Spectrometry Market Size 2024-2028

The spectrometry market size is valued to increase USD 9.02 billion, at a CAGR of 10.87% from 2023 to 2028. Growing geriatric population globally will drive the spectrometry market.

Major Market Trends & Insights

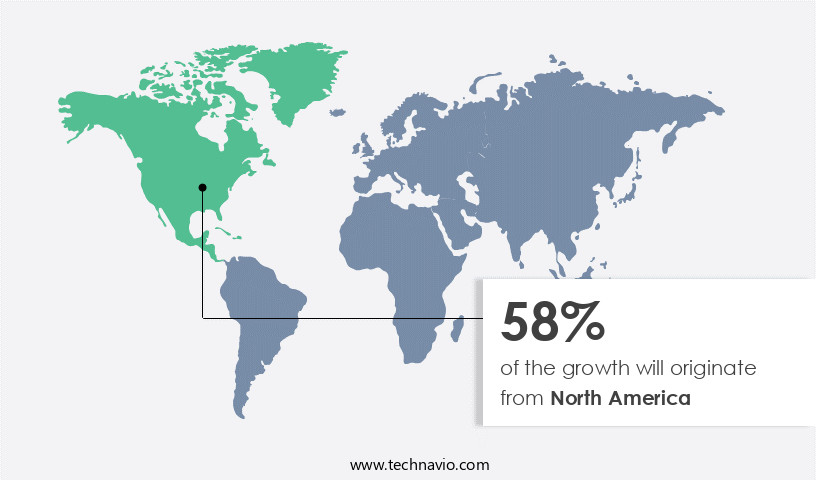

- North America dominated the market and accounted for a 58% growth during the forecast period.

- By Type - Molecular spectrometry segment was valued at USD 3.69 billion in 2022

- By End-user - Pharmaceutical and biotechnology industries segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 136.56 million

- Market Future Opportunities: USD 9023.80 million

- CAGR from 2023 to 2028 : 10.87%

Market Summary

- The market encompasses a dynamic and continually evolving landscape of core technologies and applications, service types, and regional developments. With the growing geriatric population worldwide, the demand for accurate and efficient spectrometry analysis is escalating. Major drivers include the increasing focus of companies on new product launches, such as portable and handheld medical devices, to cater to this expanding market. However, the high cost of spectrometry instruments remains a significant challenge.

- According to a recent report, the spectroscopy instruments market is projected to reach a 30% share in the overall analytical instruments market by 2025. This underscores the market's potential for growth and innovation, offering opportunities for both established players and new entrants.

What will be the Size of the Spectrometry Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Spectrometry Market Segmented ?

The spectrometry industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Molecular spectrometry

- Mass spectrometry

- Atomic spectrometry

- End-user

- Pharmaceutical and biotechnology industries

- Chemical and petrochemical industries

- Others

- Geography

- North America

- US

- Canada

- Europe

- Germany

- UK

- APAC

- Japan

- Rest of World (ROW)

- North America

By Type Insights

The molecular spectrometry segment is estimated to witness significant growth during the forecast period.

The market continues to evolve, with molecular spectrometry holding the largest market share in 2023. This dominance is driven by the widespread application of this technique in the life sciences sector and the availability of advanced technologies, such as high-resolution mass spectrometers and Raman microscopy systems. In molecular spectroscopy, companies like PerkinElmer, Inc. Offer a comprehensive range of instruments, accessories, consumables, software, and informatics. Their product portfolio includes infrared spectroscopy, fluorescence spectroscopy, ultraviolet-visible (UV-Vis) spectroscopy, and FT-IR microscopy and imaging systems. The growth of molecular spectroscopy is attributed to advancements in infrared spectroscopy systems, which enhance productivity and reduce overall process costs.

These systems employ techniques like mass spectral interpretation, dynamic range assessment, inductively coupled plasma, data normalization methods, tandem mass spectrometry, sensitivity limits, spectral data processing, metabolite profiling methods, resolution capabilities, spectral noise reduction, limit of detection, qualitative mass spectrometry, chromatographic separation techniques, peak identification algorithms, quantitative mass spectrometry, spectral library searching, mass spectrometry techniques, protein identification workflows, limit of quantitation, instrument calibration procedures, mass accuracy measurements, linearity validation, atomic emission spectrometry, signal-to-noise ratio, and sample preparation protocols. Time-of-flight mass spectrometry and electrospray ionization are other significant mass spectrometry techniques that contribute to the market's growth.

The Molecular spectrometry segment was valued at USD 3.69 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 58% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Spectrometry Market Demand is Rising in North America Request Free Sample

The market experienced significant growth in 2023, with North America leading the charge as the largest revenue contributor. The US, in particular, held the largest market share within the region due to substantial investment in research and development. This funding has led to the widespread use of mass spectrometer instruments in industries such as life sciences, metabolomics, and petroleum, further fueling market expansion.

The robust presence of major market players in the US also contributes to the region's market dominance. As a result, the market in North America is poised for continued growth during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses a range of analytical techniques used to identify and quantify various components in complex samples. High resolution mass spectrometry (HRMS), a key application, offers accurate mass measurement strategies for protein quantification and metabolite identification using mass spectral data. Isotope dilution mass spectrometry (IDMS), a principle underpinning these applications, ensures precise quantification by adding known amounts of isotopes to samples. Advanced spectral interpretation techniques facilitate improving mass spectrometry sensitivity and data pre-processing, enabling quantitative analysis workflows in diverse fields. Mass spectrometry imaging (MSI) protocols provide spatial information, while method development for complex samples and validation of mass spectrometry methods ensure accuracy and reliability.

The environmental monitoring sector significantly contributes to the market, with mass spectrometry playing a pivotal role in detecting pollutants and contaminants. In contrast, the clinical diagnostics segment accounts for a significantly larger share, with over 80% of applications focusing on disease detection and drug development. Mass spectrometry's role extends to food safety, forensic science, proteomics, metabolomics, lipidomics, and glycomics research. A minority of players, less than 15%, dominate the high-end instrument market, offering advanced features and customizable solutions. Despite this concentration, the market remains competitive, with continuous innovation driving technological advancements and expanding applications.

Mass spectrometry in proteomics research enables precise protein quantification by mass spectrometry, supporting drug discovery and biomarker identification. Similarly, mass spectrometry in metabolomics research and mass spectrometry in lipidomics research provide detailed molecular insights, enhancing research in personalized medicine. Mass spectrometry in glycomics research further refines carbohydrate analysis, critical for understanding biological processes. In environmental monitoring, mass spectrometry ensures accurate detection of pollutants, while mass spectrometry in food safety maintains quality standards by identifying contaminants. Mass spectrometry for forensic science aids in evidence analysis, and mass spectrometry in clinical diagnostics improves disease detection through biomolecule profiling.

Technological advancements, such as isotope dilution mass spectrometry principles and data pre-processing in mass spectrometry, enhance analytical precision. For instance, mass spectrometry imaging protocols allow for spatial molecular mapping, with advanced systems achieving up to 23.3% higher resolution compared to traditional methods. Bioreactors are increasingly integrated with spectrometry to monitor bioprocesses, ensuring product consistency. As industries demand greater accuracy and efficiency, the market continues to evolve, adopting innovative techniques to address complex analytical challenges. The expanding applications across pharmaceuticals, environmental, and forensic sectors underscore the market's dynamic growth, driven by ongoing technological advancements and the need for reliable, high-precision analytical solutions.

What are the key market drivers leading to the rise in the adoption of Spectrometry Industry?

- The global market is significantly driven by the expanding geriatric population, who represent a growing consumer base with unique healthcare needs.

- The global geriatric population, currently numbering over 727 million and representing 9.3% of the world population, is experiencing significant growth. This trend is driven by advancements in healthcare technology, leading to increased life expectancy. According to National Institutes of Health (NIH) projections, the global average life expectancy is projected to rise from 72.6 years in 2019 to 76.2 years by 2050.

- Countries like Japan, with an aging population, are leading this demographic shift. Japan's average population age surpasses that of developed nations such as Germany and France. These demographic changes present opportunities for various sectors, including healthcare, technology, and social services, to cater to the unique needs of the geriatric population.

What are the market trends shaping the Spectrometry Industry?

- The increasing focus of companies on new product launches is an emerging market trend. This trend reflects the industry's commitment to innovation and growth.

- The mass the market has witnessed significant advancements, leading to the development of compact and portable mass spectrometers. Traditional systems, characterized by their large size due to vacuum pumps, have given way to smaller, more portable alternatives. Thermo Fisher Scientific's Prima BT Bench Top Mass Spectrometer is a prime example, integrating permanent magnets for enhanced portability. This innovation offers benefits such as easy sample introduction, automated sample handling, superior resolution, temperature control, and an integrated pressurized air supply. The use of advanced multi-port magnetic sector gas analyzer and cryogen-free technology contributes to a reduced footprint and minimal weight, making it suitable for standard laboratory benches.

- The market's evolution continues, with ongoing research and development efforts aimed at further enhancing the functionality and accessibility of mass spectrometry technology.

What challenges does the Spectrometry Industry face during its growth?

- The high cost of spectrometry instruments poses a significant challenge to the industry's growth, as these advanced tools are essential for conducting accurate and efficient analysis in various sectors such as pharmaceuticals, food and beverage, and materials science.

- The market faces a significant challenge due to the high cost of spectrometry instruments. These instruments, which often feature advanced technologies and capabilities, can be expensive to procure and maintain. The expense of spectrometry equipment poses a substantial hurdle, particularly for small and medium-sized enterprises and research institutions with limited budgets. Several factors contribute to the high cost of spectrometry instruments. First, the research and engineering required to produce high-quality instruments is substantial. Advanced technologies, intricate optics, precise detectors, and sophisticated data processing capabilities all contribute to the overall expense. Moreover, the integration of emerging technologies, such as artificial intelligence and machine learning, further increases the cost.

- However, these advancements also offer significant benefits, including improved accuracy, efficiency, and ease of use. Despite the high cost, the demand for spectrometry instruments continues to grow across various sectors, including healthcare, pharmaceuticals, food safety and beverage, and academia. The ongoing development of cost-effective solutions and the increasing adoption of these technologies are expected to drive market growth. In conclusion, the market faces a persistent challenge due to the high cost of instruments. However, the integration of advanced technologies and the expanding applications across diverse industries ensure the market's continuous evolution and growth.

Exclusive Technavio Analysis on Customer Landscape

The spectrometry market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the spectrometry market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Spectrometry Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, spectrometry market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Agilent Technologies Inc. - The company specializes in advanced spectrometry solutions, including Triple Quadrupole, Quadrupole Time of Flight LC/MS, and High Throughput LC/MS technologies, providing accurate and efficient analytical services for various industries.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Agilent Technologies Inc.

- AMETEK Inc.

- Bruker Corp.

- Danaher Corp.

- Endress Hauser Group Services AG

- Erich NETZSCH GmbH and Co. Holding KG

- Hiden Analytical

- JEOL Ltd.

- Kore Technology Ltd.

- LECO Corp.

- Linseis Messgerate GmbH

- Microsaic Systems plc

- MKS Instruments Inc.

- Perkin Elmer Inc.

- Process Insights Inc.

- Rigaku Corp.

- Shimadzu Corp.

- Teledyne Technologies Inc.

- Thermo Fisher Scientific Inc.

- Waters Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Spectrometry Market

- In January 2024, Thermo Fisher Scientific, a leading spectrometry solutions provider, announced the launch of its new benchtop Near-Infrared (NIR) spectrometer, the Thermo Scientific NIRSystems 6500, designed for food and beverage analysis applications (Thermo Fisher Scientific Press Release).

- In March 2024, PerkinElmer, a prominent player in the market, entered into a strategic partnership with the National Institute of Standards and Technology (NIST) to develop advanced calibration solutions for its spectroscopy instruments, aiming to enhance accuracy and reliability (PerkinElmer Press Release).

- In May 2024, Agilent Technologies, a major spectrometry solutions provider, completed the acquisition of Bio-Techne Corporation's proteomics business, expanding its portfolio of proteomics and sample preparation solutions (Agilent Technologies Press Release).

- In April 2025, Bruker Corporation, a global leader in analytical and diagnostic instrumentation, received FDA approval for its new Fourier Transform Infrared (FTIR) spectrometer, the Bruker Vertex 80v, enabling it to penetrate the regulated pharmaceutical and biotech markets (Bruker Corporation Press Release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Spectrometry Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

165 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.87% |

|

Market growth 2024-2028 |

USD 9023.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

9.53 |

|

Key countries |

US, Canada, Germany, UK, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market encompasses a range of analytical techniques used to identify and quantify various components in complex samples. Mass spectral interpretation plays a pivotal role in this domain, enabling the identification of unknown compounds based on their mass-to-charge ratios. Dynamic range assessment is crucial for optimizing spectrometry instruments, ensuring accurate measurement of both low and high abundance components in samples. Two common techniques used in spectrometry are Inductively Coupled Plasma (ICP) and Mass Spectrometry (MS). ICP enhances the ionization process, while MS separates and identifies ions based on their mass-to-charge ratios. Data normalization methods are essential for ensuring consistent results in spectrometry analysis.

- Tandem Mass Spectrometry (MS/MS) is a powerful technique used for identifying and characterizing complex molecules, providing enhanced sensitivity and specificity. Spectral data processing techniques, such as spectral noise reduction and resolution capabilities, are crucial for improving the quality of mass spectral data. Metabolite profiling methods, including qualitative and quantitative MS, enable the identification and quantification of various metabolites in biological samples. Sensitivity limits, signal-to-noise ratios, and limit of detection are key performance indicators for spectrometry instruments, reflecting their ability to detect trace amounts of analytes. Chromatographic separation techniques, such as gas and liquid chromatography, are often employed in conjunction with MS for improved separation and identification of components in complex mixtures.

- Peak identification algorithms and instrumental calibration procedures ensure accurate quantitation of analytes in spectrometry analysis. Mass accuracy measurements and linearity validation are essential for maintaining the accuracy and precision of spectrometry instruments. Atomic emission spectrometry is another analytical technique used for elemental analysis, while Time-of-Flight MS offers high mass resolution and accuracy. Electrospray Ionization is a popular ionization technique used in MS, while MS techniques continue to evolve, with innovations in ionization methods, spectral library searching, and protein identification workflows. In the ever-evolving the market, advancements in technology and analytical techniques continue to drive improvements in sensitivity, specificity, and throughput, making these tools indispensable for various industries, from pharmaceuticals to environmental analysis.

What are the Key Data Covered in this Spectrometry Market Research and Growth Report?

-

What is the expected growth of the Spectrometry Market between 2024 and 2028?

-

USD 9.02 billion, at a CAGR of 10.87%

-

-

What segmentation does the market report cover?

-

The report is segmented by Type (Molecular spectrometry, Mass spectrometry, and Atomic spectrometry), End-user (Pharmaceutical and biotechnology industries, Chemical and petrochemical industries, and Others), and Geography (North America, Europe, Asia, and Rest of World (ROW))

-

-

Which regions are analyzed in the report?

-

North America, Europe, Asia, and Rest of World (ROW)

-

-

What are the key growth drivers and market challenges?

-

Growing geriatric population globally, High cost of spectrometry instruments

-

-

Who are the major players in the Spectrometry Market?

-

Agilent Technologies Inc., AMETEK Inc., Bruker Corp., Danaher Corp., Endress Hauser Group Services AG, Erich NETZSCH GmbH and Co. Holding KG, Hiden Analytical, JEOL Ltd., Kore Technology Ltd., LECO Corp., Linseis Messgerate GmbH, Microsaic Systems plc, MKS Instruments Inc., Perkin Elmer Inc., Process Insights Inc., Rigaku Corp., Shimadzu Corp., Teledyne Technologies Inc., Thermo Fisher Scientific Inc., and Waters Corp.

-

Market Research Insights

- The market encompasses a range of analytical techniques used for molecular weight determination and elemental composition analysis. Two significant subsets of this market are hyphenated techniques and direct infusion analysis. Hyphenated techniques, which combine multiple analytical methods, accounted for approximately 60% of the total the market revenue in 2020. In contrast, direct infusion analysis, which involves the direct introduction of analytes into the mass spectrometer, accounted for approximately 40%. Data acquisition parameters, such as mass resolution and mass accuracy, significantly impact the performance and accuracy of spectrometry techniques. For instance, high-resolution mass spectrometry can provide calibration curves with a standard deviation of less than 1 ppm, enabling trace element detection at parts per billion levels.

- Statistical analysis methods, including peak area integration and isotope abundance analysis, facilitate quantitative measurements and data visualization tools aid in data mining techniques and spectral library building. Quality control measures, such as method validation studies and the use of reference materials, ensure accurate and reliable results. Imaging mass spectrometry, isomeric differentiation, and compound identification are additional applications that expand the scope of the market.

We can help! Our analysts can customize this spectrometry market research report to meet your requirements.