Sponge Wipes Market Size 2025-2029

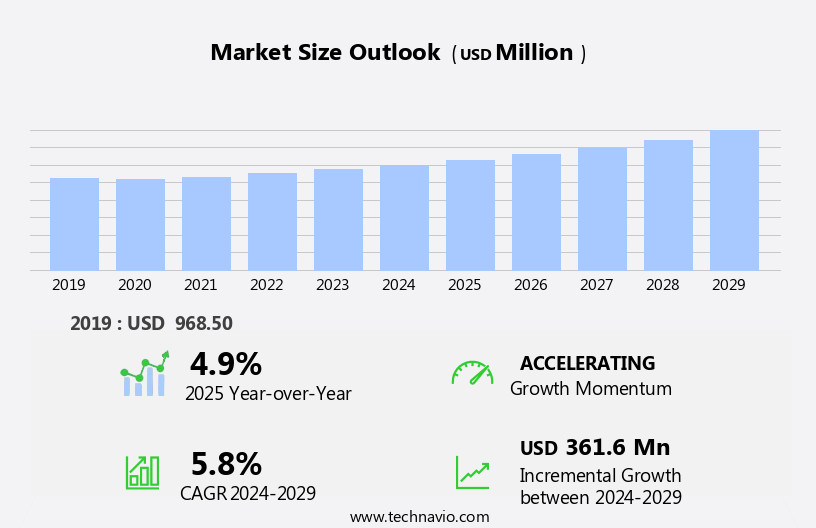

The sponge wipes market size is forecast to increase by USD 361.6 million at a CAGR of 5.8% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the increasing awareness of household and commercial hygiene. This trend is fueled by the growing concern for health and safety, particularly in the wake of the ongoing pandemic. Another key factor propelling market expansion is the strategic partnerships and collaborations between industry players, enabling innovation and product development. However, the market faces challenges as well. Regulatory hurdles impact adoption, particularly with regards to the disposal of used sponge wipes, which can contribute to environmental concerns. Supply chain inconsistencies also temper growth potential due to the dependence on raw materials and logistical challenges. Electronics cleaning wipes, cleanroom wipes, and medical device cleaning wipes address industry-specific requirements.

- Companies seeking to capitalize on market opportunities must navigate these challenges effectively, focusing on sustainable production methods and regulatory compliance. Additionally, competition from alternative cleaning products, such as reusable cloths and disposable paper wipes, requires continuous innovation and differentiation to maintain market share. Single-use wipes, including sanitizing, personal care, and antibacterial variants, prioritize germ protection and convenience. Overall, the market presents a compelling growth opportunity for companies able to address these challenges and cater to the evolving needs of consumers and businesses.

What will be the Size of the Sponge Wipes Market during the forecast period?

- In the dynamic US market for sponge wipes, various types cater to diverse applications and consumer preferences. Refillable wipes offer sustainability and cost savings, aligning with eco-conscious consumer trends. Specialized wipes, such as fragrance-free, compostable, and sensitive skin options, cater to unique needs. Woven wipes, made from natural ingredients or recycled materials, promote eco-friendly cleaning. Quaternary ammonium and hydrogen peroxide wipes ensure effective surface disinfection. Anti-microbial wipes, triclosan-free, and green cleaning solutions cater to consumer safety concerns.

- High-performance wipes, made from biodegradable materials and non-woven fabrics, provide superior moisture absorption and durability. Market dynamics include the increasing demand for sustainable packaging and sanitation protocols. Sustainable wipes, made from plant-based materials and using compostable or recycled packaging, appeal to customers seeking reduced environmental impact. Companies focus on innovation, offering specialized wipes for various industries and applications, to maintain customer loyalty. Bleach, chlorine, and alcohol wipes serve specific disinfection needs. Pet-safe, anti-static, and baby-safe wipes cater to the unique needs of pet owners and parents. Market research publishers, such as MRFR, provide insights into these trends and dynamics, enabling businesses to make informed decisions.

How is this Sponge Wipes Industry segmented?

