Specialty Insurance Market Size 2024-2028

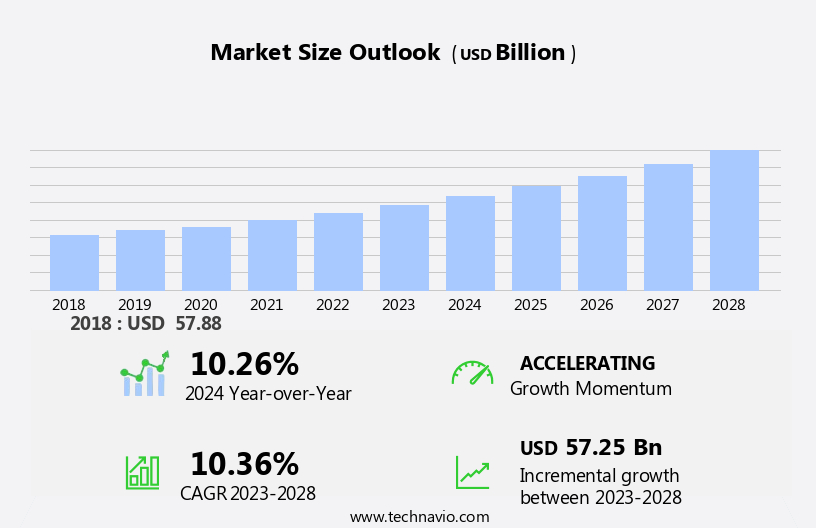

The specialty insurance market size is forecast to increase by USD 57.25 billion at a CAGR of 10.36% between 2023 and 2028.

- The market is experiencing significant growth due to several key drivers. The increasing globalization and interconnectedness of businesses are leading to a higher demand for specialized risk coverage. Moreover, there is an upward trend in collaboration among specialty insurers to offer comprehensive risk management solutions. However, the market also faces challenges related to cyberattacks through the digital technologies used for underwriting and claims processing.

- As businesses continue to digitize their operations, the risk of cyber threats becomes more pronounced. Artificial intelligence, data analytics, and digital services platforms are transforming the insurance industry, enabling customized underwriting, risk assessment, claims processing, and policy management. Therefore, insurers must invest in strong cybersecurity measures to mitigate these risks and maintain customer trust. Overall, the market is expected to witness steady growth in the coming years, driven by these factors and the evolving risk landscape.

What will be the Specialty Insurance Market Size During the Forecast Period?

- Specialty insurance caters to the unique and complex risk management needs of various industries and businesses. Negligence claims, judgment and legal fees, are just some of the risks that standard insurance policies may not cover adequately. Specialty insurers offer customized solutions for businesses in the environmental industry, technology sector, aviation, marine, fine art, terrorism, and other non-standard risks. Technology integration, such as blockchain, is transforming the market. This innovation streamlines claims processing, enhances policy management, and improves customer experiences. Cyber liability is a significant concern for businesses in today's digital age, and specialty insurers provide coverage for data breaches and other cyber threats.

- Moreover, evolving regulations and the pricing of policies are essential factors in the market. Specialty insurers employ risk mitigation strategies to help businesses navigate these challenges. Data analytics tools enable insurers to assess risks more accurately and offer tailored solutions. The aviation and marine industries present unique risks that require specialized insurance products. Fine art, for instance, necessitates coverage for theft, damage, and loss. Terrorism risks require comprehensive insurance solutions to protect businesses from potential attacks. Specialty insurers offer a range of conventional plans with flexible policy terms to cater to diverse business needs. Their expertise in handling complex risks and claims processing sets them apart from traditional insurers. By focusing on the specific needs of industries and businesses, specialty insurers help mitigate risks and provide peace of mind to their clients.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Brokers

- Non-brokers

- End-user

- Business

- Individual

- Geography

- Europe

- Germany

- France

- North America

- US

- APAC

- China

- Japan

- South America

- Middle East and Africa

- Europe

By Distribution Channel Insights

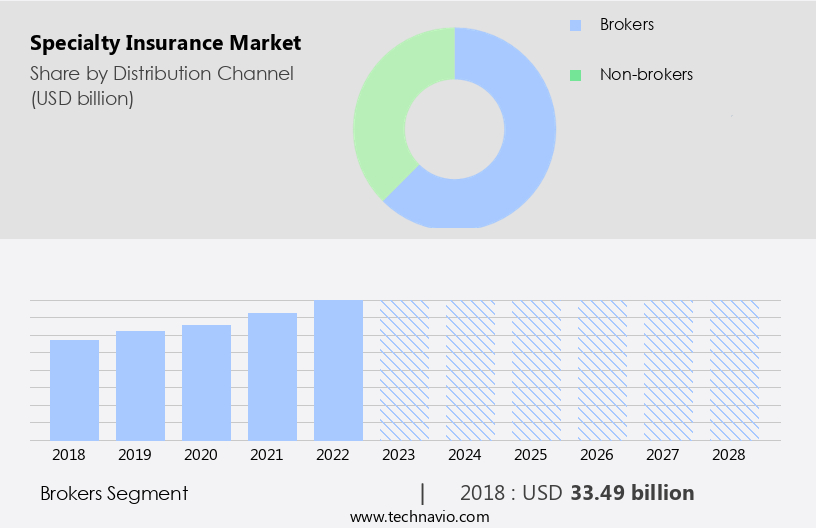

- The brokers segment is estimated to witness significant growth during the forecast period.

In the specialized insurance sector, brokers serve as intermediaries between insurers and clients, utilizing various distribution channels to cater to distinct market segments. Traditional agency networks represent a significant distribution avenue, where brokers forge relationships with carriers and offer personalized services to clients, ensuring customized coverage for intricate insurance requirements. Conversely, digital platforms and online marketplaces have emerged as a prominent distribution channel, driven by the insurance industry's digitalization. Online brokers leverage technology to simplify the purchasing process, providing clients with convenient access to a wide range of insurance policies. Both channels cater to the unique needs of the business and individuals segments in the market.

Get a glance at the market report of share of various segments Request Free Sample

The brokers segment was valued at USD 33.49 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

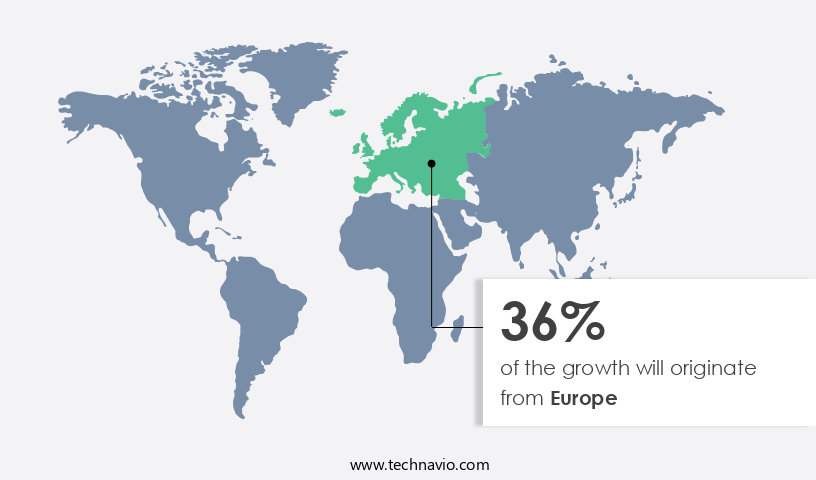

- Europe is estimated to contribute 36% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The European market is characterized by its diversity and complexity, catering to the unique risk management needs of businesses in various industries. With a economy spanning manufacturing, finance, and technology sectors, European businesses require specialized insurance solutions to mitigate risks specific to their operations. Strict regulatory requirements, including GDPR and Solvency II, necessitate insurance products that ensure compliance. Additionally, Europe's position as a global innovation hub drives demand for coverage against emerging risks, such as cyber threats and technology errors and omissions. The region's increasing focus on sustainability and environmental stewardship also creates demand for insurance solutions addressing environmental liabilities and climate-related risks. The European market continues to evolve, presenting opportunities for insurers to offer tailored risk management strategies and innovative products.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Specialty Insurance Market?

Increasing globalization and interconnectedness of business is the key driver of the market.

- The market is experiencing significant growth due to the increasing interconnectedness and globalization of businesses. As companies expand their operations internationally, they encounter unique risks that go beyond the scope of standard insurance policies. Factors fueling this trend include the rise of multinational corporations, expanding international trade agreements, and advancements in technology that facilitate cross-border commerce. Specialty risks arising from globalization include political instability, currency fluctuations, supply chain disruptions, and regulatory complexities. For instance, businesses operating in the environmental industry face potential negligence claims and judgment & legal fees, while technology integration brings about cyber liability risks.

- Moreover, entertainment industries require insurance coverage for events and art, and livestock & aquaculture industries face unique perils. Program administrators (PAs) and brokers play a crucial role in connecting businesses with specialized insurance providers and programs. Non-brokers and venture capital firms also participate in the market, catering to the needs of various business segments and individuals.Specialty insurers employ risk mitigation strategies to address evolving regulations and potential threats, ensuring financial impact for their clients. Disaster products, non-profit protection, and mortgage banking are other business segments that require specialized insurance coverage.

- Insurers offer disaster products to mitigate risks from natural catastrophes, while non-profit protection shields organizations from liability claims. Mortgage banking requires coverage for property risks and title issues. The market encompasses a wide range of niche insurance products, including those for aviation, marine, fine art, terrorism, and non-standard risks. As emerging risks continue to surface, insurers adapt their offerings to meet the evolving needs of their clients. In conclusion, the market is a dynamic and essential component of the global insurance industry. It caters to the unique risks and needs of various business segments and individuals, ensuring financial protection and risk management in an increasingly interconnected and complex business environment.

What are the market trends shaping the Specialty Insurance Market?

An increase in collaboration among specialty insurer is the upcoming trend in the market.

- The market in the US is witnessing significant growth due to the increasing complexity of risks and the need for customized solutions. Specialty insurers are collaborating with businesses, program administrators (PAs), brokers, and non-brokers to offer non-standard risks coverage for various industries, including the environmental sector, technology integration, and disaster products. These collaborations aim to expand market reach and capabilities, with Munich Reinsurance Co.'s partnership with a startup for self-driving vehicle insurance being a notable example. Moreover, specialty insurance providers are integrating artificial intelligence (AI) and data analytics to assess risks, process claims, and price policies effectively. This integration is crucial in industries with high potential threats, such as cyber liability, aviation, marine, fine art, terrorism, and supply chain disruption.

- Moreover, the entertainment industry, art insurance, livestock & aquaculture insurance, mortgage banking, non-profit protection, and digital services platforms are also benefiting from specialized insurance products. As regulations evolve and emerging risks arise, insurers are implementing risk mitigation strategies to address financial impact and improve customer experiences. Specialty insurance programs offer customized underwriting, risk assessment, and policy management for businesses and individuals, ensuring profitability and addressing their unique needs. The insurance industry's conventional plans are being supplemented with these specialized products, catering to various business segments and the individuals segment.

- In conclusion, the market in the US is experiencing a shift towards innovation, collaboration, and customization. The integration of AI, data analytics, and emerging risks is driving the growth of this market, with various industries and segments benefiting from specialized insurance products and programs.

What challenges does Specialty Insurance Market face during the growth?

Concerns related to cyberattacks through digital technologies used for specialty insurance is a key challenge affecting the market growth.

- The market caters to the unique and non-standard risks faced by businesses and individuals, encompassing various sectors such as the environmental industry, technology integration, entertainment, art, livestock & aquaculture, mortgage banking, disaster products, non-profit protection, digital services platforms, and more. Specialty insurance providers and companies offer customized underwriting, risk assessment, and claims processing through specialized insurance programs. The increasing integration of technology, including artificial intelligence and blockchain, has transformed the industry, enabling advanced risk mitigation strategies and data analytics. This evolution is particularly relevant for businesses with complex infrastructure and supply chain disruptions.

- However, these advancements also introduce new risks, such as cyber liability, terrorism, and non-standard risks, necessitating the expertise of specialty insurers. Evolving regulations and potential threats pose financial impacts on businesses and individuals, necessitating the need for comprehensive insurance coverage. Specialty insurers offer niche insurance products to address these emerging risks, ensuring client satisfaction through conventional plans, policy management, and customer experiences. Despite the benefits, challenges persist, including the pricing of policies, claims processing, and data analytics tools. As the insurance industry continues to adapt to these changes, the importance of effective risk assessment and underwriting becomes increasingly crucial.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Allianz SE

- American International Group Inc.

- Assicurazioni Generali S.p.A.

- Avolta AG

- AXA Group

- Beazley Plc

- Berkshire Hathaway Inc.

- Chubb Ltd.

- Hiscox Ltd.

- Liberty Mutual Insurance Co.

- Markel Corp.

- Munich Reinsurance Co.

- PICC Property and Casualty Co. Ltd.

- QBE Insurance Group Ltd.

- SELECTIVE INSURANCE GROUP INC.

- THE HANOVER INSURANCE GROUP INC.

- THE HARTFORD FINANCIAL SERVICES GROUP INC.

- Tokio Marine Holdings Inc.

- Zurich Insurance Co. Ltd.

- ARGO GROUP INTERNATIONAL HOLDINGS LTD.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Specialty insurance is a unique segment of the insurance industry that caters to the distinct risk management needs of various businesses and individuals. This sector encompasses a wide range of non-standard risks, from negligence claims in the entertainment industry to environmental hazards in the technology sector. Businesses across industries increasingly recognize the importance of specialized insurance coverage to mitigate risks and protect their assets. Negligence claims, judgment & legal fees, and disaster products are just a few examples of the risks that businesses face in today's complex business environment. The environmental industry, for instance, is particularly vulnerable to environmental liabilities and requires specialized insurance programs to manage these risks. Technological advancements are transforming the specialty insurance landscape. Program administrators (PAS) and digital services platforms are integrating artificial intelligence (AI) and data analytics tools to streamline underwriting, claims processing, and policy management. Blockchain technology is also gaining traction in the industry, offering enhanced security and transparency in policy issuance and claims processing.

Moreover, the entertainment industry, art market, livestock & aquaculture, and non-profit protection are among the niche areas where customized underwriting and risk assessment are crucial. Brokers and non-brokers play a vital role in connecting clients with the right specialty insurance providers and companies. Venture capital firms and mortgage banking institutions are increasingly investing in specialty insurance providers and programs, recognizing the potential financial impact of emerging risks such as cyber liability, aviation, marine, fine art, terrorism, and non-standard risks. The insurance industry is subject to evolving regulations and potential threats, requiring insurers to adapt and innovate to meet the changing needs of their clients. Customized underwriting, risk assessment, and pricing of policies are essential components of effective risk mitigation strategies. Individuals also benefit from specialized insurance products, such as art insurance and personal liability coverage.

In summary, traditional insurance policies often do not provide adequate protection for these unique risks. The market is dynamic and complex, with emerging risks and underwriting trends shaping the industry. Effective risk management strategies, evolving regulations, and technological advancements are key drivers of growth and innovation in this sector. In conclusion, the market offers a wealth of opportunities for businesses and individuals seeking customized risk management solutions. From program administrators and digital services platforms to specialty insurance providers and companies, the industry is transforming to meet the evolving needs of its clients. By staying informed of market trends and emerging risks, businesses and individuals can make informed decisions and protect their assets effectively.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

162 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.36% |

|

Market growth 2024-2028 |

USD 57.25 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

10.26 |

|

Key countries |

US, China, Japan, Germany, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch