Spectrum Analyzer Market Size 2024-2028

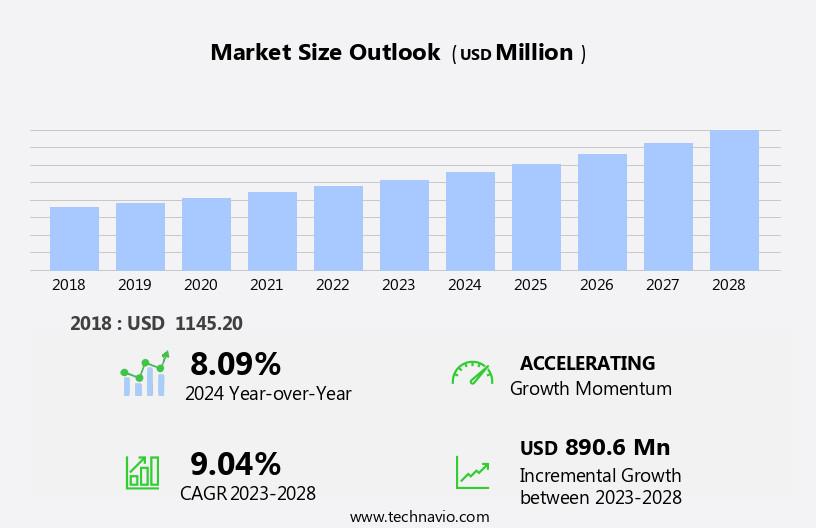

The spectrum analyzer market size is forecast to increase by USD 890.6 million at a CAGR of 9.04% between 2023 and 2028.

What will be the Size of the Spectrum Analyzer Market during the forecast period?

How is this Spectrum Analyzer Industry segmented?

The spectrum analyzer industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Communication

- Aerospace and defense

- Mechanical

- Semiconductor and electronics

- Technology

- Wired

- Wireless

- Geography

- North America

- US

- APAC

- China

- India

- Europe

- Germany

- France

- South America

- Middle East and Africa

- North America

By End-user Insights

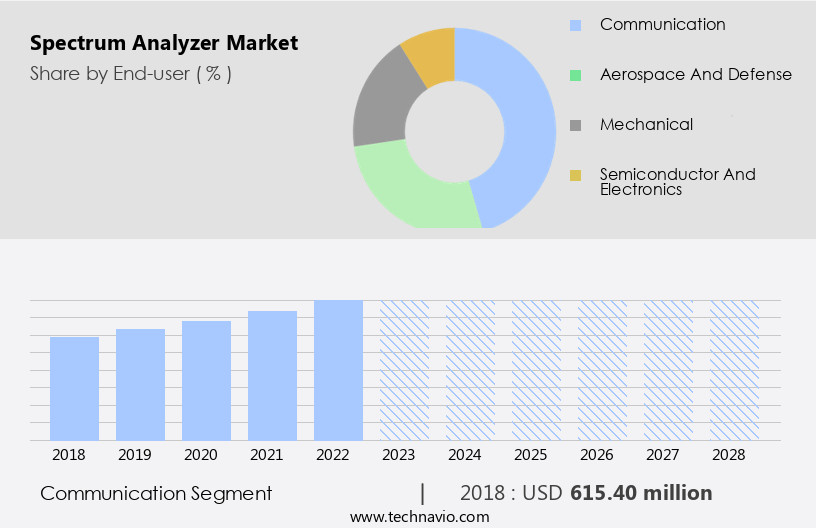

The communication segment is estimated to witness significant growth during the forecast period.

Spectrum analyzers are indispensable instruments In the telecommunications and electronics industries, enabling the analysis and monitoring of signals' frequency spectrum, measurement of signal strength, and detection of interference. With the proliferation of advanced technologies such as 5G, IoT, and digital signal processing, the demand for spectrum analyzers has significantly grown. These devices are instrumental In the design, testing, and optimization of wireless communication systems, ensuring network efficiency, troubleshooting, and regulatory compliance. As countries and regions allocate new frequency bands for wireless applications, the importance of spectrum analyzers in managing and monitoring expanded frequency ranges becomes increasingly vital, driving market expansion during the forecast period.

Spectrum analyzers come in various forms, including swept spectrum analyzers, vector signal analyzers, handheld, portable, benchtop, automotive, and wireless spectrum analyzers, catering to diverse industry needs. Advanced algorithms, artificial intelligence, and machine learning enhance their functionality, making them essential tools for network operators, engineers, and technicians in electronics and semiconductor, IT and telecommunication, and other sectors.

Get a glance at the market report of share of various segments Request Free Sample

The Communication segment was valued at USD 615.40 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

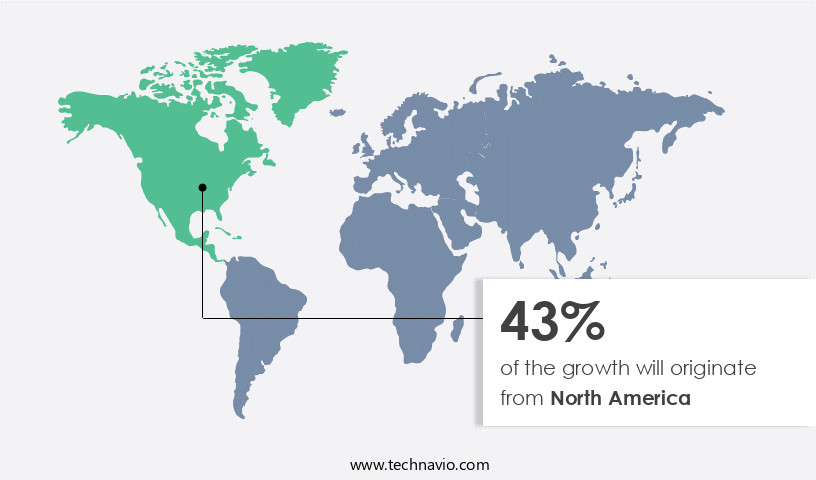

North America is estimated to contribute 43% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market is a significant segment In the advanced instruments industry, focusing on measuring electrical signals In the frequency domain. This market caters to various sectors, including telecommunications, aerospace and defense, electronics manufacturing, broadcasting, and wireless communication systems. Spectrum analyzers are integral to understanding signal frequencies, amplitudes, spectral content, and wireless applications. In North America, which dominates the global market, the deployment and optimization of 5G networks are driving demand. Spectrum analyzers are essential for characterizing and troubleshooting signals in high-frequency bands, ensuring optimal network performance. Telecommunication providers in North America are continuously expanding and optimizing their wireless networks, making spectrum analyzers indispensable tools.

Additionally, sectors like automotive and transportation, healthcare, and smart cities are also adopting wireless spectrum analyzers for coverage mapping, drive testing, direction finding, transmitter localization, and propagation analysis. Digital signal processing, advanced algorithms, artificial intelligence, and machine learning are enhancing the functionality of modern spectrum analyzers. The hardware and software segments, as well as the network technology segment, are key market categories. Frequency range, form factor, and swept spectrum analyzers, vector signal analyzers, and wireless network solutions are significant product types.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Spectrum Analyzer Industry?

- Increasing demand for spectrum analyzers in defense is the key driver of the market.

- Spectrum analyzers play a pivotal role in electronic warfare and signal intelligence, enabling the detection, interception, analysis, and identification of enemy communication signals and radar emissions. In modern military operations, gaining control over the electromagnetic spectrum is crucial for maintaining reliable communications and denying adversaries access to critical frequencies. The military sector is embracing advanced technologies such as cognitive radio and dynamic spectrum access to optimally utilize the spectrum. These technologies allow spectrum analyzers to identify and exploit available frequency bands dynamically, thereby enhancing communication capabilities in complex and congested environments. The dynamic nature of the electromagnetic spectrum necessitates the use of sophisticated spectrum analyzers to ensure effective spectrum management and maintain a competitive edge In the ever-evolving landscape of electronic warfare.

What are the market trends shaping the Spectrum Analyzer Industry?

- Robust demand for wireless communication technologies is the upcoming market trend.

- The proliferation of wireless communication technologies, such as 5G, IoT, and Wi-Fi, necessitates the use of spectrum analyzers for optimizing, managing, and troubleshooting wireless signals within various frequency bands. The growth of IoT and smart devices relies on efficient wireless communication, making spectrum analyzers indispensable. These tools prevent interference and ensure smooth wireless communication by managing the crowded radio frequency spectrum. Additionally, they verify and ensure compliance with spectrum regulations for devices, reducing the risk of interference and enhancing network reliability. As new wireless standards and technologies, like Wi-Fi 6/6E and future advancements, emerge, spectrum analyzers become essential for testing and certification, ensuring compliance with the latest wireless standards.

What challenges does the Spectrum Analyzer Industry face during its growth?

- High cost associated with spectrum analyzers is a key challenge affecting the industry growth.

- Spectrum analyzers, essential tools for measuring and analyzing radio frequency (RF) signals, come with advanced capabilities such as wider frequency ranges, high resolution, fast sweep rates, and real-time analysis. These features necessitate sophisticated components and engineering, leading to higher manufacturing costs. High-performance spectrum analyzers, which offer advanced features, can be expensive, making them less accessible to smaller businesses or organizations with budget constraints. Maintaining high calibration accuracy and quality standards is crucial for spectrum analyzers, adding to the manufacturing and maintenance costs. Real-time analysis capabilities require powerful processors and specialized hardware, further increasing the overall cost. Additionally, spectrum analyzers with advanced connectivity options and software integration capabilities necessitate additional hardware and software development, adding to the overall cost.

- These factors may hinder the growth of the market during the forecast period.

Exclusive Customer Landscape

The spectrum analyzer market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the spectrum analyzer market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, spectrum analyzer market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Aaronia AG - The company provides advanced spectrum analysis solutions, including Real-Time and Sweep Spectrum analysers, enhancing search engine visibility for organizations seeking efficient and informative spectrum analysis tools. These analysers cater to various industry applications, aligning with the company's commitment to delivering cutting-edge technology and expertise.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aaronia AG

- Advantest Corp.

- AFJ Instruments Srl

- Aim and Thurlby Thandar Instruments

- Anritsu Corp.

- Avcom of Virginia Inc.

- B and K Precision Corp.

- Berkeley Nucleonics Corp.

- CRFS Ltd.

- Fortive Corp.

- Giga tronics Inc.

- Keysight Technologies Inc.

- LP Technologies Inc.

- National Instruments Corp.

- Rohde and Schwarz GmbH and Co. KG

- Shenzhen Dingyang Technology Co. Ltd.

- Signal Hound

- Stanford Research Systems

- Teledyne Technologies Inc.

- Yokogawa Electric Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The frequency spectrum market encompasses a diverse range of applications, from telecommunications and aerospace and defense to electronics manufacturing and broadcasting. Signals, In their various forms, are the lifeblood of this industry, with spectral content and amplitudes playing crucial roles in understanding their behavior. In the realm of telecommunications, modern wireless communication systems, including those powering smartphones and IoT devices, necessitate advanced instruments for analyzing and optimizing their performance. The advent of 5G technology has further intensified the demand for spectral analysis tools, as network operators strive to maximize network efficiency and capacity. Digital signal processing and advanced algorithms are integral to the functionality of modern spectrum analyzers.

These solutions enable engineers to measure and analyze electrical signals, frequency components, and signal levels with precision. The hardware segment of the market comprises swept spectrum analyzers and vector signal analyzers, available in various form factors such as handheld, portable, benchtop, and automotive and transportation applications. The software segment of the market offers solutions for wired network technology, including wired networks and 5G networks, as well as Wi-Fi 6 and Wi-Fi 6e. Spectrum scarcity and frequency spectrum availability are pressing concerns for network operators, necessitating the adoption of spectrum management solutions. Artificial intelligence and machine learning are increasingly being integrated into measuring instruments to enhance their capabilities.

These technologies enable advanced features such as propagation analysis, coverage mapping, drive testing, direction finding, and transmitter localization. The electronics and semiconductor industry relies on spectrum analyzers for research and development, while IT and telecommunication sectors utilize these tools for network optimization and troubleshooting. Spectrum analyzers are also essential In the aerospace and defense sector for GNSS capabilities and wireless applications. In the automotive and transportation industry, wireless spectrum analyzers are used for autonomous vehicles and smart cities applications. The healthcare sector leverages these tools for medical equipment testing and research. The market for spectrum analyzers is dynamic and evolving, driven by advancements in digital technologies and the increasing demand for high-speed, efficient communication systems.

The industry is poised for continued growth, as the need for precise spectral analysis solutions becomes increasingly vital across various sectors.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

164 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.04% |

|

Market growth 2024-2028 |

USD 890.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.09 |

|

Key countries |

US, China, Germany, India, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Spectrum Analyzer Market Research and Growth Report?

- CAGR of the Spectrum Analyzer industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the spectrum analyzer market growth of industry companies

We can help! Our analysts can customize this spectrum analyzer market research report to meet your requirements.