Steel Wire Market Size 2024-2028

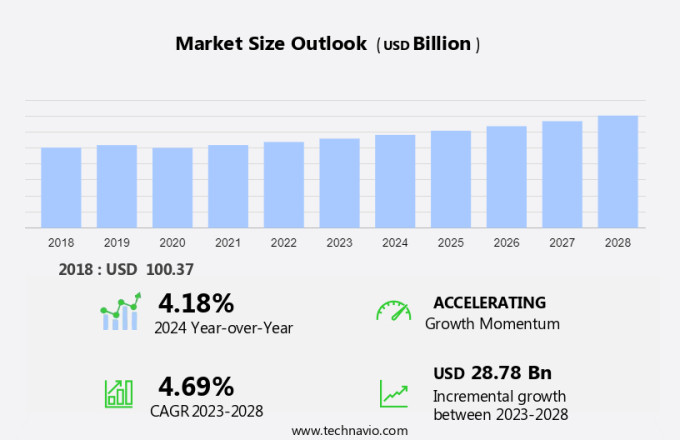

The steel wire market size is forecast to increase by USD 28.78 billion at a CAGR of 4.69% between 2023 and 2028. The market is driven by the growth of infrastructure investment in various sectors, particularly in the automotive industry, which necessitates the use of high-performance steel wires with superior shock resistance, wear resistance, and high bearing capacity. Steel wires are extensively used in wire ropes and strands for applications such as lifting, towing, and conveyance systems.

The market trends include increasing strategic alliances and partnerships among steel manufacturers to expand their product offerings and geographical reach. However, the presence of substitutes for steel wires, such as synthetic fibers and ropes, poses a significant challenge to the market growth. Additionally, the demand for rust and corrosion-resistant steel wires is increasing due to their extended durability and longevity, especially in harsh environments.

The market is witnessing significant growth due to its extensive applications in various industries, particularly in the construction sector. Steel wires are widely used in constructing infrastructure projects such as flyovers, atomic reactor domes, slabs, silos, hangers, aqueducts, and high-rise buildings. They are also essential components in the manufacturing of wire ropes and strands used in suspension bridges, prestressed concrete, metallic nets, and cables. Steel wires offer several advantages, including high shock resistance, wear resistance, and high bearing capacity. They are also known for their rust and corrosion resistance, making them suitable for long-term use in harsh environments.

Furthermore, the increasing infrastructure investment in various sectors, including agriculture, electricity consumption, and transportation, is driving the demand for steel wires. Moreover, steel wires find applications in various hardware, such as armored cables, used in power transmission and distribution networks. The growing demand for high-performance and durable materials in construction and infrastructure projects is expected to boost the market growth. The use of alloy steel in producing steel wires further enhances their strength and durability, making them an ideal choice for various applications.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Construction

- Automotive

- Industrial

- Others

- Type

- Carbon steel

- Alloy steel

- Stainless steel

- Geography

- APAC

- China

- India

- Japan

- Europe

- North America

- US

- Middle East and Africa

- South America

- APAC

By End-user Insights

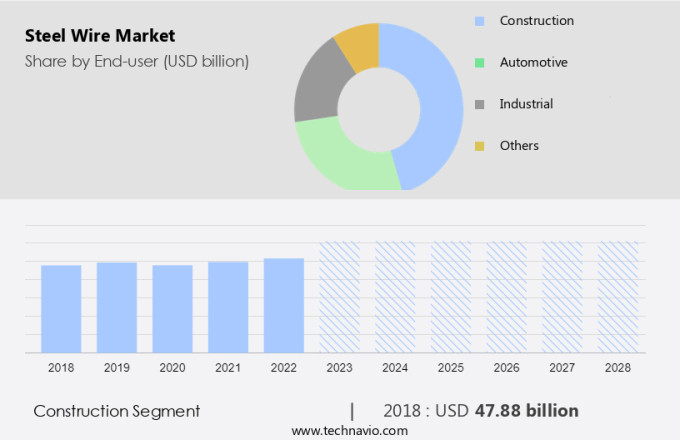

The construction segment is estimated to witness significant growth during the forecast period. Steel wires play a pivotal role in various industries, including railway sleeper construction, mining applications, mechanical manufacturing, and the automotive sector. In railway sleeper construction, steel wire ropes are utilized to lift and transport heavy sleepers, ensuring the efficient and safe transportation of rail infrastructure components. Plastic fibers are often incorporated into steel wires to enhance their durability and flexibility, resulting in improved performance. The demand for steel wires is also significant in the mining industry for various applications, such as lifting and lowering heavy mining equipment, and securing loads during transportation. Furthermore, the automotive industry relies on steel wires for tire reinforcement and suspension systems.

Moreover, the growth in urbanization and infrastructure investments has led to a increase in demand for steel wires in the construction sector. This trend is driven by the increasing number of residential and non-residential projects, as well as the focus on enhancing healthcare infrastructure. Governments worldwide are investing in new healthcare facilities, creating immense business opportunities for the construction industry and, consequently, the market.

Get a glance at the market share of various segments Request Free Sample

The construction segment accounted for USD 47.88 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

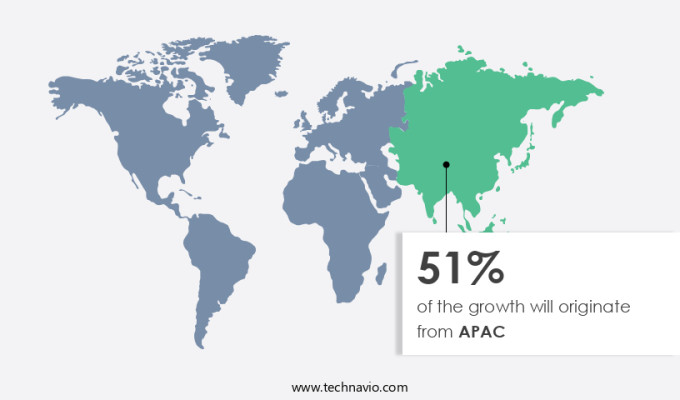

APAC is estimated to contribute 51% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market is anticipated to witness significant growth during the forecast period, with the Asia Pacific region leading the charge. The expansion of industries such as automotive and construction in countries like China, Japan, and India is fueling market growth. In India, for instance, the Smart Cities Mission, which aims to develop 100 cities, has led to a increase in construction activities, resulting in increased demand for steel wires. Furthermore, steel wires are extensively used in various applications, including railway sleeper construction, mining, mechanical manufacturing, and tires. The automotive industry also contributes significantly to the market's growth due to the increasing demand for vehicles in developing economies.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Growth of automotive sector is the key driver of the market. The market is poised for significant growth due to increasing demand from various industries, particularly the Construction sector. In this industry, steel wires are extensively used in constructing flyovers, atomic reactor domes, slabs, silos, hangers, aqueducts, and high-rise buildings. Moreover, the infrastructure sector's expansion, driven by the development of viaducts and other large-scale projects, will further fuel the market's growth. Developing countries, such as India and China, and developed economies, including the US, Germany, and the UK, are key contributors to the market's growth. Companies like Volkswagen, BMW, Tata Motors, Toyota Motor, Honda Motor, Fiat, and Daimler are investing heavily in setting up manufacturing plants in India and China, which will increase the demand for steel wires in the automotive sector.

Furthermore, governments worldwide are promoting the sales of electric vehicles (EVs) due to growing environmental concerns, which will also contribute to the market's growth. In countries like China, India, Germany, the Netherlands, Denmark, Sweden, and the US, the shift towards EVs is expected to boost the demand for steel wires in the production of these vehicles.

Market Trends

Increasing strategic alliances and partnerships among steel manufacturers is the upcoming trend in the market. The market plays a significant role in catering to the demands of various industries, particularly the Construction industry. Steel wires are extensively used in constructing flyovers, atomic reactor domes, slabs, silos, hangars, aqueducts, and high-rise buildings, among others. In the construction sector, steel wires are essential components in the fabrication of viaducts and reinforcing bars. Several strategic partnerships among steel manufacturers aim to increase productivity and expand manufacturing units. For instance, ArcelorMittal SA acquired an 80% shareholding in a world-class Hot Briquetted Iron (HBI) plant in Texas to ease the supply of raw materials for producing rolled steels, steel wire, and metallic-coated steels.

