Spray Polyurethane Foam Market Size 2024-2028

The spray polyurethane foam market size is forecast to increase by USD 1.64 billion at a CAGR of 10.16% between 2023 and 2028. The spray polyurethane foam (SPF) market is experiencing significant growth due to its increasing utilization in building construction for insulation and air barrier applications. SPF effectively seals cracks, voids, and crevices in walls and roofs, providing energy efficiency and enhancing the overall building performance. Weather conditions and construction activities further boost the demand for SPF, as it offers excellent resistance to temperature fluctuations and structural movement. In response to environmental concerns, the industry is witnessing a shift towards the use of methylal and hydrofluoroolefin (HFO) blowing agents as alternatives to hydrofluorocarbons (HFCs) and hydrochlorofluorocarbons (HCFCs). Additionally, the market is witnessing a growing demand for alternative insulation materials, which may impact the future growth of the SPF market.

The spray polyurethane foam (SPF) market is experiencing significant growth due to its effectiveness in air sealing insulation and energy efficiency. Closed-cell spray polyurethane foam, such as methylene diphenyl diisocyanate (MDI)-based formulations, is widely used for cavity filling, mold filling, and insulating and ventilating buildings, including residential and commercial structures. SPF provides flexible, durable insulation for attics, crawl spaces, ceilings, and floors, significantly reducing building air leakage and improving comfort by minimizing heating and cooling costs. As code-mandated energy efficiency improvements become more stringent, SPF is an essential solution for meeting energy standards. Additionally, health considerations are addressed with non-toxic formulations, ensuring safer indoor environments, especially in dusty or humid conditions. The demand for SPF continues to rise as more builders and homeowners seek cost-effective, long-lasting insulation options.

Market Segmentation

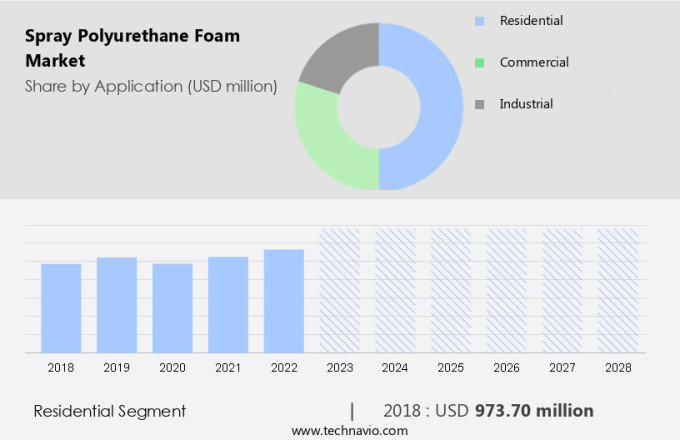

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Residential

- Commercial

- Industrial

- Type

- Open cell

- Closed cell

- Geography

- APAC

- China

- Japan

- South Korea

- North America

- US

- Europe

- Germany

- South America

- Middle East and Africa

- APAC

By Application Insights

The residential segment is estimated to witness significant growth during the forecast period. The Spray Polyurethane Foam (SPF) market is poised for significant growth due to its increasing application in both interior and exterior insulation for residential and commercial buildings. Heating and cooling systems are a major consideration for energy efficiency, and SPF's ability to seal and insulate effectively makes it a cost-effective solution. However, the price of raw materials, such as crude oil and benzene, can impact the overall cost of SPF. Fuel prices are a crucial factor in the production process, and any fluctuations can influence the market dynamics. In the residential sector, the construction of new houses and other residential properties is on the rise, particularly in urban areas.

Additionally, the increasing urban population, driven by migration from rural areas, is leading to a swell in demand for new residences, especially in high-density regions like APAC and MEA. With China and India being the most populous countries in these regions, the demand for SPF is expected to increase substantially during the forecast period. In summary, the SPF market is experiencing growth due to its energy-efficient insulation properties and increasing demand in the residential and commercial sectors. The use of SPF in both interior and exterior applications for heating and cooling systems is a cost-effective solution for building interiors. The price of raw materials, such as crude oil and benzene, can impact the market, but the demand for SPF is expected to remain strong, particularly in high-density regions like APAC and MEA.

Get a glance at the market share of various segments Request Free Sample

The residential segment accounted for USD 973.70 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

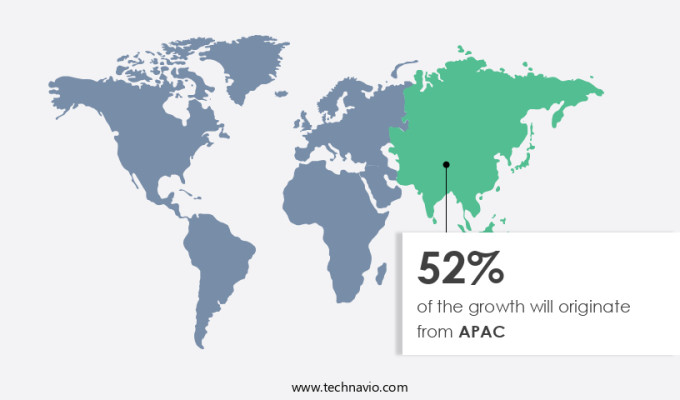

APAC is estimated to contribute 52% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In the realm of construction materials, Spray Polyurethane Foam (SPF) has emerged as a preferred choice for builders and homeowners in both residential and commercial sectors. The significance of SPF lies in its ability to provide effective sound insulation, mitigating the impact of noise pollution in urban environments. As population growth continues to increase in Asia Pacific (APAC), the demand for residences and commercial establishments is surging. With India and China being the most populous countries in APAC, their markets represent significant opportunities for SPF. In 2023, APAC led The market, with China, South Korea, India, and Japan being the key contributors.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Increasing demand for spray polyurethane foams in the construction industry is the key driver of the market. In the realm of construction insulation, spray polyurethane foam (SPF) has emerged as a preferred choice due to its energy efficiency and versatility. SPF is applied as a liquid and expands to form a solid foam, sealing air leaks and providing an effective insulation layer. Its use extends beyond walls and panels, finding application as an adhesive in window and door installations and in manufactured housing. The expanding construction industry, fueled by increasing infrastructure development, has resulted in a significant demand for SPF. This insulation solution is particularly valuable in adverse weather conditions, as it forms a weatherproof sealant and prevents air and moisture intrusion.

Furthermore, its high thermal and mechanical performance makes it an ideal choice for various applications. However, the use of SPF is not without challenges. Corrosions and high maintenance costs are potential concerns, especially in harsh environments. Overspray potential is another issue that requires careful consideration during application. Stringent regulations governing the use of insulation materials add to the complexity of the market. Despite these challenges, the benefits of SPF, including improved energy efficiency, make it a valuable investment for builders and contractors.

Market Trends

Increasing use of methylal and HFOs as alternatives to HFCs and HCFCs is the upcoming trend in the market. In the realm of building construction, cracks, voids, and crevices have long posed significant challenges. To address these issues, spray polyurethane foams (SPF) have emerged as a popular solution. SPFs effectively seal buildings, including walls and roofs, against weather conditions and construction activities. Methylal and hydrofluoroolefins (HFOs) are increasingly used as blowing agents in the production of these foams, supplanting the previously utilized hydrochlorofluorocarbons (HCFCs) and hydrofluorocarbons (HFCs). Methylal, a clear, odorless liquid, is gaining traction due to its lower global warming potential (GWP) compared to HFCs and HCFCs. It is soluble in water and miscible with common organic solvents, making it a versatile ingredient in various industries, including adhesives, resins, perfumes, and protective coatings.

The impending ban on HCFCs in the US and some European countries is expected to fuel the demand for methylal. HFOs, on the other hand, are considered the next generation of blowing agents and are extensively employed in the manufacturing of spray polyurethane foams. They offer excellent insulation properties and are more environmentally friendly than their predecessors. The adoption of HFOs is poised to expand as the construction industry shifts towards more sustainable and energy-efficient practices. In conclusion, the use of methylal and HFOs in the production of spray polyurethane foams is a game-changer in the building and construction sector.

Market Challenge

Increasing demand for alternatives of spray polyurethane foams is a key challenge affecting the market growth. The use of petroleum-based feedstocks, specifically Toluene diisocyanate (TDI), in the production of spray polyurethane foam (SPF) has raised concerns regarding its environmental impact, particularly with regard to the Middle Eastern upheaval and Iran's prohibition on TDI exports. However, the demand for SPF remains strong in various applications such as waterproofing, roofing, asbestos encapsulation, and sealant for gaps. In response to environmental concerns, alternatives to petroleum-based feedstocks have emerged. These include natural latex, cotton fiber foam, organic wool, plain cotton, short-staple polyester fiber, and polystyrene. Natural latex, derived from the sap of the rubber tree, is a biodegradable option that is resistant to dust mites, mold, and mildew.

Additionally, cotton fiber foam is utilized in automotive car panels and seats due to its excellent insulation properties. In summary, while petroleum-based feedstocks continue to dominate the market, the demand for eco-friendly alternatives is on the rise. Natural latex, cotton fiber foam, organic wool, plain cotton, short-staple polyester fiber, and polystyrene are some of the promising substitutes that offer environmental benefits without compromising performance.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Akkim Construction Chemicals Inc. - The company offers spray polyurethane foam under its brand Akfix.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Anagha ASF LLP

- Barnhardt Manufacturing Co.

- BASF SE

- Compagnie de Saint Gobain

- Covestro AG

- Dow Chemical Co.

- Honeywell International Inc.

- Huntsman International LLC

- Indospark Inc.

- Innovative Chemical Products

- Isothane Ltd.

- Johns Manville

- Sekisui Chemical Co. Ltd.

- Shanghai Junbond Building Materials Co. Ltd.

- Sika AG

- SOPREMA SAS

- Specialty Products Inc.

- Tosoh Corp.

- Woodbridge Foam Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Spray Polyurethane Foam (SPF) is a type of insulation that has gained significant popularity in the construction industry due to its energy efficiency and ability to seal air leaks. SPF is applied as a liquid and expands into a foam, filling gaps, cracks, voids, crevices, and building envelope assemblies. It is effective in various applications, including roofing systems, walls, interiors, and exteriors. However, the use of SPF comes with certain challenges. Adverse weather conditions during application can affect the quality of the foam. Corrosions and high maintenance are concerns in some applications, especially in structures exposed to harsh environments. Overspray potential is another issue that requires careful consideration during application. Stringent regulations govern the use of SPF due to the petroleum-based feedstock and the presence of toluene diisocyanate (TDI). These regulations impact the cost-effectiveness of SPF, making it a more expensive option compared to traditional insulation materials.

Additionally, SPF is also used for waterproofing, asbestos encapsulation, sealant, and sound insulation in buildings. Its flexibility, moisture resistance, and energy efficiency make it a preferred choice for building interiors, heating & cooling systems, and urban environments. Despite these challenges, SPF remains a popular choice for energy-efficient solutions due to its ability to act as a thermal insulator, contribute to energy conservation, and promote sustainability. Builders and homeowners value its comfort, quieter living spaces, and noise pollution reduction properties. The increasing focus on reducing fuel prices and crude oil consumption further highlights the importance of SPF in the construction industry.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

173 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.16% |

|

Market growth 2024-2028 |

USD 1.64 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.98 |

|

Regional analysis |

APAC, North America, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 52% |

|

Key countries |

China, US, Japan, Germany, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Akkim Construction Chemicals Inc., Anagha ASF LLP, Barnhardt Manufacturing Co., BASF SE, Compagnie de Saint Gobain, Covestro AG, Dow Chemical Co., Honeywell International Inc., Huntsman International LLC, Indospark Inc., Innovative Chemical Products, Isothane Ltd., Johns Manville, Sekisui Chemical Co. Ltd., Shanghai Junbond Building Materials Co. Ltd., Sika AG, SOPREMA SAS, Specialty Products Inc., Tosoh Corp., and Woodbridge Foam Corp. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch