies. Market research indicates that health-conscious consumers are driving demand for organic baking products and ingredients, such as aluminum-free baking powder, gluten-free flour, and organic baking flour. Although these organic goods are more expensive due to higher manufacturing and raw material costs, their popularity is expected to fuel the growth of the organic specialty bakery segment. Pastry techniques, shelf life, and ingredient quality are essential factors that differentiate specialty bakeries from conventional ones.

- Energy efficiency is also a critical consideration, with many bakeries investing in energy-efficient equipment to reduce operating costs. Product innovation, such as sourdough starters and unique flavor combinations, is another key trend in the market. Wholesale baking is another revenue stream for specialty bakeries, allowing them to expand their reach beyond their physical locations. In conclusion, the market is an attractive business opportunity for entrepreneurs, offering potential for growth, innovation, and consumer appeal.

What challenges does the Specialty Bakery Industry face during its growth?

- The decline in popularity of specialty bakeries poses a significant challenge to the growth of the industry. This trend, which is a key concern for professionals in the field, necessitates innovative strategies to maintain customer interest and increase market share.

- The market is experiencing steady growth, with a higher expansion rate compared to traditional packaged bakery foods. However, the market share for specialty bakery items remains smaller than that of fresh bakery and mass-produced packaged bakery goods. The accessibility of packaged bakery foods in the market caters to a larger consumer base, making it a competitive landscape for manufacturers. Corporate social responsibility plays a significant role in the industry, with many companies focusing on waste reduction and sourcing ingredients from local flour mills and sugar refineries. Customers increasingly demand texture consistency and high-quality decorating tools for their specialty cakes, driving innovation in the market.

- In the food service industry, restaurant suppliers offer a wide range of proofing boxes and other equipment to ensure the best possible results. The profitability analysis of specialty bakery manufacturers depends on their ability to maintain a harmonious balance between cost and quality. Awards recognition and industry trade shows further boost market visibility and consumer trust. Gluten-free baking is a growing trend in the market, catering to the needs of consumers with dietary restrictions. Overall, the market is a dynamic and evolving industry, driven by consumer preferences, technological advancements, and a focus on sustainability.

Exclusive Customer Landscape

The specialty bakery market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the specialty bakery market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, specialty bakery market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ARYZTA AG - This company specializes in producing a diverse range of bakery items, encompassing bread rolls, artisan loaves, sweet baked goods, morning treats, and savory delights.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ARYZTA AG

- Associated British Foods Plc

- Britannia Industries Ltd.

- Conagra Brands Inc.

- Corporativo Bimbo SA de CV

- Dawn Food Products Inc.

- EUROPASTRY SA

- Flowers Foods Inc.

- Harry Brot GmbH

- IL GERMOGLIO FOOD Spa

- Krispy Kreme Inc.

- Lantmannen Unibake International

- Maple Donuts Inc.

- McKee Foods

- Puratos NV SA

- Raisio plc

- Rich Products Corp.

- The J.M. Smucker Co.

- UAB Mantinga

- Yamazaki Baking Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Specialty Bakery Market

- In January 2024, Ace Bakery, a leading specialty bakery company, introduced its new line of gluten-free artisanal breads in the US market. The product launch was announced in their press release and aimed to cater to the growing demand for gluten-free options (Ace Bakery Press Release, 2024).

- In March 2024, Panera Bread, a major player in the specialty bakery sector, partnered with General Mills to expand its bakery-cafe business. This collaboration allowed Panera to leverage General Mills' resources and expertise in the food industry, as stated in a Reuters article (Reuters, 2024).

- In May 2024, Lantmannen Unibake, a global bakery solutions provider, acquired the Dutch specialty bakery company, Meijer's Bakery. The acquisition, according to a company press release, strengthened Lantmannen Unibake's position in the European bakery market (Lantmannen Unibake Press Release, 2024).

- In February 2025, the US Food and Drug Administration (FDA) approved the use of a new natural preservative, natamycin, for use in artisanal breads. This approval, as stated in an FDA press release, allowed specialty bakeries to offer longer shelf life without the use of synthetic preservatives (FDA Press Release, 2025).

Research Analyst Overview

- In the market, customer reviews significantly influence consumer choices, with dietary restrictions being a key consideration. Influencer marketing and content marketing strategies help bakeries reach wider audiences, catering to the demand for specialty diets such as vegan and gluten-free options. Afternoon tea services and gourmet foods, including gourmet coffees and breakfast pastries, remain popular offerings. Bakeries employ inventory tracking software, data analytics, and supply chain management to optimize ingredient costs and ensure food safety certifications. Talent acquisition and workforce development are essential for maintaining high-quality baking classes, culinary workshops, and custom orders. Event catering, including wedding catering, contributes to growth, with point-of-sale systems facilitating efficient order processing.

- Allergen management and dairy-free baking are crucial for catering to diverse customer needs. Brand storytelling and food photography showcase unique offerings, while online ordering platforms and food labeling regulations ensure transparency. Coffee shop partnerships expand reach and provide opportunities for cross-promotion. Bakeries must balance these trends while managing inventory, optimizing supply chains, and focusing on employee retention.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Specialty Bakery Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

231 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.6% |

|

Market growth 2025-2029 |

USD 16209.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.4 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Specialty Bakery Market Research and Growth Report?

- CAGR of the Specialty Bakery industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the specialty bakery market growth of industry companies

We can help! Our analysts can customize this specialty bakery market research report to meet your requirements.