Stainless Steel 400 Series Market Size 2024-2028

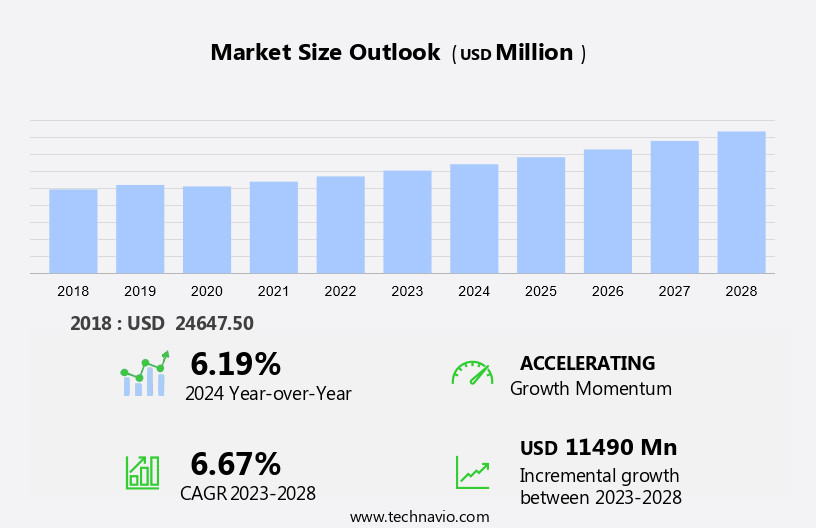

The stainless steel 400 series market size is forecast to increase by USD 11.49 billion at a CAGR of 6.67% between 2023 and 2028.

- The market is experiencing significant growth due to several key factors. The economic expansion in China and India is driving demand for this type of stainless steel, as it is widely used in various industries In these countries. Additionally, the increased penetration of the stainless steel 400 series in industrial applications, such as chemical processing and power generation, is contributing to market growth. The market is seeing increased demand due to its use in cladding applications, offering a combination of strength, corrosion resistance, and aesthetic appeal for various architectural and industrial projects. However, the market is also facing challenges, including the volatility of raw material prices, which can impact the cost-effectiveness of producing and using the stainless steel 400 series. Producers must carefully manage their supply chains and production costs to remain competitive In the market. Overall, the market is expected to continue growing due to its versatility, durability, and increasing demand from various end-use industries.

What will be the Size of the Stainless Steel 400 Series Market During the Forecast Period?

- The market encompasses a diverse range of corrosion-resistant alloys, primarily composed of iron, chromium, nickel, molybdenum, and other elements. These alloys, including 304 and 316 stainless steels, are renowned for their strength, durability, and resistance to various environmental conditions. The market for Stainless Steel 400 series alloys serves numerous industries, including consumer goods, such as cutlery and kitchen appliances, automotive components, industrial equipment, construction, and architectural applications. Applications span from handrails and drainage systems to roofing and cladding, reflecting the versatility of these materials. The market has experienced steady growth, driven by increasing demand for sustainable and long-lasting materials in various sectors.

- Raw material prices, particularly chromium and nickel, have influenced market dynamics, but the overall trend remains positive. As the demand for stainless steel continues to grow, its usage extends beyond traditional industries to emerging sectors like renewable energy and electric vehicles. The market is expected to maintain its momentum, offering significant opportunities for manufacturers and end-users alike.

How is this Stainless Steel 400 Series Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Consumer goods

- Mechanical engineering and heavy industries

- Automotive and transportation

- Building and construction

- Others

- Product Type

- Plate and sheet

- Bar and tubular

- Structural

- Geography

- APAC

- China

- India

- Japan

- South Korea

- Europe

- North America

- US

- Middle East and Africa

- South America

- APAC

By End-user Insights

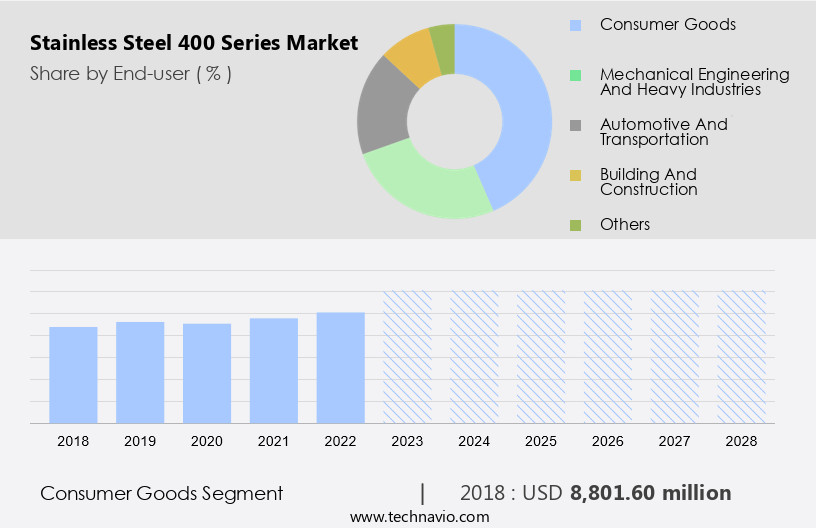

- The consumer goods segment is estimated to witness significant growth during the forecast period.

The market encompasses a diverse range of materials, primarily composed of iron, chromium, and nickel. These corrosion-resistant alloys are widely used in various industries, including consumer goods, automotive components, industrial equipment, construction, and architectural cladding. The 400 series stainless steels, specifically 304 and 316, offer superior corrosion resistance and are commonly utilized in cookware, kitchen sinks, ornamental items, automotive parts, consumer electronics, and building and construction. The cost-effectiveness, high strength, and durability of the 400 series stainless steels make them an attractive choice for manufacturers. These alloys are fabricated using advanced refining methods, such as vacuum induction melting, electro slag refining, and computational modeling, ensuring consistent alloy compositions.

Molybdenum additions enhance the corrosion resistance of these alloys, making them suitable for demanding applications. The 400 series stainless steels cater to various industries, including automotive and transportation, mechanical engineering, heavy industries, aerospace, and home components. In export-oriented economies, the demand for these alloys is significant due to their versatility and superior performance. The market is expected to grow due to its extensive applications and the increasing demand for high-performance materials.

Get a glance at the market report of share of various segments Request Free Sample

The Consumer goods segment was valued at USD 8.8 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

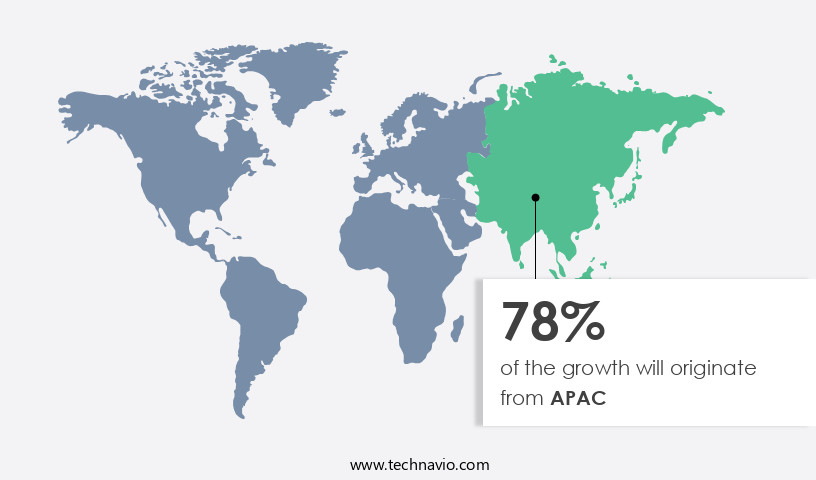

- APAC is estimated to contribute 78% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in the Asia Pacific (APAC) region is experiencing significant growth, driven by increasing industrialization and infrastructure development. Major consumers of stainless steel In the region include China and India, where the demand for this material is increasing due to its high strength, durability, and corrosion resistance. The automotive industry's growing demand for corrosion-resistant alloys, primarily made up of diversified materials like Iron, Chromium, and Nickel, is also contributing to the market's expansion. The APAC region's construction sector is another significant end-user, with applications ranging from cookware and kitchen sinks to architectural cladding, handrails, drainage systems, and roofing systems.

Consumer goods production, including cutlery, kitchen appliances, and consumer electronics, is also driving demand for the stainless steel 400 series. The market's growth is further fueled by advancements in refining methods, such as vacuum induction melting and electroslag refining, and computational modeling, which have improved alloy compositions. Molybdenum-containing alloys, like 304 and 316 stainless steels, are particularly popular due to their excellent corrosion resistance. Export-oriented economies In the region, such as South Korea and Taiwan, are also significant contributors to the market's growth, with applications extending to mechanical engineering, heavy industries, aerospace, and home components. Overall, the market In the APAC region is poised for continued growth, driven by increasing industrialization, infrastructure development, and rising demand from various end-use industries.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Stainless Steel 400 Series Industry?

Economic growth in China and India boosting demand for stainless steel 400 series is the key driver of the market.

- The stainless steel 400 series, a category of corrosion-resistant alloys, is a significant contributor to the global materials market. This diversified material is primarily composed of iron, chromium, and nickel, with varying proportions of molybdenum and other elements. The 300 series stainless steels, which include 304 and 316 varieties, are well-known for their excellent corrosion resistance and wide applications. The market is fueled by the demand for these alloys in various industries. In the manufacturing sector, they are used extensively in automotive components, industrial equipment, and mechanical engineering applications. In construction, the stainless steel 400 series is utilized in architectural cladding, handrails, drainage systems, and roofing systems.

- Consumer goods, such as cookware, kitchen sinks, ornamental items, and consumer electronics, also incorporate these alloys for their aesthetic appeal and durability. The market dynamics are influenced by raw material prices, alloy compositions, and refining methods, such as vacuum induction melting and electroslag refining. The demand for the stainless steel 400 series is driven by the increasing need for corrosion resistance in various industries, particularly in building and construction, automotive and transportation, and heavy industries. Additionally, the aerospace sector and home components, including utensils and cutting tools, also contribute to the market growth. Export-oriented economies, such as China and India, are major consumers of stainless steel 400 series due to their rapid industrialization and expanding manufacturing sectors.

What are the market trends shaping the Stainless Steel 400 Series Industry?

Increased penetration of the stainless steel 400 series in industrial applications is the upcoming market trend.

- The Stainless Steel 400 series is a popular choice for various industries due to its superior properties, including corrosion resistance and yield strength. This diversified material is primarily composed of iron, chromium, and nickel, with additives like molybdenum enhancing its resistance to pitting and crevice corrosion. The Stainless Steel 400 series finds extensive applications in industries such as mining and quarrying, chemicals, petrochemicals, electrical engineering, power generation, and food and beverage. In the automotive sector, it is utilized for manufacturing axle shafts, steering components, chassis components, and seats. Furthermore, this alloy is widely used In the production of consumer goods, such as cookware, kitchen sinks, ornamental items, and automotive parts.

- Stainless Steel 400 series is also employed in consumer electronics, export-oriented economies, and architectural cladding for buildings and construction projects. Vacuum induction melting and electroslag refining are essential refining methods used to produce high-quality Stainless Steel 400 series. Computational modeling is employed to optimize alloy compositions and enhance the material's performance. The Stainless Steel 300 series, including 304 and 316, shares some similarities with the 400 series, but their alloy compositions differ, resulting in distinct properties. The 300 series is commonly used in mechanical engineering, heavy industries, aerospace, and home components. In summary, Stainless Steel 400 series is a versatile material with a wide range of applications, from industrial equipment and construction to consumer goods and automotive components.

What challenges does the Stainless Steel 400 Series Industry face during its growth?

Volatility in raw material prices is a key challenge affecting the industry growth.

- The market faces significant challenges due to the volatile prices of raw materials. The production of this steel grade relies on various commodities and metals, such as iron ore, ferrochrome, scrap steel, chromium, and nickel. The prices of these materials are directly linked to global economic conditions and price elasticity, leading to market uncertainties and impacting profit margins. The diverse applications of Stainless Steel 400 series span across industries like automotive components, industrial equipment, construction, consumer goods, and more.

- This steel grade is renowned for its corrosion resistance and durability, making it an essential component in cookware, kitchen sinks, ornamental items, consumer electronics, architectural cladding, handrails, drainage systems, roofing systems, and various other applications. Alloy compositions, refining methods like vacuum induction melting and electroslag refining, and computational modeling play crucial roles in enhancing the properties of the Stainless Steel 400 series. The market for this steel grade is export-oriented and caters to sectors like building and construction, automotive and transportation, mechanical engineering, heavy industries, aerospace, home components, utensils, cutting tools, fridges, washing machines, and more. Molybdenum is a vital addition to Stainless Steel 400 series alloys, enhancing their corrosion resistance, particularly in 304 and 316 stainless steels.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ambica Steels Ltd.

- Aperam SA

- ArcelorMittal

- BALLKINGS

- Baosteel Group Corp.

- Cleveland Cliffs Inc.

- E United Group

- Helander

- Hunan Fushun Metal Co. Ltd.

- Jindal Stainless Ltd.

- Metline Industries

- Mirach Metallurgy Co. Ltd.

- Nippon Steel Corp.

- Outokumpu Oyj

- POSCO holdings Inc.

- Tata Steel

- thyssenkrupp AG

- Tianjin Pipe International Economic and Trading Corp.

- Tsingshan Holding Group Co. Ltd.

- Tubacex SA

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The stainless steel 400 series, a subset of diversified materials, comprises corrosion-resistant alloys that offer superior resistance to various environmental conditions. These alloys contain chromium as the primary element, with nickel and other elements, such as molybdenum used to enhance their properties. The 400 series stainless steels are widely used in various industries due to their unique characteristics. In the realm of consumer goods, they find extensive applications in cutlery and kitchen appliances. Their usage extends to automotive components and industrial equipment, where their strength and durability are essential. Construction is another significant sector that benefits from the use of 400 series stainless steels.

Moreover, their corrosion resistance makes them suitable for architectural cladding, handrails, drainage systems, and roofing systems. Furthermore, they are increasingly used In the aerospace industry for their lightweight properties and high strength. The demand for 400 series stainless steel is driven by several factors. The increasing awareness of the importance of hygiene and durability in consumer goods has led to a rise in their usage in cookware and kitchen sinks. In the automotive and transportation sector, the need for lightweight and strong materials has fueled their adoption in manufacturing automotive parts and consumer electronics. The production of 400 series stainless steels involves refining methods such as vacuum induction melting and electroslag refining.

Furthermore, these techniques ensure the alloy compositions are consistent and of high quality. Computational modeling is also used to optimize the manufacturing process and improve the overall efficiency. The raw material prices for chromium and nickel, the primary components of 400 series stainless steels, can significantly impact their market dynamics. Fluctuations In these prices can influence the production costs and, consequently, the selling prices of the finished products. The market for 400 series stainless steels is diverse and export-oriented. Export-oriented economies play a crucial role In the global supply chain, with many countries specializing In the production and export of specific products.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

171 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.67% |

|

Market Growth 2024-2028 |

USD 11.49 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.19 |

|

Key countries |

China, India, US, Japan, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Stainless Steel 400 Series Market Research and Growth Report?

- CAGR of the Stainless Steel 400 Series industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the stainless steel 400 series market growth of industry companies

We can help! Our analysts can customize this stainless steel 400 series market research report to meet your requirements.