Structural Steel Fabrication Market Size 2025-2029

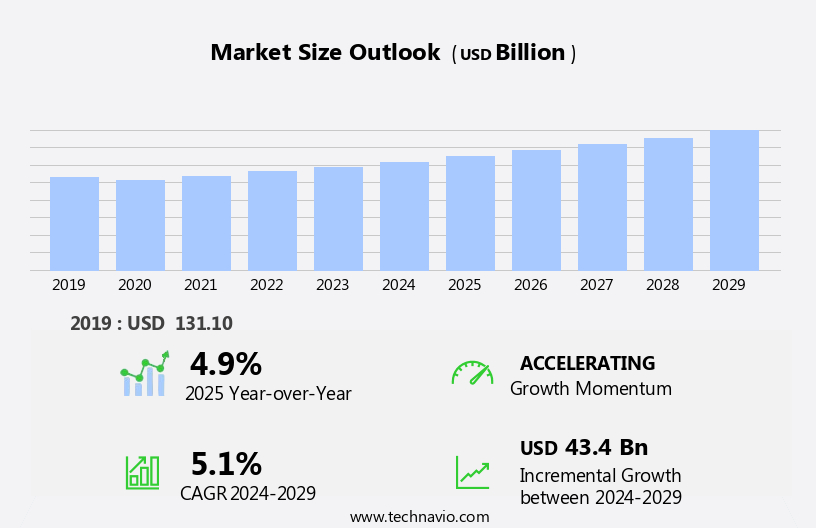

The structural steel fabrication market size is forecast to increase by USD 43.4 billion at a CAGR of 5.1% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing infrastructure development in various sectors such as construction, transportation, and energy. Another key trend driving market growth is the adoption of automation and robotics in fabrication processes, which enhances productivity and reduces production time. However, the industry faces challenges related to the shortage of skilled labor, which can impact the quality of fabrication and increase costs. To address this issue, companies are investing in training programs and collaborating with educational institutions to develop a skilled workforce. Overall, these factors are shaping the growth trajectory of the market.

What will be the Size of the Structural Steel Fabrication Market During the Forecast Period?

- The market encompasses the production of custom-designed, high-strength, and heavy-duty structures using advanced fabrication techniques for various industries, including building construction, infrastructure development, aerospace, automotive, and industrial metal fabrication. Durability and safety are paramount in this sector, with a focus on engineering services, manufacturing solutions, and sustainability. The market is driven by increasing infrastructure development, energy production, and transportation projects, as well as the need for compliance with certifications and regulations.

- Pricing, logistics, and capacity are significant factors influencing market dynamics. Sustainability and traceability are also becoming essential considerations, with a growing emphasis on reducing costs and improving efficiency through innovative engineering and manufacturing processes. The market caters to diverse industries, from bridge construction and offshore structures to mining and industrial construction materials. Safety, certifications, and compliance are critical aspects of the supply chain, with a strong focus on ensuring the highest standards of quality and reliability. Corrosion resistance and welding techniques are also essential factors In the production of structural steel units, ensuring durability and longevity for end-users.

How is this Structural Steel Fabrication Industry segmented and which is the largest segment?

The structural steel fabrication industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Material

- Carbon steel

- Stainless steel

- Others

- End-user

- Construction

- Energy and power

- Manufacturing

- Automotive

- Others

- Geography

- APAC

- China

- India

- Japan

- South Korea

- Europe

- Germany

- UK

- France

- North America

- Canada

- US

- Middle East and Africa

- South America

- Brazil

- APAC

By Material Insights

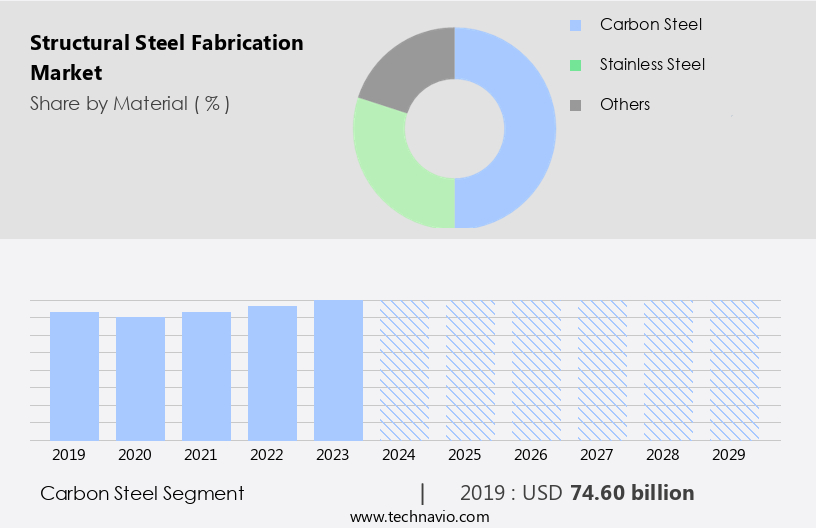

- The carbon steel segment is estimated to witness significant growth during the forecast period.

Carbon steel is a widely used material In the structural steel fabrication industry, recognized for its exceptional strength, affordability, and versatility. This material is essential in constructing various structures, including buildings, bridges, and industrial equipment, across multiple sectors. The fabrication process involves cutting, welding, and assembling carbon steel to create structural components such as beams, columns, and trusses, tailored to specific engineering requirements. Carbon steel's high strength-to-weight ratio is a significant advantage, offering optimal strength while minimizing weight. This property is crucial in applications requiring the support of heavy loads without excessive bulk. Furthermore, carbon steel is cost-effective compared to other materials like stainless steel and aluminum, making it an economical choice for projects without compromising performance.

The fabrication industry utilizes advanced technologies, such as 3-D modeling, augmented reality, and machining, to ensure precision and efficiency in production. Additionally, sustainable practices and energy-efficient fabrication methods are increasingly adopted to minimize environmental hazards and reduce greenhouse gas emissions. The industry caters to various sectors, including automotive manufacturing hubs, power plants, infrastructure development, and construction, among others. Carbon steel's durability and cost benefits make it a preferred choice for long-term infrastructure investments.

Get a glance at the Structural Steel Fabrication Industry report of share of various segments Request Free Sample

The carbon steel segment was valued at USD 74.60 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

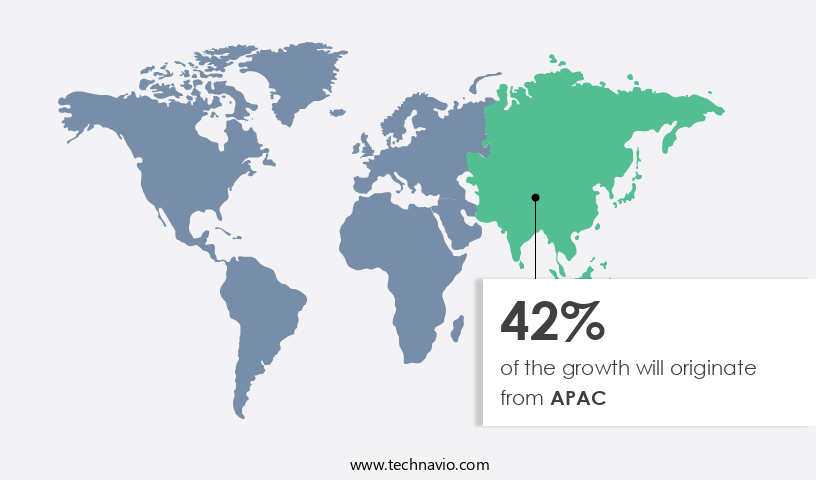

- APAC is estimated to contribute 42% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market In the Asia-Pacific (APAC) region is experiencing significant growth due to intensive urbanization, industrialization, and substantial infrastructure development, primarily in China and India. The construction and manufacturing sectors are the primary drivers, with major projects like skyscrapers, bridges, and residential developments increasing the demand for structural steel. Structural steel's durability and strength-to-weight ratio make it an ideal choice for various applications, including industrial facilities, automotive manufacturing hubs, and mining structures.

Advanced fabrication technologies, such as 3-D models, augmented reality, machining, and welding, are increasingly being adopted to improve efficiency and precision. Sustainable practices and energy-efficient fabrication methods are also gaining popularity to reduce environmental hazards and minimize greenhouse gas emissions. Infrastructure investments in sectors like power, transportation, and logistics further fuel the demand for structural steel. Cost benefits, competitive pricing, and customizable components are additional factors contributing to its widespread adoption.

Market Dynamics

Our structural steel fabrication market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Structural Steel Fabrication Industry?

Infrastructure development is the key driver of the market.

- The market is experiencing significant growth due to the increasing demand for durable and strong construction materials in response to global urbanization trends. This urban population growth has led to substantial investments in infrastructure development by governments worldwide. Structural steel is a preferred choice for industrial facilities, automotive manufacturing hubs, and other large-scale construction projects due to its durability and strength-to-weight ratio. The market is driven by various fabrication technologies, including cutting, bending, welding, and metal forming, among others. The sector caters to various industries, including power, mining, automotive, aerospace, and construction, among others.

- Sustainable practices and energy-efficient fabrication methods are gaining popularity In the market due to increasing environmental concerns. Structural components are being designed using 3-D models, augmented reality, and other advanced technologies to ensure precision and safety. Competitive pricing and cost benefits are also key factors driving the market's growth. The market is also witnessing innovation In the form of customizable components, pre-engineered buildings, and smart cities. The infrastructure development in industry corridors, ports, and metro stations is creating new opportunities for the market. However, challenges such as corrosion and disposal of waste materials remain concerns for the industry.

What are the market trends shaping the Structural Steel Fabrication Industry?

The adoption of automation and robotics is the upcoming market trend.

- The market is undergoing a significant evolution due to the integration of advanced technologies and automation. As industrial facilities and manufacturing hubs, including automotive manufacturing hubs, require high-performance structures, the demand for precise and efficient fabrication processes is escalating. Robotics is playing a pivotal role in enhancing the accuracy and speed of fabrication, particularly in tasks such as cutting, welding, material handling, and assembling. These automated systems ensure that structural components adhere to engineering specifications, thereby improving the durability and safety of the final product. Moreover, automation addresses workforce challenges, including the scarcity of skilled labor and safety concerns associated with traditional manual fabrication processes.

- Sustainable practices and energy-efficient fabrication methods are also gaining traction In the market, as environmental hazards, such as corrosion and greenhouse gas emissions, become increasingly concerning. The adoption of 3-D models, augmented reality, and other digital technologies further streamline the fabrication process, enabling customizable components and reducing construction time. The sector encompasses various product types, including light and heavy sectional steel, pipe, and structural components for industries such as power, infrastructure development, automotive, aerospace, mining, pharmaceuticals, logistics, FMCG, and more. Cost benefits, infrastructure investments, and competitive pricing are key drivers for the market's growth.

What challenges does the Structural Steel Fabrication Industry face during its growth?

Skilled labor shortage is a key challenge affecting the industry growth.

- The market experiences a persistent labor shortage, particularly in specialized areas such as pipe welding, despite advancements in automation and robotics. This skilled workforce gap, which is a global concern, can lead to project delays, reduced efficiency, and supply chain disruptions. The demand for steel structures in various sectors, including industrial facilities, automotive manufacturing hubs, and infrastructure development, intensifies the labor shortage. Environmental hazards, durability, and sustainability are crucial factors driving the demand for structural steel In the construction of green buildings, power plants, and other energy-efficient facilities. Fabrication technologies, including metal forming, metal rolling, and welding, are essential for producing structural components.

- Advanced manufacturing methods, such as 3-D models, augmented reality, and machining, enhance production efficiency and precision. The market sector encompasses a wide range of product types, including light and heavy sectional steel, pipe, and customizable components, catering to diverse industries such as automotive, power, mining, and aerospace. Sustainable practices and energy-efficient fabrication methods are increasingly important In the industry. Corrosion resistance and cost benefits are significant factors In the selection of structural steel for various applications. Infrastructure investments, including infrastructure development in industry corridors, ports, and metro stations, contribute to the growth of the market. The market is also influenced by policy and regulatory frameworks, which can impact prices and production.

Exclusive Customer Landscape

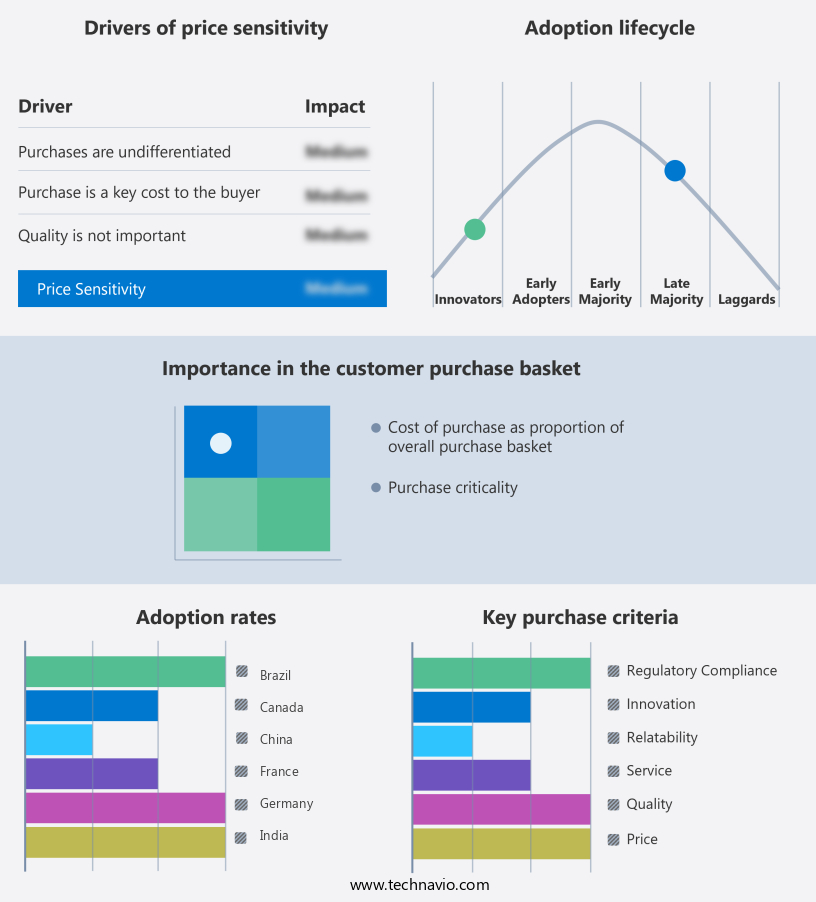

The structural steel fabrication market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the structural steel fabrication market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, structural steel fabrication market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

ArcelorMittal SA - The company offers structural steel fabrication products such as Angelina, Arcorox, Cofraplus 220, and others.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ArcelorMittal SA

- Artson Engineering Ltd.

- ASSENT STEEL INDUSTRIES L.L.C.

- Bechtel Corp.

- Fabrication Engineering Maintenance

- Fluor Corp.

- Fortaco Group

- Hindustan Construction Co. Ltd.

- Hyundai Engineering and Construction Co. Ltd.

- Jindal Steel and Power Ltd.

- JSW Holdings Ltd.

- Kloeckner Metals Corp.

- Larsen and Toubro Ltd.

- Mayville Engineering Co. Inc.

- ONeal Manufacturing Services

- Saipem S.p.A.

- Schuff Steel

- SteelFab Inc.

- YENA Engineering

- Zamil Steel Holding Company Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses the production of complex steel structures through various manufacturing processes. This sector plays a crucial role In the construction industry, providing the foundation for a wide range of industrial facilities and infrastructure projects. The demand for structural steel fabrication is driven by several factors. Durability is a significant factor, as steel structures offer strength and resilience, making them ideal for use in heavy-duty applications. Additionally, the sector's ability to produce customizable components and assemble large structures efficiently contributes to its popularity. Manufacturing hubs across the globe are increasingly adopting advanced fabrication technologies to improve productivity and reduce costs.

Moreover, three-dimensional modeling and augmented reality are among the innovations that have transformed the sector, enabling manufacturers to create precise designs and optimize production processes. The automotive manufacturing sector is a major consumer of structural steel fabrication, with the production of automobiles requiring intricate and lightweight components. The aviation industry also relies heavily on this sector, with the need for strong and lightweight structures for aircraft frames and components. Mining and power generation industries are other significant consumers of structural steel fabrication. The sector's ability to produce large, complex structures for power plants and mining facilities makes it an essential partner In these industries.

Furthermore, in recent years, there has been a growing focus on sustainable practices and energy-efficient fabrication methods In the sector. The use of greenhouse gas emission reduction technologies and the production of environmentally friendly products have become increasingly important. Corrosion is a common challenge In the structural steel fabrication industry, and manufacturers are continually developing new methods to mitigate its effects. Cutting-edge technologies such as metal forming, welding, and metal shearing are used to produce high-quality, corrosion-resistant components. Infrastructure investments in sectors such as transportation, construction, and energy are driving demand for structural steel fabrication. Pre-engineered buildings and light and heavy sectional structures are becoming increasingly popular due to their cost benefits and quick construction times.

|

Structural Steel Fabrication Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

213 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.1% |

|

Market Growth 2025-2029 |

USD 43.4 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.9 |

|

Key countries |

US, China, India, Germany, UK, Japan, Canada, France, South Korea, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Structural Steel Fabrication Market Research and Growth Report?

- CAGR of the Structural Steel Fabrication industry during the forecast period

- Detailed information on factors that will drive the Structural Steel Fabrication market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the structural steel fabrication market growth of industry companies

We can help! Our analysts can customize this structural steel fabrication market research report to meet your requirements.