The sponge wipes industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Product

- Residential

- Non-residential

- Service

- Common sponge wipe

- Super absorbent sponge wipe

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Distribution Channel Insights

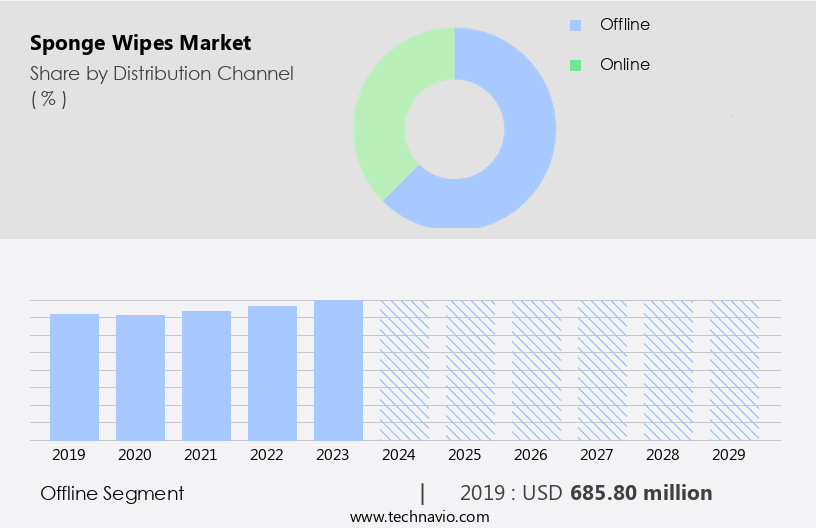

The offline segment is estimated to witness significant growth during the forecast period.

The global market for sponge wipes encompasses a range of products, including bathroom wipes, disinfection wipes, disposable wipes, and surface cleaning wipes, among others. Material science plays a crucial role in the development of these wipes, with advancements in moisture absorption, recyclable materials, and germ protection driving innovation. Brands strive for consumer safety and personal care, offering antibacterial, refillable, and sustainable options. Performance testing and regulatory compliance are essential considerations, ensuring product effectiveness and adherence to standards. Distribution channels are diverse, with offline retail outlets remaining significant. Supermarkets, hypermarkets, convenience stores, and wholesale distributors offer various pack sizes, brands, and material options, enabling consumers to physically evaluate product quality and compare features.

Online channels are also gaining traction, with e-commerce platforms providing convenience and access to a wider range of products. Manufacturing processes for sponge wipes involve non-woven materials like cellulose, polyester, and microfiber, catering to different applications such as stain removal, automotive, industrial, and kitchen use. Sustainability and environmental impact are increasingly important, with companies focusing on reducing waste and improving recyclability. Quality control and product differentiation are key strategies for market differentiation, as brands seek to cater to diverse consumer preferences and needs.

The Offline segment was valued at USD 685.80 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

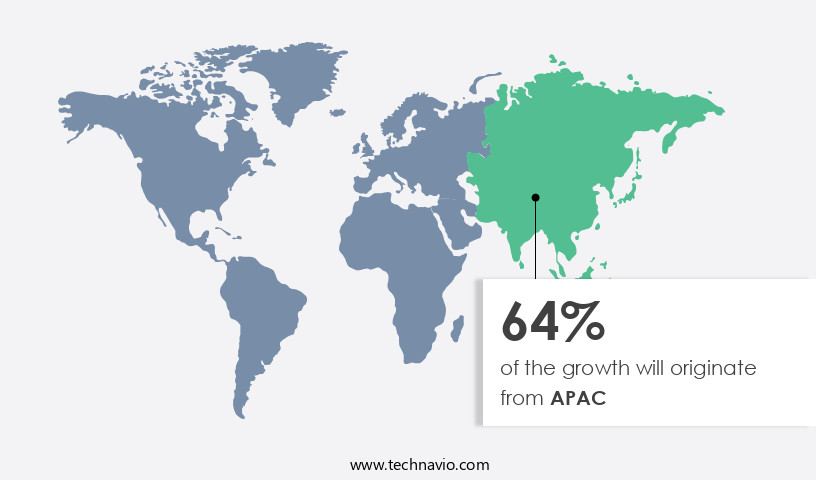

APAC is estimated to contribute 64% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in APAC is poised for significant growth due to the increasing urbanization, rising disposable incomes, and expanding hospitality and foodservice industries. With the United Nations projecting that the APAC region will house approximately 60% of the global urban population by 2030, the demand for household cleaning products, including sponge wipes, is expected to increase. This urbanization trend is particularly evident in China, where the per capita disposable income reached approximately USD 5,511 in 2023, marking a 6.3% year-on-year increase. This economic growth translates into increased consumer spending power, leading to a higher demand for quality cleaning products.

Material science advancements have played a crucial role in the development of various types of sponge wipes, such as disinfection wipes, sanitizing wipes, and odor control wipes. These wipes cater to diverse consumer needs, including personal care, surface cleaning, and germ protection. Brands have invested heavily in product innovation, ensuring the availability of different textures, sizes, and materials, such as cellulose, single-use, and refillable wipes. Manufacturing processes have become more efficient, enabling the production of sustainable wipes, including recyclable and biodegradable options. Regulatory compliance is a key consideration in the market, with stringent regulations governing the production and distribution of cleaning wipes.

Wholesale and bulk purchases have become common distribution channels, catering to the needs of industrial, institutional, and retail customers. The market for sponge wipes is vast and diverse, encompassing various applications, from kitchen and bathroom cleaning to automotive and electronics. Product differentiation is crucial, with brands focusing on quality control, moisture absorption, and stain removal to meet the evolving needs of consumers. The market's growth is further fueled by the increasing demand for personal care wipes, such as baby wipes and antibacterial wipes, which offer convenience and germ protection. The market in APAC is experiencing dynamic growth, driven by urbanization, rising disposable incomes, and evolving consumer needs.

Brands are investing in product innovation, material science, and manufacturing processes to cater to diverse consumer demands while ensuring regulatory compliance and sustainability. The market's future looks promising, with continued growth expected in various sectors, including personal care, industrial, and retail.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Sponge Wipes market drivers leading to the rise in the adoption of Industry?

- The increasing consciousness towards household and commercial hygiene is the primary factor fueling market growth. The global market for sponge wipes has experienced notable growth due to the increasing emphasis on household and commercial hygiene. This trend has been particularly pronounced following the COVID-19 pandemic, as consumers have become more conscious of cleanliness, health, and safety. In homes, daily cleaning routines have become more rigorous, with a preference for reliable and eco-friendly tools that can effectively clean various surfaces. Sponge wipes offer an ideal solution, as they possess high absorbency, reusability, and versatility, making them suitable for cleaning kitchen countertops, bathroom fixtures, and other surfaces. In the commercial sector, industries such as healthcare, hospitality, food service, and retail have significantly heightened their hygiene protocols.

- Sponge wipes, with their superior disinfection capabilities and odor control properties, have become indispensable tools in these settings. Material science advancements have contributed to the development of high-performing sponge wipes, ensuring consistent cleaning and disinfection. Distribution channels have expanded to cater to the growing demand, providing easy access to these products for both households and businesses. Performance testing and quality assurance measures have become essential to ensure the effectiveness and safety of sponge wipes, further bolstering consumer confidence in this market. Overall, the market dynamics of the sponge wipes industry are driven by the evolving needs of consumers and businesses, as they prioritize cleanliness, health, and safety.

What are the Sponge Wipes market trends shaping the Industry?

- Strategic partnerships and collaborations have emerged as a significant market trend. By forming alliances with other businesses or organizations, companies can expand their reach, share resources, and leverage each other's expertise to create mutually beneficial opportunities. The market is witnessing significant growth through strategic partnerships and collaborations. Companies are teaming up to combine their strengths, expand product offerings, and reach broader markets. These collaborations bring together complementary expertise, enabling enhanced research and development capabilities and leveraging established distribution networks to fuel growth.

- For instance, Scrub Daddy Inc. Recently announced a strategic partnership with Unilever on January 25, 2023, to co-create and distribute innovative cleaning products under the Cif brand. This alliance aims to cater to evolving consumer demands for quality, convenience, and innovation in the sanitizing wipes segment, which includes personal care wipes, antibacterial wipes, and refillable wipes. By joining forces, both companies can capitalize on each other's resources, driving growth in the market while ensuring customer loyalty through germ protection and moisture absorption.

How does Sponge Wipes market faces challenges face during its growth?

- The expansion of the market for alternative cleaning products poses a significant challenge to the industry's growth trajectory. The market faces significant competition from alternative cleaning solutions, such as disposable paper towels, microfiber cloths, and traditional sponges. Although sponge wipes offer benefits like durability, reusability, and effectiveness, they are often overshadowed by the convenience and cost-effectiveness of their competitors. For instance, disposable paper towels are widely used for quick, one-time cleaning tasks due to their ease of use and disposability. They do not necessitate rinsing or reuse, making them a popular choice for consumers seeking low-maintenance cleaning tools.

- Regulatory compliance and environmental impact are crucial factors influencing the market dynamics. Recyclable wipes and non-woven wipes, which are gaining popularity due to their eco-friendly nature, are expected to drive market growth. Industrial applications, such as electronics cleaning and manufacturing processes, also contribute significantly to the market demand. Medical wipes and bulk wipes are other key segments of the market, catering to specific industries and use cases.

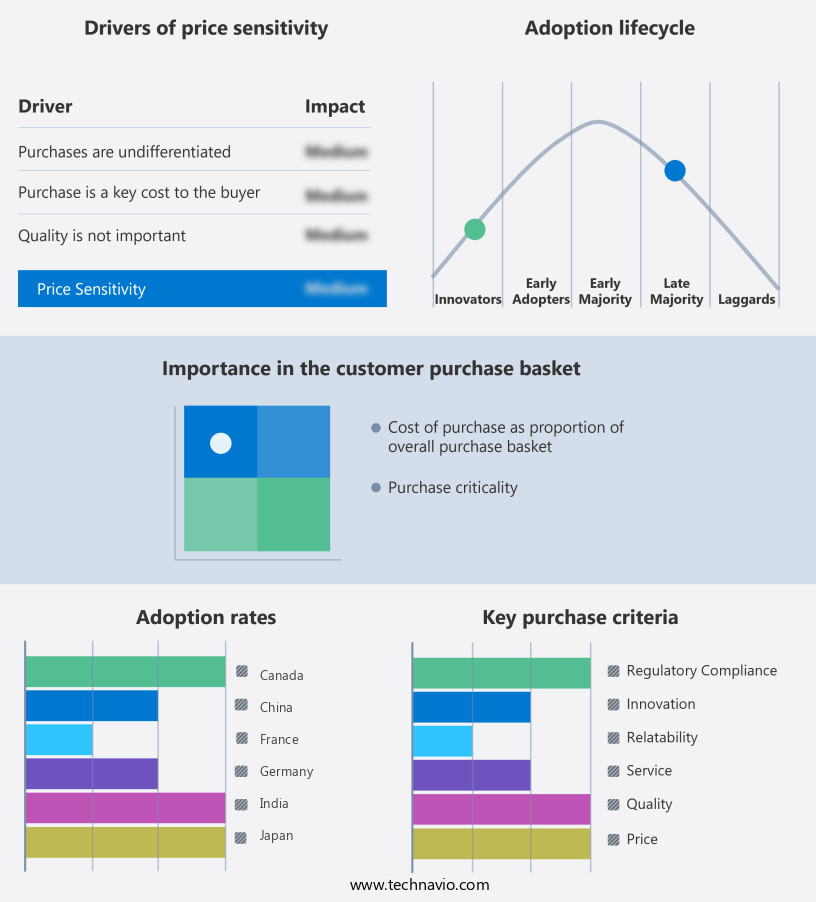

Exclusive Customer Landscape

The sponge wipes market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the sponge wipes market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, sponge wipes market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3M Co. - The company offers sponge wipes such as zero scratch scrub sponge, heavy duty foam scrubber, non-scratch scrub dots sponges, and others.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- Amway Corp.

- Arix S.p.A

- Armaly Brands Inc.

- Corazzi Fibre Srl

- FABLAS IMPEX PVT. LTD

- Freudenberg Gala Household Products Pvt Ltd

- Henkel AG and Co. KGaA

- Kalle GmbH

- Kiwi Scourers Ltd.

- Koparo Clean

- Madhu Instruments Pvt. Ltd

- Mapa Spontex

- Ramon Holdings Ltd

- Scrub Daddy Inc.

- Shagun Cleaning

- The Clorox Co.

- The Crown Choice

- The Libman Co

- Unilever PLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Sponge Wipes Market

- In February 2024, Clorox Corporation, a leading consumer goods company, introduced a new line of disinfecting sponge wipes called "Clorox Disinfecting Wipes with Sponge Technology" (Clorox, 2024). This innovative product combines the benefits of sponge materials and disinfecting wipes, offering a more effective and convenient cleaning solution for consumers.

- In July 2025, 3M, a prominent industrial corporation, announced a strategic partnership with Eco-Friendly Solutions, a leading manufacturer of biodegradable sponge wipes (3M, 2025). This collaboration aims to develop and commercialize a new line of eco-friendly sponge wipes, addressing the growing demand for sustainable cleaning products.

- In September 2024, Diversey, a global leader in cleaning and hygiene solutions, completed the acquisition of Spic-n-Span, a well-known brand of sponge wipes (Diversey, 2024). This strategic move strengthened Diversey's position in the market and expanded its product offerings.

- In March 2025, the European Union (EU) approved the use of certain plant-based materials in sponge wipes, paving the way for more sustainable and eco-friendly alternatives to traditional petroleum-based sponge wipes (European Commission, 2025). This regulatory approval is expected to boost the growth of the European market and encourage innovation in the sector.

Research Analyst Overview

The market encompasses a diverse range of products, including bathroom wipes, disinfection wipes, disposable wipes, surface cleaning wipes, and personal care wipes. This dynamic industry is driven by several key factors, including advancements in material science, changing consumer preferences, and evolving regulatory requirements. Material science plays a pivotal role in the development of sponge wipes. Innovations in cellulose, non-woven, and polyester materials have led to the creation of wipes with superior moisture absorption, enhanced germ protection, and improved odor control. For instance, some manufacturers are exploring the use of sustainable materials, such as recyclable wipes, to reduce the environmental impact of their products.

Brand awareness and consumer safety are crucial aspects of the market. With an increasing number of brands vying for market share, product differentiation and quality control have become essential. Performance testing and regulatory compliance are essential components of the manufacturing processes, ensuring that wipes meet the highest standards of hygiene and safety. Distribution channels and customer loyalty are also significant factors shaping the market. Wholesale and bulk purchases are common in the industrial and automotive sectors, while retail wipes are often targeted towards individual consumers. Consumer preferences for specific wipe types, such as antibacterial or baby wipes, can influence sales patterns and distribution strategies.

Performance testing and regulatory compliance are essential for maintaining consumer trust and ensuring product safety. Regulatory bodies, such as the Food and Drug Administration (FDA) and the European Chemicals Agency (ECHA), impose strict guidelines on the production, labeling, and disposal of wipes. Compliance with these regulations is a critical aspect of any sponge wipes business. Product innovation continues to drive growth in the market. New technologies, such as refillable wipes and moisture-activated wipes, offer consumers more convenient and eco-friendly alternatives to traditional disposable wipes. Additionally, the integration of advanced microfiber and stain removal technologies has expanded the applications of sponge wipes beyond traditional cleaning and personal care uses.

The market is a complex and evolving landscape, shaped by factors such as material science, consumer preferences, regulatory requirements, and product innovation. Companies must remain agile and responsive to these trends and challenges to maintain a competitive edge in this dynamic industry.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Sponge Wipes Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

213 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.8% |

|

Market growth 2025-2029 |

USD 361.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.9 |

|

Key countries |

US, China, India, Germany, UK, Japan, South Korea, Mexico, France, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Sponge Wipes Market Research and Growth Report?

- CAGR of the Sponge Wipes industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the sponge wipes market growth and forecasting

We can help! Our analysts can customize this sponge wipes market research report to meet your requirements.