Street Furniture Market Size 2025-2029

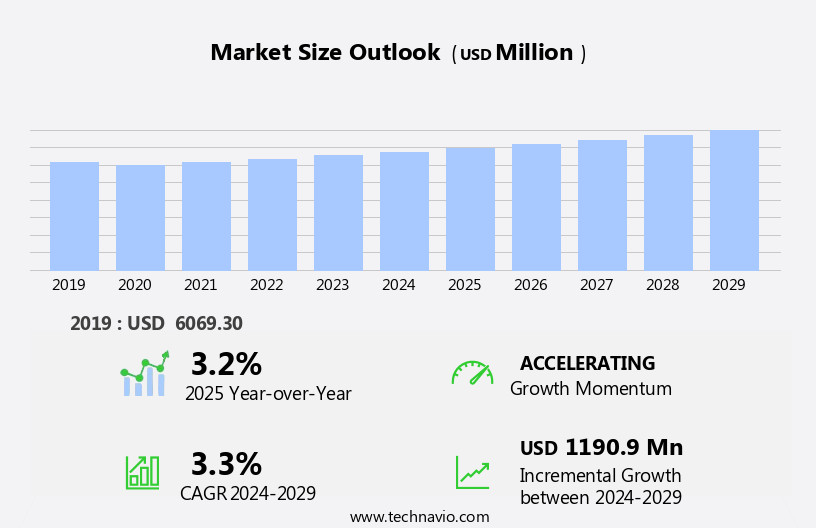

The street furniture market size is forecast to increase by USD 1.19 billion, at a CAGR of 3.3% between 2024 and 2029.

- The market is experiencing significant shifts, driven by the increasing preference for sustainable solutions. The trend towards replacing traditional wooden furniture with composite alternatives is gaining momentum, as these materials offer durability and resistance to weather conditions, while reducing the environmental impact. However, this shift is not without challenges. The volatility in raw material prices, essential for manufacturing street furniture, poses a significant obstacle. Producers must navigate this price volatility to maintain profitability and meet demand, necessitating strategic sourcing and supply chain management.

- To capitalize on opportunities and navigate challenges effectively, companies must stay informed about market trends and price fluctuations, and explore innovative solutions to mitigate the impact of raw material price volatility. By focusing on sustainability and operational efficiency, street furniture manufacturers can differentiate themselves in a competitive market and meet the evolving needs of consumers and urban environments.

What will be the Size of the Street Furniture Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market dynamics shaping its various sectors. Cast iron units, a long-standing fixture, are being reimagined with smart city applications, integrating digital signage, wireless connectivity, and solar power. Prefabricated units offer modular design and structural integrity, while urban design incorporates waste management solutions using recycled materials. Smart benches, bicycle racks, and bus shelters enhance public spaces, incorporating automated cleaning, water drainage, and anti-graffiti coatings. Environmental impact is a key consideration, with life cycle assessments and corrosion resistance shaping manufacturing processes. Project management and custom designs ensure safety features and weather resistance, while traffic calming solutions integrate into landscape integration.

Weight capacity, UV resistance, and vandalism prevention are essential considerations in the evolving market. Supply chain optimization and distribution networks are crucial for meeting demand, with powder coating and maintenance contracts ensuring long-term durability. Interactive elements and installation services cater to community engagement, further emphasizing the continuous unfolding of market activities.

How is this Street Furniture Industry segmented?

The street furniture industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Type

- Metal furniture

- Wood furniture

- Plastic furniture

- End-user

- Residential

- Commercial

- Product

- Seating sets

- Chairs

- Dining sets

- Loungers

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

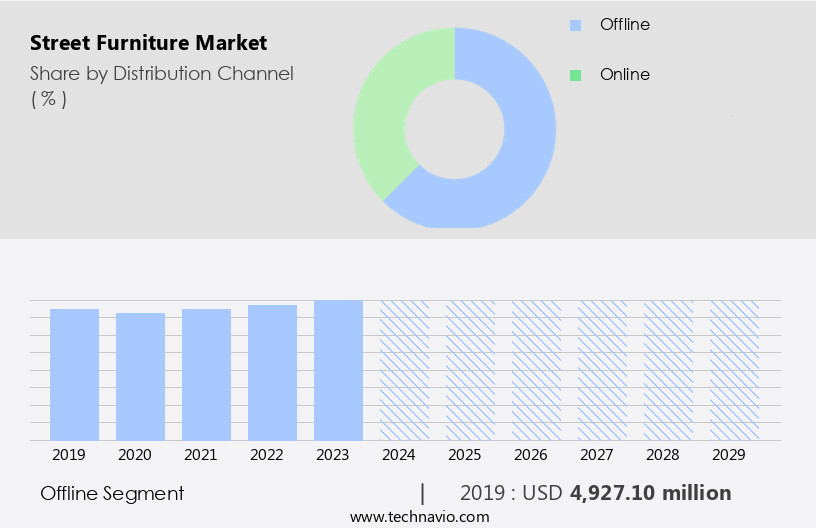

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period.

The market encompasses a range of products designed to enhance urban environments, including smart benches, bicycle racks, bus shelters, and more. Design standards prioritize durability, functionality, and aesthetics, ensuring these pieces integrate seamlessly into transportation infrastructure and public spaces. Environmental impact is a significant consideration, with manufacturers focusing on recycled materials, solar power, and weather resistance. Smart benches incorporate automated cleaning, water drainage, and interactive elements, while bicycle racks offer corrosion resistance and weight capacity. Maintenance contracts ensure long-term structural integrity, and digital signage provides retail channels with opportunities for advertising. Vandalism prevention measures, such as anti-graffiti coatings and safety features, are essential.

Manufacturing processes prioritize sustainability, with a focus on recycled aluminum, composite materials, and cast iron. Prefabricated units enable easy installation, and distribution networks ensure efficient supply chain management. Urban design principles guide the creation of bus shelters and other structures, integrating them into landscapes and promoting community engagement. Waste management and traffic calming are also essential considerations. Project management and custom designs cater to unique project requirements, while safety features and powder coating ensure durability. Wireless connectivity and UV resistance add functionality, making street furniture an essential component of smart city applications.

The Offline segment was valued at USD 4.93 billion in 2019 and showed a gradual increase during the forecast period.

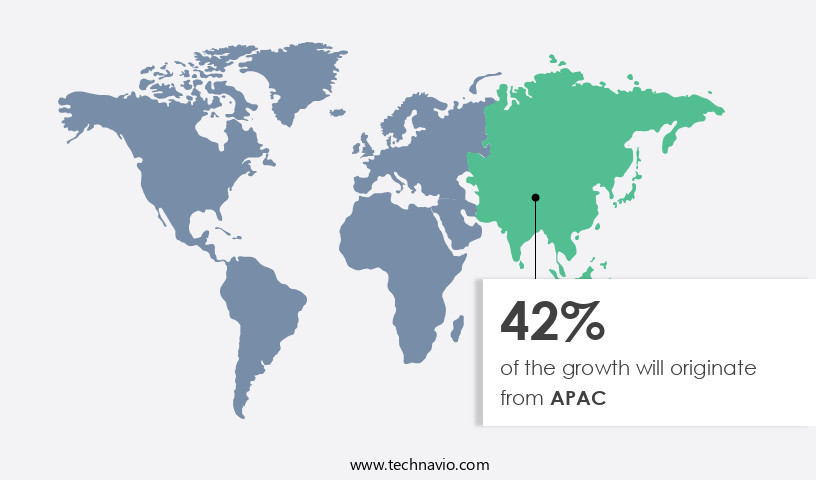

Regional Analysis

APAC is estimated to contribute 42% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American the market is experiencing consistent growth, driven by the expansion of the real estate sector and increasing urban population. The US, Canada, and Mexico are key contributors to this market, with major demand coming from tourist hotspots and historic locations. The market's growth is further fueled by rising consumer buying power and travel trends. Design standards are a crucial consideration in the production of street furniture, ensuring functional and aesthetically pleasing structures. Environmental impact is also a significant factor, with a focus on using recycled materials, solar power, and modular designs to minimize waste and reduce carbon emissions.

Transportation infrastructure is another essential element, with smart benches, bicycle racks, and automated cleaning systems enhancing the functionality of public spaces. Water drainage and anti-graffiti coatings are essential features for ensuring the longevity of street furniture, while corrosion resistance and maintenance contracts help maintain their structural integrity. Smart city applications, such as digital signage, interactive elements, and wireless connectivity, are increasingly popular in urban design. Safety features, such as UV resistance, weather resistance, and vandalism prevention, are also essential considerations. Manufacturing processes prioritize sustainability, with recycled aluminum, composite materials, and cast iron used in the production of bus shelters, prefabricated units, and other structures.

Project management and custom designs are crucial for ensuring efficient installation and meeting the unique needs of each project. The supply chain is streamlined through distribution networks and manufacturing processes that prioritize safety and quality. Landscape integration is also a critical aspect, with street furniture designed to blend seamlessly into public spaces and enhance their overall appeal. Waste management and community engagement are essential components of the market, with a focus on creating sustainable and inclusive public spaces that cater to the needs of diverse populations.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses a diverse range of products designed for public spaces, enhancing urban aesthetics, functionality, and safety. These include benches, bike racks, bus shelters, waste bins, lighting fixtures, and pedestrian crossings. Manufacturers prioritize durable materials like stainless steel, cast iron, and recycled plastic for longevity. Sustainability is a significant trend, with eco-friendly designs and solar-powered solutions gaining traction. Smart city integration is another key trend, with furniture featuring sensors, Wi-Fi, and charging ports. Urban planning and community engagement are essential considerations, ensuring furniture blends harmoniously with architectural styles and meets the needs of diverse user groups. Accessibility is paramount, with designs catering to individuals with disabilities and the elderly. The market continues to evolve, reflecting societal shifts and technological advancements.

What are the key market drivers leading to the rise in the adoption of Street Furniture Industry?

- The shift towards composite wooden furniture from traditional wooden furniture is the primary market trend, driven by its numerous advantages such as durability, resistance to moisture, and ease of maintenance.

- Composite wooden furniture has gained popularity due to its eco-friendly production and minimal maintenance requirements. Manufactured using recycled wood and plastic products, this type of furniture offers a natural wooden appearance while boasting enhanced durability. Companies provide powder-coated versions, ensuring weather resistance and resistance to environmental degradation. The sustainable nature of composite wooden furniture aligns with environmentally conscious urban development, reducing the demand for natural wood resources and preserving forests. Moreover, its longevity leads to fewer replacements and lower maintenance costs for municipalities and businesses.

- Interactive elements and wireless connectivity can be integrated into composite wooden furniture, enhancing its functionality and appeal. Installation services are often offered by manufacturers, ensuring a seamless integration into various landscapes. With robust manufacturing processes and extensive distribution networks, composite wooden furniture is a viable alternative to traditional wooden furniture, offering both environmental benefits and cost savings.

What are the market trends shaping the Street Furniture Industry?

- The trend in the market is shifting towards an increasing demand for sustainable street furniture. This eco-conscious approach is becoming mandatory in both new installations and upgrades to existing infrastructure.

- The market is witnessing significant growth due to the increasing preference for eco-friendly solutions. Traditional materials like cast iron are being replaced with sustainable alternatives, such as recycled plastic, aluminum, and reclaimed wood. This shift is driven by environmental concerns, including the negative impacts of deforestation and the use of toxic finishes. Smart city applications, such as traffic calming measures and waste management systems, are also fueling the demand for prefabricated units made from recycled materials. Urban design projects are prioritizing community engagement and the creation of inviting public spaces, leading to an increased focus on aesthetically pleasing, harmonious designs.

- Moso bamboo, which is stronger and harder than most other types of wood, is gaining popularity as an eco-friendly alternative. Its use in street furniture not only reduces the environmental impact but also enhances the aesthetic appeal of urban spaces. Project management and custom designs are becoming essential aspects of the market, as local governments and businesses seek to create unique, functional, and sustainable street furniture solutions. The trend towards eco-friendly materials is expected to continue, as the importance of preserving the environment becomes increasingly recognized.

What challenges does the Street Furniture Industry face during its growth?

- The volatility in raw material prices poses a significant challenge to the growth of the street furniture industry, as manufacturers must navigate price fluctuations in essential materials used in production.

- The market is driven by the increasing demand for aesthetically pleasing and functional designs that adhere to stringent environmental impact standards. This market encompasses various product offerings, such as smart benches, bicycle racks, and transportation infrastructure components, which are integrated into urban landscapes. Sustainable manufacturing practices and the use of eco-friendly materials are essential considerations in the production process. Raw material prices, particularly for steel, plastic, wood, and aluminum, pose a challenge to market growth due to their volatility. The manufacturing process involves the utilization of raw materials like steel, wood, chipboard, timber, foam, polish chemical materials, color paints, hardware, and aluminum.

- The rising input and transportation costs, coupled with the shrinking production capacities of furniture manufacturers, have contributed to an increase in the price of wood particleboard. Innovative features, such as automated cleaning, water drainage, anti-graffiti coatings, life cycle assessment, and street lighting, enhance the functionality and appeal of street furniture. Retail channels, including e-commerce platforms and traditional brick-and-mortar stores, facilitate the distribution and accessibility of these products. Market dynamics are further influenced by the integration of technology, such as smart sensors and IoT capabilities, to create immersive and harmonious urban environments.

Exclusive Customer Landscape

The street furniture market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the street furniture market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, street furniture market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AREA - This company specializes in innovative, high-quality street furniture designs. Offerings include the Chaise longue Atlantique, Bench Atlantique, Picnic table Atlantique, Domino Atlantique, Backless bench Atlantique, and litter bins Tamaris (45L and 75L). Our designs enhance urban landscapes with sleek, modern aesthetics, elevating public spaces for communities worldwide.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AREA

- Area Safe Products Pty Ltd.

- Artform Urban Furniture

- BENITO URBAN SL

- Beruru Pvt. Ltd.

- Broxap Ltd.

- Daktronics Inc.

- Edilportale.com SpA

- Environmental Street Furniture LLC

- EP Draffin Manufacturing Pty Ltd.

- Furnitubes International Ltd

- Inter IKEA Holding BV

- Macemain Amstad

- Marshalls plc

- Newton Brown LLC

- Ozone Overseas Pvt. Ltd

- Saflow Product Pvt. Ltd.

- Street Furniture Australia Pty Ltd.

- STREETLIFE America LLC

- STREETPARK sro

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Street Furniture Market

- In January 2024, global street furniture manufacturer, Urban Furniture Co., announced the launch of its new product line, 'Eco-Smart Benches,' which integrate solar panels to charge mobile devices and promote energy efficiency (Urban Furniture Co. Press release).

- In March 2024, leading street furniture provider, StreetSolutions, entered into a strategic partnership with technology firm, TechVentures, to develop smart city furniture integrating IoT sensors and communication systems (StreetSolutions press release).

- In May 2024, European the market leader, Urban Elements, completed a â¬50 million funding round led by private equity firm, GreenTech Capital, to expand its production capacity and global market presence (Bloomberg News).

- In January 2025, the European Union passed the 'Smart Cities Regulation,' mandating the integration of smart technologies in all new public infrastructure, including street furniture, by 2030 (European Commission press release).

Research Analyst Overview

- The market is characterized by a focus on maintenance schedules to ensure brand equity and reputation. Strategic alliances with sales channels and marketing materials are essential for profitability analysis and market penetration. Installation techniques and safety regulations are critical for product liability risk assessment and compliance standards. Public art integration adds aesthetic appeal and community feedback, enhancing the value proposition for customers. Design innovation and product differentiation are key growth strategies, with pricing strategies and sustainability initiatives shaping the competitive landscape. Warranty claims and quality control are crucial for customer satisfaction and loyalty. User experience and intellectual property protection are essential components of the innovation pipeline.

- Manufacturing technology and material sourcing are vital for competitive pricing and profitability, while distribution logistics and compliance with safety regulations ensure efficient delivery and risk mitigation. Pragmatic promotional strategies and adherence to sustainability initiatives are essential for brand reputation and customer trust.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Street Furniture Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

236 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.3% |

|

Market growth 2025-2029 |

USD 1190.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.2 |

|

Key countries |

US, China, Canada, Japan, Germany, India, UK, South Korea, France, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Street Furniture Market Research and Growth Report?

- CAGR of the Street Furniture industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the street furniture market growth of industry companies

We can help! Our analysts can customize this street furniture market research report to meet your requirements.