Stress Testing Market Size 2024-2028

The stress testing market size is forecast to increase by USD 4.91 billion at a CAGR of 17.53% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing focus on early detection and management of health conditions such as mortality rate concerns in elderly and obese populations. Stress testing plays a crucial role in assessing the risk of coronary artery disease and heart failure. The adoption of advanced technologies like artificial intelligence (AI) in stress testing is gaining momentum, enabling more accurate and efficient testing.

- Furthermore, the use of mobile devices and applications for stress testing is increasing, providing greater accessibility and convenience. However, cybersecurity concerns in cloud-based testing environments pose a challenge to market growth. Ensuring secure data transmission and storage is essential to maintain patient trust and regulatory compliance.

What will the Stress Testing Market Size During the Forecast Period?

-

The market is a critical component of the IT industry, ensuring the optimal performance and security of IT infrastructure and applications. Small and Medium Enterprises (SMEs) are increasingly recognizing the importance of outsourced testing services to address their IT security needs. Cybersecurity concerns have become a global health concern, with information security being a top priority for businesses. IT security guidelines mandate regular testing to ensure the protection of sensitive data and systems. In the banking segment, application testing, including load testing and diagnostic procedures, is essential to maintain customer trust and regulatory compliance. Moreover, mobile applications and cloud computing have revolutionized the way businesses operate. Stress testing tools are vital in assessing the performance and security of these applications under various conditions. Load testing helps determine the application's ability to handle high traffic and user volumes, ensuring a seamless user experience. Physiological functions, such as cardiovascular diseases (CVDs), are a significant demographic concern. Early detection and management of CVDs, including coronary artery disease, heart failure, obesity, hypertension, diabetes, dyslipidemia, and CVD mortality, are crucial for morbidity and mortality rate reduction. The elderly and obese groups are particularly vulnerable to CVDs. Preventive healthcare and proactive health management are essential to mitigate risks and improve overall health outcomes.

-

Stress testing plays a vital role in identifying potential issues before they become critical, enabling timely intervention and effective management. The market caters to various industries and applications, providing diagnostic procedures to assess the functionality and performance of IT infrastructure and applications under stress conditions. The market's growth is driven by the increasing demand for reliable and secure IT systems, the proliferation of digital transformation, and the need for early detection and management of health conditions. In conclusion, the market is a crucial player in the IT and healthcare industries, addressing cybersecurity concerns, ensuring application performance, and enabling early detection and management of health conditions. SMEs can benefit significantly from outsourced testing services, ensuring regulatory compliance, maintaining customer trust, and improving overall business performance.

How is this market segmented and which is the largest segment?

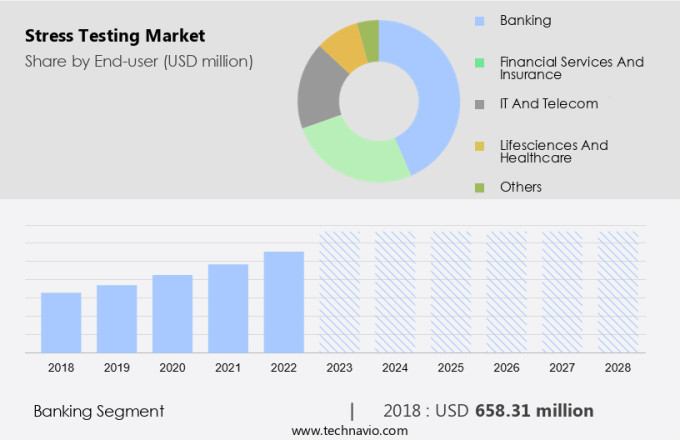

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Banking

- Financial services and insurance

- IT and telecom

- Lifesciences and healthcare

- Others

- Product

- Application testing

- Product testing

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- APAC

- China

- South America

- Middle East and Africa

- North America

By End-user Insights

- The banking segment is estimated to witness significant growth during the forecast period.

The market in the US is significantly influenced by the demographic landscape of obesity, hypertension, diabetes, and dyslipidemia, which are major risk factors for Cardiovascular Diseases (CVD) mortality and morbidity. According to the Centers for Disease Control and Prevention (CDC), approximately 133 million Americans have one or more chronic diseases, making preventive healthcare a priority. The market for stress testing is expected to grow steadily due to the increasing need for early detection and risk assessment of these conditions. In the US healthcare sector, stress testing is increasingly being adopted to improve patient outcomes and reduce healthcare costs. The market is segmented into various end-users, with hospitals and diagnostic centers holding the largest market share.

The adoption of advanced technologies such as Electrocardiogram (ECG) and Echocardiogram (ECHO) for stress testing is driving the growth of this segment. The IT sector is also a significant contributor to the market, with the increasing use of stress testing in IT infrastructure to ensure system stability and reliability. The need to mitigate risks and ensure business continuity in the face of increasing cyber threats and data breaches is driving the adoption of stress testing in this sector. In conclusion, the market in the US is expected to grow steadily due to the increasing focus on preventive healthcare and the need to ensure system reliability and stability across various industries.

The adoption of advanced technologies and the increasing awareness of the benefits of early detection and risk assessment are key drivers of market growth.

Get a glance at the market report of share of various segments Request Free Sample

The Banking segment was valued at USD 658.31 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

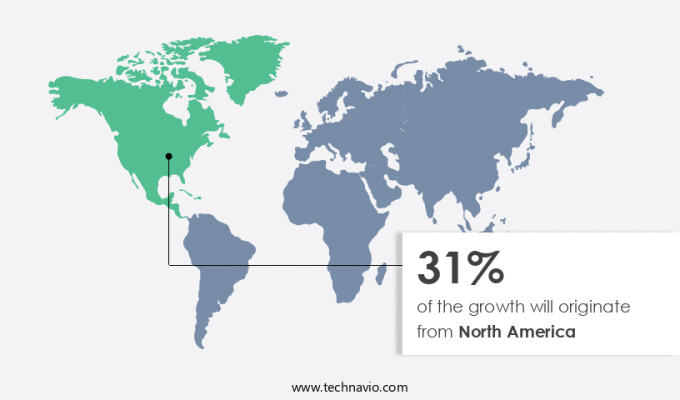

- North America is estimated to contribute 31% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In North America, the market is experiencing significant growth due to the increasing adoption of advanced technologies like AI, IoT, cloud, and analytics by healthcare organizations. The region's well-established cloud infrastructure is fueling the digital transformation in the healthcare sector, particularly in primary healthcare facilities such as cardiology departments. The SMAC (social, mobile, analytics, cloud) trend is gaining momentum in North America, leading to an increase in the implementation of mobile-first strategies for stress testing. Ergometry equipment, including treadmills, and imaging technologies like echocardiograms are increasingly being used for cardiovascular assessments and treatments. The market is witnessing a rise in the number of applications introduced by enterprises to support digitalization and DevOps.

Furthermore, the integration of AI in stress testing is revolutionizing patient care by enabling early detection and diagnosis of cardiovascular diseases. The high penetration of mobile devices in North America is also driving the growth of the market. Healthcare providers are leveraging mobile applications to offer remote patient monitoring and teleconsultation services, making stress testing more accessible and convenient for patients. With the increasing focus on patient-centric care and the need for efficient and accurate stress testing, the market is expected to continue its growth trajectory in North America.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Stress Testing Market?

The increasing adoption of mobile devices and applications is the key driver of the market.

- The global market is experiencing significant growth due to the increasing number of Small and Medium Enterprises (SMEs) prioritizing information security and IT security guidelines, particularly in the banking segment. With cybersecurity concerns becoming increasingly prevalent, the need for rigorous application testing and testing tools is on the rise. According to recent studies, the adoption of mobile devices is expanding rapidly in emerging economies, including India, Brazil, China, Indonesia, and Argentina.

- This mobile-first trend has led companies to invest heavily in mobile application development, making it essential for these applications to perform optimally. For e-commerce and digital payment providers, mobile applications serve as the foundation of their businesses. Any disruption in mobile application functionality could result in substantial financial losses. As the demand for mobile devices and applications continues to stream, ensuring their quality becomes increasingly important.

What are the market trends shaping the Stress Testing Market?

AI-based stress testing is the upcoming trend in the market.

- Artificial Intelligence (AI) is revolutionizing the market by offering numerous advantages to organizations. In particular, AI is proving to be beneficial for assessing the health of elderly and obese groups, who are at higher risk for conditions such as coronary artery disease and heart failure. By utilizing AI technologies, stress testing can provide early detection and effective management of these conditions. AI enables faster test execution, reducing the time-to-market for new applications and software. It also enhances the depth and scope of test results, leading to increased accuracy and reliability. In today's competitive business landscape, organizations require quick turnaround times for testing to keep up with the frequent launch of new applications.

- Performance testing is a crucial aspect of software development, and it begins with analyzing the user interface (UI) and generating test scripts. AI-driven stress testing solutions streamline this process, allowing for more efficient and effective testing. Moreover, AI algorithms can identify complex patterns and anomalies that might be missed by traditional testing methods. In summary, AI is transforming the market by providing faster test execution, increased accuracy, and a broader scope of test results. Its implementation is essential for organizations to stay competitive in today's fast-paced business environment and ensure the delivery of high-quality software for the elderly and obese populations.

What challenges does Stress Testing Market face during the growth?

Cybersecurity concerns in cloud-based testing environment is a key challenge affecting the market growth.

- In the realm of technology, ensuring the optimal performance and security of cloud-based services, particularly mobile applications, is of paramount importance. With the global health concern of cardiovascular diseases (CVDs) on the rise, diagnostic procedures are increasingly relying on these services. However, the primary challenge to the widespread adoption of cloud computing is the concern for data privacy and information security. To mitigate these risks, testing services are growing in complexity. Guidelines and IT security regulations demand stringent testing procedures for Software as a Service (SaaS), Infrastructure as a Service (IaaS), and Platform as a Service (PaaS).

- The increasing frequency of cyber threats and security breaches in cloud-based services necessitates rigorous testing. companies must ensure that cloud infrastructure is tested in various environments using comprehensive tests. These tests should adhere to the latest IT security guidelines to safeguard against potential vulnerabilities. By implementing thorough testing, cloud service providers can instill confidence in their clients and maintain the integrity of their services. This commitment to security is crucial for the continued growth and success of the cloud computing industry.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast , partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accenture Plc

- Akamai Technologies Inc.

- Capgemini Service SAS

- Cigniti Technologies Ltd.

- DIGITAL HEARTS HOLDINGS Co. Ltd.

- Dotcom Monitor Inc.

- HCL Technologies Ltd.

- Infosys Ltd.

- International Business Machines Corp.

- Microsoft Corp.

- Open Text Corp.

- Oracle Corp.

- PFLB Inc.

- RadView Software Ltd.

- SmartBear Software Inc.

- Stimulus Technology

- Tata Consultancy Services Ltd.

- Wipro Ltd.

- XB Software

- Tricentis GmbH

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The outsourced testing services market is witnessing significant growth due to the increasing demand for application testing, load testing, and cybersecurity concerns in various industries. Small and Medium-sized Enterprises (SMEs) are increasingly outsourcing IT security testing to ensure compliance with IT security guidelines and mitigate information security risks. The banking segment is a major contributor to this market due to the sensitive nature of financial data. In the healthcare sector, the focus on preventive healthcare and proactive health management has led to an increased demand for diagnostic procedures and cardiovascular assessments. With the rise of mobile applications and cloud computing, testing tools are becoming essential for ensuring the security and functionality of these systems.

Further, cybersecurity concerns are not the only stressors for businesses. In the healthcare industry, conditions such as cardiovascular diseases (CVDs), obesity, hypertension, diabetes, dyslipidemia, and heart failure are major global health concerns. Early detection and assessment are crucial for effective management and reducing morbidity and mortality rates, especially in elderly and obese groups. Exercise ECG systems, treadmills, ergometry equipment, and echocardiograms are versatile tools used for physiological stress testing. These tools are used in hospitals & clinics, diagnostic centers, ambulatory surgical centers, and other end-users for patient care. Cardiology departments rely on these tools for cardiovascular assessments and treatments.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

179 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 17.53% |

|

Market growth 2024-2028 |

USD 4.91 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

15.61 |

|

Key countries |

US, Canada, China, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch