Spreads Market Size 2024-2028

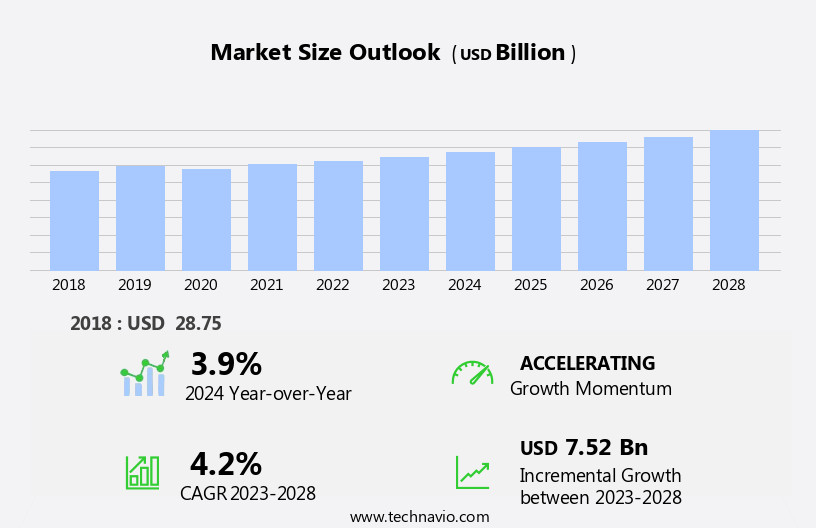

The spreads market size is forecast to increase by USD 7.52 billion at a CAGR of 4.2% between 2023 and 2028.

- The market is experiencing significant growth, driven primarily by the increasing trend towards on-the-go consumption and the growing popularity of e-commerce channels. The consumers' busy lifestyles have led to a surge in demand for convenient and portable food options, including spreads and sandwiches. Moreover, the rise of e-commerce platforms has made it easier for consumers to access a wide range of spreads from various brands, further fueling market growth. However, the market also faces challenges,One major obstacle is the health concerns associated with spreads, particularly those high in sugar and saturated fats.

- As consumers become more health-conscious, there is a growing demand for healthier spread options. Another challenge is the intense competition in the market, with numerous players vying for market share. Companies must differentiate themselves by offering unique and innovative products to meet the evolving needs and preferences of consumers. To capitalize on opportunities and navigate challenges effectively, market participants must stay abreast of consumer trends and respond with agility and innovation.

What will be the Size of the Spreads Market during the forecast period?

- The market continues to evolve, with financial institutions increasingly relying on advanced data analysis techniques to gain insights and make informed decisions. Data quality is paramount, as enterprise solutions implement data warehousing and financial modeling to ensure accurate and reliable information. Data governance and marketing analysis employ machine learning and sales forecasting to identify trends and patterns in big data. Freemium models and artificial intelligence are transforming customer segmentation, enabling businesses to target their offerings more effectively. Cloud computing platforms and spreadsheet software offer user-friendly data dashboards for business process automation and user experience optimization.

- Predictive modeling and collaboration tools facilitate real-time data analysis and scenario planning for investment firms. Business intelligence software and data visualization tools provide valuable insights for business users, while risk management and operations optimization rely on prescriptive analytics and data analytics software. Portfolio management and investment analysis benefit from interactive reports and data integration, enabling advanced analytics and mobile accessibility. Data storytelling and user interfaces enhance the value of data, while data security remains a critical concern. Subscription models and project management tools enable data mining and workflow automation for power users. The continuous dynamism of the market underscores the importance of staying informed and adaptable to evolving trends and patterns.

How is this Spreads Industry segmented?

The spreads industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Offline

- Online

- End-User

- Households

- Food Service

- Industrial

- Product Type

- Jams & Jellies

- Nut Butters

- Cheese Spreads

- Savory Spreads

- Packaging

- Jars

- Tubes

- Packets

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- Spain

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Distribution Channel Insights

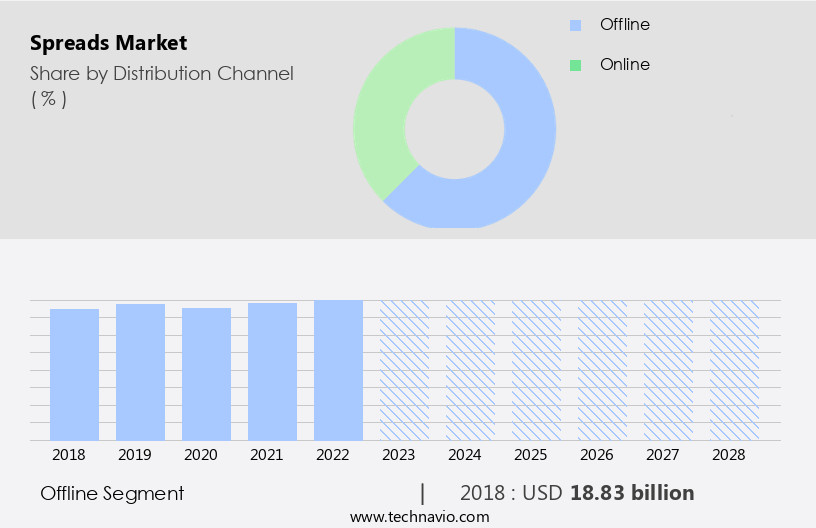

The offline segment is estimated to witness significant growth during the forecast period.

The market encompasses various retail sectors, including department stores, supermarkets, hypermarkets, convenience stores, and restaurants. Major retail chains, such as Tesco Plc (Tesco) and Walmart Inc. (Walmart), have dedicated sections for spreads, offering a diverse range of butter, fruit, and chocolate spreads. companies employ marketing strategies, like branding through signages and discounts on product packages, to attract consumers. Walmart and Walgreens are long-standing retailers of spreads. Operating in the organized retail sector, companies consider factors like geographical presence, production and inventory management ease, and goods transportation. Businesses utilize enterprise solutions, such as data warehousing, financial modeling, and data governance, to manage their spreads offerings.

Machine learning and predictive analytics enable sales forecasting and customer segmentation. Data visualization tools help in data storytelling and risk management. Cloud-based platforms facilitate business planning and collaboration. Data analytics software and portfolio management tools support investment analysis and scenario planning. Prescriptive analytics offer recommendations for operations optimization. Data security ensures user interfaces remain secure. Data integration and real-time data processing are essential for advanced analytics and mobile accessibility. Business intelligence software and interactive reports provide decision support for power users and subscription-based models. Collaboration platforms facilitate project management and workflow automation. Data mining uncovers valuable insights for data scientists.

The Offline segment was valued at USD 18.83 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

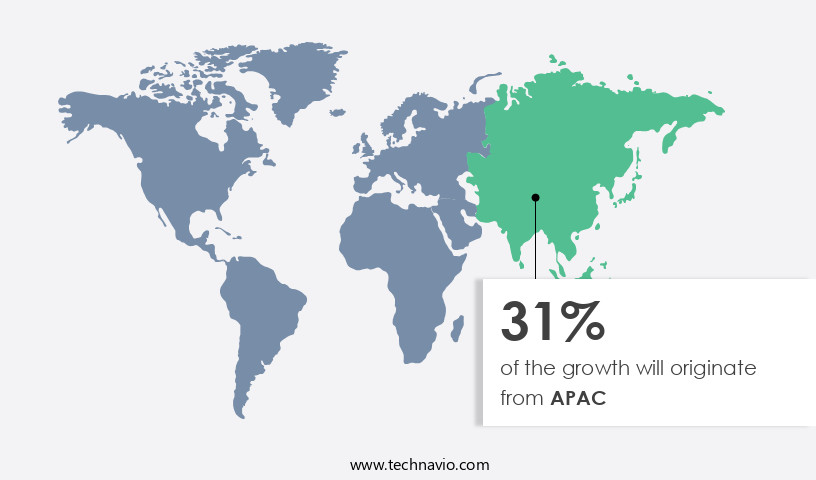

APAC is estimated to contribute 31% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The European the market experiences significant growth, fueled primarily by the expanding bread market. Spreads such as cheese, creams, and peanut butter are popular choices for sandwiches and crackers in prominent European markets like the UK, France, Germany, and Italy. Consumers' increasing preference for convenience and takeaway foods, driven by busy lifestyles, further boosts market demand. Additionally, bread manufacturers are expanding their presence in Europe, with companies like KFC aiming to establish 500 stores in Germany by 2025. Enterprise solutions, including data analysis, data warehousing, financial modeling, and data governance, play crucial roles in catering to the increasing market needs.

Cloud computing platforms, business intelligence software, and collaboration tools facilitate efficient data integration, predictive analytics, and real-time data access. Data quality, user experience, and data security are essential considerations for businesses and financial institutions. Machine learning, artificial intelligence, and prescriptive analytics enable advanced data mining and scenario planning, providing valuable insights for investment analysis, risk management, and portfolio management. Business process automation, project management, and workflow automation streamline operations optimization and decision support. Subscription models cater to both power users and small businesses, ensuring flexible and cost-effective solutions.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Spreads Industry?

- The prevalent trend toward increased on-the-go consumption serves as the primary market driver. The market for data analytics software in business intelligence and portfolio management, specifically for the market, has witnessed notable growth due to the increasing preference for convenience food products among consumers worldwide. Chocolate and peanut spreads, among others, have gained popularity due to their time-saving and consistent taste benefits. Working professionals, in particular, have driven the demand for such products as they simplify meal preparation. Furthermore, the trend towards healthier food choices has led consumers to opt for peanut butter spreads, catering to their nutritional needs. Advanced analytics, including predictive and prescriptive analytics, enable investment firms to gain valuable insights from real-time data, enhancing their decision-making capabilities.

- Data integration and interactive reporting tools offer mobile accessibility, allowing users to access critical information anytime, anywhere. Scenario planning and data security are essential aspects of this market, ensuring business continuity and data protection. Overall, the market dynamics of data analytics software in the market are driven by the need for efficiency, convenience, and data-driven insights.

What are the market trends shaping the Spreads Industry?

- The increasing prevalence of e-commerce channels represents a significant market trend. E-commerce's growing popularity is a notable development in today's business landscape.

- The market for spreads has experienced substantial growth due to the proliferation of e-commerce platforms and the increasing preference for online shopping. E-commerce enables business users to access a wide range of spreads from various brands and regions, offering multiple flavor and ingredient options. The rise of cloud-based collaboration platforms and workflow automation tools have facilitated seamless business planning and project management processes, further boosting the demand for spreads. Data visualization tools and data mining techniques are increasingly being utilized by power users to gain valuable insights for decision support.

- Subscription models have emerged as a popular business model, providing customers with regular access to their preferred spreads. Online retailers, such as Amazon and eBay, dominate the global market, offering personalized shopping experiences and product recommendations. The convenience and efficiency of online shopping continue to drive the growth of the market.

What challenges does the Spreads Industry face during its growth?

- The growth of the industry is significantly influenced by the health concerns associated with the use of spreads, representing a major challenge that necessitates continuous research and innovation to mitigate potential risks and ensure consumer trust.

- The market for spreads has gained significant traction due to the convenience they offer to consumers with hectic schedules. Data analysis reveals that financial institutions and businesses increasingly rely on enterprise solutions for data warehousing and financial modeling to understand consumer behavior and preferences. Spreads, including cheese and butter, are popular choices for quick breakfast options, but concerns regarding data quality and health implications persist. Data governance is crucial in ensuring accurate and reliable data for marketing analysis. Machine learning and artificial intelligence are integral to sales forecasting and customer segmentation in the big data era. Freemium models have emerged as a viable business strategy, offering basic services for free while charging for premium features.

- However, it's essential to be mindful of the potential health risks associated with high-fat spreads. Excessive consumption of spreads with over 50 grams (1.76 ounces) of fat can negatively impact cardiovascular health. Data analysis indicates that, within a few hours of consumption, blood flow in the arteries can decrease by up to one-fifth. Therefore, it's vital to strike a balance between convenience and health considerations.

Exclusive Customer Landscape

The spreads market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the spreads market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, spreads market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The J.M. Smucker Company - This company specializes in providing spreads, including Bonne Maman, free from high fructose corn syrup, additives, preservatives, and gluten. Our offerings prioritize natural ingredients, ensuring a healthier option for consumers. These spreads undergo rigorous quality control, maintaining their authentic taste and nutritional value. By eliminating unnatural additives, we cater to health-conscious individuals and those with dietary restrictions. Our commitment to transparency and authenticity sets US apart in the market.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- The J.M. Smucker Company

- Kraft Heinz Company

- Conagra Brands Inc.

- Hormel Foods Corporation

- B&G Foods Inc.

- Unilever

- Ferrero Group

- Nestlé S.A.

- Mondelez International

- Associated British Foods plc

- Premier Foods plc

- Orkla ASA

- Hero Group

- Zentis GmbH & Co. KG

- Andros Group

- Beijing Yili Food Co. Ltd.

- Shanghai Yihaodian Food Co. Ltd.

- Guangdong Yashili Group Co. Ltd.

- Haitai Confectionery and Foods

- Lotus Bakeries

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Spreads Market

- In February 2024, Unilever, a leading consumer goods company, introduced a new line of reduced-sugar spreads under its popular brand, Promise, in the United States. This expansion was a strategic response to the growing demand for healthier food options (Unilever, 2024).

- In June 2025, Danone and Nestlé, two major players in the market, announced a joint venture to develop plant-based food products, including plant-based spreads. This collaboration aimed to capitalize on the rising trend of plant-based diets and expand their product offerings (Danone & Nestlé, 2025).

- In October 2024, Conagra Brands completed the acquisition of Pinnacle Foods, significantly increasing its presence in the market with the addition of brands like Jif and Smucker's. This deal strengthened Conagra's position as a leading player and provided a platform for future growth (Conagra Brands, 2024).

- In January 2025, the European Commission approved the use of rapeseed oil as a sustainable feedstock for biodiesel production, potentially boosting the demand for rapeseed oil-based spreads. This approval aligns with the European Union's commitment to reducing greenhouse gas emissions and increasing the use of renewable energy sources (European Commission, 2025).

Research Analyst Overview

In today's data-driven business landscape, Spreadsheet macros and templates continue to play a pivotal role in data accessibility and usability. Data quality tools ensure the accuracy and reliability of the data used in these spreadsheets. Data storytelling techniques enable effective communication of insights derived from statistical analysis and machine learning algorithms. Data-driven transformation is accelerating, with data warehousing tools facilitating real-time reporting and portfolio optimization. Data compliance tools help organizations adhere to regulations, while risk modeling and sensitivity analysis provide valuable insights for data-driven decision making. Monte Carlo simulations and scenario analysis are essential for understanding potential outcomes and managing risk.

Data governance tools maintain data privacy and security, while computer vision and deep learning algorithms enhance data analysis capabilities. Data-driven innovation is revolutionizing product development, marketing, sales, and customer service. Financial modeling tools and time series analysis provide valuable insights for strategic planning. Data visualization libraries simplify complex data analysis and enable data-driven actions. Machine learning algorithms and data mining techniques uncover hidden patterns and trends, driving data-driven strategy and the data-driven future. Data analysis techniques and risk modeling enable organizations to make informed decisions and remain competitive.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Spreads Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

138 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.2% |

|

Market growth 2024-2028 |

USD 7.52 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.9 |

|

Key countries |

US, China, Japan, Germany, France, Spain, Canada, India, South Korea, France, Japan, Italy, Brazil, UAE, UK, Spain, Rest of World (ROW), and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Spreads Market Research and Growth Report?

- CAGR of the Spreads industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the spreads market growth of industry companies

We can help! Our analysts can customize this spreads market research report to meet your requirements.