Furthermore, ArcelorMittal is a strategic partner to major original equipment manufacturers, primarily in the automobile and appliance industries. Similarly, Nippon Steel Corp. Acquired Essar Steel in India, jointly with ArcelorMittal SA, and the Hazira steel mill to increase productivity and manufacturing capacity from 7 million tons to over 14 million tons.

Market Challenge

Presence of substitutes for steel wire is a key challenge affecting the market growth. The market caters to various industries, including construction, where it is extensively used in constructing flyovers, atomic reactor domes, and high-rise buildings. Steel wires are also integral to the fabrication of slabs, silos, hangers, aqueducts, and viaducts. However, the market growth may face challenges from alternative products such as plastic wire, titanium alloy wire, and fiber wire.

Moreover, fiber wire, made from ultra-high molecular weight polyethylene (UHMWPE) fiber, offers superior strength, durability, and efficiency for marine, arborist, nautical, off-roading, and manufacturing industries. Its lightweight property ensures safety and easier handling compared to steel wire. Another eco-friendly alternative is PlasLOC, a heavy-duty, non-slip plastic wire, which offers a cost-effective and environmentally friendly disposal method for waste.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Acerinox SA - The company offers steel wire which is used in a wide range of sectors, including manufacturing, pharmaceuticals, food processing, and construction.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ArcelorMittal SA

- Bansal

- Gerdau SA

- Jiangsu Baosteel Metal Product Co. Ltd.

- Jiangsu Shagang International Trade Co. Ltd.

- Joneja Bright Steel Pvt. Ltd.

- KEI Industries Ltd.

- Kobe Steel Ltd.

- Mechel PAO

- Nippon Steel Corp.

- Nucor Corp.

- PAO Severstal

- Rajratan Global Wire Ltd.

- SSAB AB

- Tata Sons Pvt. Ltd.

- thyssenkrupp AG

- Usha Martin Ltd.

- Voestalpine AG

- Shree Steel Wire Ropes Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing demand from various end-use industries. The construction industry is a major consumer of steel wires, with applications including construction & infrastructure projects such as flyovers, atomic reactor domes, slabs, silos, hangars, aqueducts, high-rise buildings, viaducts, and railway sleeper construction. In the industrial sector, steel wires find extensive usage in mechanical manufacturing, metal industries, and energy transfer infrastructure. Steel wires are also extensively used in the automotive industry for tires, cords, hoses, wire harness, and springs. The automotive demand for steel wires is driven by the increasing production of vehicles and stringent safety regulations.

Additionally, steel wires are used in mining applications for ropes and strands, and in agriculture for fencing, clips, staples, mesh, screws, nails, barbed wires, and chains. Steel wires offer several advantages such as high shock resistance, wear resistance, high bearing capacity, rust resistance, and corrosion resistance. The market is expected to grow further due to infrastructure investment, government regulation, and the increasing demand from industries such as automotive production and industrial manufacturing. The types of steel wires include carbon steel, stainless steel, and alloy steel.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

174 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.69% |

|

Market growth 2024-2028 |

USD 28.78 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.18 |

|

Regional analysis |

APAC, Europe, North America, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 51% |

|

Key countries |

US, China, India, Japan, and Russia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Acerinox SA, ArcelorMittal SA, Bansal, Gerdau SA, Jiangsu Baosteel Metal Product Co. Ltd., Jiangsu Shagang International Trade Co. Ltd., Joneja Bright Steel Pvt. Ltd., KEI Industries Ltd., Kobe Steel Ltd., Mechel PAO, Nippon Steel Corp., Nucor Corp., PAO Severstal, Rajratan Global Wire Ltd., SSAB AB, Tata Sons Pvt. Ltd., thyssenkrupp AG, Usha Martin Ltd., Voestalpine AG, and Shree Steel Wire Ropes Ltd. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch